How companies can win back trust (and why it matters to share price returns)

Trust, as Michelle Levine, CEO Roy Morgan Australia, sees it, is pivotal

“Trust is the foundation of all human connections - from intimate relationships to everyday business transactions.” (Source RMA Survey Research Results presentation, August 2023).

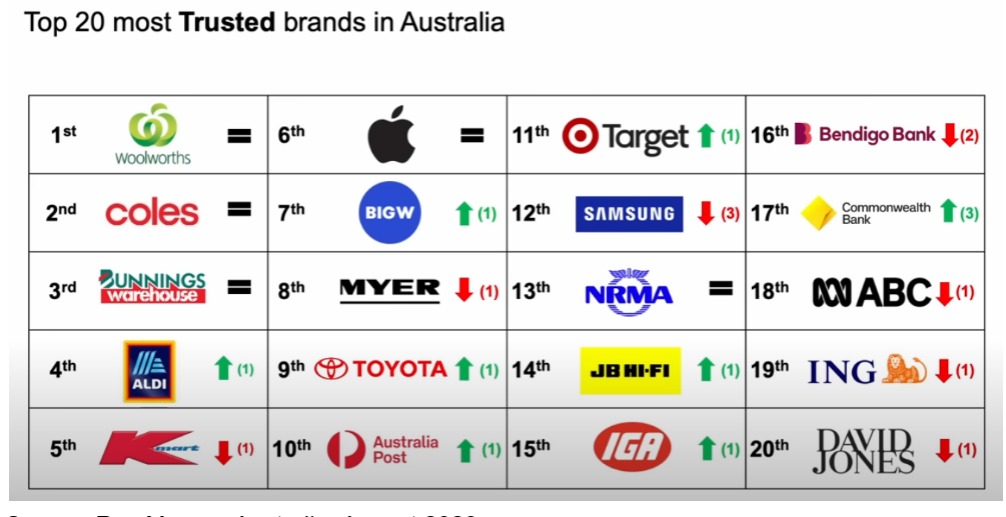

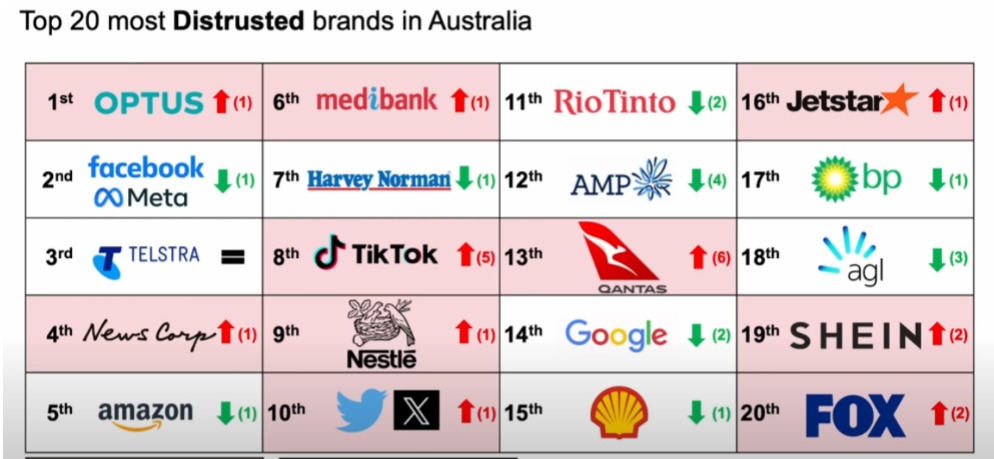

The latest Roy Morgan Survey of Australia’s most trusted and most distrusted brands had interesting data. A number of the top 20 most trusted brands are linked to familiar companies...

...as are the 20 most distrusted brands.

Picking up on two of the most distrusted brands

Qantas (ASX: QAN) its litany of woes is elegantly summarised in this recent wire from Roger Montgomery of Montgomery Investment Management

AGL Energy (ASX: AGL)’s FY23 results show the company is in its transition phase.

It is possible that bad news over a number of years will impact the views of trust/distrust. BHP (ASX: BHP) ranked the 49th most distrusted company, moving up 14 positions on the list. Its FY23 results had news beyond the financials according to Kerry Sun: around India as a powerhouse for energy and materials use, the challenges of nickel pricing and likely increases in capex:

It’s not the kind of news that made headlines in 2015 when its 50:50 Samarco JV in Brazil (with Vale as partner) reported deaths and losses from its tailings dam collapse. But the impact of that event is still being felt. On Monday 4 September, BHP announced that it had received court approval for the restructuring of the JV, paving the way for a US$3.7bn debt restructuring.

Share price reactions

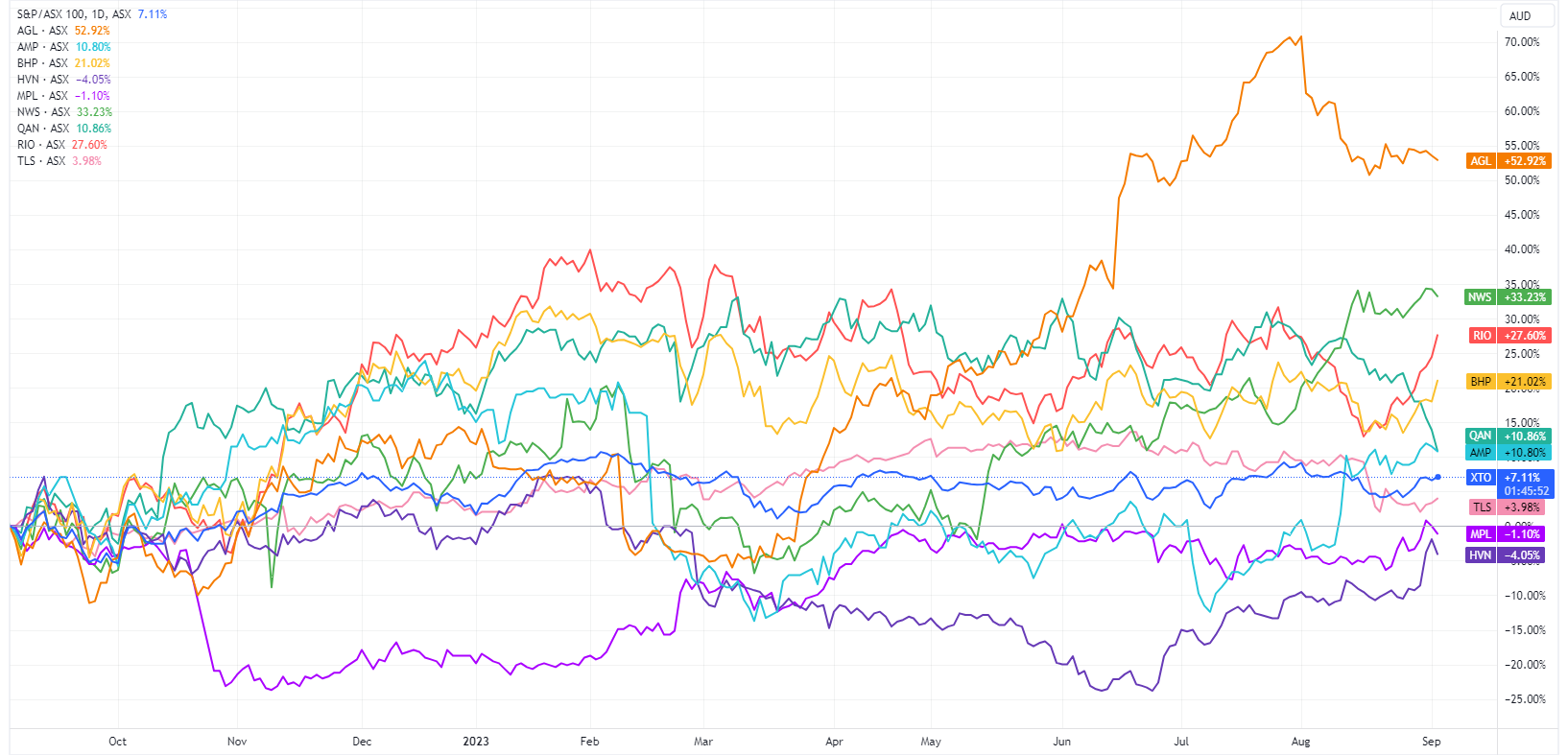

Noting that many of these events are long-term in nature (not restricted to 2023), what is the market’s verdict, as reflected in the share price over 1 year? Using the ASX 100 as a baseline from which to measure growth (7.11% over the 12 months to 1 September 2023), the charts below reveal some surprising results.

For the most distrusted brands, over one year, the share price performance has not matched broader community sentiment as captured in the Roy Morgan Australia research.

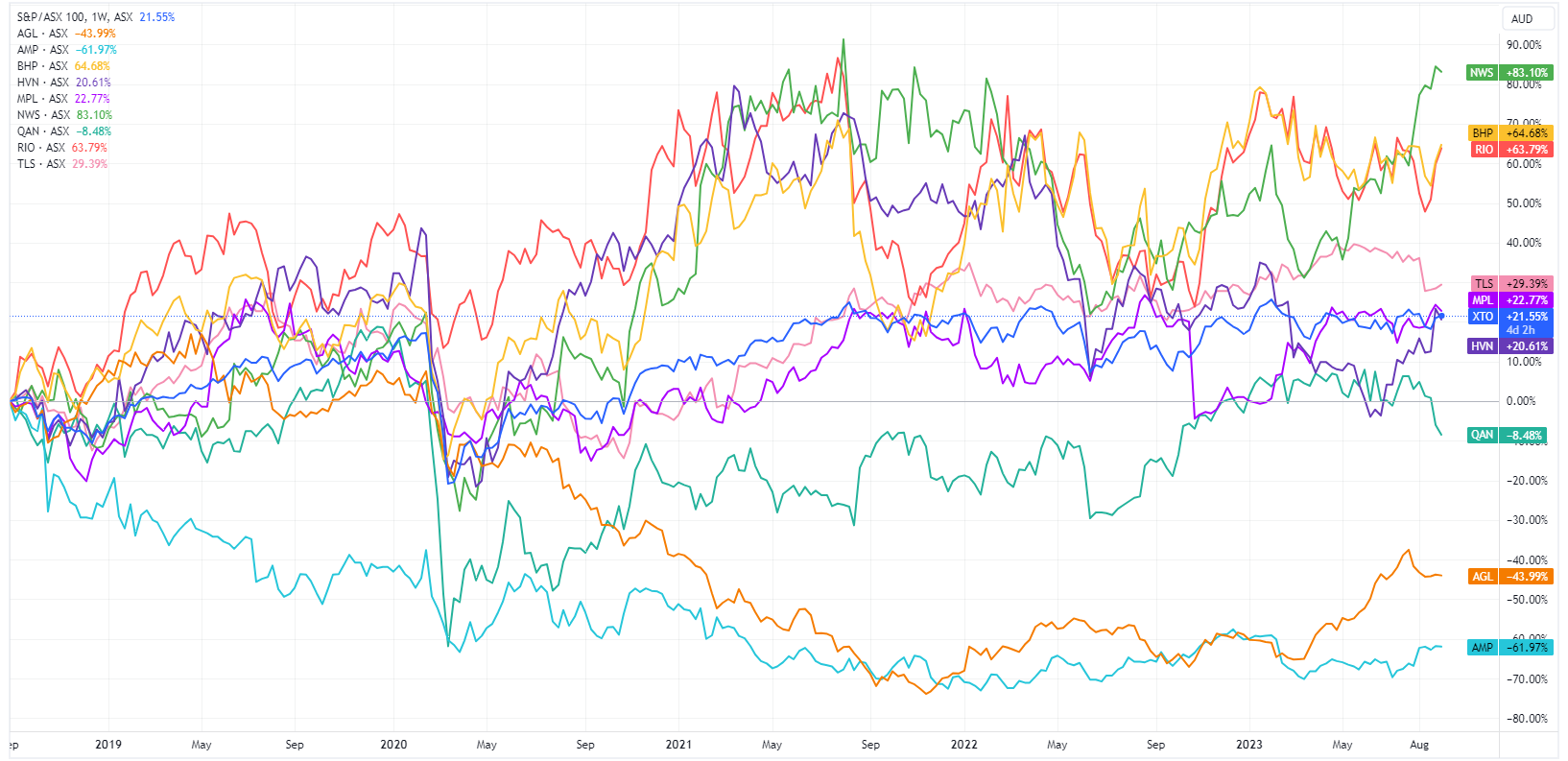

What about the performance of these same companies over the past 5 years?

Recall that some events over the past 5 years have identified trust/distrust issues from the perspective of those surveyed: Juukan Gorge for Rio Tinto, the pace of the energy transition for AGL Energy, and COVID impacts on customers for Qantas. While the ASX 100 has grown 21.53%, some of our most distrusted companies from the latest RMA report have not matched the index performance.

Winning back trust via performance

An event need not spell a loss of trust. It can be negative or positive depending on how the company responds, as the data breaches impacting customer/member data such as Medibank Private (ASX: MPL) and at Commonwealth Bank of Australia (ASX: CBA) demonstrate. Commonwealth Bank is improving its trusted brand performance, whereas Medibank Private is becoming more distrusted.

So how can a company win back trust?

A first step in that direction is recognising the situation. Consider Qantas’ ASX announcement from 4 September 2023

“The ACCC’s allegations come at a time when Qantas’ reputation has already been hit hard on several fronts. We want the community to know that we hear and understand their disappointment. We know that the only way to fix it is by delivering consistently. We know it will take time to repair. And we are absolutely determined to do that.“

Of course, this news can be combined with today's news of Alan Joyce's early departure.

A second step is a Board commissioned review, which can be internal but will usually also see the Board will commission a review or investigation by a third party, on the company’s coin. The report may be made public via release to the ASX. It might remain carefully locked away for legal privilege reasons. Boards will also be mindful of the optics of having been found out seeking changes to the independent report, as happened at AMP (ASX: AMP) over its report on ‘fees for no services’.

At some stage in this cycle the 4As - the regulators: ASIC, APRA, ACCC and AUSTRAC - might release an announcement of their supervisory or regulatory activities. The regulators have varied records of success in bringing actions against companies.

Around this time a shareholder or consumer class action or actions could be announced.

Business-as-usual also has to continue to deliver performance. Where that occurs, then the next stage, accountability by executive resignations might not happen at all. But if there are lingering performance issues or any of the steps above tend to point the finger of blame at one individual, then executives will depart as the Board signals how it is holding the executives accountable for their actions.

A final step is to review the Board Risk Register. Adding “Distrust” to the Board Risk Register was Michelle Levine’s final suggestion as a way forward. This means board recognition of how being distrusted by the general public can translate into negative outcomes for the company. It should generate activity within the company to identify and mitigate this risk.

What gets measured gets managed. Eventually.