Have you got your bunker in order?

Toilet Paper – check; Food – check; Gold – check; Defence(s) – check. We have written extensively on gold and food so here-in we detail some of the work we have completed on Defence, one of the essential service components of our portfolio.

In October 2018 we completed a detailed analysis, that we recently revisited, of investable Defence opportunities. Although ASX investors aren’t as blessed as our American and European counterparts when it comes to Defence, we identified three businesses offering unique sector exposure: Austal (ASB), Codan (CDA) and Electro Optic Systems (EOS). The irony was not lost on us that while completing the work in late 2018 market participants were getting more defensive considering market turbulence. At the time we were drawn to the space given increasing global hostilities and relatively stable spending against a challenged domestic outlook. Tailwinds that have now become a full-blown gale in 2020.

- Hostility. In early April 2020 the Epoch Times proposed a theory on the origins of the Coronavirus (must watch video here). Whether or not you believe it was man-made, the video sets the tone for a global China backlash for damages stemming from the virus

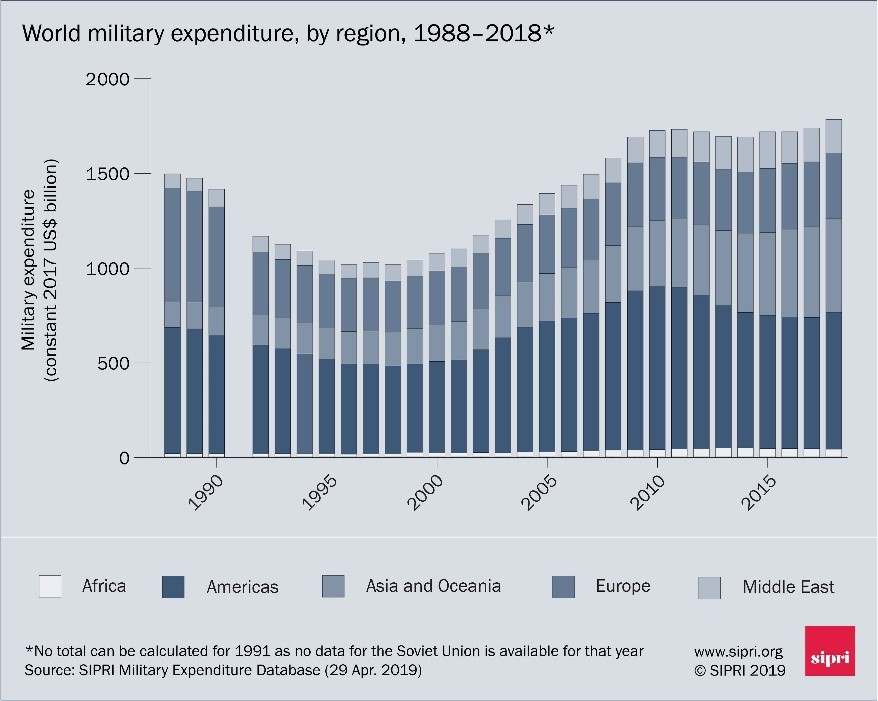

- Government Counterparties. In a world where discretionary expenditure is being sliced like a knife through butter, with many businesses facing uncertain futures, it pays to have revenue underpinned and designated as an essential service by Governments. Highlighting the benefit of this, Defence spending globally increased before and during the GFC and more recently is estimated to have increased by 4% to USD1.9trn in 2019. We believe Defence spending will likely become even more essential as scrutiny over the virus intensifies

- USD revenue streams. These 3 companies boast revenues largely denominated in US dollars (USD), and in the case of EOS and CDA, Australian dollar (AUD) cost bases. Hence these companies stand to benefit from a weakening AUD

Despite the strong argument mounted for each of these stocks, which was debated at length, only one stock made it into the portfolio in 2018 (EOS). At the start of 2020, we exited EOS on valuation grounds, while building a position in ASB over the past 8 weeks. A summary of some of that work is presented below.

Chester Defence Valuation Summary - April 2020

Source: Chester Asset Management

Austal

Austal (ASB) is a company that is reasonably well known in the market as a global shipbuilder, servicing Defence and Commercial ferry customers. ASB has shipyards located in the United States (Mobile, Alabama), Western Australia (Henderson), the Philippines (Cebu) and most recently Vietnam (Vung Tau).

US Operations

The US Operations in Mobile Alabama generate the bulk of ASB’s earnings (~90% FY19 segment earnings). ASB is the world leader in the construction of aluminium vessels and are one of only 2 contractors delivering Littoral Combat ships (LCSs) to the US Navy (LCSs were designed by ASB). The other contractor being Lockheed Martin who build a steel variant of the ship. It is our understanding the steel model hasn't displayed the same durability as ASB’s aluminium model, is twice as heavy and slower. In 1H FY20 ASB delivered LCS22 to the Navy with LCSs 24, 26, 28, 30 and 32 under construction. We note margins are expected to continue to increase with LCS 28 and beyond won at higher margin. ASB are also currently constructing Expeditionary Fast Transport (EPF) Vessels with EPF 11 delivered in 1H FY20 and EPFs 12 and 13 under construction. Vessels constructed importantly generate current year revenue but also provide future support revenue, increasing the sustainability of earnings.

Source: Defenceconnect.com.au (LCS Image)

Australasian Operations

Australasian operations comprise key shipyards in WA, Philippines and Vietnam. Capacity within ASB’s Asian business (ex Australia) has increased 4x since 2016 and recorded an approximate doubling of revenue in FY19. The momentum in the business is driven by a global ferry replacement cycle where ASB are in largely a duopoly with (Tasmanian based) Incat. The replacement cycle, although representative of multiple one-off orders, rather than multi-year Government contracts, was thought to provide strong visibility on commercial earnings for 10+ years. We put a disclaimer around that statement due to COVID-19 potentially interrupting the previous momentum of the business. We note that the ramp up in ASB’s Asian shipyards provide a platform to leverage lower labour costs, under the guidance of expat Management, which should translate to materially higher EBIT margins over the long term.

Investment View

When we reviewed ASB in October 2018 it was trading on <6x EV/EBITDA 1yr forward and we believed the market was underappreciating the business’ momentum and analysts underappreciating earnings. Trading on <6x EV/EBITDA FY20 we once again feel ASB is being underappreciated. Prior to COVID-19 disruptions we saw ASB as highly likely to upgrade into its full year result. With all the uncertainty at present we weren’t surprised to see this not transpire recently (1) but ASB remains one of the few companies in the market to retain guidance.

In addition to continuing to operate as an essential service we saw enough headroom in ASB’s FY20 earnings due to factors 1 through 10 detailed below.

Chester Earnings Expectations vs Market ~15% above (pre potential COVID-19 Inefficiencies)

Source(s): Historic financials – Austal financial reports; Earnings projections - Chester Asset Management

Beyond FY20 there are a few opportunities not priced into (our based case) or market expectations that provide for material upside:

- FFG(X) – ASB are now one of 4 parties tendering for the contract, with the US Government looking to announce in July 2020. ASB is using the Littoral Combat Ship (LCS) design as its parent design. The contract is for 20 guided missile frigates at a cost of USD940m each (real) dollars, for ships 3-20. Navy’s budget is calling for procurement of 1,1,2,2,3 ships from FY21 to FY25 so the opportunity is huge vs current US shipbuilding revenue of ~USD900m p.a. (2)

- Philippines OPVs - It has previously been announced in the press (3) ASB are to be awarded an Offshore Patrol Vessel (OPV) contract with the Philippines Government, with financing support from Australia. The contract is speculated at USD600m over 5 years (~AUD200m revenue p.a.) at presumably strong margins (i.e. ~AUD20m EBIT p.a.)

- Subic Bay Shipyard – ASB have reportedly considered the acquisition of the Subic Bay Shipyard in the Philippines with Cerberus Capital Management (4). We assume if ASB is successful with the OPV contract it may assist in funding Subic Bay

- Unmanned Vessel Program – Austal has been named as a participant in a USD1bn contract on unmanned vessel systems development to bid for work in the Medium Unmanned Surface Vessel Program and the large unmanned surface vessel concept design

Codan

We have traditionally thought of Codan (CDA) as a Defence business as they have historically serviced the military with communications devices, at least that was their core business when we undertook a day of audit work at their Newton office ~15 years ago. Hence, we have included it within our work on Defence but admit it is less exposed to the sector than ASB and EOS.

Metal Detection

Through its Minelab division CDA are now known as the global leader in the development of metal detectors, selling into 150 countries globally with exports accounting for ~85% of sales. In the last few years CDA have diversified their metal detector revenue base with the introduction of additional products some of which leverage into the recreational detection space (Equinox released Feb18 and Vanquish Oct19) and countermine (MDS-10). Although sales have increased at a compound annual growth rate of ~25% FY2015 to FY2019, and remained strong in 1H and Q3 FY20 we are somewhat unsure of the following factors:

-

Deferred purchases. I.e. although the gold price is strong are there a level of sales that are discretionary, particularly in the recreation market?

- Logistical Disruptions. Despite us believing EOS’s cited logistical issues weren’t freight related Dubai represents a significant hub for CDA so we are mindful there could be added complexities to the supply chain as a result of COVID-19

- Manufacturing. The majority of CDA’s metal detectors are manufactured by Plexus in Malaysia. Although receiving a partial exemption during lockdown to produce at 50%, the extended Malaysian lockdown leaves us cautious of stock shortfalls

Management themselves have in the past projected base sales at AUD125m (vs AUD182m FY19) and admit sales in Africa can be volatile. There are however 5 key products under development previously slated for release in FY21 and we do appreciate historically releases have been associated with strong sales boosts.

Source: Codan 2019 Annual Report

Communications

Despite now being a lower percentage of sales CDA continue to produce communication devices which in FY19 generated sales of AUD77m (~30% of Group). These include Land Mobile Radios (LMR) and Tactical Radios.

Key customers for LMR are US state and local governments with an estimated market size of USD900m. Tactical services largely military and NGO markets with an estimated market size of USD500m for high frequency (HF) or ~USD2bn across all frequencies. Funding is generally via the US Government or European Union. We are very interested in the Cascade (LMR) product, being released into the market in FY21 which we got to demo at CDA’s 2019 Investor Day. It expands the CDA offering into systems integration and ongoing services and increases their addressable market.

Tracking Solutions

The added kicker to CDA is a business called Minetec. Minetec is billed as the world’s most accurate underground tracking technology, think Catapult for underground mining operations, tracking equipment and staff in real time in 3D. In fact, the technology was developed by the CSIRO (with Catapult) and is exclusively licensed to CDA. It was acquired in December 2011 and significant investment has been made since then. Minetec's purpose is to improve the safety and productivity of underground mining (assisting with underground social distancing)! Having trialled the product with BHP and Newmont and having signed a distribution JV with Caterpillar (Feb18) to develop a combined underground mining solution. We see material upside if the Caterpillar JV succeeds but note progress to date has been slow, so we wait with interest.

Investment View

When we looked at CDA in October 2018 it was trading on 12x 1 year forward consensus earnings, for a high ROE business, with strong margins, with Minetec (and Defence) for free. It currently trades on 15x FY21 earnings and remains extremely interesting but at present we remain slightly cautious on earnings.

Electro Optic Systems

Electro Optic Systems (EOS) is probably the least known of these 3 businesses being officially covered by only one analyst. It was even less well known when we participated in its February 2018 capital raise at AUD2.91/share but arguably became discovered in 2019 when it put on 200% and more recently conducted its second capital raise in the space of 6 months.

The business was formed in 1983 and listed on the ASX in 2002. In 2005 the business formed a strategic alliance with US Defence Major Northrop Grumman; who although haven’t lodged a change in substantial we believe remain a shareholder with ~3.5% of the company. Since listing the business has established a global presence in Defence, Space Systems and most recently (Space) Communications. The business is led by Dr Ben Greene who established laser space tracking in Australia and US Army remote weapon programs. We have high regard for Ben.

EOS has 2 significant production facilities in Australia (Hume, ACT) and the United States (Huntsville, Alabama) to support their Defence operations, 2 further facilities in Singapore and UAE and 2 research centres in Australia (ACT and WA, with an additional QLD site) to support their Space operations. The total capacity of their 4 defence facilities is estimated at AUD900m p.a. with output expected to be achieved by 2024.

Defence

EOS Defence specialise in technology for weapon systems optimisation and integration, reducing the role of a human operator for a wide range of existing and future weapons systems. Key products are remote weapon systems (RWS) and unmanned turrets. EOS is also expected to be a major beneficiary of anti-drone requirements or counter unmanned aerial systems (CUAS).

Having progressed from loss-making in 2017, after years of material R&D and development, EOS is achieving strong growth in this division particularly from the advanced RWS product the EOS R-400s. The business has been awarded close to AUD1bn in R-400s contracts since 2017. Although no qualified competing product currently exists to the R-400s, Management estimate that they should take 40% future market share (with the emergence of competition). Management estimate the RWS market to be worth AUD12bn over a decade to 2030.

in February 2019 EOS launched the T2000 Remote Turret (RT) System. EOS has historically completed an AUD30m development program aimed at new global market requirements for new turret technology and is currently partnered with Hanwha using this technology to tender for a multi-billion-dollar defence contract for the Australian Government.

The company has bid for AUD1.1bn of CUAS’s with contracts to be awarded from Q420. EOS believes the CUAS market to be an AUD12bn market to 2030.

We also note that there is additional long-term revenue of up to 100% of the original contract values over 15 years that is expected to be derived from maintenance and spares support not included in the estimated market sizes above.

Source: EOS Presentation (R-400s)

(Space) Communications

As a market space communications infrastructure generates ~AUD500bn in annual revenue from AUD1trn of infrastructure employing microwave technology. Given on land we have replaced microwave technology with fibre, providing 100x the capacity EOS envisions the same progression in space. There have been technical challenges (atmospheric distortion being key), and incompatibility with existing infrastructure that has prevented the adoption of optical technology in space. EOS has been able to overcome these challenges using new laser probes and has been able to achieve space communication with 1% of the power previously required. The company is now packaging microwave technology (acquired through EMS Takeover Oct19) with optical technology to enhance and transition customers. Remains an exciting proposition but will take time to develop and will require a satellite to be launched into space.

Space

The Space division is the R&D and technology incubator of the group, with the laser optic technology enabling the Defence sector to be created. EOS laser technology in Space provides a more accurate low-cost solution for tracking objects of all sizes to existing radars that only provide ~90% coverage and have limited accuracy in tracking small objects. The intention was to deploy the lasers via a network of sensor sites to track orbiting debris and objects in space, and to monetise the data generated for intelligence purposes and the protection of space infrastructure. I.e. there are ~USD900Bn of satellites in orbit, most of which are vulnerable to loss from debris collision. The potential market for data was previously estimated by EOS at >AUD2bn to 2029, based on customer budgets. Although EOS achieved its initial target of turning the division breakeven, Government policy changes through 2018/2019 have changed the business model of the group and we believe monetisation (large scale contracts for space-tracking data) now represents a longer dated proposition.

Investment View

As discussed, we initially entered EOS in February 2018 and sold down progressively over 2H 2019 before exiting in January 2020.

After a benign COVID-19 update on March 24 we were somewhat disappointed/confused with the 15th April update, which cited key logistical issues with their number one customer, out of the Middle East. This has led to a delay in production, hence payments and an earnings downgrade. Although Management was quick to dismiss this as simply a logistics issue, unrelated to the financial health of the counterparty, we can’t help but wonder what impact supressed oil prices may have on budgets and spending of nations heavily reliant on oil revenue. With the customer representing ~half of EOS's current backlog we continue to have the company on our watchlist, for when the opportunity may become more favourable again.

With an AUD3.1bn pipeline and material contracts and tenders over the next 12 to 18 months: 1.1bn CUAS award Q420; US army (Stryker) tenders / contract Q420, etc. we continue to view EOS’s upside as compelling. A reminder that global Defence companies have historically traded on ~1x order book so success in any of the existing tenders could add material value.Stay Safe. Keep your Defences Up.

(1) Refer 7 April 2020 ASX announcement https://stocknessmonster.com/announcements/asb.asx-6A974647/

(2) https://fas.org/sgp/crs/weapons/R44972.pdf Noting ships 1 and 2 are at a cost above this amount

3 topics

3 stocks mentioned