How sustainable is the stunning rally in residential property?

Livewire Markets

Not too long ago, I was driving in what is typically a quiet street in my area. As I turned a corner, I was met with crowds of people blocking the road. Upon further investigation, I realised they were standing at an auction. I had never seen so many people at an auction before and it made me wonder - surely it's too expensive for people to be buying property at the moment. After all, the shack down the road is now selling for $2 million! Well, truth be told, I may be right about this (property lovers block your ears).

According to data from CoreLogic last week, Sydney house values increased by 19.3% over the last financial year while unit values have increased by 5.1%. So, how long can this growth keep trucking? Well to find the answer for all you keen residential property investors, the final instalment of this three-part collection will aim to answer this exact question.

Unfortunately, for those homeowners, or perhaps fortunately for those looking to buy, the recent surge in prices is unsustainable. That is according to our trio of housing experts who share their thoughts below.

Responses come from:

- Chris Rands, Yarra Capital Management

- Shane Oliver, AMP Capital

- Pete Wargent, Buyers Buyers

Two reasons why we may see a decline

Chris Rands, Yarra Capital Management

Loan commitment charts evidence it is a question of how long owner-occupiers keep seeking new loan commitments. Given the size of the increase in owner-occupied finance, I would have already expected borrowing to have started to peak, but that has clearly not been the case. And it’s not just Australia that is facing this phenomenon: prices are rising in many other countries, with Turkey (+32%), New Zealand (+22%) and the United States (+13%) already outpacing Australia.

So as an alternative, let’s focus on two other ideas. Firstly, how long can we expect house price momentum to persist given current levels of loan commitments? And, secondly, historically how long have people continued to borrow following an RBA cut?

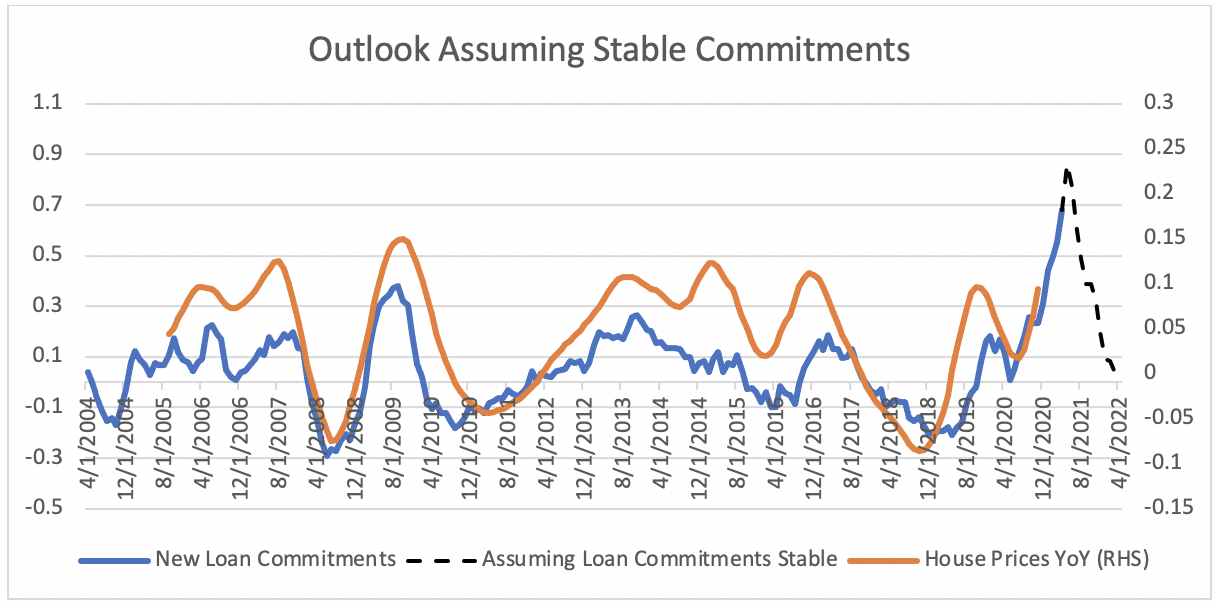

If we take the loan commitment series and assume that it moves sideways from its current lofty levels, this implies that we are relatively close to the peak in the year-on-year change in commitments. The house price series below is lagged by six months and shows that house prices should continue to rise through 2021 and potentially be flat in the middle of 2022. It’s somewhat of a crude estimate, but at least provides some parameters of how the momentum will change.

Source: Australian Bureau of Statistics, Bloomberg, Yarra Capital Management

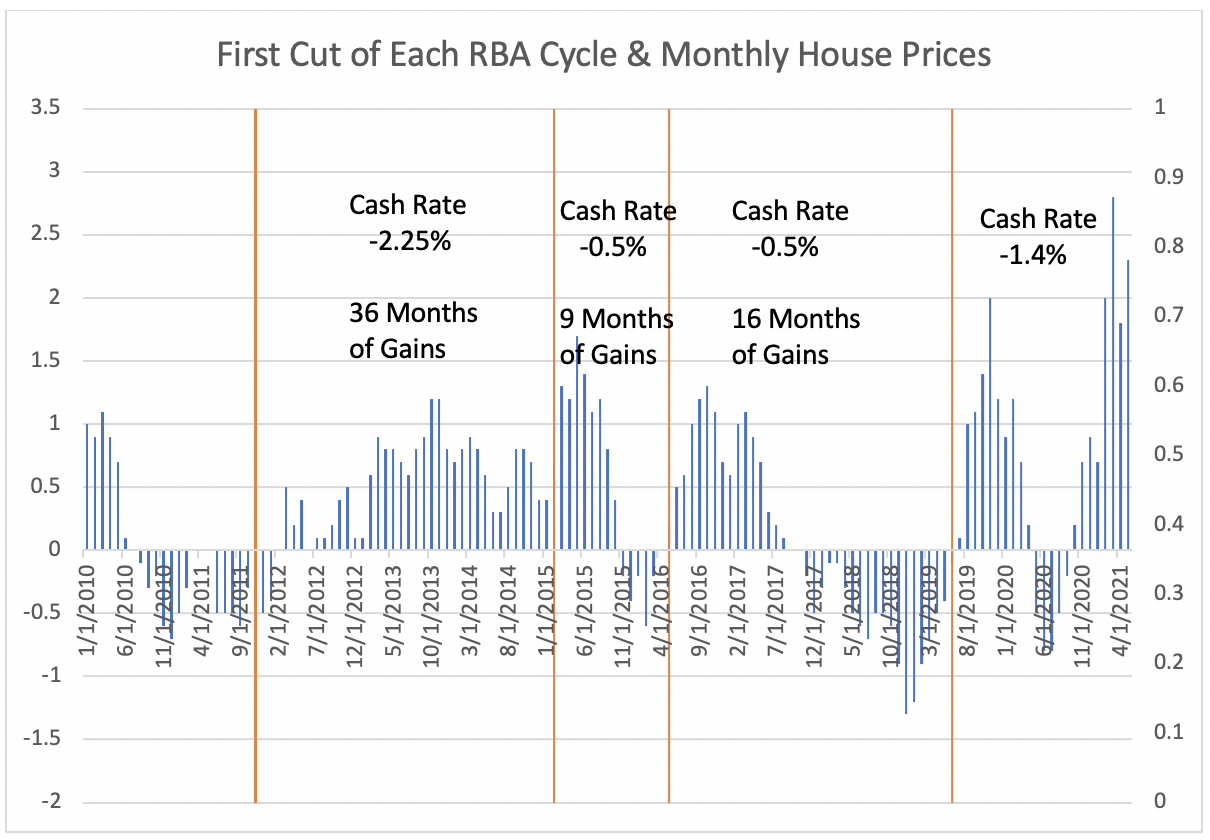

Next, let’s look at the change in house prices following an RBA cut. In the chart below, the orange bars represent the first cut of an RBA easing cycle, with the blue bars laying out the subsequent changes to monthly house price. From 2011 onwards the cash rate fell 2.25% and there were 36 months of appreciation, followed by a cumulative 1% rate cut over 2015 and 2016 which was followed by another 25 months of gains. Since the cash rate has fallen 1.4%, we can infer 30 months of appreciation, which suggests that house prices should start losing momentum in mid-2022.

Source: Bloomberg, Yarra Capital

This momentum is not sustainable

Shane Oliver, AMP Capital

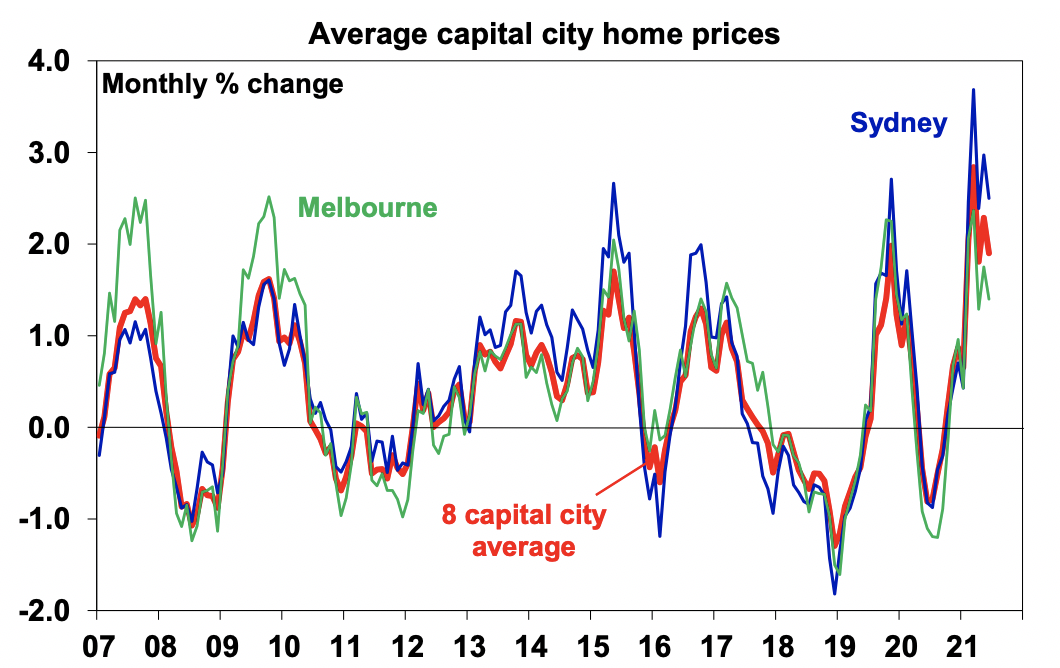

The last 20 years has seen the property market go through multiple booms lasting a few years punctuated by modest (5 to 10%) price falls as deteriorating affordability and monetary tightening take their toll.

Source: CoreLogic, AMP Capital

In fact, we have probably already seen the peak in monthly price gains in March this year. We expect price gains to slow from 18% this year (of which it’s already done around 12%) to 5% next year with a 5% fall likely in 2023. The expected loss of momentum reflects a combination of things.

- Deteriorating affordability is now starting to hit demand from first home buyers and even upgraders.

- APRA is expected to use macro-prudential controls to slow housing lending sometime in the next six months.

- Interest rates have bottomed - while variable rate hikes are probably 18 months to two years away, fixed mortgage rates have started to move up

- Government housing incentives are likely to be wound back a bit.

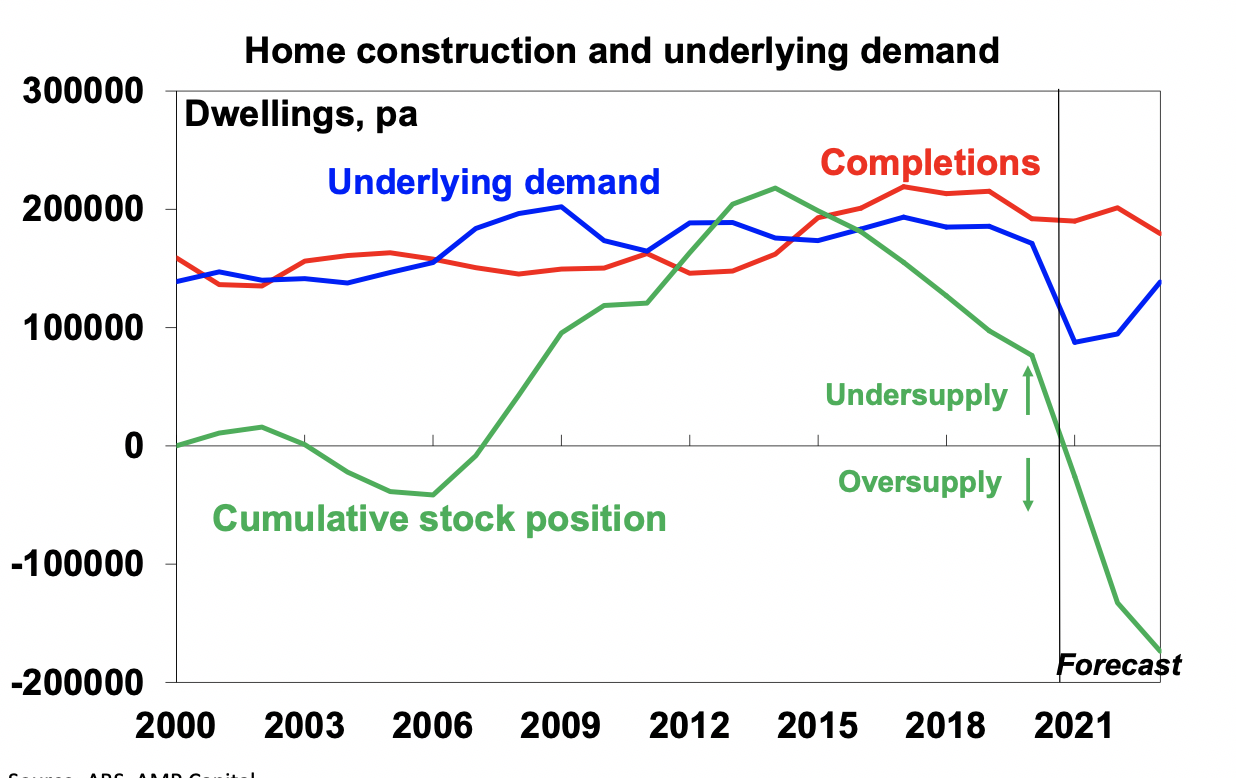

- The hit to immigration, which has cut underlying demand for housing by around 100,000 dwellings a year combined with continued strong home building, is likely to lead to an oversupply of property. See the next chart.

While average prices are expected to fall 5% or so in 2023 this should be seen as a normal cyclical downturn rather than a crash. While high debt levels mean that there is a risk of a crash, it's most unlikely in the absence of either much higher interest rates or a recession that is not offset by government support like that seen last year. When the RBA does start raising rates it will only do so gradually and high debt levels mean that it won’t need to raise rates as much in past cycles. And a recession is not on the horizon at present.

The best opportunities are probably in the recovery cities of Perth and Darwin along with Adelaide and Brisbane and in regional centres. Lifestyle demands will likely continue to favour houses over units.

Source: Australian Bureau of Statistics, AMP Capital

It's all downhill from here

Pete Wargent, Buyers Buyers

There already has been a downturn underway for inner-city units, especially for asking rents and rentals in Melbourne CBD, Docklands, and the city fringe.

Even with a cursory look at the latest demographic trends, it’s not hard to see why.

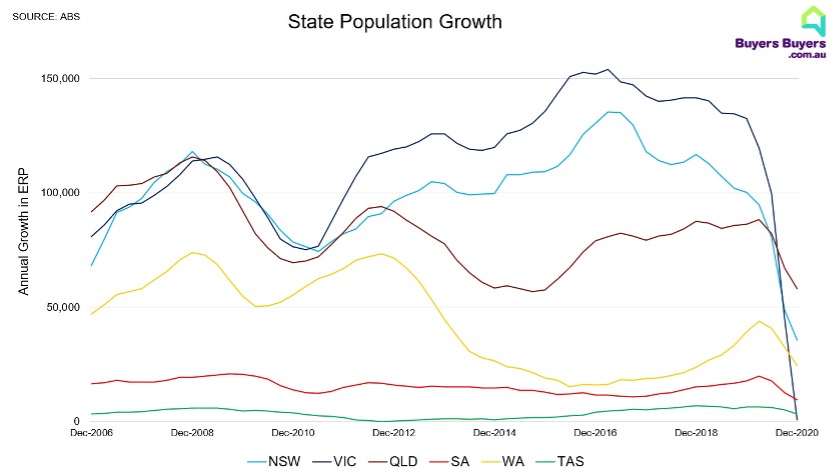

Victoria’s annual growth in its estimated resident population has collapsed from a peak of nearly 154,000 in 2017 to around just 750 in 2020.

In fact, the population of the state has actually been in decline since June 2020.

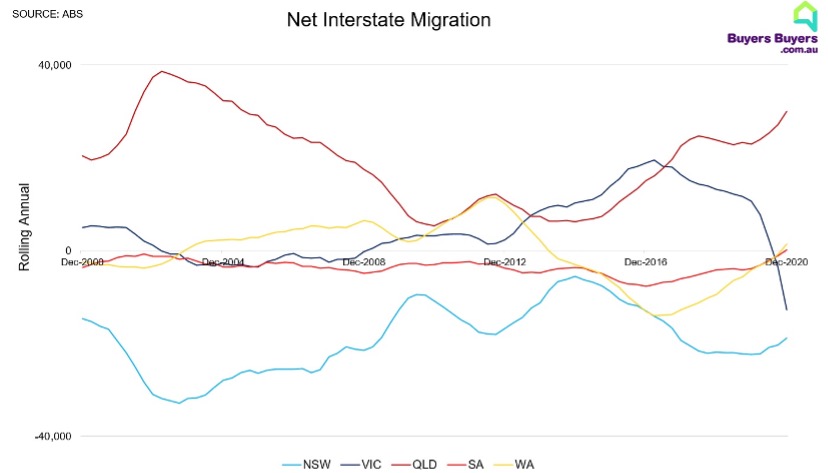

On-again/off-again lockdowns continuing into 2021 and the related restrictions have accelerated interstate relocations to southeast Queensland in particular.

Net interstate migration into Queensland exceeded 30,000 in 2020 for the first time in 15 years, and the numbers in the final quarter of 2020 were exploding (as is more than evident in lifestyle markets such as Noosa and the Gold Coast, as well as in some inland cities).

Many investors are choosing to invest interstate these days, and south-east Queensland has been a popular choice of late.

The outlook

We expect to see dwelling prices appreciating, but ultimately at a lower rate, since the current boom conditions are not sustainable.

The double digit pace of growth is likely to last for no more than 12 months, and will be quashed either through credit restrictions (by the regulators or voluntarily by lenders) or by market forces, including deposit and affordability barriers combined with a higher level of supply from owners who want to realise their capital gains.

With mortgage rates remaining ultra-low, we expect to see capital growth moderating to a rate of around 5-8 per cent, with no meaningful downturn any time soon, unless strong macroprudential measures are implemented.

Key points

Whilst eyeballs are drawn to doom and gloom headlines the consensus view from our guests appears to be that growth will continue albeit at a subdued levels. The availability of credit coupled with low interest rates remains a driver of property prices for now. However, expectations are that these favourable conditions are likely to dwindle in the years ahead. It is also evident that the ongoing presence of Covid is creating some nuances with regards to the type of dwelling (house vs unit) and sustained interest in regional property.

More wires on residential property

If you enjoyed this collection, please make sure to give it a like and follow my profile for more content like this. You can also access parts 1 and 2 of this collection via the links below.

2 topics

2 contributors mentioned

Bella is a Content Editor at Livewire Markets.

Expertise

Bella is a Content Editor at Livewire Markets.