How much risk are you really willing to take?

Every investment carries some level of risk. Whether it's the volatility of stock prices, changing interest rates, or global economic shifts, these factors can significantly impact the value of your investment. However, understanding and managing these risks can be the key to successful investing.

The Risk Trio

- Personal – capital restrictions, investment goals, self-awareness, risk tolerance

- Company – risk/reward, pre-set plans, position sizing

- Market – volatility, sector allocation, diversification

Personal Risk

What is your goal: We all know the goal is to make money but ask yourself;

- "How much is enough?"

- "How much am I willing to lose?"

If you ask and answer these questions you will, at a bare minimum, know where the goalposts are.

Know your risk tolerance: This is a personal factor and varies from one investor to another. Some investors are comfortable taking on more risk in search of higher returns, while others prefer a more conservative approach. Your risk tolerance will significantly influence how much of your portfolio you're willing to allocate to a particular investment.

Self-awareness: Recognize and acknowledge your emotions. Are you feeling anxious because of a news headline? Did a tip from a friend make you overly excited about a stock? By being aware of your emotional triggers, you can prevent them from dictating your investment decisions.

Investment horizon: If you're investing with a long-term horizon, entry prices may be of less concern, however over shorter-term time horizons, where you enter a trade can make a huge difference.

Company Risk

Make a plan (in advance): when you invest in a stock, many investors stop doing their research after they have decided to buy, which is only half of the decision, you also have to have a plan to sell. One of the best examples of this was the BNPL phenomenon which ran for 2 years. Particularly towards the end of rally, many investors had enjoyed the rally, but had no exit plan.

For many of our clients that missed the sell in the BNPL stocks in 2021, it caused an emotional trigger that led to frustration, with many of them attempting to actually add to the position on the way down, making the problem worse. On the flipside, those who sold (or used trailing stops) to take profit and re-asses later, were more subjective and largely left it alone and moved onto fresh ideas.

Many of the investors that held on, kept using the eye watering highs as a justification for why it was a buy on the way down, instead of looking at the trade from a neutral standpoint.

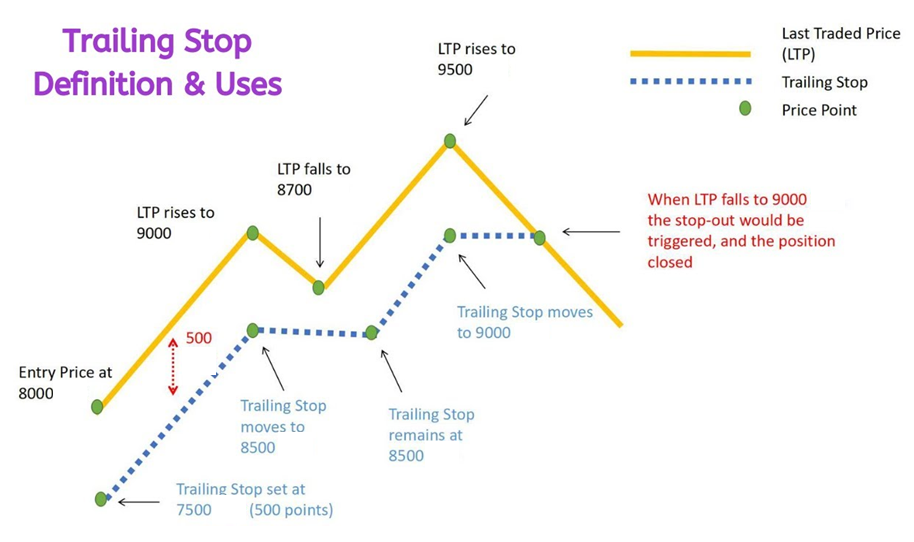

Using stop-loss orders: This is a strategy where an investor sets a predetermined price at which they will exit a stock to prevent further losses. One of the best (and most underrated) types of stops is a 'trailing stop-loss'. This is where you move your stop-loss up with a rising price so you don’t give away unrealised profits.

Market risk

Diversification: It's the classic strategy of not putting all your eggs in one basket. Spreading risk through diversification is one of the most effective risk management tools. This doesn’t mean buying five different versions of the same style of company, it means having an appropriate amount of fixed income, property, and stocks.

Sector allocation: Sectors perform very differently at different times of the economic cycle. You wouldn’t allocate to REITs, nor a high debt company, in a high interest rate environment. But you would likely buy them in a low interest rate environment. So why carry them through both parts of the cycle?

Hedging: This involves making an investment to reduce the risk of adverse price movements in an asset. There are different hedges for different situations, so it's important to know which hedges work in which situation, better explained in my Livewire article: The art of hedging your portfolio

Volatility (fear and greed) - the twin drivers: Two primary emotions drive the market: fear and greed. When stocks are rising and the future looks bright, greed can push investors to jump in, hoping for quick gains. Conversely, when the market takes a downturn, fear can grip even the most seasoned investors, leading to panic selling.

The emotional rollercoaster of investing can be both intoxicating and demoralising. Whether you are a seasoned trader or novice investor, all of us have felt the rush of excitement when our stocks surge and the pit of dread when they plummet.

These emotions are natural but they can also be treacherous. They can cloud judgment, prompt impulsive decisions, and divert you from your long-term investment goals.

The best traders and investors learn how to manage them.

Strategies to navigate the emotional impacts of volatility

Market volatility is as much a test of psychological endurance as it is of financial acumen. By understanding the emotional landscape of investing and equipping yourself with strategies to navigate it, you will make better decisions.

In the words of famed economist John Maynard Keynes, “The market can remain irrational, longer than you can remain solvent,” so you need to manage your risk to fight another day.

Stick to the plan: Your investment strategy was crafted for a reason. When emotions run high, revisit your plan. Remind yourself of your long-term goals and the rationale behind your investment choices.

Practice patience: The stock market is inherently volatile in the short term. But with that brings opportunity as well as danger. Let the opportunities come to you - there are 2500+ stocks on the ASX and there will always be another opportunity.

Seek support: Talk to fellow investors or an advisor. Sharing your concerns and hearing diverse perspectives can provide clarity and calm nerves.

The pub tip - I have had clients in the past wanting to swing for the fences on a tip from a mate that is a "sure thing". Such situations are fraught with emotional landmines like fear of missing out (FOMO), because we inherently trust our friends, tend to not question the validity of the tip, and skip the research process. We have found the best way to deal with this is to mitigate the emotional risk and buy a small allocation, then decide at a later date if you want to add or not. You still get to share the success with your mate in the pub (if it eventuates) but don’t lose a chunk of your portfolio if things turn sour.

We're here to help you navigate risk - Risk Management Webinar

If you would like to learn more about risk management and how MPC Markets helps clients navigate volatile markets, register for our “Risk Management” webinar on the 2nd of February

5 topics