Graphite stocks surge amidst China's export curbs: Does the rally have legs to run?

Most Australian graphite stocks have rallied more than 20% since Friday after China announced plans to roll out export controls for some graphite products to protect national security.

China is the world’s largest graphite producer and exporter, producing more than two-thirds of global graphite production and refines more than 90% of the final processed material for EV battery anodes.

The restrictions are similar to those in place since August 1 for two chip-making metals – Gallium and Germanium. The curbs required exporters to apply for a license as well as disclose customer details and what they manufacture with those metals.

The announcement boosted China’s exports in July as overseas buyers rushed to lock in supply, while the launch of the restrictions slashed exports in August and September, according to Reuters.

The Price Action So Far

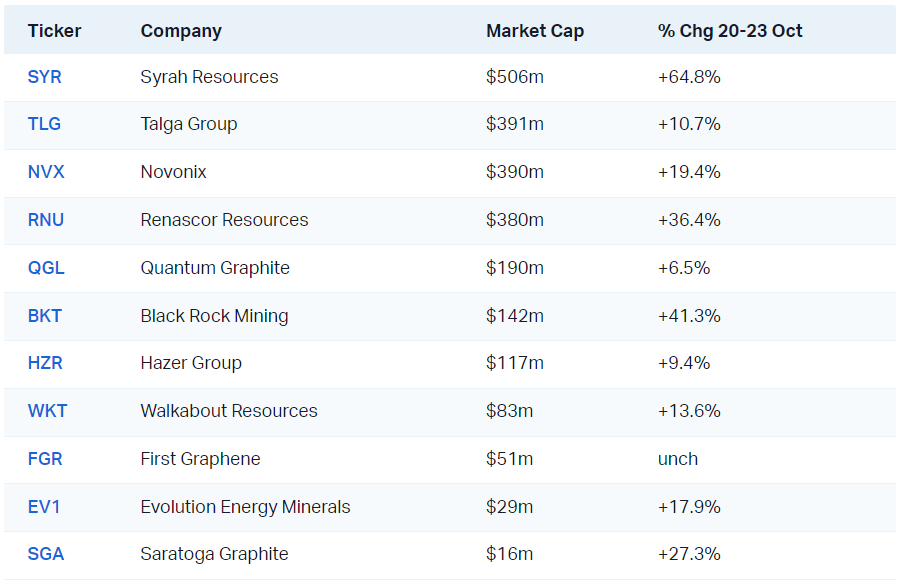

The average stock below is up 22.5% since Friday and the median gain is 17.9%.

Shares in Syrah Resources rallied 41.5% on Monday after an initial 17% gain in early trade. The elevated short interest in the stock (10.9% as at Oct 17) could be fueling a short squeeze, forcing short sellers to buy back shares and placing upward pressure on the share price.

The state of play

The policy will take effect on December 1 and it is “very reasonable to expect a surge in graphite stockpiling through November given the uncertainty this situation presents for EV battery makers, " said James Cooper, Commodities Analyst at Fat Tail Investment Research.

“Given the lack of alternative supplies, stockpiling offers manufacturers some short-term reprieve as they try to work through the fallout from these export restrictions. This remains a very unsettling period for graphite buyers as there’s no clear understanding of what metric Chinese authorities will use to approve permits,” he says.

Macquarie identified three ASX-listed graphite companies that could potentially benefit from the export ban, including:

- Syrah Resources (ASX: SYR): Syrah was viewed as the only natural graphite producer outside of China of scale, although current production at its Balama Operation is well below its 350,000 tpa capacity due to market-related headwinds. “We believe SYR could benefit from increased ex-China demand and the ramp-up of Vidalia,” the analysts said.

- Talga Resources (ASX: TLG): Talga is progressing the Vittangi Project in Sweden, which is viewed as a “key market differentiator allowing it to leverage EV demand and battery growth in Europe.”

- Renascor Resources (ASX: RNU) and Black Rock Mining (ASX: BKT): Renascor is developing the Siviour Project in South Australia and Black Rock is looking to progress the Mahenge project (over four stages) in Tanzania. “Both have connections to POSCO,” note the analysts.

All hype or legs to run?

Despite a recent surge of more than 70% in a week, shares in Syrah Resources remain down 56% year-to-date. Could this be nothing more than a dead cat bounce?

“The key risk here is that junior mining stocks remain in a bear market. Stocks have sold off heavily and investors have held onto steep losses. If prices recover on the back of this announcement, investors may look to exit once they’ve captured their initial investment. This will put pressure and resistance on rising prices,” said Cooper.

Syrah's Vidalia Project in Louisiana also faces a potential funding shortfall of $100 million, according to Macquarie analysts. The company is exploring alternative financing options, including a larger loan from the US Department of Energy. The analysts anticipate an equity raise in the first quarter of 2024 to address the funding gap.

What happens from here?

“What happens from here really depends on how heavy-handed China becomes in allowing permits for continual sales of refined graphite. Remember it hasn’t announced an outright export ban. Yet, there’s every reason to believe it could levitate in that direction,” warns Cooper.

“What we do know is that China is using its dominance of graphite supply and other critical metals to push back against any pressure from the West. That’s why I don’t see China taking an easy stance here. That could offer a sustained rally across all graphite stocks, especially those looking to develop downstream capacity,” he says.

3 topics

4 stocks mentioned

1 contributor mentioned