Bulls outnumber bears 3-to-1

In our first reader survey for 2020, we asked you "What is your #1 source of investment ideas and insights" and for your favourite investing podcast. Nearly 1800 readers have participated already, and I look forward to crunching the data once the survey closes on Sunday.

But with the market deep in correction territory when we sent it out, we took the opportunity to ask you "How are you feeling about markets right now"?

The responses show a clear trend on the market sentiment which we think you may find surprising. I know I did, so have put together a quick interim summary for you while we wait for the final results. Read on to see who's in the driving seat in the market right now.

How are you feeling about markets right now?

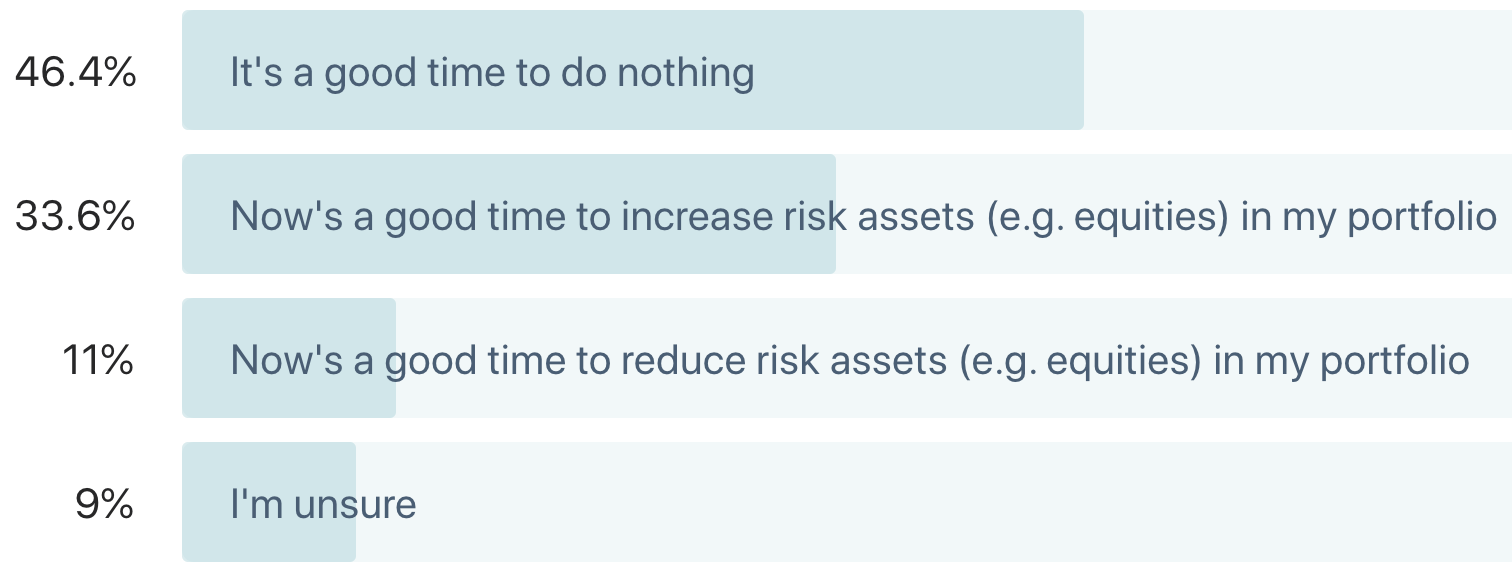

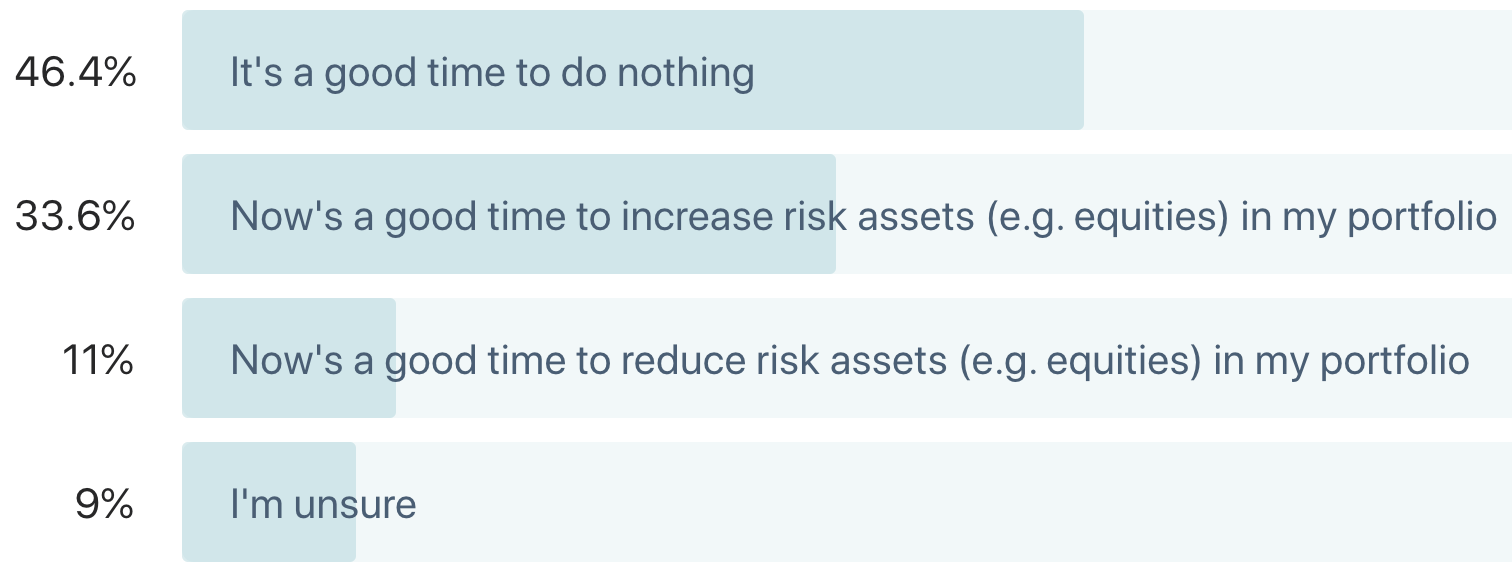

The preliminary results on how 1800 Livewire readers are feeling about the markets are as follows:

A good time to do nothing

A resounding 46% of participants think the best thing to do right now is to simply sit on their hands.

While the volatility may be great for traders trained to capitalise on it, for the rest of us, the wild swings have been dizzying. And as famously trader and author, Jesse Livermore famously wrote nearly 100 years ago,

“After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: it never was my thinking that made the big money for me. It was always my sitting. Got that? My sitting tight!"

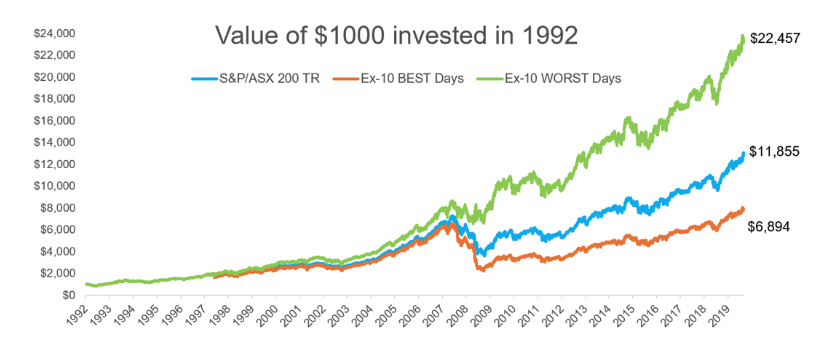

Making the same point, Patrick Hodgens At Firetrail wrote about this recently in “The big money is in the waiting” illustrating the point by showing the huge difference that missing the ten best days of each year makes to long-term performance. And seeing as how you can’t predict when those bumpers days will occur, you have to stick through thick-and-thin to get them.

“As the chart below shows, missing the 10 best performing days (orange) resulted in a loss of almost half of your potential gains vs simply staying invested in the Index. Market timing can be very lucrative… but also very costly to long-term returns.”

Source: Firetrail Research, Factset

As Patrick summarises neatly:

One of the best questions you can ask yourself is “are you a trader or an investor?” For investors, the key is to make sensible, long-term capital allocation decisions, and to stay patient. The big money isn’t made in the buying and selling. It isn’t made trading in and out of the equity market. The big money is made in the waiting. For patient, long-term investors, there are always opportunities to add value. But timing the market isn’t one of them.

Bulls outnumber the bears three-to-one

Let's have another look at the table. The next thing that jumps out is that more than 33% of participants felt it is time to increase risk assets, while notably, just 11% felt it is time to reduce.

Or put another way, the bull-to-bear ratio was 3:1.

It’s worth noting that we sent the survey on Wednesday 4th March, when the market was at around 6300, following a white-knuckle 12% fall over 9 trading days. So, it is perhaps surprising that the over-riding sentiment was so positive. Though whatever happens next, there is no denying that stocks are now more than 10% cheaper than they were.

At the start of the week, Richard Coppleson from Bell Potter explicitly called the bottom of the market in his wire, This is a huge buying opportunity, writing that:

S&P 500 tumbled more than 10% from record highs in an unprecedented pace of just 6 days. According to Deutsche Bank, the speed of the decline is even faster than that during Black Monday in October 1987. So for me, that plus numerous indicators I have used in the last 20 years - in times like this – are all slapping me in the face that this is a massive buying opportunity.

Digging deeper into the data from our survey, there were some interesting trends worth mentioning. The stockbrokers and advisors in the survey were the most bullish by far, with a ‘bull-to-bear' ratio of 5.5: 1. Retail investors were slightly less bullish with a ‘bull-to-bear' ratio of 3.6:1, while Fund managers and high net worth investors had a 'bull-to-bear' ratio of 2.3:1.

'Unsure' of how to invest in this market

A significant 9% of participants reported they are ‘unsure’ of how to invest in this market, which you have to respect.

No matter how much research and forecasting you do, there are still huge knowledge gaps in our understanding of COVID-19, and we don’t know yet how it will impact the global economy or what the policy responses will be.

Being ‘unsure’ is probably the most honest response possible.

So, how are you feeling?

The survey is still running, so let us know how you are feeling about the market right now.

We are also asking participants to tell us about their top sources of investment ideas. Once the survey closes, we will collate the data to create an essential guide that will inject fresh ideas to your investment process and if you participate will get first access to the results.

You can take part by clicking here.

1 topic

1 contributor mentioned

Alex happily served as Livewire's Content Director for the last four years, using a decade of industry experience to deliver the most valuable, and readable, market insights to all Australian investors.

Expertise

Alex happily served as Livewire's Content Director for the last four years, using a decade of industry experience to deliver the most valuable, and readable, market insights to all Australian investors.