Hedge fund bets, Saudi diversification, and the global dollar debate

.png)

This week’s charts begin with a visualisation of hedge funds’ bets that Treasuries will fall. Next week look at Saudi Arabia's oil producer’s progress in diversifying its economy. We wade into the “de-dollarisation” debate, showing that the greenback’s share of central bank reserves may be falling, but its importance to global trade remains crucial. In Europe, we show how year-on-year comparisons are likely to paint a positive picture for inflation, while the looming end of emergency ECB support may be stressful for banks. Finally, in China, we chart the biggest retail beneficiaries of the nation’s spending boom and the “positive surprises” for growth and inflation that have followed its great reopening.

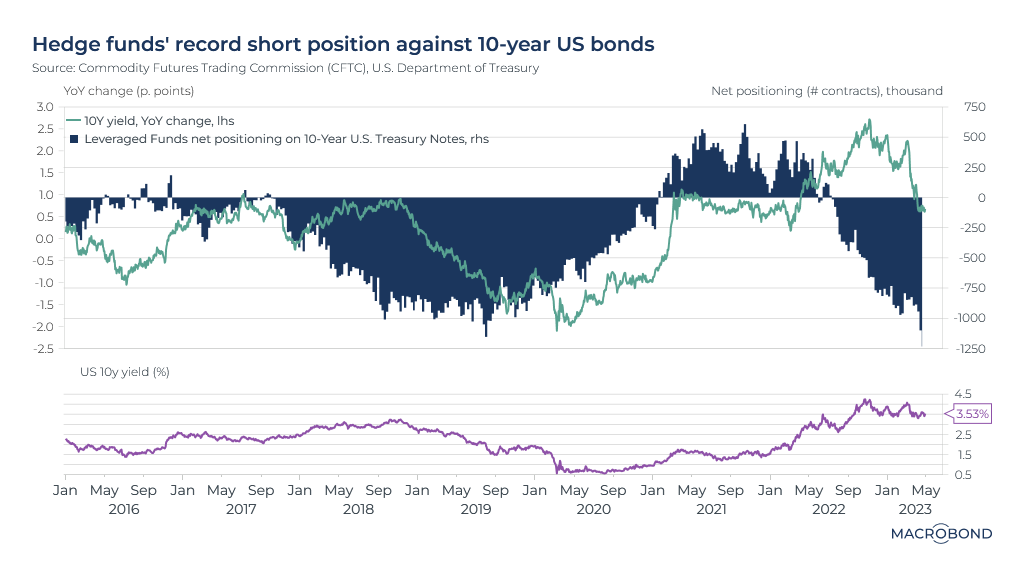

Hedge funds are taking a strongly negative view on Treasuries

.png)

This chart tracks bets by hedge funds with regards to 10-year Treasuries, as reported to the Commodity Futures Trading Commission. They have steadily built up a record net short position, even after 2022 was a historically catastrophic year for bonds and 10-year yields have stayed below last year’s peak (as the second panel shows).

As investors debate prospects for a Federal Reserve “pivot,” rate cuts and recession, some hedge funds may be staking out an unambiguous view: Treasury yields will stay high.

As Bloomberg News recently noted, the short position may be also related to so-called basis trades, when hedge funds by cash Treasuries and short the underlying futures.

Saudi Arabia’s more diversified economy

.png)

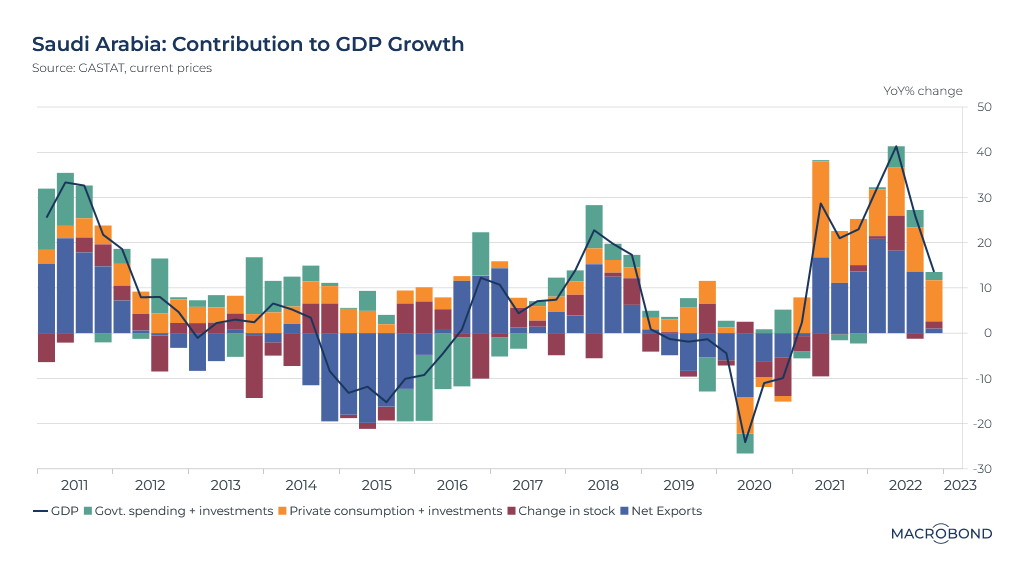

Saudi Arabia recorded the highest GDP growth among G-20 nations in 2022. Surging oil prices in the wake of Russia’s invasion of Ukraine obviously helped, but by at least one metric, the nation has made progress diversifying its economy over the years.

Our chart breaks down the contributions to the year-on-year GDP growth rate in current prices by different sectors.

The blue bars represent net exports. This is where the positive effect of higher oil prices can be seen. But the strong performance of the orange bars in recent quarters is also notable. This includes private consumption and private investment.

With growth expected to slow in 2023 as crude prices stabilise at lower levels, these non-oil activities are expected to support the economy.

Global currency reserves and the de-dollarisation debate

.png)

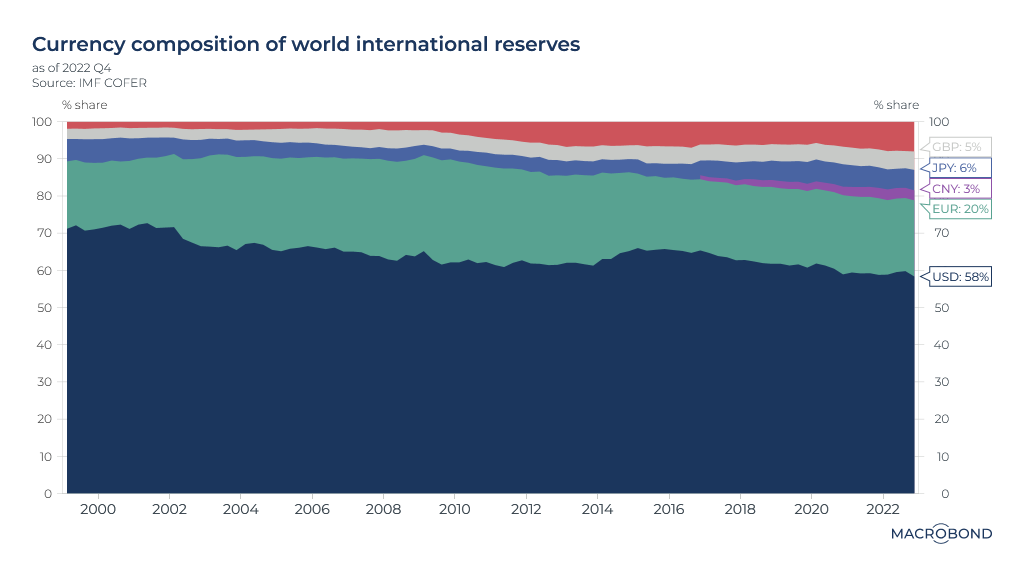

The “de-dollarisation” debate is in the news.

“Why can’t we do trade based on our own currencies?” Brazilian President Lula da Silva recently remarked. China has been promoting the use of the renminbi in settling cross-border trade. Some nations view US sanctions against nations like Russia as “weaponising” the dollar, given the global reserve currency is so crucial for paying oil import bills.

By at least one measure, reliance on the dollar has been steadily declining: its share of global foreign-exchange reserves held by central banks. As our chart of IMF data shows, the dollar remains by far the main currency of choice, but its share has dropped to 58 percent from 70 percent over the past 20 years.

Holdings of Chinese yuan have been increasing from a tiny base, and now stand at 3 percent.

The euro’s share grew in the 2000s before retreating; it’s back at about 20 percent. The “other” category, including Australian, Canadian, South Korean and Scandinavian currencies, is also gradually inching higher. IMF economists posit that these currencies are considered to be “safe” but offer higher returns than the greenback.

The dollar's share of SWIFT transactions remains stubbornly high

.png)

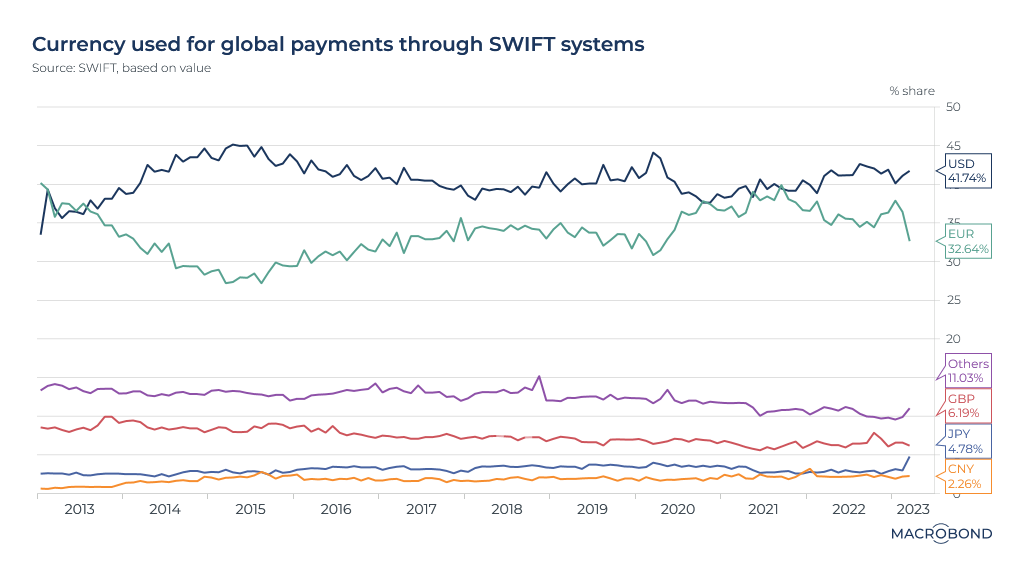

Dollar reserves might be falling at central banks, but the greenback’s share of international transactions has barely budged.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is the messaging network that executes worldwide payments for banks. This chart tracks different currencies’ share of global SWIFT payments over time.

The dollar accounts for 40 percent of the value of transactions, about the same as a decade ago. The euro and pound have seen their proportions shrink. Starting from a low base, China’s renminbi grabbed an increasing share in the mid-2010s, but that trend has levelled off.

A high-profile recent impasse shows how sticky the greenback is – even for nations hostile to the US. Russia has long counted on India as a key market for its military equipment, but New Delhi risks running afoul of US sanctions if it pays Moscow in dollars. The Russians are refusing to pay in rupees, citing depreciation against the ruble.

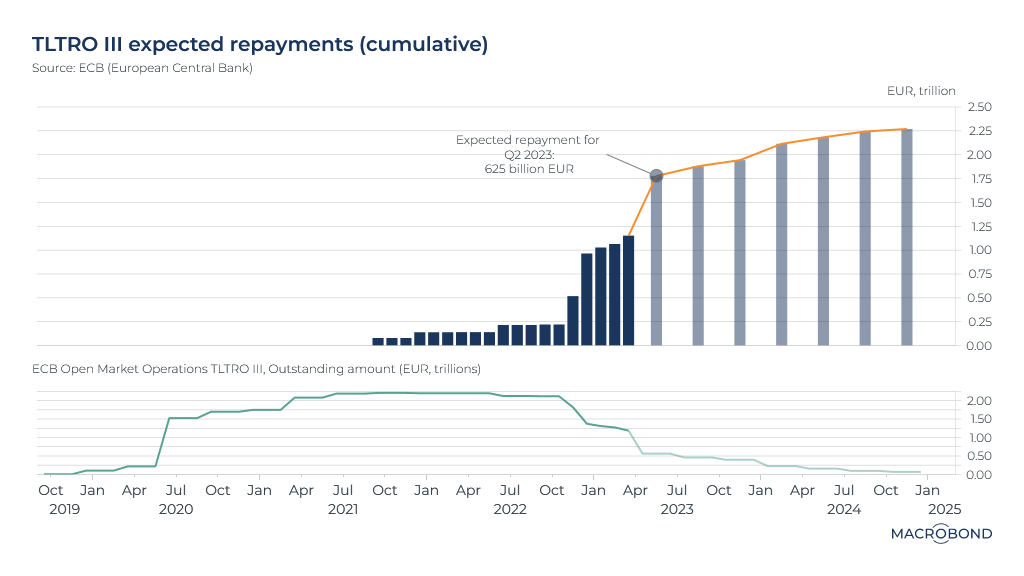

European banks face TLTRO repayments at a stressful moment

.png)

For European banks, a pandemic-era rescue bill is coming due at a time that might prove inconvenient.

As our chart shows, analysts surveyed by the ECB expect lenders to start stepping up repayment of the central bank’s program of targeted longer-term refinancing operations (TLTRO). Final repayments are due in December 2024.

TLTROs were launched to support lending in the aftermath of the debt crisis in 2014. After their revival in 2020 – charted in the second panel – they became the ECB’s largest-ever infusion of liquidity.

TLTROs offered longer-term loans to banks at a favourable cost, and helped banks exceed liquidity requirements, but the most attractive terms of the program ended in June 2022.

As our chart shows, after further ECB changes in October, voluntary repayments initially accelerated, but then flatlined. The most recent ECB survey was in February, and systemic stress has worsened since then amid high-profile bank failures.

Banks must balance preserving their liquidity, tapping more expensive sources of funding and repaying their central bank.

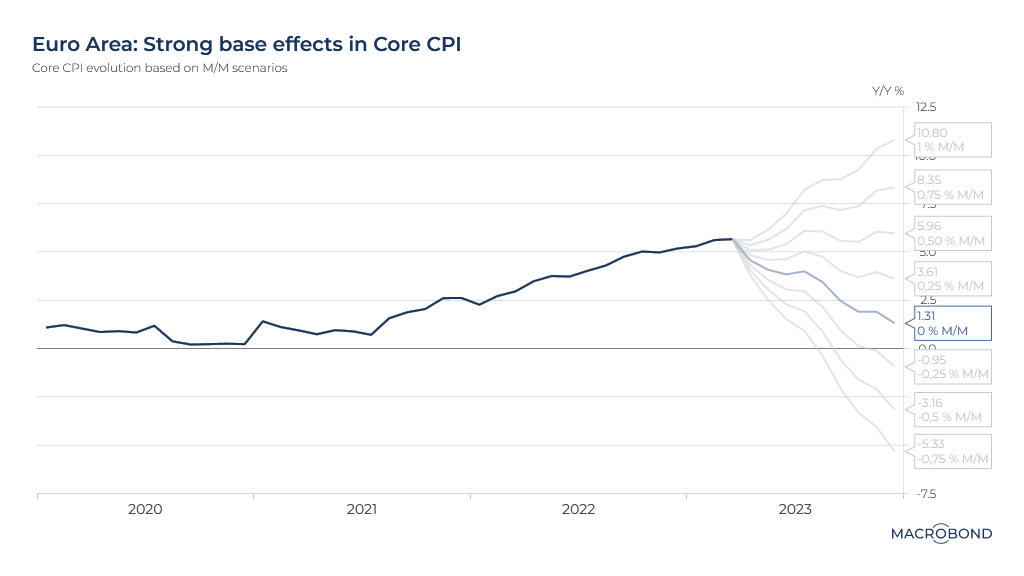

European CPI scenarios and the base effect

.png)

With at least one more rate increase expected from the ECB, stubbornly high inflation remains in focus. New figures are expected next week.

This chart shows different scenarios for year-on-year growth in the core consumer price index for the eurozone, which excludes food and energy prices. While headline CPI has started to slow, core CPI is still accelerating in many regions.

One phenomenon worth watching is the base effect. This refers to volatility in the CPI 12 months earlier (the base month) when making a year-on-year comparison of inflation rates. Put another way, month-by-month price trends are important, but it’s worth being mindful of an outsized surge or drop a year earlier. And we are more than a year into the era of elevated inflation.

As our chart indicates, even steady core CPI growth of 0.25 percent month-over-month will mean a long-term slowdown in the year-over-year figures. And looking closely, even a 1 percent increase for April will result in a falling year-on-year trend – due to the base effect a year earlier.

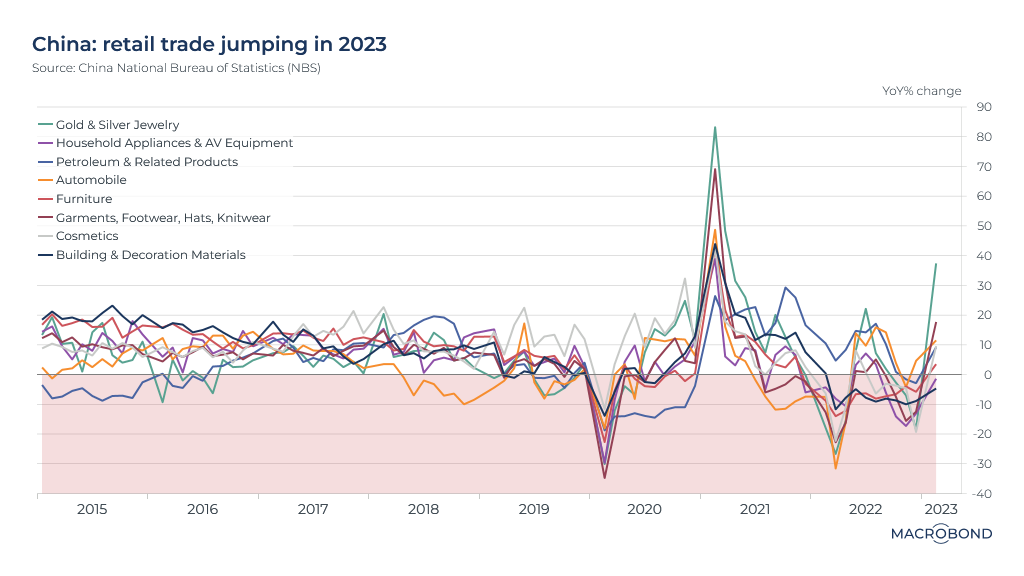

The unleashed Chinese consumer is splashing out on jewellery and cars

.png)

The Chinese consumer is spending again. Last week, we charted the services rebound after the nation reopened its economy. This week, we show how sales of goods in different sectors have rallied from locked-down doldrums.

In March, China reported 10.6 percent year-on-year growth in retail sales of consumer goods. Jewellery stands out, surging 37 percent. Automobiles and clothing both jumped over 10 percent.

A few categories are still stagnating, with home décor and household appliances in negative territory. This may well be related to the struggling real estate market.

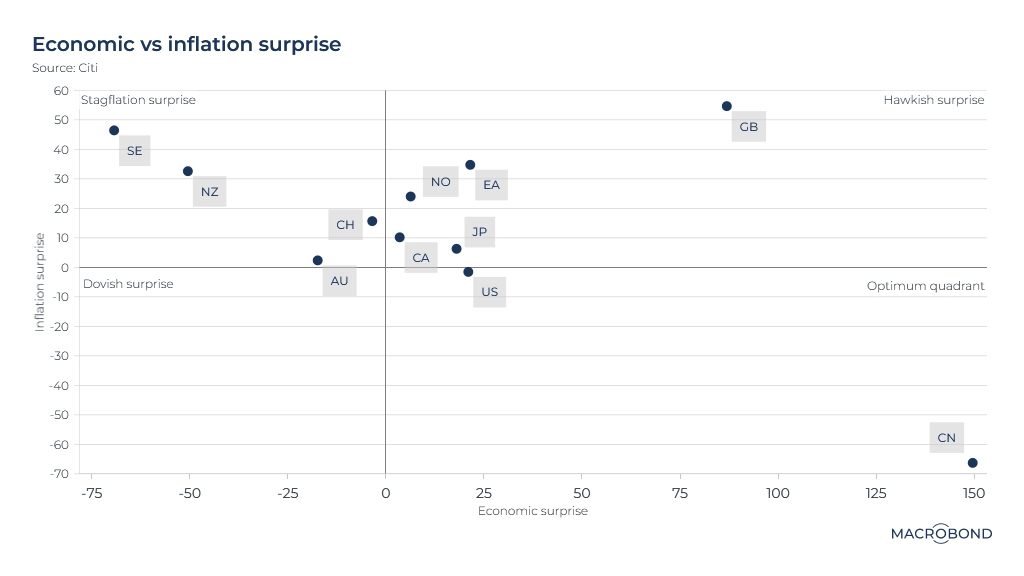

Economic and inflation surprises are bullish for China and hawkish for Britain

.png)

With the release of every economic data point, markets compare the figure to analysts’ expectations and react accordingly.

Citigroup maintains an economic and inflation surprise index, which we have charted to show how various nations are faring.

There are four quadrants. The “stagflation surprise” quadrant of higher-than-expected inflation and disappointing growth includes New Zealand and Sweden, whose woes we examined last month.

Given the gloomy news flow in the UK, Britons might be surprised to learn that they are experiencing the greatest “hawkish surprise.” The worst inflation in the group is combined with GDP figures that were recently revised upward.

China is in the sweet spot. Growth is surging after the country’s great reopening, while it appears that slack in the labour market has kept inflation in check.

There are no “dovish surprises” of weak growth and tumbling inflation to be seen yet, even though economists forecasting a central bank “pivot” certainly expect nations to start moving into that quadrant.

5 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)