Greed and fear

Emerging markets investing has always been risky, yet not investing in them is risky too.

The Omicron outbreak, inflation and monetary tightening are shaking emerging markets.

Emerging markets investing has always been risky, yet not investing in them is risky too. For investors, avoiding emerging markets means missing potential opportunities and diversification benefits.

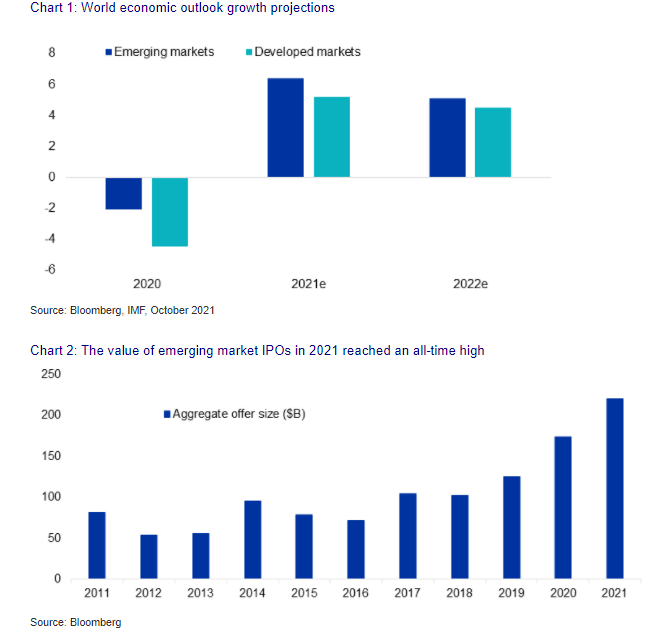

There are a number of long-term structural tailwinds supporting emerging markets such as favourable demographics and increasing wealth. In the near term, the IMF estimate for emerging market GDP growth for 2021 forecast is 5.1%, higher than developed markets.

Astute investors are including exposure to emerging markets to capture this growth opportunity as part of a well-diversified international portfolio strategy.

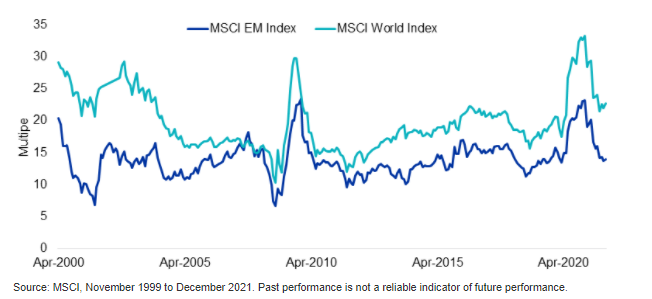

Right now, emerging markets equities look compelling from a valuation standpoint, however, not all emerging markets companies are desirable from an investment perspective and quantifying factors in emerging markets is near impossible for non-institutional investors.

Emerging markets wild ride

Investing is fraught with risk. Investors must weigh the potential opportunity costs and the relative risks of one investment choice over another. It is no mean feat and the decision to allocate to emerging markets is one such decision. It can be risky and it can be expensive.

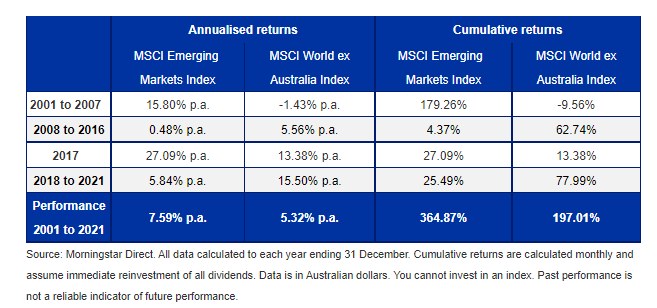

Since 2001, emerging markets have outperformed developed markets, but it’s been a wild ride. Australian investors with global equity portfolios that had exposure to emerging market equities were rewarded in the lead up to the GFC (2001 to 2007 below) benefiting from an emerging markets boom. Emerging markets equities then underperformed, despite growth in emerging market economies such as China helping the global recovery. Emerging markets then had a stellar 2017 with growth buoyed by a synchronised global expansion and still-loose monetary policy in developed nations, particularly the US. Then, in 2018, the US started raising rates and since then emerging markets have underperformed developed markets in the face of a strong US dollar and the COVID crisis and its many waves.

Table 1: Developed and emerging markets equity performance

Monetary tightening, while the market has faith in the US Federal Reserve, is currently shaking emerging markets, however, the investment case for emerging market equities is still compelling given their significant projected growth prospects. Emerging markets are predicted to grow faster than developed markets, despite the much-publicised expected slowdown in China growth. 2021 was a record year for emerging market equity IPOs, and much of this was driven by China.

Investors may be considering risky assets as the global economy opens further. However, taking the right approach is important.

“Be greedy when others are fearful”

Right now, emerging markets look compelling from a valuation standpoint, approaching historical lows relative to developed markets.

Investing in emerging markets is difficult

Investing in emerging markets has traditionally been expensive and returns among active managers vary significantly from year-to-year because it is almost impossible for active managers to time factors in emerging markets.

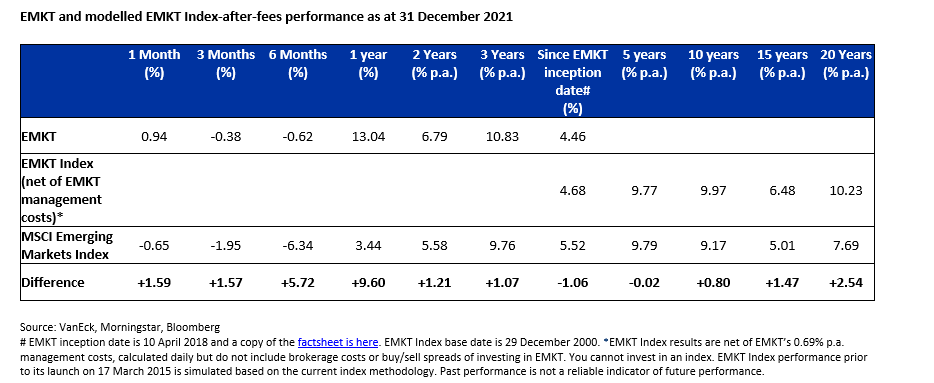

The VanEck MSCI Multifactor Emerging Markets Equity ETF (ASX: EMKT) tracks the MSCI Emerging Markets Diversified Multiple-Factor Index (EMKT Index) which includes companies on the basis of four factors: Value, Momentum, Low Size and Quality. The four factors combined demonstrate long term outperformance relative to the MSCI Emerging Markets Index, even considering EMKT’s management costs.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics