How long will the value rotation last?

So far in 2021, the “growth at any price, high-multiple” stocks have been underperforming. Despite widely beating analyst consensus estimates, global and ASX listed growth companies have been sold off in favour of cyclical and value stocks. The market is in “price discovery mode” for value and cyclical stocks because their prospects for earnings growth have materially improved. This is a recent development and on average, growth as a strategy outperformed value over the last ten years. So how long can this rotation into value and cyclicals last and what advantages does this rotation provide to bottom-up stock-pickers?

How the value rotation strengthened into 2021

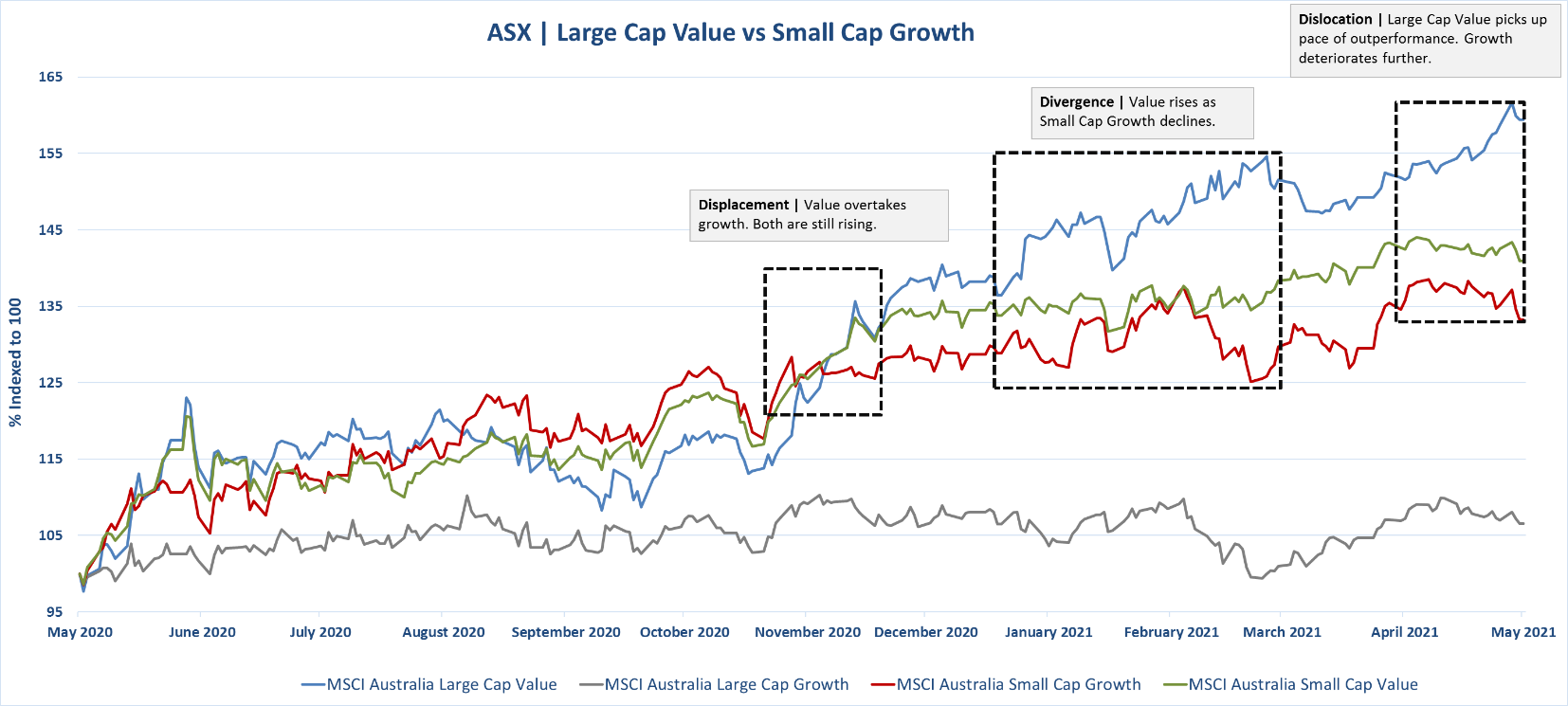

The rotation from growth to value is also a rotation into larger capitalisation stocks. Below is a chart showing the returns of the Morgan Stanley Securities Indexes for their Large Cap Value, Large Cap Growth, Small Cap Value and Small Cap Growth strategies over the last twelve months. If we use these indices as proxies for the performance of value and growth strategies, the following timeline sign posts can be seen:

- Displacement | the market is forward-looking and thanks to better-than-expected vaccine progress, it anticipated a broader rotation in November 2020 when the Large Cap Value index displaced the Small Cap Growth index and took the lead in relative returns.

-

Divergence | a clear divergence began to emerge between January to March 2021 where Large Cap Value yielded strong returns whilst Small Cap Growth went backwards. Small Cap Value also underperformed relative to Large Cap Value.

- Dislocation | Large Cap Value’s returns increased strongly whilst Large Cap and Small Cap Growth was broadly flat. It appears investors continued to move capital up into larger and more liquid stocks.

Source: FactSet, Monash Investors

Growth is less scarce

- Economies are firing back to life after months of COVID-19 induced lock-downs. The global vaccine roll out is challenging, but well underway. The IMF is forecasting a global GDP growth rate of 6.0% in 2021 , with the US forecast at 6.4%, partly fuelled by fiscal policies such as the US infrastructure spend, pent-up savings and stimulus packages.

- The banks are still lending and asset intensive companies are seemingly able to refinance at attractive rates. Large Cyclical and “real economy” companies with established revenue streams, operating leverage, earnings and free cash flows stand to enjoy super-charged growth rates during this period of higher economic growth. These stocks trade at relatively cheap valuation multiples so investors can buy their growth at more attractive prices.

Inflation and bond yields are rising

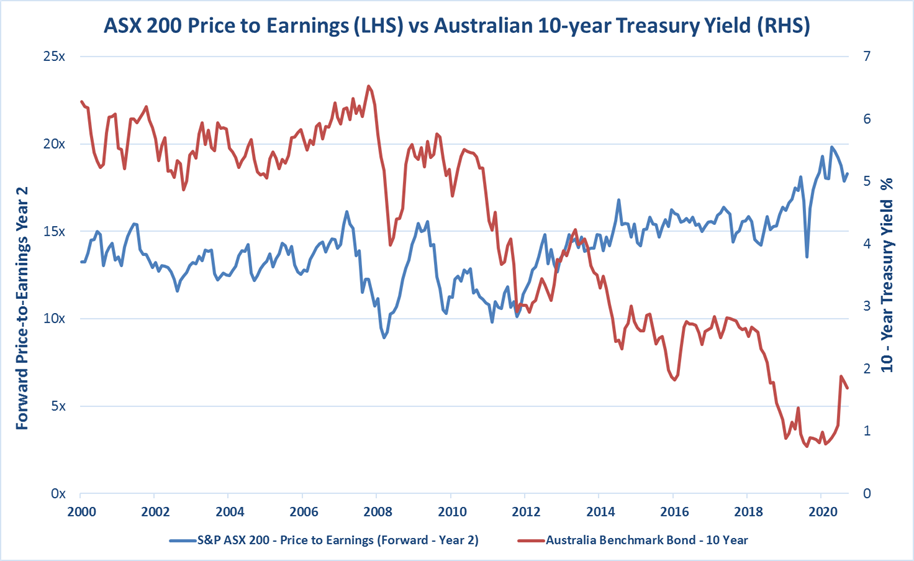

- Growth stocks traditionally have a long lead time before they start to generate meaningful free cash flows. These stocks are beneficiaries of low bond yields and are considered “long duration.” The below chart shows that the two-year forward looking price-to-earnings ratios continued to expand as interest rates fell over the last ten years. But what happens when interest rates have bottomed near zero and inflation starts to appear? Have we reached a temporary psychological ceiling where investors are no longer willing to pay for future growth at any price?

Source: Monash Investors, FactSet. Note: “Year 2” refers to analyst consensus earnings forecasts for the second financial year in the future

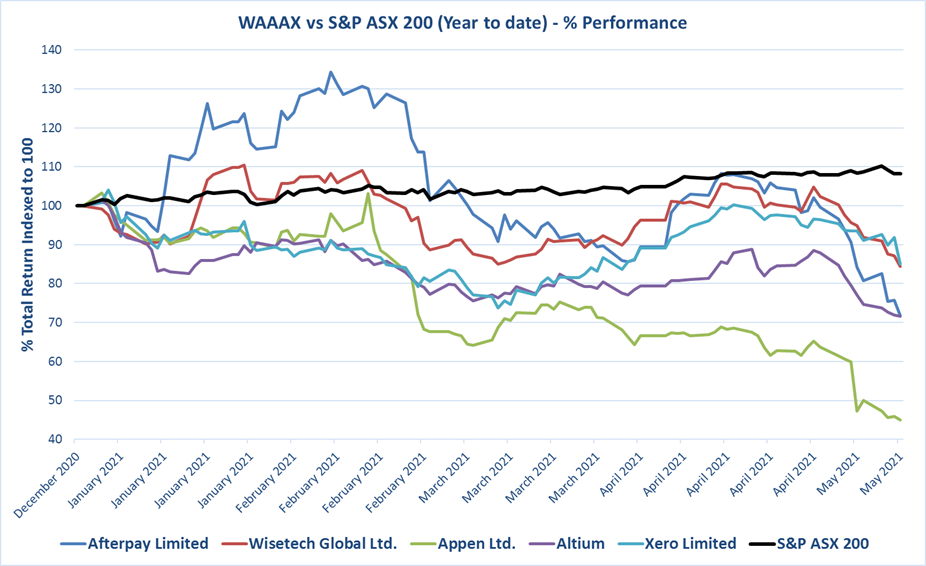

- When inflation concerns increased in early 2021, we saw profit taking from small caps, long duration and high valuation multiple stocks that operate in technology, e-commerce, consumer discretionary and biotechnology sectors. The ASX “WAAAX” stocks (WiseTech, Appen, Altium, Afterpay and Xero) were particularly hard hit.

Source: Monash Investors, FactSet , Weekly price data points

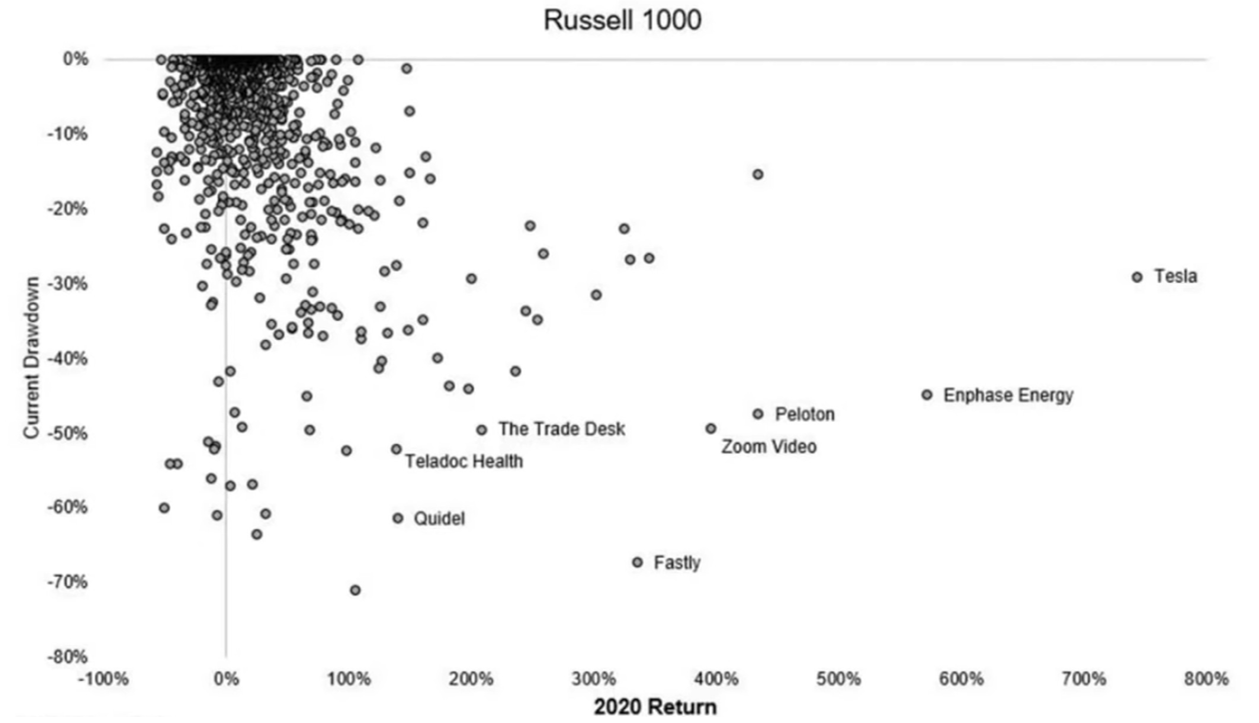

- This also occurred in the US, most infamously across the COVID-19 winners, ARK funds, SPACs and non-profitable technology companies listed on the NASDAQ and NYSE as shown below.

Source: Y-Charts, The Compound

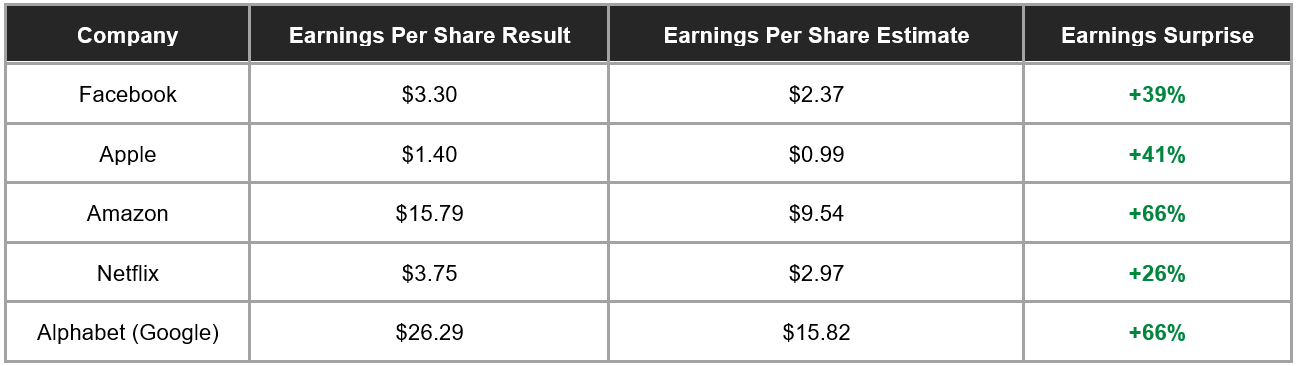

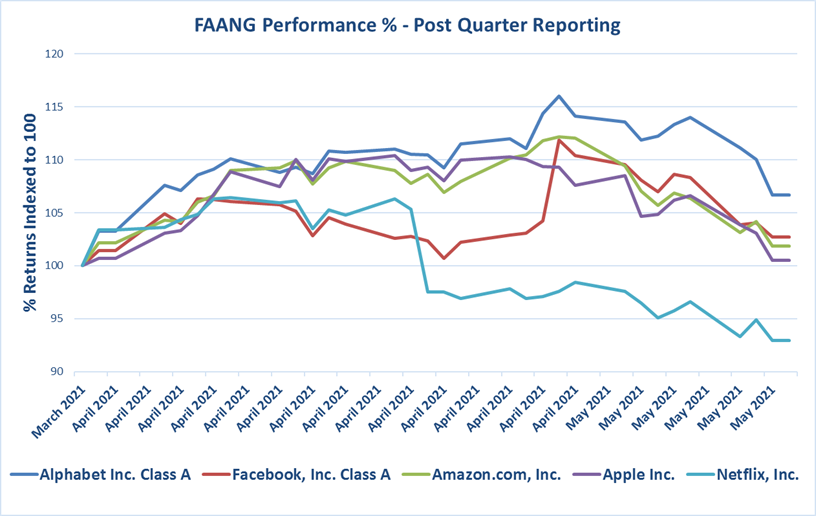

- Facebook, Amazon, Apple, Netflix and Google (FAANG) stocks recently reported earnings far higher than analyst expectations across the board. The average quarterly earnings result was 48% above consensus expectations as shown by the table below. But that growth surprise was not good enough to stop a sell off as shown by the chart below. The fundamentals of these stocks have strengthened as the economy recovers but it appears the market already priced in this extraordinary earnings growth.

Source: FactSet

Source: Monash Investors, FactSet Weekly price data points

How long can the rotation into value and cyclical stocks last?

It’s unclear how long this rotation can last, but there is a built-in limit. By definition, value stocks have price ceilings. Once a stock’s forecast price-to-earnings ratio rises to 20x-25x and above, most Value fund managers would consider its growth prospects fully priced and the company no longer meets the traditional definition of “value.”

That being said, these rotations can last for some time as value and cyclical companies grow into their valuation multiples. Many of these companies have been forced to reduce operating costs to improve profitability and corporate balance sheets have been replenished during 2020 through capital raises. A widely anticipated mergers and acquisitions boom could also support this rotation. Private Equity has filled its cash coffers during COVID-19, corporate confidence is high and Value stocks are traditionally more attractive targets.

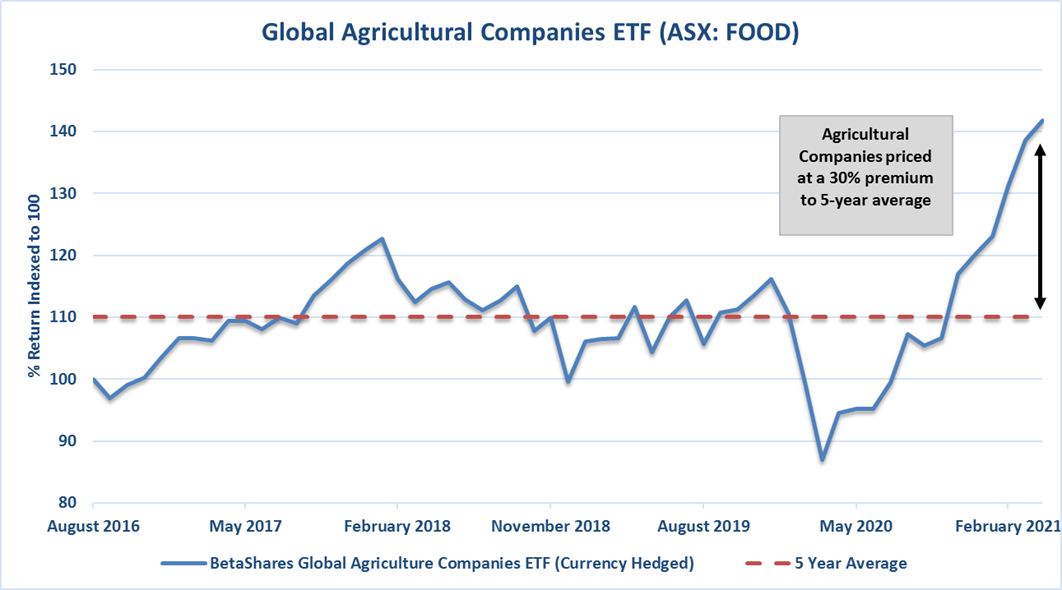

It’s not yet clear whether inflation will be transitory or longer-lasting but it is here. Central Banks continue to buy billions in bonds each month, artificially keeping yields down despite a recovering economy. We have seen that supply chain bottlenecks, surging demand and fiscal stimulus are strong forces for rising prices which in turn fuels inflation expectations. In North America we have seen lumber prices surge over 300% in less than a year and the Global Agricultural Companies ETF (ASX: FOOD), is currently priced 30% above its pre-COVID average. If inflation roars back for a while then all equities will suffer, but Value should suffer a lot less than Growth.

Source: Monash Investors, FactSet

There are strong long-term deflationary forces still in play that could appease the life of this Value rotation before Growth returns to favour. Falling global population growth rates and technology-fuelled surges in productivity are two of the greatest deflationary forces in existence.

Conclusion

This rotation may mean that the market becomes more neutral between Growth and Value. For bottom-up stock-pickers, this offers certain advantages in both investment styles. Finding overlooked Value companies can provide exposure to rising prices as these companies upgrade their earnings and re-rate their valuation multiples. Secondly, the sharp fall in prices of Growth stocks means that some of the high quality companies with durable growth are oversold, and present stock-pickers with more attractive entry points.

Benefit at every stage of a cycle

We are pleased to invite you to a 30 minute webinar to introduce you to the Monash Absolute Active Trust (Hedge Fund) (ASX:MAAT), with will be available on the ASX on the 10th of June 2021 under the ASX code of MAAT. The ASX listed managed fund has been created to make it easier for investors to purchase units without the discount to NTA issue that plagues many LICs.

We are excited about providing investors with information on how it works, the new features including a targeted 6% p.a. income target, the multi-distributed capability meaning investors can buy and sell units on the ASX or directly with the Responsible Entity and a quick update on the portfolio positioning.

Click here to register for tomorrow's webinar

1 stock mentioned

1 contributor mentioned