Hidden growth potential in this ASX microcap

For microcaps, some of the best opportunities can often be found when a share price tracks sideways for a prolonged period, creating the impression that a business is stagnating. This type of price action can mask operational turnarounds, strategic shifts, or emerging segments as it often takes time for these initiatives to come to fruition.

I believe a recent addition to the Merewether Capital Inception Fund fits this bill. SDI Limited (ASX: SDI) was formerly known as Southern Dental Industries and has been manufacturing dental products in Australia for over 50 years. A decade ago, SDI traded at around 60 cents a share and at face value, the current share price of 85 cents reflects the business over that time frame.

Lacklustre mid-single-digit revenue growth and lumpy profitability dominate the headline numbers, but underneath that is a business that has strategically shifted its operating segments and is emerging from the cost impacts caused by COVID.

Shifting segments

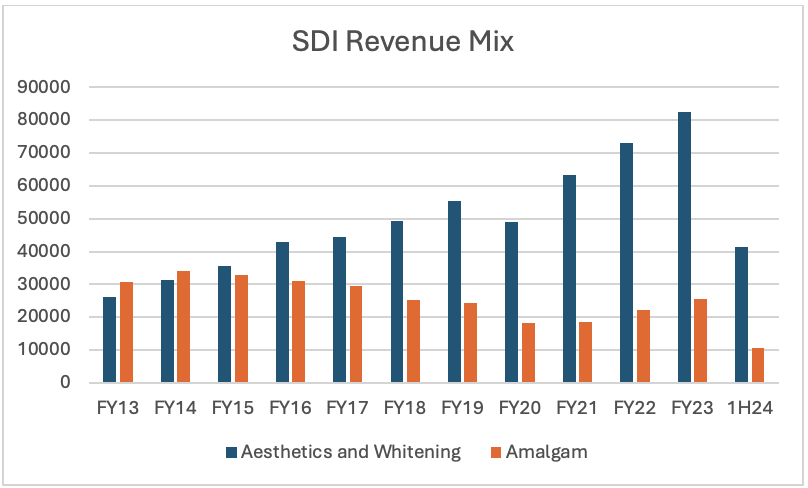

For most of its life, SDI specialised in the manufacture of “amalgam”, the classic silver fillings made of an alloy of mercury and silver. Demand for amalgam has fallen dramatically in developed countries through a combination of health concerns with the use of mercury and consumers preferring the emergence of tooth-coloured composite resin products. Seeing this shift occurring, SDI began to invest heavily in its non-Amalgam segments, Aesthetics and Whitening brands many years ago.

The investment into these segments could only be labelled a success, with a revenue CAGR of 12% over the last 10 years. Only COVID created a small blip in the growth trajectory, as shown in the blue lines below.

At the group level, growth hasn’t been as smooth because revenues in the Amalgam segment have fallen steadily and partially masked the strength of Aesthetics and Whitening.

Looking forward, with Amalgam revenues less than 15% of the group in the recent 1H24 result, the terminal decline of the segment is having a diminished effect on the headline numbers. We believe the growth of Aesthetics and Whitening can shine through.

Costs of COVID

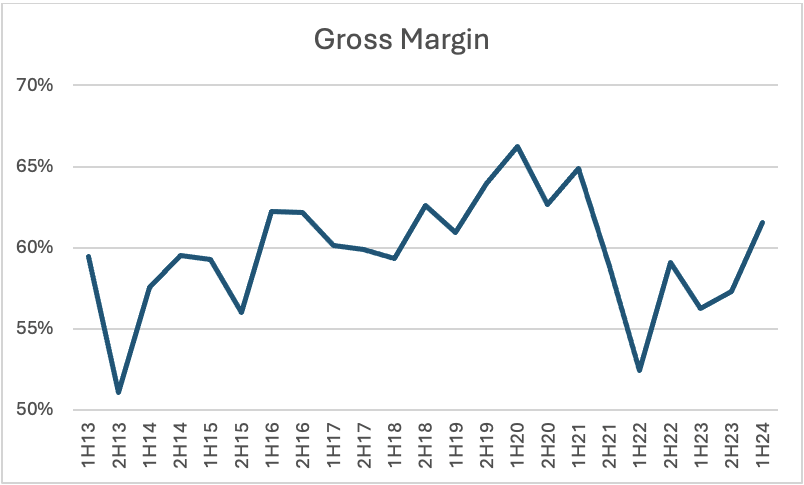

Another factor that impacted SDI in recent years is a weakened gross margin because of COVID effects on logistics and warehousing costs. After steadily increasing to a record 66% pre-pandemic, the gross margin fell to a low of 52% in 1H22, as shown below.

With a revenue base of more than $100 million, a swing in gross margins of around 14 percentage points brought severe stress to the company’s profitability – though SDI management did a fantastic job keeping the business profitable by reducing operating costs.

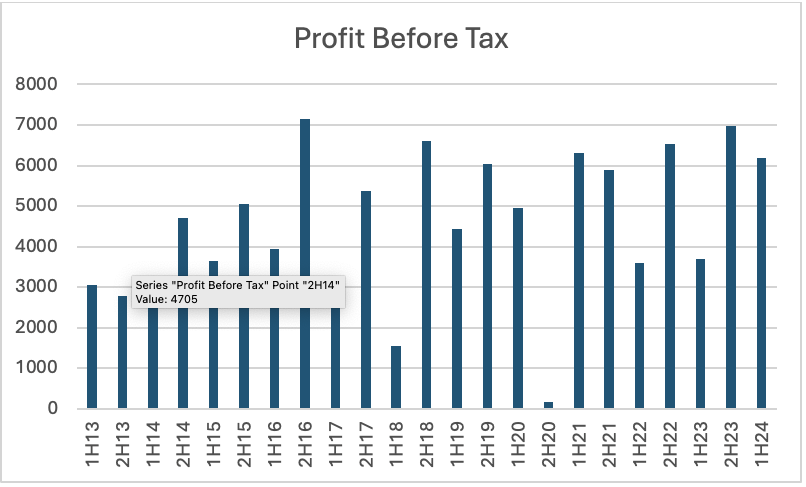

As COVID impacts have eased, the gross margin recovered to 62% in the recent 1H24 result. This led to a record 67% climb in first-half profit before tax versus the prior year, with the gross margin recovery coming on top of the higher revenue base and lower operating costs.

While the chart above may look like a business with lumpy profitability, it is partly explained by a first-half versus second-half skew in the business. We’ve sometimes seen this split 33 versus 66 between the halves, outside of the COVID-impacted years.

After a $6.2 million profit before tax in the first half of FY2024 (normalising for one-off impairments of around $730,000), the historical skew in the second half should result in a profit before tax of between $9 million and $11 million. This should see FY24 profit before tax of between $15 million and $17 million.

Assuming a normal 30% tax rate leaves SDI likely trading around 9-10 times this year’s net profit. That sort of multiple is what you would expect for a business with stagnant growth, not one that has grown its emerging segment at around 12% a year for the last decade.

Growth pains

Despite steady growth in a very defensive sector, no investment is without risk. For SDI, the largest one looming is a problem that faces all growing manufacturers at some point; outgrowing existing manufacturing capacity.

After manufacturing in the company’s facility in Bayswater (an outer suburb of Melbourne) for decades, SDI purchased a new site a couple of suburbs away in Montrose two years ago for $17.8 million.

The new manufacturing project is a large undertaking, the company estimating a $60 million cost over the next three years. This is broken up into $45 million of land and buildings and $15 million of new manufacturing equipment.

The large capital cost introduces balance sheet risk over the coming years, with the company looking to fund the land and buildings portion with long-term debt. However, with the current Bayswater facilities having a market value of circa $15 million – and the company likely to generate around $10 million of annual operating cash over the next few years – the balance sheet should be managed easily unless there are issues during the construction or fit out.

A bright future

If all goes well with the construction of the new Montrose facility, SDI will more than double its current manufacturing capacity. This should drive significant efficiencies to potentially grow gross margins beyond 70% in the future.

Management has a planned cadence of one or two new or upgraded product lines a year, headlined by the recently released Stela. This offers an alternative to amalgam, with an industry-leading compressive strength required for the treatment of back molar cavities.

The continued steady growth of the Aesthetics and Whitening segments, combined with the ongoing recovery of gross margins from COVID impacts, SDI looks set to generate very strong profit growth over the next year or two. Trading on a forward profit multiple less than 10 times earnings, I believe the market has overlooked the likelihood that the headwinds of recent years, which have masked the underlying quality of the business, are quickly dissipating.

Follow me for more like this

If you enjoyed this wire, don’t forget to click Like. To read all my content, including my latest on how the share price of a company often moulds the market’s perception, you can follow me on the link below.

2 topics