How Australian investors can navigate a global trade conflict

Note: This interview was taped on Tuesday 4 February 2025. Since this interview was taped on Tuesday morning, the 10% additional tariff on Chinese goods (15% on Chinese LNG and coal) commenced.

China has retaliated by probing Google in relation to alleged anti-trust violations. Beijing also announced 15% levies on coal and liquefied natural gas and 10% on oil and agricultural equipment from the US. (Source: Bloomberg)

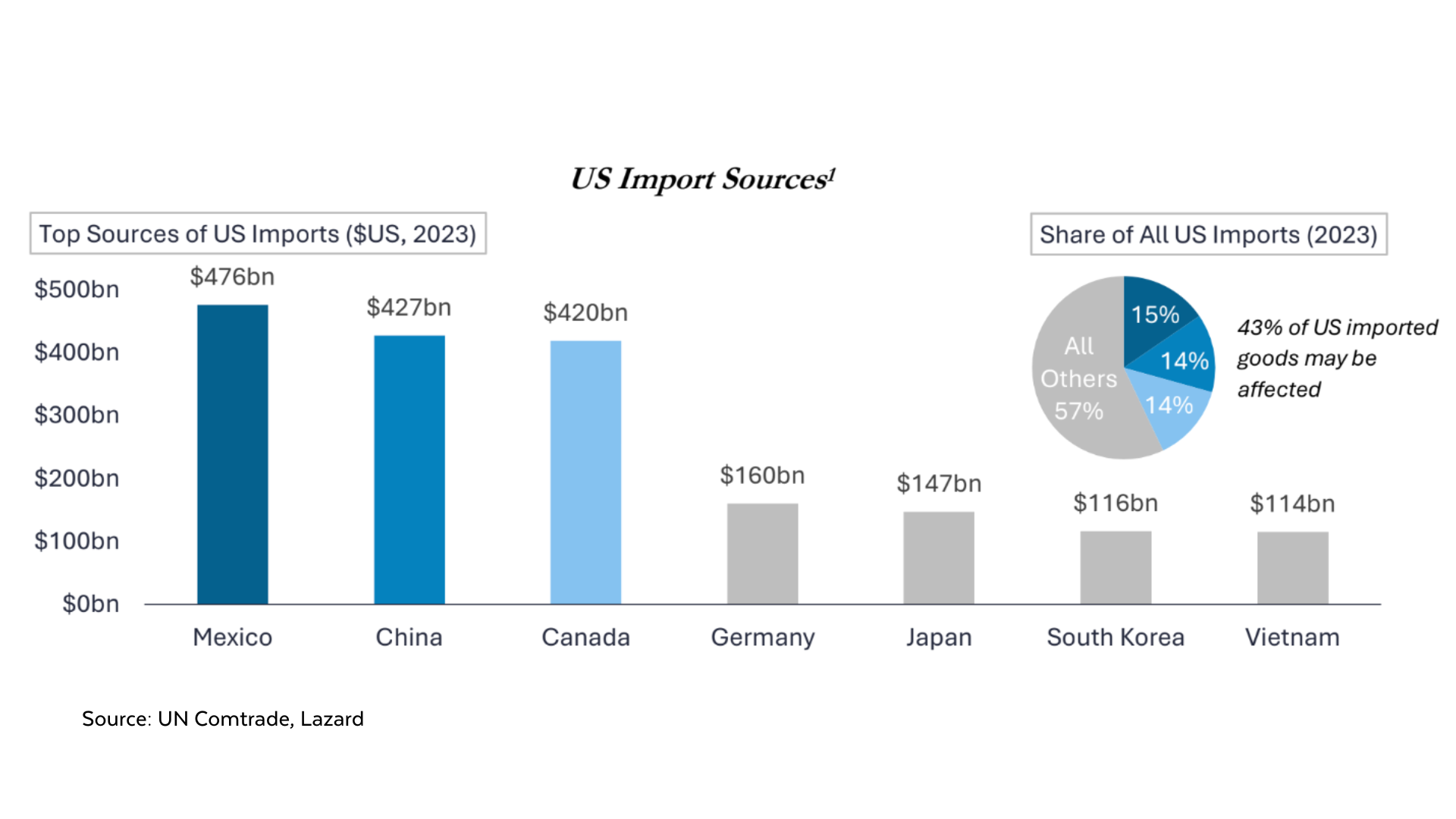

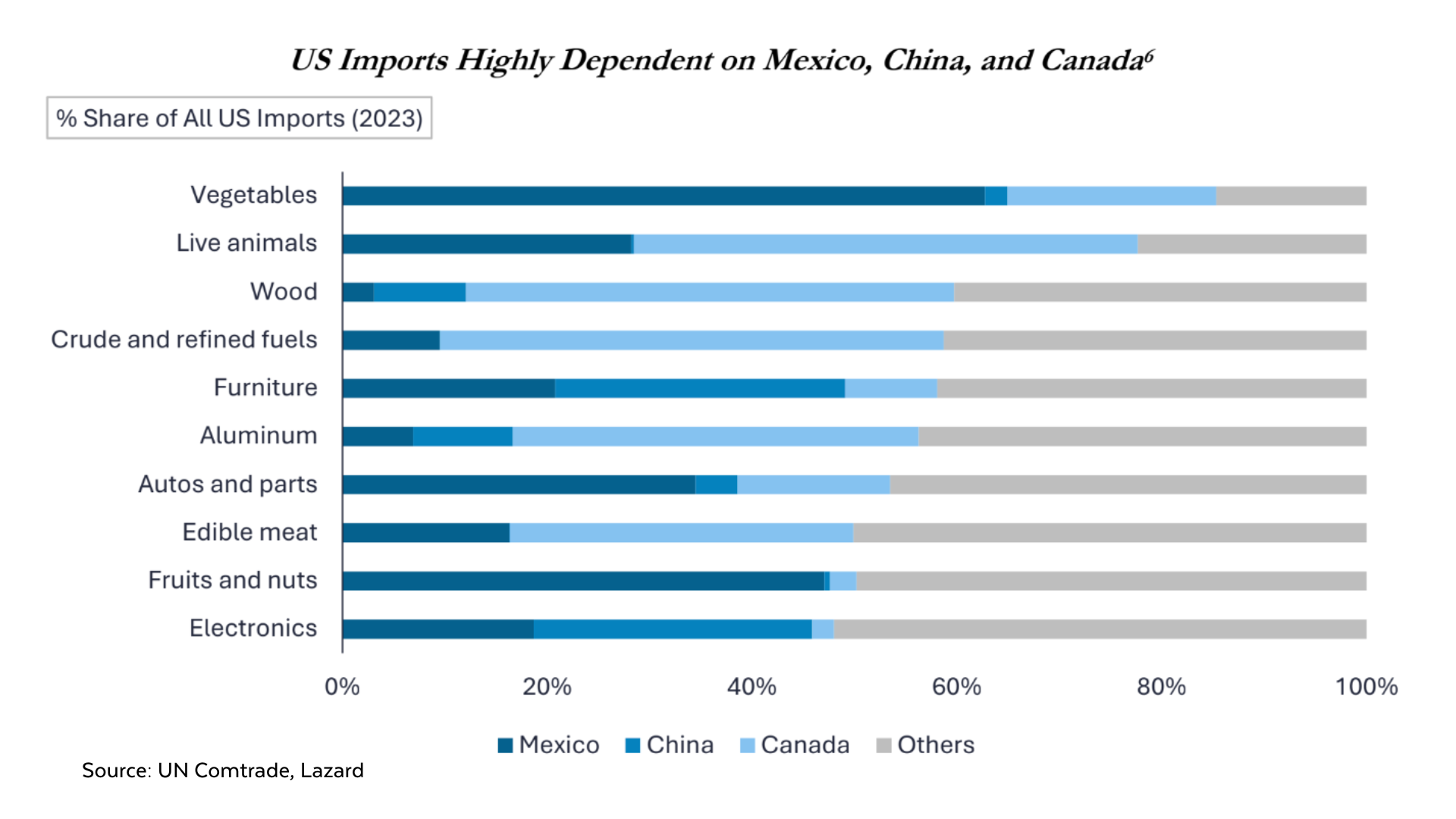

It's week three of the second Trump administration and already, we've seen more policy action taken at once than at any other time in the last few years. At the very top of that list is the US President's numerous tariff threats - namely, 25% on Canada and Mexico and an additional 10% tariff on Chinese products in addition to the tariffs which already exist on goods made in the world's second largest economy.

Two of those tariffs, as of writing, now have 30-day moratoriums in place thanks in part to a last-minute reversal of retaliatory tariffs from Canadian Prime Minister Justin Trudeau, and in the case of Mexico, after President Claudia Sheinbaum agreed to immediately send 10,000 soldiers to her country’s border to prevent the trafficking of fentanyl and other drugs.

Markets have reacted accordingly to the return of "tariff by tweet" policymaking. US equity markets fell sharply on Monday but stabilised on the news that deals had been brokered. The US Dollar and crude oil also experienced big buying while bond markets seemed to more or less take the news in its stride.

But that's only the immediate reaction. Many investors will have to be thinking longer-term about how their investment strategy will change in light of the new administration and how any policy initiatives it releases will be taken by markets. After all, even if Australia is not directly affected by the brunt of these tariffs, it doesn't mean that Australian investors won't be immune to its knock-on effects.

To walk us through his views on what's happened, what might happen, and the longer-term implications of Donald Trump's tariff threats, we sat down this week with Ronald Temple, Chief Market Strategist at Lazard.

In this interview, Ron will also share his practical tips for what investors can do in the face of these tariffs. He will share his views on two different assets that have seen a lot of benefit from Trump's re-ascension to the White House (the US Dollar and gold) and share what impact this style of policymaking has, even if it's temporary, on the Federal Reserve. While this is a long interview, we encourage you to watch through the entire video as Ron's insights are invaluable. His answers disseminate valuable context in this evolving story.

Timestamps

- 0:00 - Intro

- 0:34 - Hans' charts to introduce the story

- 2:33 - How much more significant is this round of tariffs versus the ones that were imposed during Trump's first presidential term?

- 5:08 - "Candidate" Donald Trump is serious about using tariffs as a mechanism for solving problems

- 5:25 - What does Ron think is the next leg for this story?

- 7:43 - Is there a bigger strategic signal to come from these tariffs?

- 8:18 - Were you surprised by the savage reaction in equity and currency markets?

- 11:17 - Does Trump genuinely believe tariffs are a long term tool to protect the US economy?

- 13:22 - How do these tariff proposals affect the interest rate path of the Federal Reserve?

- 14:42 - There is a "good" chance we get zero rate cuts this year, but single-digit risk of a rate hike this year

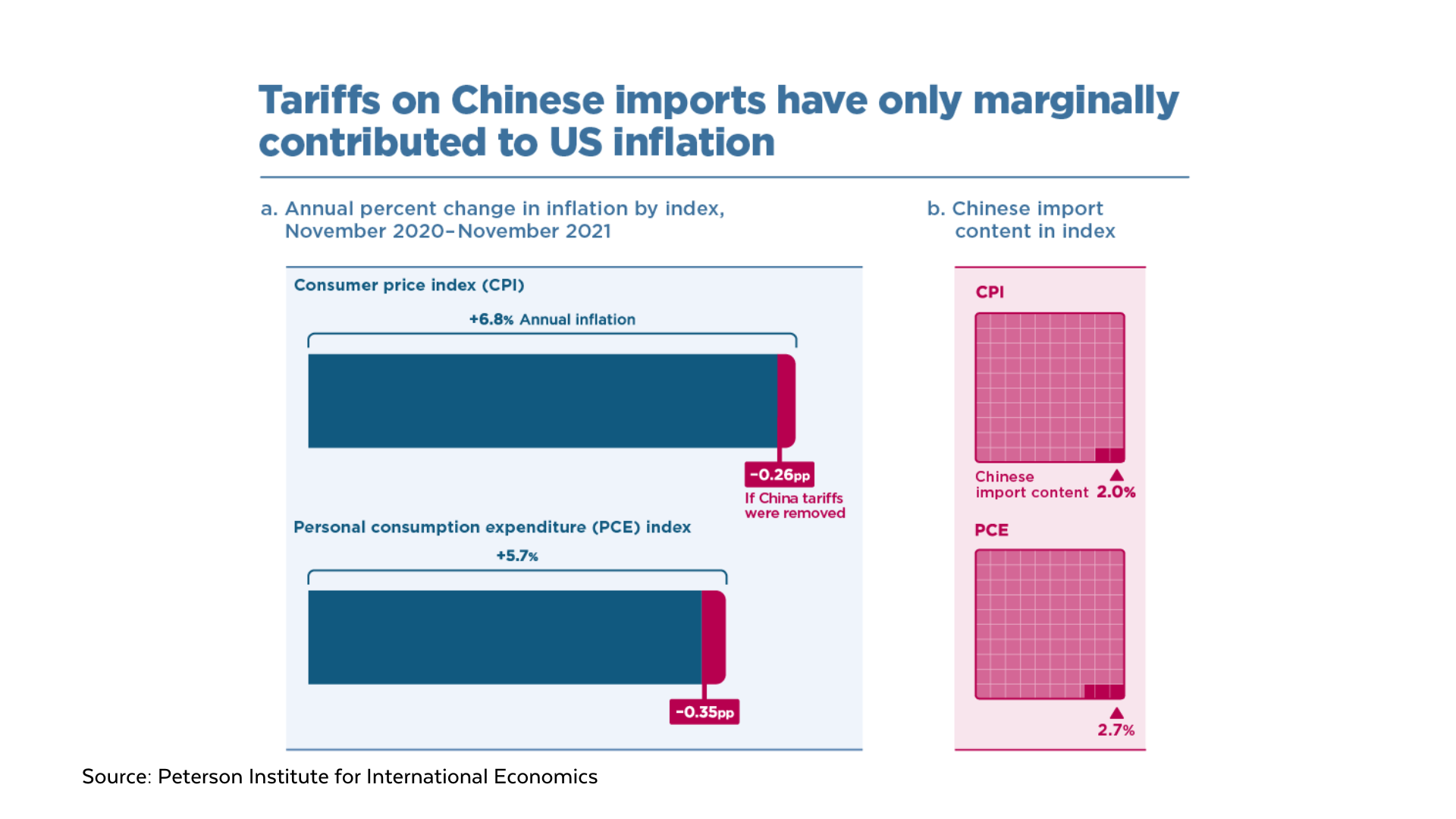

- 15:55 - Could tariffs be stagflationary in the long run?

- 17:31 - How will these tariffs indirectly affect Australian investors?

- 20:30 - Is now the time to be buying geopolitical hedges like the US Dollar and gold?

- 22:58 - What is Ron's favourite geopolitical hedge?

- 25:10 - What other tangible moves can investors make to insure their portfolio right now?

Appendix: Charts

4 topics

1 contributor mentioned