Home Loan Data Shows the Economic Cost of Lockdowns

Australia’s political leaders are making critical decisions daily. The greatest of these is striking a balance between a potential spike in deaths from Covid-19 and the economic toll from the lockdown. Key indicators such as GDP and unemployment are awful but are often distant for those experiencing limited personal impact. However, data coming from lenders is showing the pain of the lockdown in a much more tangible way – around one in eight home loan borrowers are unable to keep up with their scheduled repayments.

Problems for home loan borrowers are seen in two ways: arrears and hardship claims. Arrears capture borrowers who have fallen behind without prior approval. Major bank borrowers behind by at least one repayment have so far only increased by a small amount to around 2% of all loans, which on its own would be reassuring. However, this isn’t the full story as those who have asked for hardship assistance typically aren’t counted in arrears data.

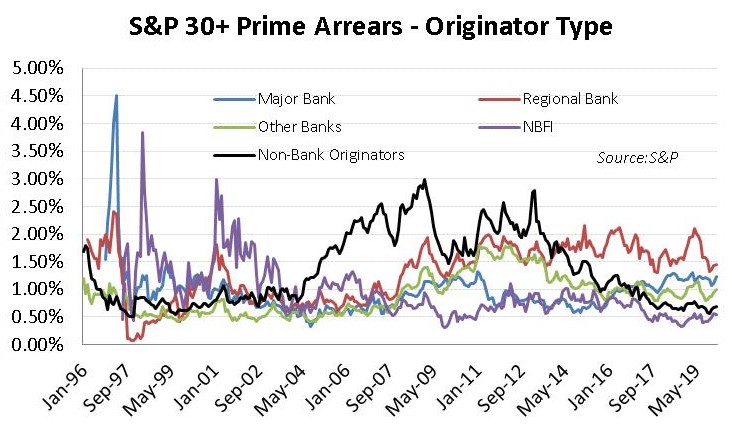

The graph below shows the long term arrears levels for Australian residential borrowers whose loans are included in securitisation transactions. This is only a small portion of home loans for the major banks but a much larger portion for other lenders. In the lead up to this crisis, arrears were highest for regional banks followed by the major banks. Credit unions, building societies and non-bank lenders had the lowest rate of borrowers behind on their repayments. Major banks tend to put better than average loans in their securitisation transactions, so this data clearly demonstrates the higher lending standards of smaller prime lenders.

Where the real pain of this crisis is showing up first is in hardship claims. Unlike arrears, borrowers with hardship status have received approval from their lender to reduce their repayments. This could be a partial reduction in repayments, such as switching from principal and interest repayments to interest only repayments, or a full deferral of repayments. Note that some borrowers requesting hardship are ahead of their scheduled repayments, so they have a buffer which they are now able to draw upon.

In the last fortnight NAB and Westpac have both reported 9% of borrowers requesting hardship status and ANZ has reported 14%. The latest update from the Australian Banking Association has another 50,000 residential borrowers requesting hardship status this week, a material slowing of the rate from previous weeks.

Based on these numbers, we have more than 10% of home loan borrowers in hardship and roughly another 2% in arrears. Combing all the data results in approximately 12-14% of borrowers failing to keep up with their scheduled repayments. The hope is that when workplaces reopen, most of these borrowers will be able to return to normal repayments. However, a difficult to estimate minority won’t be able to rectify their position in a standard way and will need to take additional action. This could be help from family members, withdrawing superannuation or as a last resort selling the property to hopefully clear the debt in full.

This brings us back to the balance between saving lives and saving livelihoods. When someone has been locked out of their workplace and cut-off from earning an income they may see their political leaders as responsible for their financial predicament. The Federal Government stimulus payments are helpful but are nowhere near sufficient to cover an average mortgage repayment and other living expenses for a family. Small business owners can be particularly badly impacted as debts may be accruing on both their business and their home loan.

It is now over to State and Territory leaders to make the hard call on who can return to work and when. Delaying a resumption of normal business activity may be seen as the safe option, but it will result in higher unemployment, greater business failures and more homeowners being forced to sell up.

3 topics

4 stocks mentioned