How all investors can access the best alternative funds (and their top ideas)

Alternative assets provide an increasingly popular way for investors to add portfolio diversification outside of traditional equities and bond exposures. But the assets, markets and industries of the space are notoriously difficult for Australian investors to access.

That’s why “democratisation” of the asset class – which includes private credit, private debt, property, carbon futures, resources and more – is core to what we deliver. Through our three funds, we seek to bring retail investors hard-to-access, unlisted assets that have traditionally been limited to institutions.

In the video below, I delve into each of the three investment strategies we offer investors.

-

Lucerne Alternative Investments Fund (LAIF)

-

LARK Mortgage Income Fund (LARK)

-

Lucerne Select Alpha Fund (LSAF)

Time codes:

- O:00 – Introducing Lucerne's Funds

- 1:10 – Lucerne's Investment Committee Process.

- 3:25 – The Lucerne Alternative Investments Fund (LAIF)

- 6:50 - Examples of long, medium and short term thematics within LAIF

- 11:50 – LARK Mortgage Income Fund (LARK)

- 13:21 - Four investment examples within LARK

- 16:36 – The Lucerne Select Alpha (LSAF)

- 17:54 – Three investment examples within LSAF

- 21:25 – Wrap-up, thank you, and ways to find more information.

Lucerne Alternative Investments Fund (LAIF)

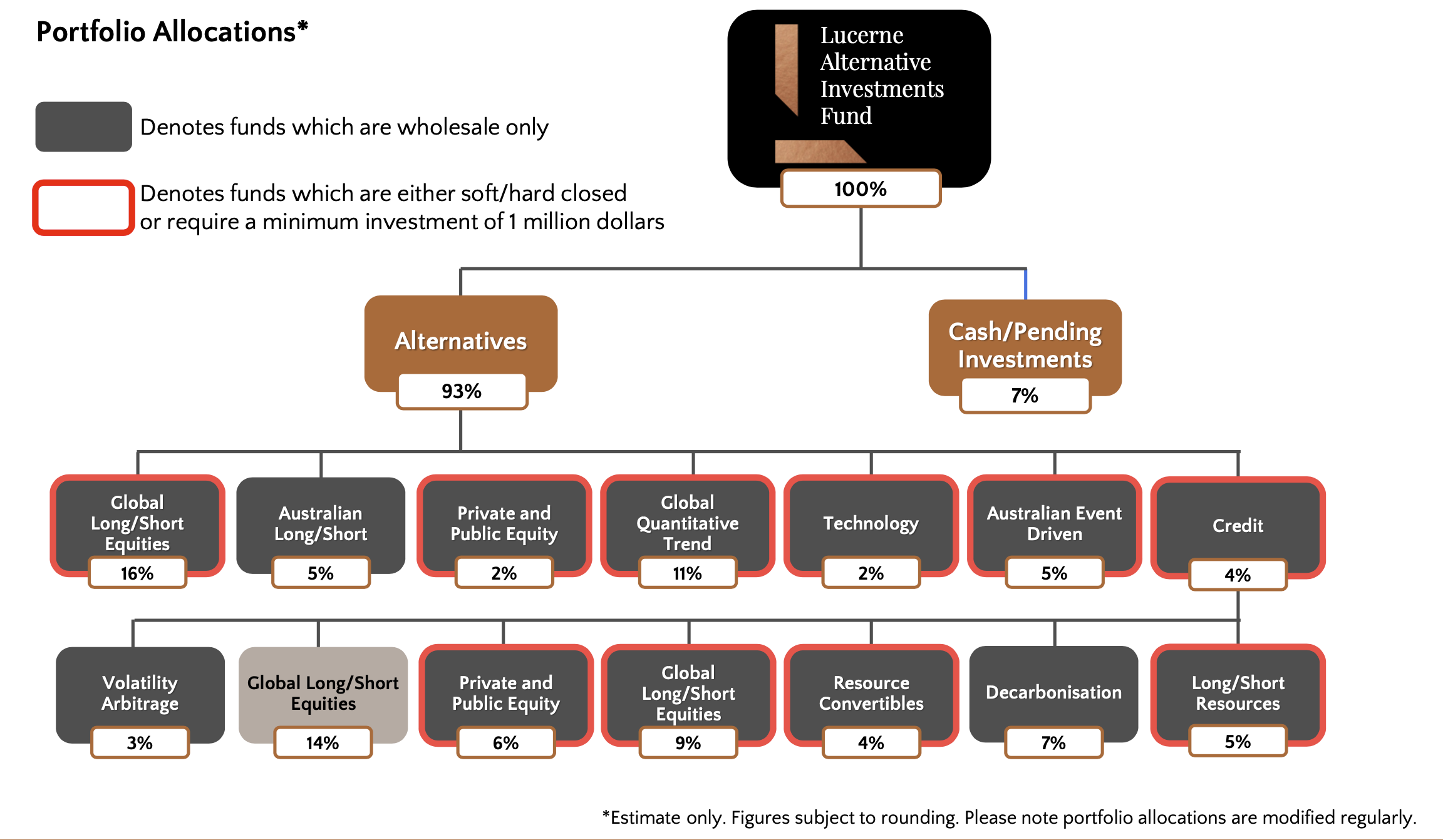

Our flagship fund, the Lucerne Alternative Investments Fund, actively manages a portfolio of Alternative funds from around the world. A key challenge, and one core to our approach, is identifying only the best opportunities. How do we do that? By conducting more than 250 meetings with both potential and existing fund manager partners each year. Our due diligence process reduces this pool down to 50+ fund managers, which our investment committee narrows to a preferred list of up to 30 high-quality fund managers investing in what we regard as the most compelling opportunities.

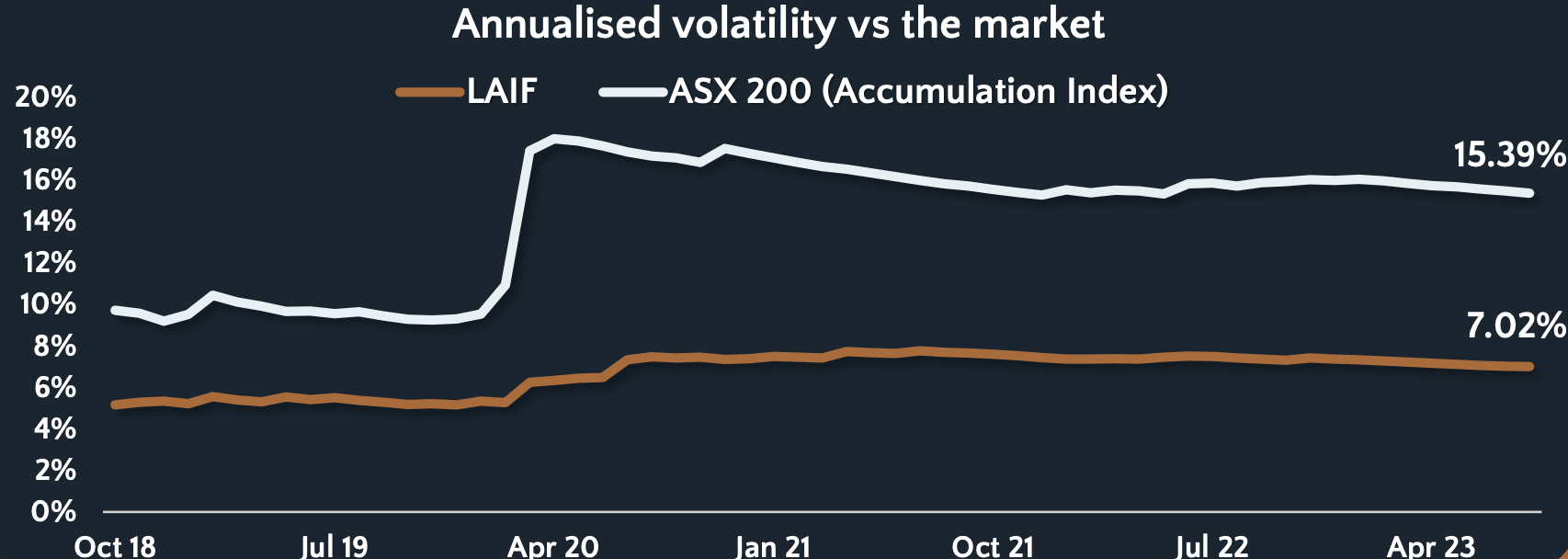

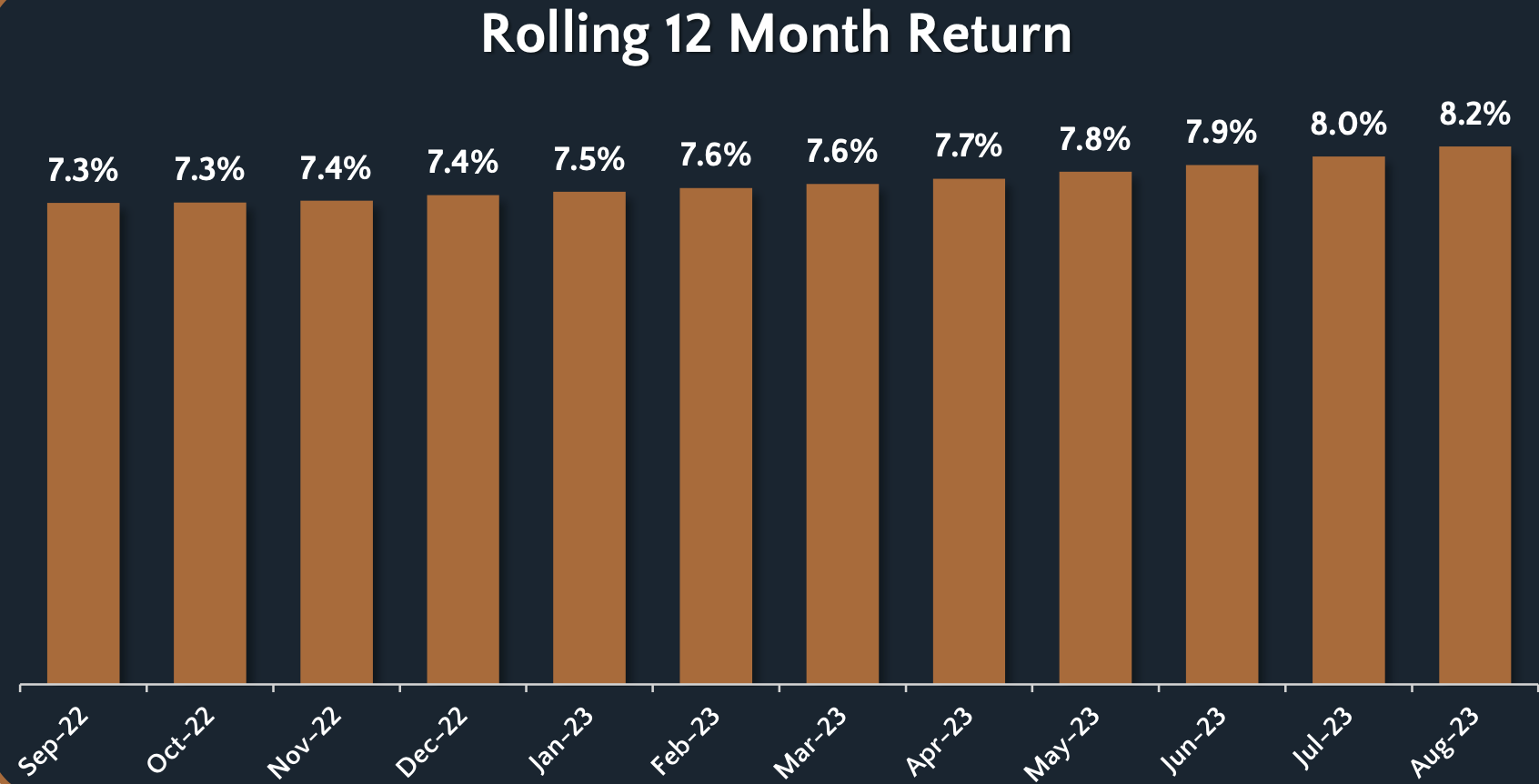

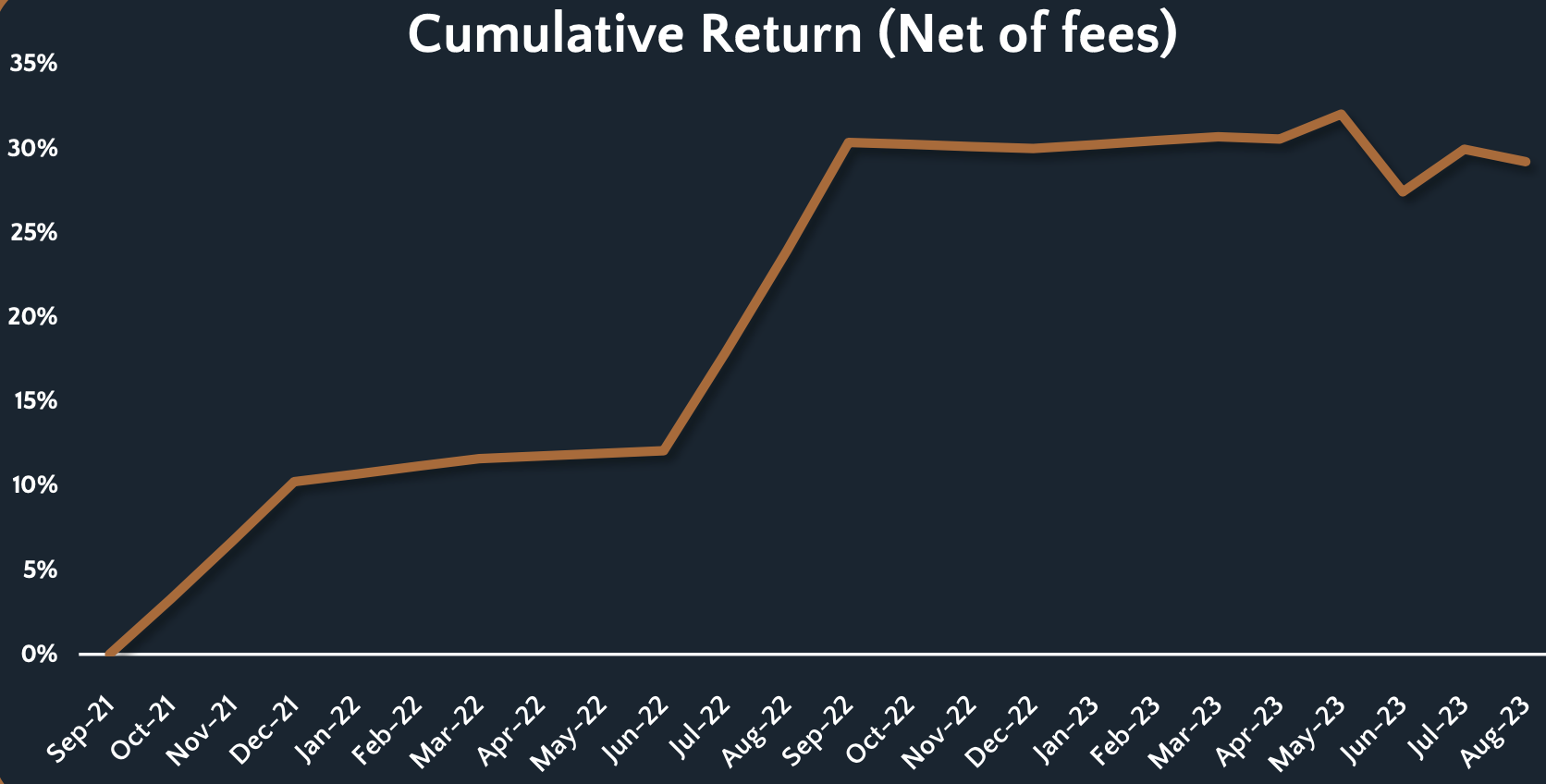

LAIF has delivered 9.34% since inception, versus a return of just over 7% from the ASX 200 Accumulation Index, while delivering around half the volatility.

The LAIF portfolio, which comprises 14 underlying funds, delivers on its combined goals of capital preservation and solid investment returns throughout market cycles by using a dynamic, active investment approach.

We’ve turned over 87% of the portfolio since July 2020. That doesn’t mean we’re constantly hiring and firing fund managers. Instead, we regularly shift our weighting to individual managers in line with our investment committee’s view on market conditions.

This approach saw us realise gains of 40% and 60% from two of our underlying funds since 2020, as we actively reduced and then re-allocated exposure at various times, in line with our investment committee’s view.

One of the unique attributes of LAIF is that it provides all investors with access to the capability of fund manages that are either closed to new investment or have high minimum investment amounts.

LARK Mortgage Income Fund (LARK)

A portfolio of Australian mortgage debt, this fund invests across a broad range of property investments in capital cities and regional centres.

A beneficiary of rising interest rates, returns from the LARK Mortgage Income Fund have risen as first-mortgage loans in the portfolio have rolled off and been replaced with newly vetted deals. This has seen our annualised returns top 9.5% as of the end of September, from 7.3% previously.

Avoiding the troubled construction sector, instead focusing on land banking and horizontal development, has underpinned some of the fund’s most recent success.

The Lucerne Select Alpha Fund (LSAF)

The newest fund in the stable, LSAF brings together some of the best ideas from the fund managers we partner with across our business. Launched in 2021, it was established on the back of consistent approaches from partners keen to acknowledge our support and create a separate vehicle showcasing some of their best investment ideas.

Since then, the fund has made 15 investments – all in the unlisted, private space – and is on track to deliver its targeted net return of 20% per annum over five years, having returned 100% in the last six months.

Three companies that have contributed to the fund’s success so far are set out below.

- Skykraft: An Australian aviation and space services specialising in the design, manufacture and operation of satellite constellations,

- Urban Rest: A build-to-rent and corporate accommodation provider serving the likes of Disney, Amazon, Google and the big four accounting firms, and

- Gasco: A Mongolian natural gas explorer that is eyeing an ASX listing in the first half of 2025.

Tailored Investment Solutions

Lucerne is a privately owned, boutique investment group. We source investments from our global network and through a considered and high touch approach, provide investors with a proven, dynamic investment solution.

Find out more

Lucerne is a privately owned, boutique investment group. We source investments from our global network and through a considered and high touch approach, provide investors with a proven, dynamic investment solution.

Find out more

4 topics

2 funds mentioned