Guide to ETFs: Rising flows, growth of active and the Australian connection

Demystifying the ETF marketplace

Exchange-traded funds (ETFs) have surged in popularity, and in recent years have transitioned from passive index-tracking instruments to actively managed ones. This rapid evolution means the industry, despite holding over US$15T in assets and registering the highest annual inflow on record in 20241, is still new to many investors.

To demystify the ETF marketplace, we have launched our inaugural Guide to ETFs (GTE) Australia. The guide is designed to serve as a handy resource for all things ETFs – highlighting the trends shaping the industry, providing helpful guidance around portfolio construction and outlining best practices for trading.

In the spirit of our two-decade strong Guide to the Markets programme, the GTE provides actionable thought leadership and resources for both financial professionals and investors alike.

Our 40 plus page quarterly guide explores six key areas: the ETF landscape, active ETFs, the fixed income ecosystem, industry trends, principles of ETF investing, and ETF trading best practices.

The current iteration, among other things, also cast a light on several pertinent topics as highlighted below.

The case for active management

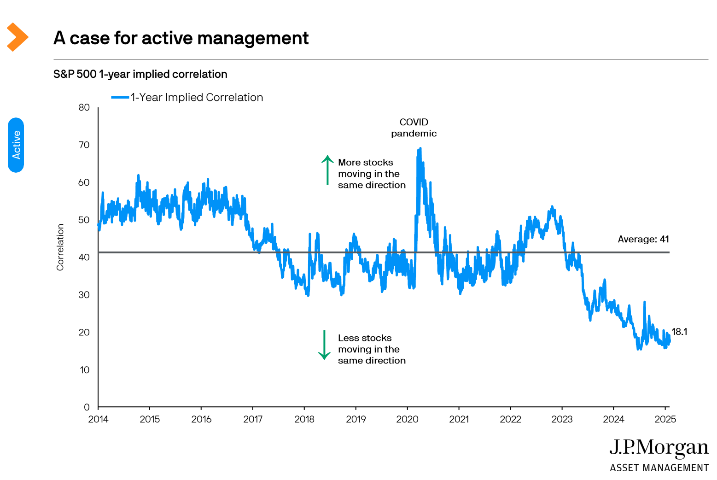

To a certain extent, a rising tide may lift all boats and drive market performance. In a scenario where most stocks move in the same direction, an index approach might suffice. However, when correlations break down and the gap between winners and losers widen, fundamental analysis and active stock selection can help differentiate opportunities.

As illustrated in the chart, the 1-year implied correlation of the S&P 500 – a gauge of how closely the index components move together – has declined to post-pandemic lows, indicating that fewer stocks are moving in unison1. The wide dispersion in performance underscore the importance of active management to help separate the wheat from the chaff, thereby gaining exposure to quality opportunities and potential market leaders. To that end, Active ETFs can come in handy, blending a portfolio manager's expertise with the efficiency of an ETF structure.

Harness the active edge in fixed income investing

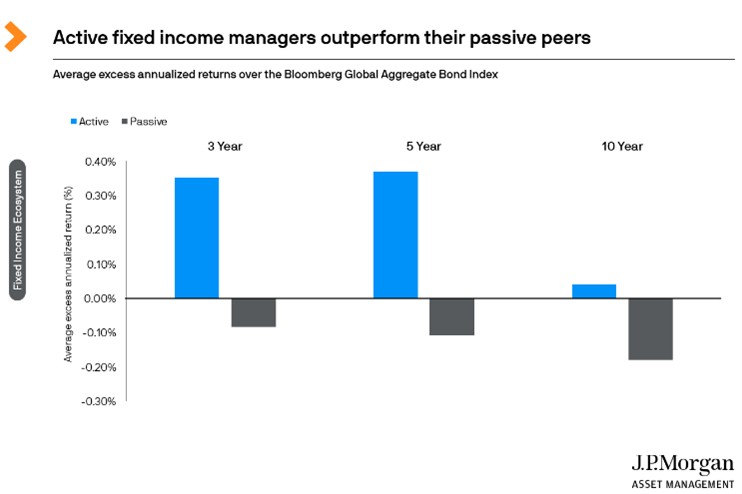

As illustrated in the chart, actively managed fixed income strategies have tradionally outperformed passive ones over the long term. In managing a typical fixed income portfolio, investors have to balance a range of risk factors, such as interest rate sensitivity, credit risks, liquidity risks, market inefficiencies, and potential concentration risks in the most heavily indebted issuers.

While both active and passive strategies face the same set of challenges, active managers can navigate these factors more effectively. Indeed, about 80% of core and core plus managers, who have the flexibility to invest in credit, securitised paper, and non-currency exposures, have outperformed the Bloomberg US Aggregate Index over the past five years2.

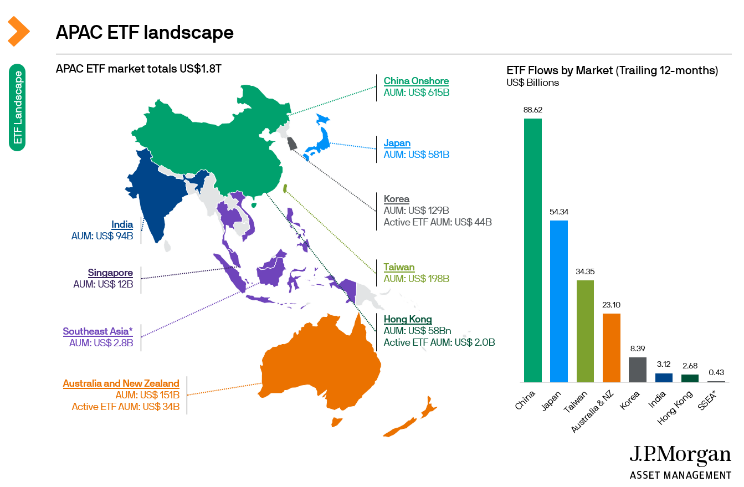

The rise of Asia

While ETFs have logged 15 years of growth1, the Asia Pacific region has emerged as a new engine driving this expansion. As of end of January the region listed over 3,500 ETFs1, accounting for almost US$2T in assets3. Assets under management (AUM) has doubled in the last three years with some markets such as China and Taiwan driving the growth3.

A standout in 2024 was the growth of China’s ETF market – the world’s second largest economy4 and capital market5. China added US$88.6B in net new ETF assets during the past 12 months, achieving the fastest growth in the Asia-Pacific region3. This surge enabled China to surpass Japan and become the largest ETF market by assets in the region3. As of Jan. 31, ETF AUM in China reached US$615B3.

This has been driven by several factors, namely the introduction of new products, the increased adoption of ETFs by institutions, and the drive for diversification in investment options among retail investors. As it stands, China's ETF AUM trails only that of the US – the world's largest ETF market – and Ireland-domiciled ETFs3.

Source: Bloomberg, Morningstar, Local ETF AUM data as of 31.12.2024, Local AUM is for locally domiciled ETFs only. *Southeast Asia includes Indonesia, Malaysia,

Thailand and Vietnam. Only Indonesia has approved transparent active ETFs. **SSEA is Singapore and Southeast Asia. Provided for information only to illustrate macro trends.

The markets above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell. Guide to ETFs - Australia. Data as of 31.01.2025Australia joins the active ETF revolution

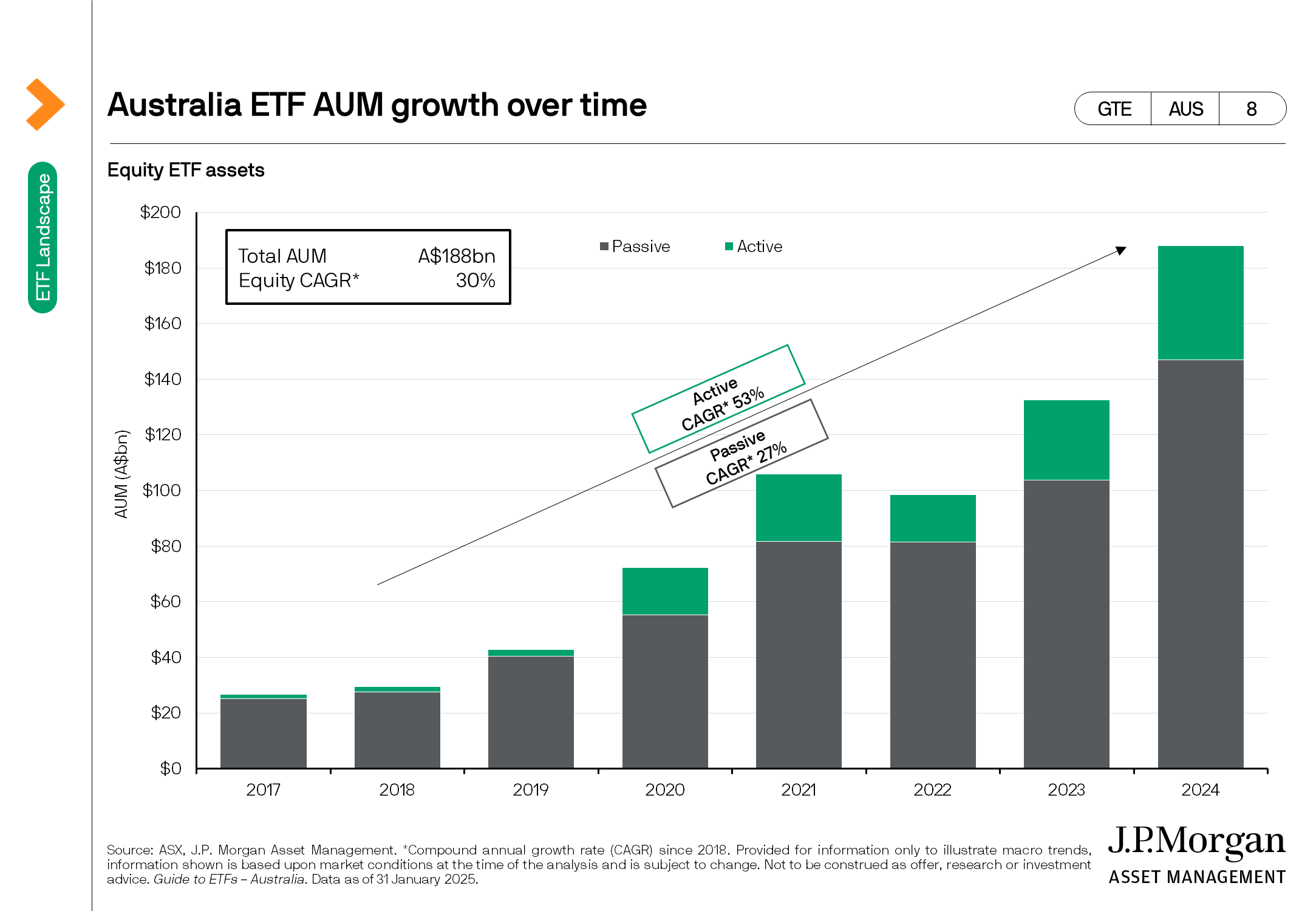

Active ETFs have been gaining popularity in Australia over the last few years, mirroring a global trend. Globally, active ETFs assets exceeds US$1.2T and accounts for one-fifth of all ETF flows over the past 12 months1.

In Australia, Active ETF AUM rose some 53% between 2018 and 2024, albeit from a small base. This was nearly double the growth rate of passive index ETFs, which grew 27%. In addition, Active ETFs continue to capture a larger share of the asset management (including mutual funds and ETF assets) market in Australia, reflecting the rise in demand for such solutions. By end-2024, the market share for ETFs stood just under 8.9%, up from 3.1% in 2018.

The growth in Active ETFs has been driven by regulatory changes in the US and other global markets, along with investor demand for transparent, lower-fee products that can provide potentially stronger performance, reduced volatility, and income.

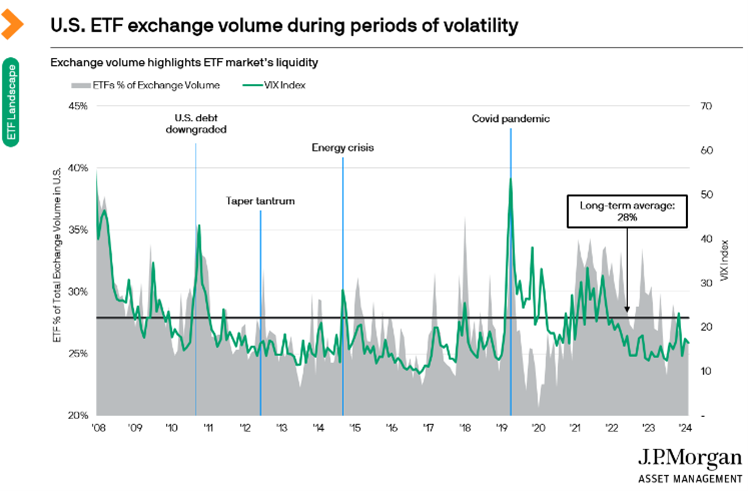

Providing liquidity even during times of stress

ETFs are largely known to be transparent, accessible, and cost efficient. A lesser known feature is liquidity. ETFs have, time and again, demonstrated the ability to provide liquidity to the market during times of volatility or market stress. During such times, ETF units have exhibited greater liquidity than the underlying holdings supporting the market and investors1. This was apparent during the Global Financial Crisis, the Federal Reserve taper tantrum episode and the Covid-19 pandemic1.

Moreover, ETFs have the ability to absorb large trades. They can absorb large dollar amounts without moving markets when the underlying securities are leveraged to provide liquidity.

Such liquidity is supported by a unique creation and redemption process. This process involves authorised participants (APs), which are typically large institutional investors or market makers that facilitate the buying and selling of ETF shares on the secondary market. They play a crucial role in maintaining the efficiency and liquidity of ETFs.

Source: Bloomberg, J.P. Morgan Asset Management. The CBOE Volatility Index, or VIX Index, is a real-time market index representing the market’s expectations for volatility over the coming 30 days. Provided for information only to illustrate macro trends, information shown is based upon market conditions at the time of the analysis and is subject to change. Not to be construed as offer, research or investment advice. Guide to ETFs – Australia. Data as of 31.01.2025.

Download the guide

For those who might have missed it earlier in the week, you can download the J.P. Morgan Asset Management (JPMAM) Guide to ETFs via the link below.

DOWNLOAD HERE

4 topics

At J.P. Morgan Asset Management, we believe investors deserve an expert global partner they can trust to step up and deliver strong outcomes. From the largest institutional investors around the world to financial advisors around the corner, our...

Expertise

No areas of expertise

At J.P. Morgan Asset Management, we believe investors deserve an expert global partner they can trust to step up and deliver strong outcomes. From the largest institutional investors around the world to financial advisors around the corner, our...

Expertise

No areas of expertise