How few ETFs do you need to build the perfect portfolio?

It was Peter Lynch who coined the term "diworsification" in his book One Up On Wall Street. And while it was originally used to describe inefficient companies, it has now morphed to describe portfolios themselves.

Diversification, supposedly, is the only free lunch in finance. But "diworsification" relates to portfolios that are over-diversified, with too many investments that add layers of unnecessary complexity and/or double up - increasing investment costs and leading to poor risk-adjusted returns.

Exchange-traded funds are, in themselves, diversified products, allowing investors to access a basket of stocks or bonds, or providing them with exposure to commodities and other less-liquid asset classes.

This is just one of the reasons why ETFs have taken off, in addition to ease of trading, transparency and, of course, their typically lower management expense ratios (or costs).

So, as part of our Listed Series for 2024, I thought I would put one question to a range of different experts - including a financial adviser, an ETF expert and a product issuer: Can investors still properly diversify their portfolios with as few ETFs as possible, and if so, how few ETFs do investors need to own to build the perfect portfolio?

And their answers, my dear friends, are sure to surprise you.

Vanguard Asia Pacific Head of ETF Capital Markets Adam DeSanctis believes there is "no perfect number" when it comes to a portfolio of ETFs. However, while Thomas and Brycki believe investors need around a handful or more of ETFs, DeSanctis argues investors could do the same thing with just one.

"You can get broad-based diversification with one ETF, commonly referred to as diversified ETFs, or you can build a portfolio of five to 10 ETFs that would offer good diversification," he says.

The choice you make on the above depends on your investment goals and risk appetite, like any investment.

"If you're trying to get a stable return over time, holding a diversified portfolio of securities with the proper mix of equities and bonds would be one of the best options. You could certainly achieve that with one ETF. You don't need to hold more than that to get a diversified portfolio," DeSanctis says.

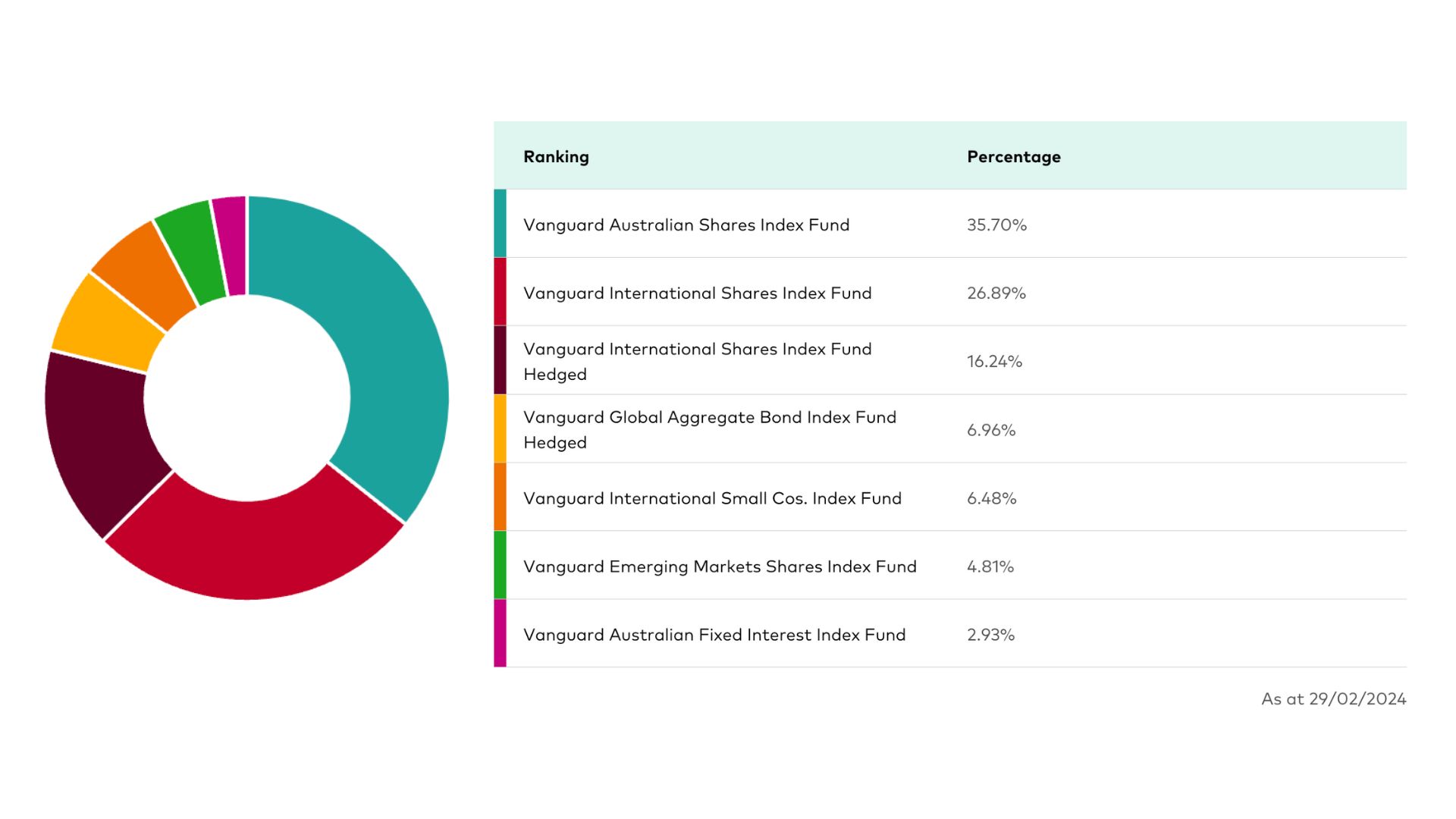

Vanguard has several diversified ETFs with exposure to multiple asset classes, with allocations depending on the firm's strategic asset allocation. For example, Vanguard's High Growth Index Fund is split up as below and costs investors 0.29% in fees per annum. Vanguard charges 0.27-0.29% across its range of conservative, balanced and growth options).

For context, AustralianSuper's Balanced option - the default MySuper fund - has annual fees of $382 based on a $50,000 balance. This includes annual admin fees of $52 and annual investment and indirect fees of 0.56%.

According to Stockspot founder and CEO Chris Brycki, the "perfect" number of ETFs a person should hold in their portfolio depends on their personal goals. For instance, if your goal was to earn a cash-like return, you could just hold one cash ETF.

"Assuming your question was more around someone who is trying to grow their wealth from growth-type ETFs over the long run and not just plug it in cash, I think it's a balance," he says.

"You can definitely have too many and you can definitely have too few."

If an investor holds too few ETFs, they could miss out on sectors, countries, markets or assets that will provide a portfolio with better diversification and generate smoother returns throughout the cycle.

In comparison, if an investor holds too many, there could be some overlap between products - adding complexity, and potentially, additional cost for no actual benefit, Brycki explains.

"From a simplicity perspective, we don't think you need too many," he says.

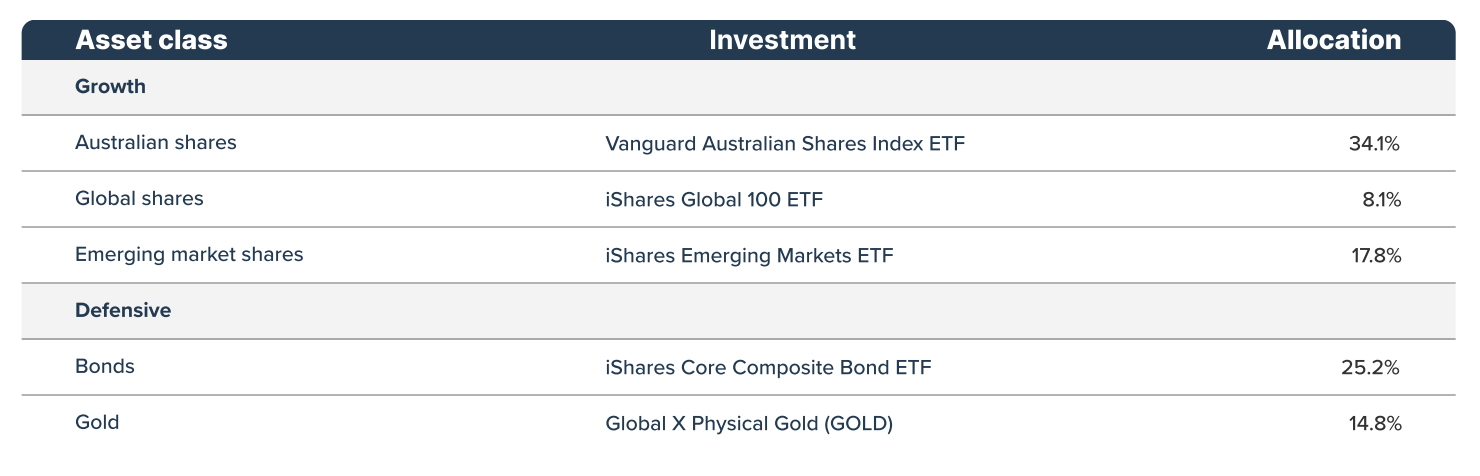

"For good diversification across the cycle and to have a portfolio that can weather different environments, you need local shares, global shares, bonds, and gold because all of those assets do well and badly in different environments."

For instance, in the table below you can check out how Stockspot would build a balanced portfolio, allocating to five different ETFs:

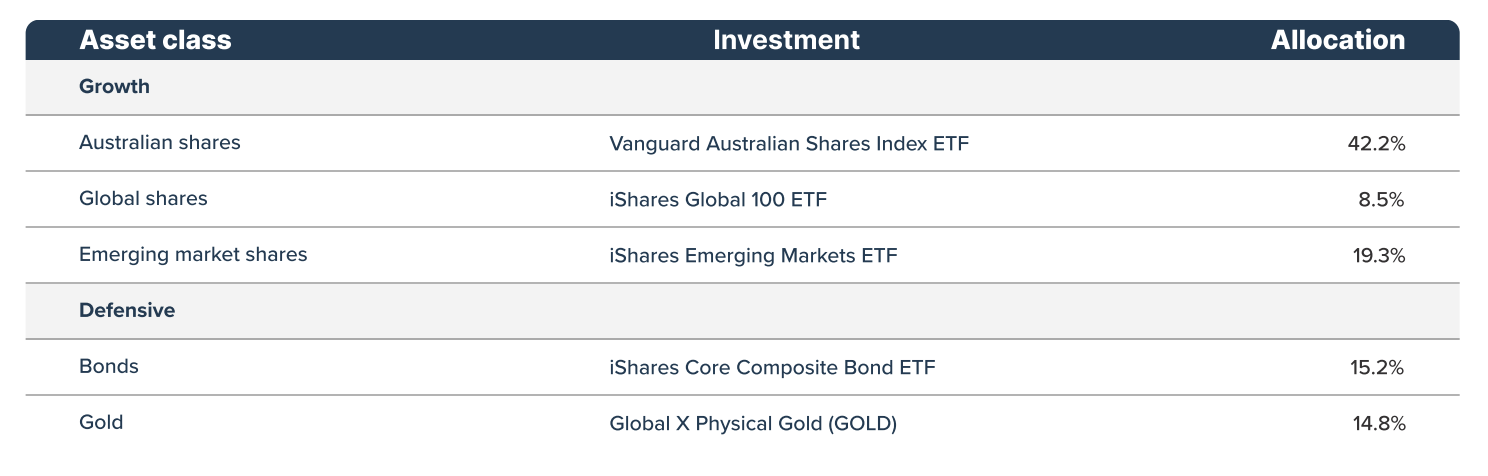

And here, Stockspot allocates to the same five ETFs but with different weightings to create a portfolio better suited to those looking for more growth:

If investors are keen to simplify things further, Brycki says they could probably lose the emerging markets ETF, and just allocate to global shares, Aussie shares, bonds and gold (and thus, four ETFs would be the absolute minimum).

He isn't a massive fan of "diversified" ETFs which would allow investors to hold just one ETF and call it a day.

"Betashares and Vanguard have diversified options that give you a spread of different types of investments. The disadvantage from an investor perspective is that you only get access to that one fund manager's experience and portfolio," he explains.

"The other point to mention here is tax differences since many of these diversified funds don’t use ETFs so you as the investor pay the tax consequences of redeeming unit holders. This isn’t the case with ETFs where you only pay tax as it relates to your holdings."

But, if these products just track an index, does it really make a difference? I asked.

"It does," Brycki says. "We've tracked our performance, just as an example, versus those diversified funds over rolling five-year periods. We outperformed them by about 1% per year. So there's a big opportunity loss when you're not investing in other fund manager's funds."

The biggest challenge to investors, is not how many ETFs they hold, according to Brycki, but managing emotions in up and down markets.

"When you are diversified across different assets, you naturally will always have something doing well and some things doing badly," he says.

"But you've got to resist the temptation to sell the things that are doing badly and put it all in the things that have done well, because at some point that will reverse."

That said, managing your emotions in volatile markets - particularly when one part of your portfolio is bleeding and the other soaring higher is easier said than done.

.jpg)

Meanwhile, senior financial adviser at Shaw and Partners Felicity Thomas believes investors should hold seven to 10 ETFs in their portfolios.

"There are some really interesting ETFs out there and I wouldn't want to limit myself," she says.

This includes ETFs focused on ESG criteria, and thematic ETFs in specific themes or trends like cybersecurity, healthcare innovation, clean energy, and the digital economy, which have all seen explosive growth, she says.

"Smart beta ETFs, which use alternative index construction rules instead of traditional market capitalization-weighted indexes, have also gained traction," Thomas says.

"These ETFs aim to provide better risk-adjusted returns by focusing on factors such as low volatility, dividend yield, and momentum."

In addition, Thomas points to the growth in active ETFs (actively managed funds available as easily traded ETFs), and fixed income ETFs in various segments of the bond market - including corporate bonds, government bonds, high yield and emerging market debt, as well as cryptocurrency and blockchain ETFs in recent years.

That said, if investors wanted to hold as few ETFs as possible, she would recommend the below three:

1. An all-cap equities index ETF: Betashares All Growth ETF (ASX: DHHF)

This ETF has 100% allocation to shares and is invested in a blend of large, mid and small-cap equities from Australia, global developed and emerging markets so it's really an “all cap, all world” share portfolio with the potential for high growth over the long term.

2. A thematic ETF: Global X Uranium ETF (ASX: ATOM) or Betashares Uranium ETF (ASX: URNM)

Nuclear energy is back in favour as governments around the world have realised that renewables alone will not decarbonise energy grids. At last year’s COP28 climate conference in Dubai, 22 nuclear states (including the US, UK, France and Japan) pledged to triple their installed nuclear capacity by 2050. China alone is adding around 150 new nuclear reactors in the next 15 years. After a decade of under-investment post-Fukushima, uranium supply is constrained.

3. An actively managed ETF: Loftus Peak Global Disruption Fund (ASX: LPGD)

I want an actively managed ETF in my portfolio and one that consistently outperforms. This actively managed Fund focuses on disruptive businesses - some of the best and fastest-growing companies in the world that are driving change across all industries globally.

If investors want to hold just one ETF, she recommends a diversified product, like Vanguard's Diversified Balanced Index ETF (ASX: VDBA)

"This is a ready-made solution that invests in an equal 50/50 split of growth assets (shares) and defensive assets (bonds)," she says.

"They have risk profiles from conservative to high growth and are a professionally designed mix of investments that you can align with your risk profile."

For those investors nearing retirement, Thomas likes the Betashares FTSE RAFI Australia 200 ETF (ASX: QOZ), which provides investors with exposure to ASX 200 companies with a 12-month gross distribution yield of 6.60%. In addition, she points to the JPMorgan Equity Premium Income ETF (ASX: JEPI) as another great option to generate additional income, providing investors with a distribution yield of 5.46%.

"JEPI employs a proven bottom-up research process seeking defensive equity exposure, with stock selection based on their proprietary risk-adjusted stock ranks. A disciplined overlay uses call options to generate distributable monthly income. The option premium generated can vary depending on market volatility," she explains.

For those in the accumulation phase (those wanting more growth), Thomas points to the Betashares All Growth ETF (ASX: DHHF), and the Loftus Peak Global Disruption Fund (ASX: LPGD) as great options - but she recommends investors add in an ASX 200 focused ETF and a NASDAQ 100 ETF as well.

3 topics

7 stocks mentioned

7 funds mentioned