How social media frenzies could present opportunities in stocks

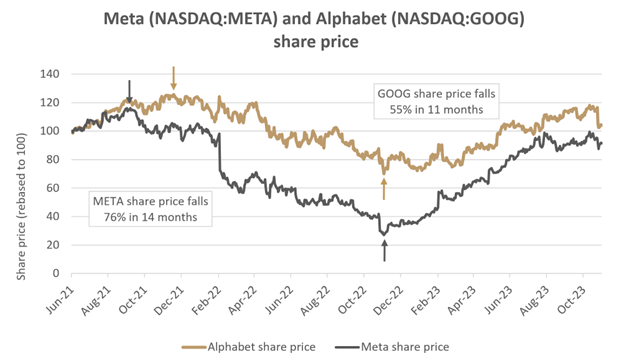

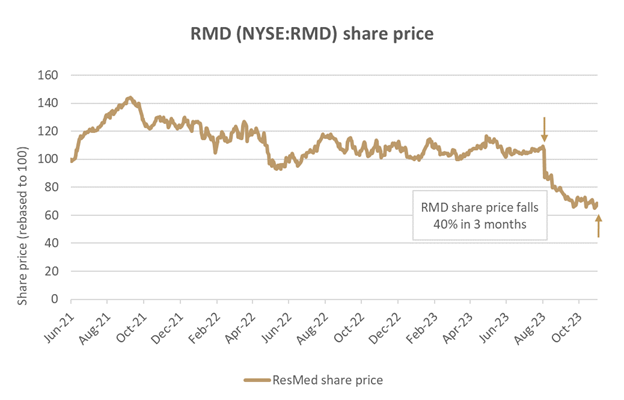

Alphabet (NASDAQ: GOOG), Meta (NASDAQ: META) and ResMed (ASX: RMD) are three of the world’s most successful businesses over the past two decades. They have something else in common more recently: all three have suffered peak-to-trough share price falls of more than 40% since 2021.

Google owner Alphabet’s share price was $138 at the beginning of 2022. Just 11 months later, it hit a low of $83 in November, a fall of 44% from the peak. Meta fared even worse, dropping 76% between September 2021 and November 2022 . More recently, ResMed’s US share price has fallen 40% in just three months.

Markets have been volatile, sure. But all three are profitable, quality businesses that investors have flocked to in past periods of distress.

So what caused the share price of three of the world’s best businesses to change so much?

Narratives run markets

Markets have always been driven by narratives. Whether the Nifty Fifty of the 1970s or the railway mania of the 1840s, investors have always been lured, fooled and fleeced by an appealing story. But the influence of hedge funds and social media on stock markets has grown exponentially in the digital age, causing significant volatility in share prices based on trends or themes that capture public attention.

Social media platforms like Twitter and Reddit have given rise to "meme stocks", where a high volume of retail investors rally around a specific stock, driving its price to levels that have nothing to do with fundamental valuation metrics. Additionally, influential figures can move markets with a single tweet or post. Elon Musk's tweets about Bitcoin and Dogecoin are examples of this.

The impact of media and social media trends on stock markets isn't just positive; it can also trigger sharp declines in stock prices due to negative sentiment or perceived shortcomings.

These declines are exacerbated by the speed at which information (or misinformation) spreads on social media platforms, as retail investors rush to sell, with no regard to the actual valuation of the business.

This now brings us back to our three wonderful businesses.

Reaction to themes

On 30 November 2022, ChatGPT was released to the market. It was the fastest (at that time) app to reach over 100 million users, which happened by the end of February 2023. In the weeks leading up to its release, there was a huge anticipation around AI within the media and on social media. Then, once it hit 100 million users, there was further excitement at this ‘unprecedented event’.

Chat GPT is going to kill Google, the narrative went. Meta’s nemesis was TikTok. ResMed’s threat comes from the obesity-ending drugs known as GLP-1s.

Many of these themes are real changes to the world. ChatGPT is stealing some of Google’s search traffic. TikTok is claiming more of the digital media pie. The GLP-1 drugs will lead to less obesity* and reduced demand for ResMed’s sleep apnoea treatment.

Opportunities come from recognising the risk but quantifying the magnitude of the impact on existing businesses. We believe that’s the value of being an active investor.

Taking advantage of the opportunity

While the narrative might be right, the market reaction is often overdone due to social media, which amplifies the theme and causes further investor and social media reactions.

With its troves of user data, Google is as well placed as any company in the world to take advantage of AI. Meta has reinvented itself numerous times and was able to do so in this case through Instagram’s Reels. And we’re confident ResMed, too, will remain an extremely valuable business with decades of growth ahead of it.

Long-term investors may need to move quickly to take advantage of these dips. Attention spans are fleeting in social media land, meaning the opportunity may also be short-lived. When the meme noise is at its peak, though, long-term investors who know the affected industries can pick up some wonderful bargains.

Alphabet’s share price is up 50% from its lows. Meta’s has risen more than 200% in less than a year. The “sell everything treating obesity theme” still has momentum, and it might last a while longer. With ResMed trading at the lowest multiple it has traded at in eight years, though, we’re happy to take the other side of this one too.

*The Forager team discussed weight loss drugs and the subsequent market reaction in more detail in a recent podcast.

If you share our passion for unloved bargains and have a long-term focus, Forager could be the right investment for you. Click 'FOLLOW' below for more of our insights.

For all of Forager's latest content, videos, podcasts and fund reports, register here.

3 topics

3 stocks mentioned

.jpg)

.jpg)