Greenland Minerals - Rare opportunity in Rare Earths

Pitt Street Research and NDF Research

In April 2016 Greenland Minerals updated its Feasibility Study on its Kvanefjeld Rare Earths Project in Greenland. Since the original Feasibility Study had been published in May 2015 the price of uranium, a significant by-product at Kvanefjeld, had come down, but Greenland Minerals had also made a lot of progress optimising the project flowsheet. The result of the company's rethink was that it raised the NPV of its project by 14%, to A$1.59bn. So how much do you think you can acquire Greenland MInerals for today? A mere 6% of that, at A$91m.

Pitt Street Research just published a comprehensive issuer-sponsored research note on Greenland Minerals where we evaluated the data that went into that Feasibility Study. The assumptions were, we think, reasonable. Indeed, more than reasonable because since late 2016 a large Chinese Rare Earths company called Shenghe Resources has been a major shareholder in Greenland Minerals and a collaborator in Kvanefjeld. As the two companies continue to optimise the flowsheet using Shenghe's vast repository of technical knowledge, it's reasonable to expect further capital and operating cost reductions in the project that could drive further valuation increments.

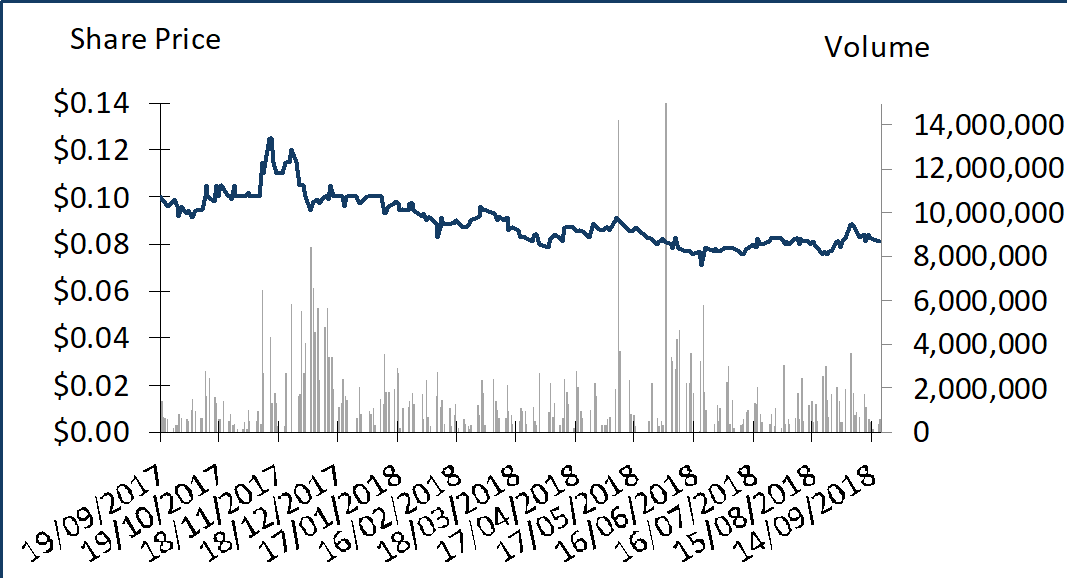

Which begs the question as to why Greenland MInerals is trading way below its reasonable long run value. At Pitt Street Research we've thought of a few reasons, including the perception that uranium will stay weak indefinitely, or that the Kvanefjeld project is somewhat 'long in the tooth'. Indeed, it could just be that investors are bored waiting for permitting to be completed by the Greenland government, a process that has been ongoing since 2015. Whatever the reason, Greenland Minerals appears to be trading well below the base case of our valuation range. To learn more, check out our research note, which is available by clicking here or visiting pittstreetresearch.com. Note, the usual disclaimers apply - click here for those.

1 topic

1 stock mentioned

I am an equity research professional who worked in stockbroking from 2001 to 2015. After 15 months doing investor relations I returned to equity research with the founding of NDF Research. With Marc Kennis I founded Pitt Street Research in July 2018.

Expertise

I am an equity research professional who worked in stockbroking from 2001 to 2015. After 15 months doing investor relations I returned to equity research with the founding of NDF Research. With Marc Kennis I founded Pitt Street Research in July 2018.