How should your portfolio be positioned if the RBA's next move is a hike?

It may only be a monthly inflation indicator but the shock upside surprise caused rumblings around the financial world this week. So much so that UBS and Morgan Stanley have both changed their calls for the next RBA meeting in August.

There is no question that the Reserve Bank has tried to do something differently to the rest of its global peers - hike rates by less but keep it there higher for longer. But if this week's May monthly inflation indicator is anything to go by, it appears that the gamble has not paid off. Now, the RBA risks a second mistake - a mistake that overshadows even its own delays in hiking interest rates back in 2022.

In this wire, we'll explain why this inflation print moved markets and find out how different investors are turning the scenario of an emergency rate hike into investable ideas.

Why this inflation indicator moved markets

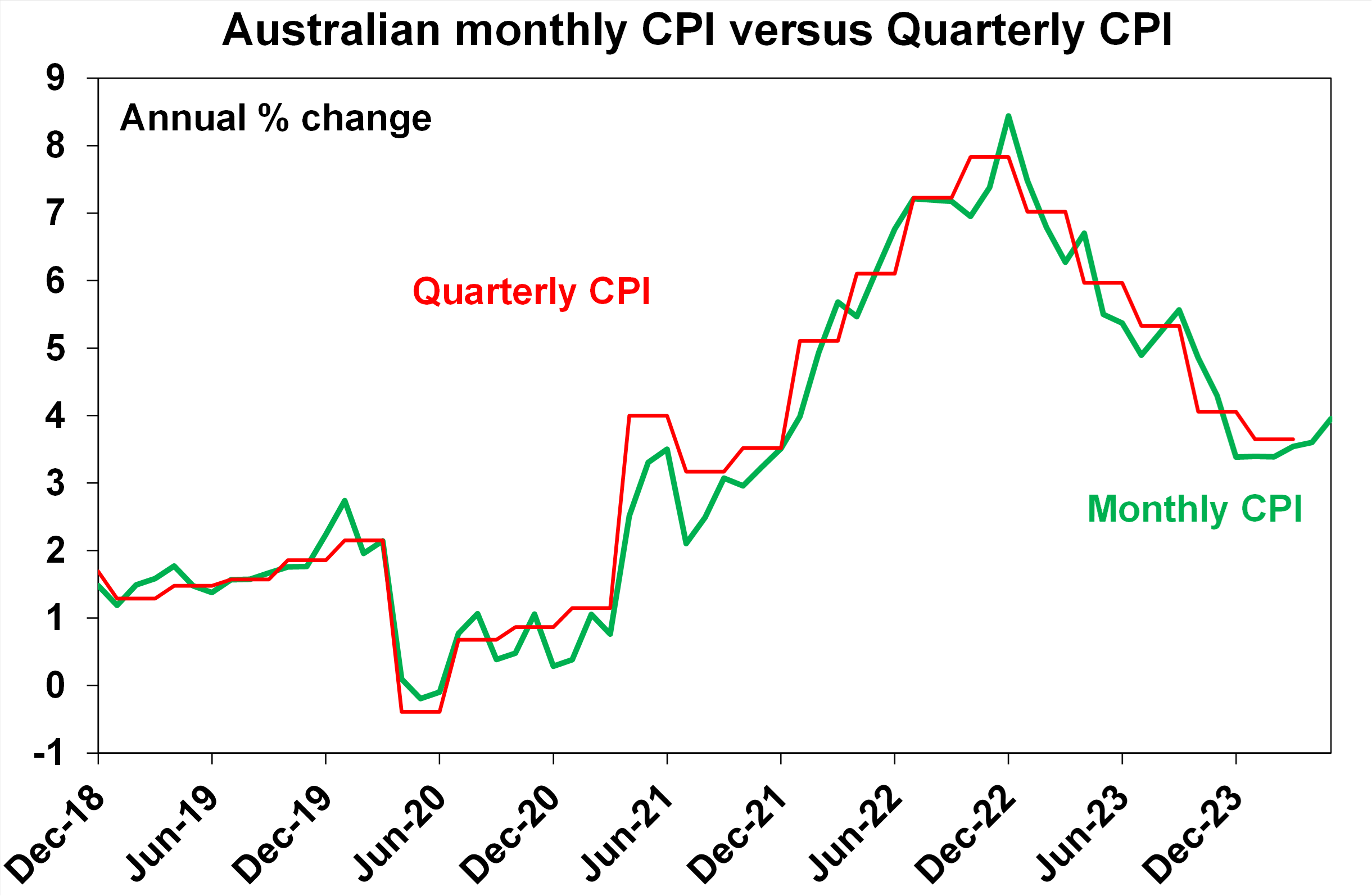

Normally, the ABS Monthly Inflation Indicator is just used as a clue to the quarterly inflation print. That's because the monthly inflation indicator does not measure everything in the inflation basket whereas the latter does. The quarterly print is also the figure that the RBA bases its monetary policy decisions on.

But Wednesday's figure was a big upside surprise - so much so that Citi, UBS, and Morgan Stanley have all changed their house calls for the August meeting in the last 48 hours alone.

.png)

The May monthly inflation indicator came in at 4% on a headline level, economists surveyed by Bloomberg expected 3.8%. On a headline level, inflation is now at its highest level for six months. The trimmed mean (headline minus food and energy prices) indicator rose 4.4% last month - up 0.3% in one month alone.

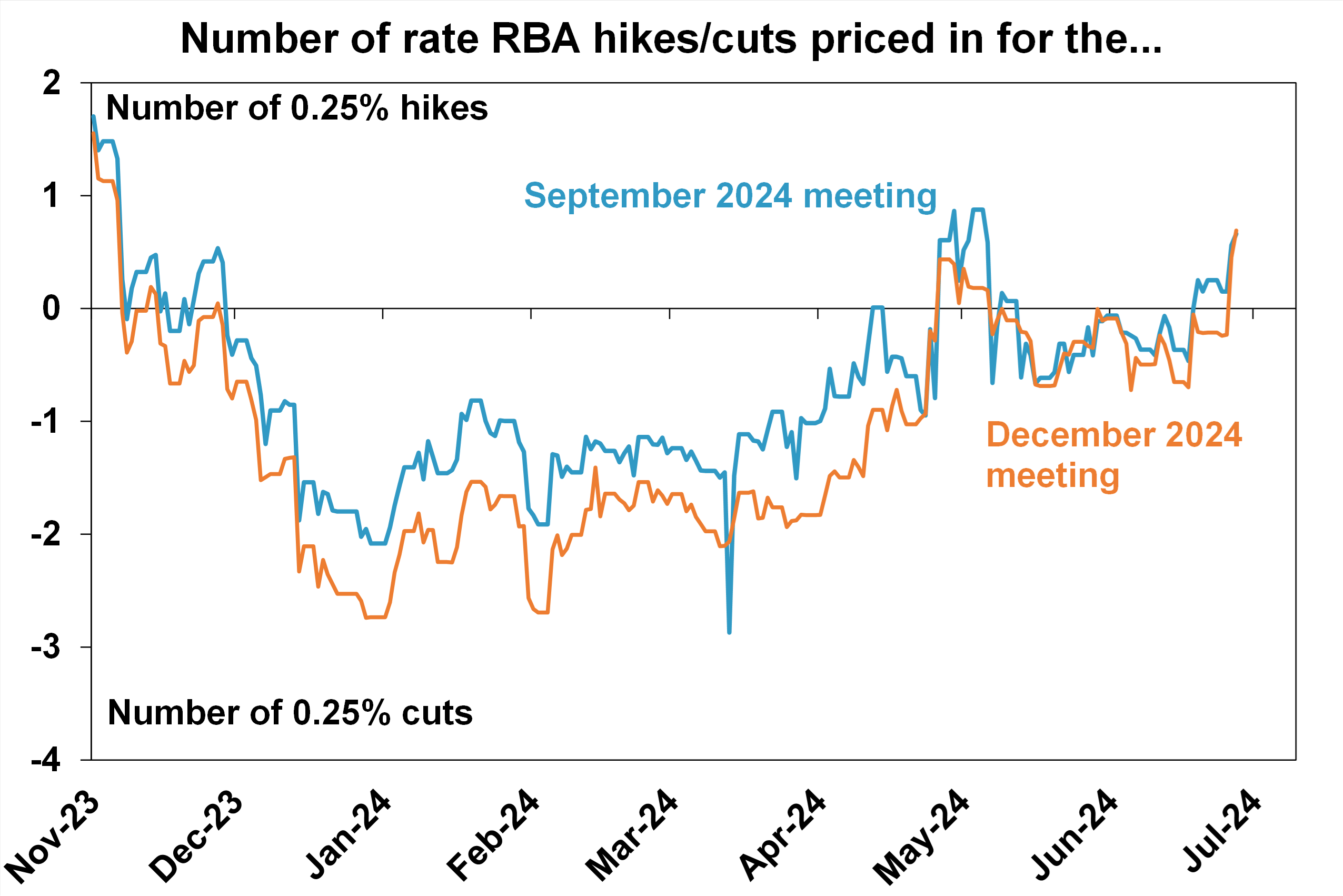

As a result of this data point, markets are now pricing in a 45% chance of a rate hike in August. Shane Oliver, Chief Economist & Head of Investment Strategy at AMP, told me that he would agree with this pricing but adds he wants to wait until July 31 before making a final call:

"We think it’s a close call but would put the risk at 45%. The hot May inflation result has certainly increased the risk substantially but the monthly CPI is an imperfect guide to the quarterly, e.g. earlier this year it was running low and didn’t provide a good guide to the higher-than-expected March quarter inflation data."

"The quarterly is still the gold standard, it's released on 31 July and it will be key. By the August meeting, we will also get another jobs report and there may be some anecdotal evidence as to what people are doing with their tax cuts. So, we think that while the risk of a hike has gone up dramatically, it's not as high as the market is now allowing," he told me.

The following extra chart shows how market pricing has back-pedalled dramatically as all those downside inflation surprises turned into upside inflation surprises!

How can you prepare your portfolio?

Firstly, we've been through this before and it didn't turn out so bad.

"Another rate hike will be bad news for demand and will increase the risk of recession. That said, we had five hikes last year and it was a good year for shares and the bad news on rates locally may be offset by good news on rates globally with the Fed likely on track to start cutting from around September," Oliver reminded me.

Secondly, for multi-asset investors, Oliver has this advice:

"If an investor is really worried about it, they could allocate a bit more to global [shares] relative to Australian shares or a bit more to defensive assets like bonds and cash."

"Within their Australian share portfolio, they could consider a slightly lower exposure to cyclical sectors (like consumer discretionary) in favour of defensive sectors like (consumer staples). Trying to time it, though, will be hard as if it’s “one and done”, the market may quickly swing back to focusing on the next move being a cut," he said.

Oliver has long held the view that the RBA's next move should be down and still believes that should be the case.

But Isaac Poole, Chief Investment Officer at Oreana Financial Services, has had a very different view for a long time. Poole has long argued that investors should be protecting their portfolios and not chasing risk - even as the S&P 500 continues to smash all-time records in 2024. He's also argued that markets have been asking the wrong questions about inflation, interest rate cuts, and even the nature of those cuts.

"Sticky inflation and slowing growth have been a key risk scenario for us. It is far more painful than the prevailing “soft landing” consensus. A lot of the drivers of sticky inflation globally have been a risk to Australia and now we’re seeing markets have to contemplate those risks," Poole told me.

Now, the sticky inflation concern that he and his team have had for so long might be coming to pass. And as a result, he says he wouldn't rule out the RBA hiking at least once more - and possibly even twice.

"From here, the RBA will probably have to hike to maintain credibility. That is a terrible outcome for the economy that is slowing. I think we could be marching to a scenario where we get 1-2 hikes followed by emergency rate cuts six months or so down the track," he said.

Two more rate hikes would push the RBA's official cash rate to 4.85% - which is closer to the 5% that internal modelling said would be the figure strong enough to quell inflation.

So what do you do if you think this is a pivotal moment for markets? Poole says the first thing to do is to change your strategy, by firstly rethinking what equities you are invested in.

"It is time to rethink your equity allocations. High multiples have been pricing in a re-acceleration in growth."

"But sales growth is falling and margins are shrinking. A rate hike is going to exacerbate those trends. And what do companies do when they see margins falling? They cut costs through headcount. Rising unemployment could drive a doom loop in the economy. Even without that, valuations need to correct to reflect reality rather than hope," Poole argued.

And then, once your equity holdings have been audited, the next thing he says is prudent is to improve your portfolio's resilience. Or, to put it another way, add more defensive plays to your portfolio.

"That can be done by adding exposure to high quality, shorter duration fixed income. We have focused in on Treasuries but the backup in Australian government bond yields is also a place to consider."

Within corporate credit, shorten spread duration and increase quality. Within equities, reducing overall market beta is important. That could be actioned by lowering equity market exposure or by increasing relative exposure to quality value. We’d also have a modest tilt towards global versus Australian equities relative to neutral settings," he said.

2 topics

2 contributors mentioned