How the green wave is influencing emerging markets

redwheel

The road to net zero emissions has the potential to set in place the conditions for a commodity super-cycle which has significant implications for emerging and frontier markets.

Governments and authorities made many pledges following the two-week COP26 meeting in November 2021. More than 100 countries, including Brazil and Russia, agreed to end deforestation by 2030. Another 80, led by the US and the EU, pledged to cut methane emissions by at least 30% by 2030 while over 40 countries made new commitments to phase out coal power despite China, US, India and Australia holding back.

These widespread commitments to achieve carbon neutrality are likely to intensify electrification and renewable energy efforts, creating multi-decade support for relevant industries.

Solar is set to play a more important role while producers of “green wave” materials like copper, uranium and lithium may also be key beneficiaries of this trend.

Investing in climate change

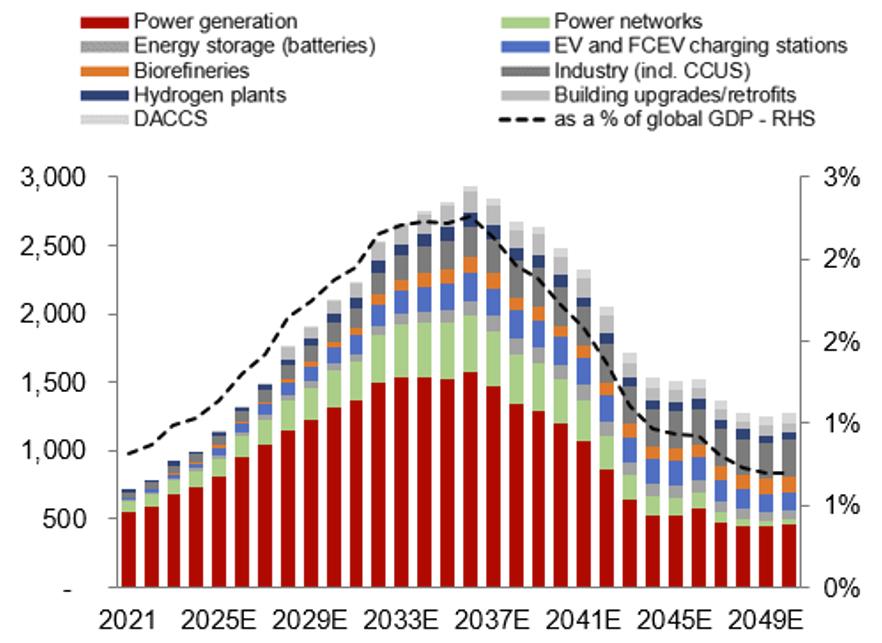

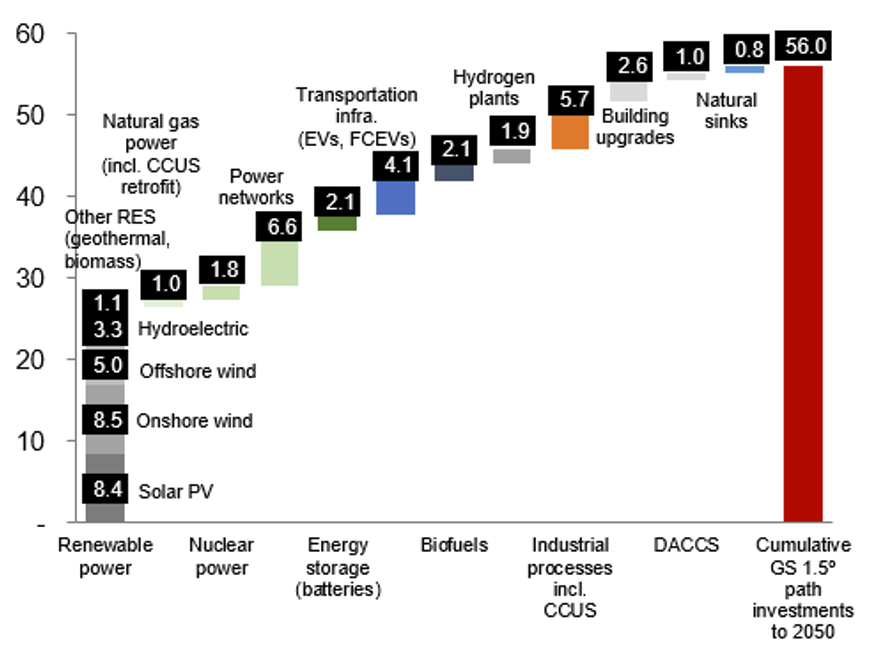

An estimated $56tn in incremental infrastructure investment should be needed to achieve net zero carbon emissions by 2050. This implies an average annual investment of $1.9tn in decarbonization worldwide.

If politicians commit a fraction of the capital which they have talked about we believe that copper, aluminium, nickel, cobalt and lithium prices could increase significantly as supply and demand dynamics may create serious bottlenecks.

The majority of these commodities are located in emerging markets. The economies which are net exporters of these metals should be beneficiaries of higher prices as the contribution of exports to GDP increases rapidly.

Figure 1 - Investment to reach >2% of Global GDP by 2032 in 1.5 degree celsius scenario

We see equity outperformance from companies that produce commodities related to the electrification of the global economy and businesses involved in the respective supply chains (e.g. copper/lithium, electricity transmission, energy storage). The Redwheel Emerging and Frontier Markets team has identified several key themes that look set to benefit from this long-term secular growth opportunity: Sustainable Energy, New Auto Tech and Copper.

Sustainable energy

The International Energy Agency (IEA) estimates that global electricity demand could double by 2050 under a net zero scenario.¹ We believe that demand has the potential to grow more than that.

As the world continues to focus on decarbonization, the majority of the new sources of electricity will have to be generated sustainably. We identify and invest in companies that are actively involved at any point in the supply chain of low carbon energy.

The target of sustainable energy is to produce affordable and reliable energy for extended periods of time, while at the same time helping to combat climate change with the lowest possible emission of CO2 and other greenhouse or polluting gases. We have key portfolio holdings across different sectors such as solar power and nuclear energy.

Solar power

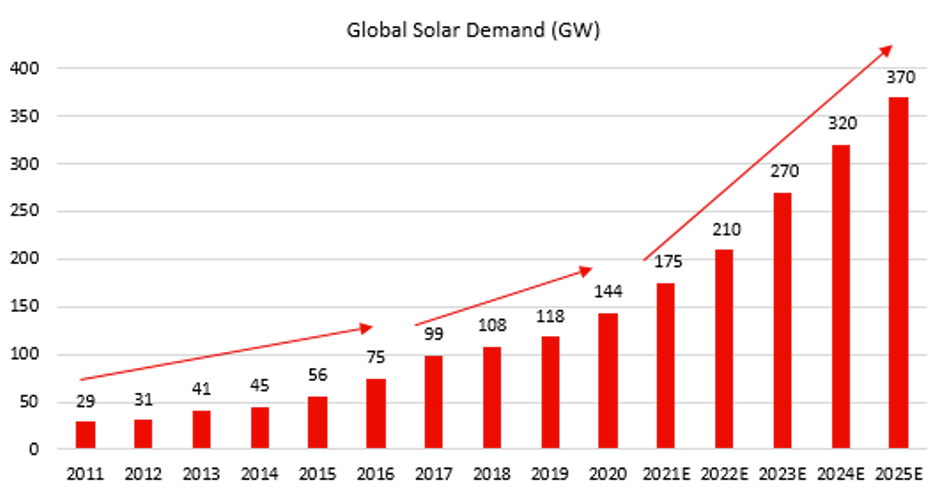

The development of solar power will be crucial in phasing out fossil fuels. Solar PV² is becoming the lowest-cost option for electricity generation in most of the world leading to significant investment in the coming years and strong growth for solar power manufacturers.

In the solar sector, after years of expansion and consolidation, Chinese suppliers now represent more than 80% of the effective capacity in most segments across the solar supply chain.³ Chinese solar suppliers started to expand their capacity in 2019 on the back of stronger visibility on future demand. The robust performance of these companies in the equity market has enabled them to raise capital and further accelerate their expansion plans.

LONGi is the largest mono-silicon wafer producer in the world and is set to be a key enabler of the shift to solar power. We expect ongoing vertical integration (from wafer to cell and module) to potentially further boost LONGi’s market share in the global module markets. Additionally, LONGi believes the distributed solar market in China, especially commercial and industrial, should see strong demand in 2022 driven by government policies. In 2021, distributed solar modules accounted for 15-20% of LONGi’s total module shipment, which may increase to 35-40% in 2022. LONGi believes the distributed solar market has higher module price affordability than solar farms, leading to higher margins.

Uranium

Nuclear energy has been brought back into the spotlight due to its low cost and high energy efficiency. Nuclear capacity is increasing in countries such as China and India due to the constant search for more sustainable forms of energy.

This is offsetting the decommissioning and decline of nuclear as a source of electricity generation in Western countries.

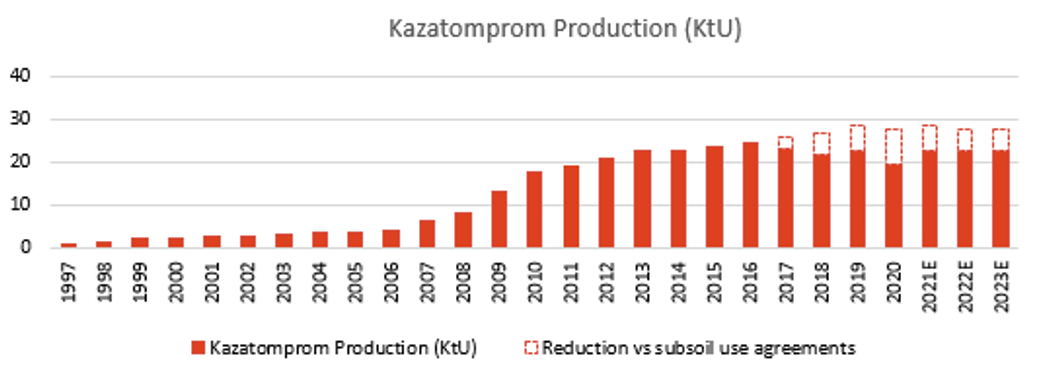

However, we believe that nuclear power will regain political support in the US and parts of Europe which will drive life extensions of existing reactors and positively impact medium term demand. Additionally, supply curtailments by key industry players such as Cameco and Kazatomprom could continue to drive uranium prices higher, benefitting low cost uranium miners.

Kazatomprom is the world’s largest uranium producer commanding a direct share of 45% of the world’s production. Its mines operating in Kazakhstan are also the lowest cost uranium producer globally. This uranium miner will be a key beneficiary from the expected rise in uranium prices.⁴

Copper

We have been bullish on the role of copper in the drive for global decarbonization for several years. Copper is one of the key metals and beneficiaries of the electrification of the global economy, whether through the production of electric vehicles or the electrification of industries and is crucial in the construction and build out of renewable energy.

For example, electric vehicles use seven times more copper per car than vehicles powered by internal combustion engines while wind power is five times as copper intensive as thermal power stations. A wholesale switch would require the copper supply to almost double from today’s levels.⁵

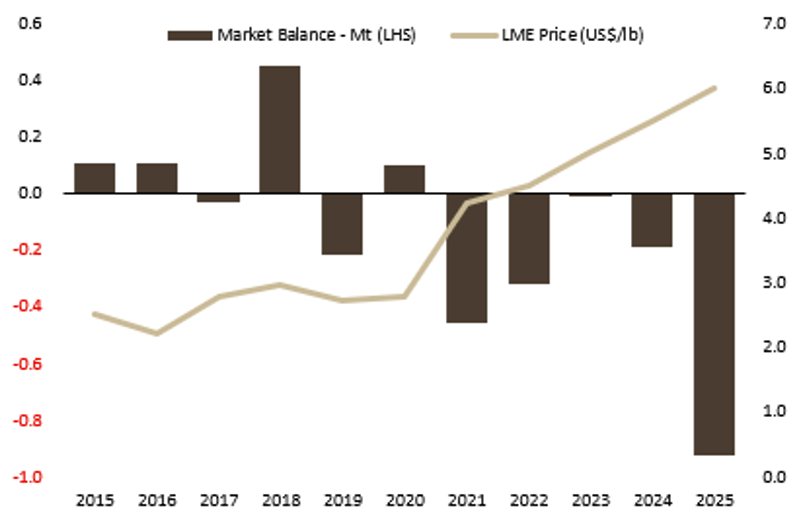

On the supply side, large existing copper producers are struggling to maintain copper production at current levels as higher cost underground mines are replacing above ground open pit mines. Ore grades have decreased substantially, and our research suggests new copper greenfield projects are only viable at sustainable prices of over $3.50 per pound of copper. These supply issues, combined with secular growth in demand, suggests that the outlook for the base metal is positive over the coming years.

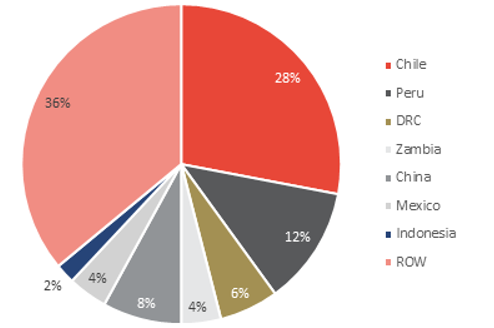

Emerging markets account for over 60% of the copper supply globally, therefore we see several emerging markets benefitting from the robust long-term supply-demand dynamics of copper.

In Zambia, First Quantum Minerals operates one of the largest copper mines globally. The company is set to benefit from an appreciation in the copper price over the next decade due to robust demand and subdued supply.

New auto technology

There is currently a dramatic change taking place in the world’s transportation sector. New Energy Vehicles (NEVs) are replacing vehicles with internal combustion engines (ICEs). NEVs require different materials for construction and operation which lead to a new set of beneficiaries within the automobile supply chain.

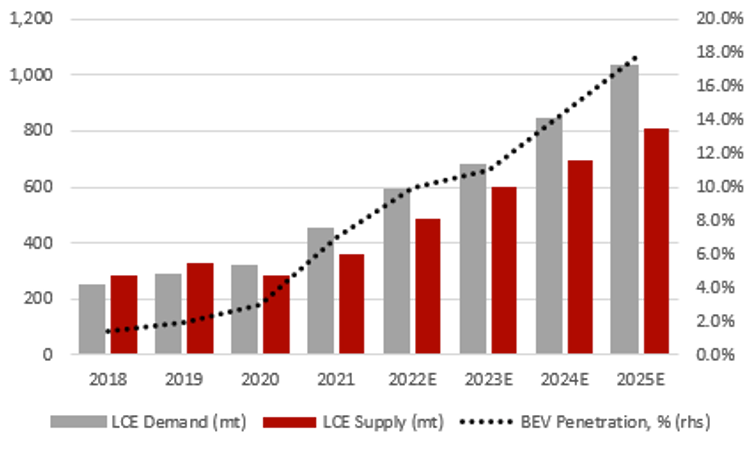

We believe there is a considerable growth opportunity within the upstream segment of the NEV value chain. Demand for commodities such as lithium, nickel, cobalt, copper and platinum group metals should rise exponentially as the penetration of NEVs increases worldwide. The supply dynamics of many of these commodities are strained which will likely lead to higher and more stable prices over the medium to long term.

Electric vehicles are the main driver of future lithium demand, accounting for c30% of total lithium demand currently and potentially rising to over 60% by 2025e⁶. As a result, lithium demand is expected to grow 20-25% annually in the medium term. We expect lithium prices to be supported over the next decade by strong demand and lagging supply leading to deficits.

SQM operates one of the world largest lithium mines in Chile and is well positioned to take advantage of this price environment. The company should see robust production growth through the end of the decade, while its projects have attractive positions on the cost curve. Additionally, SQM has a solid balance sheet to fund this growth and has significant leverage to lithium prices.

What happens to fossil fuels?

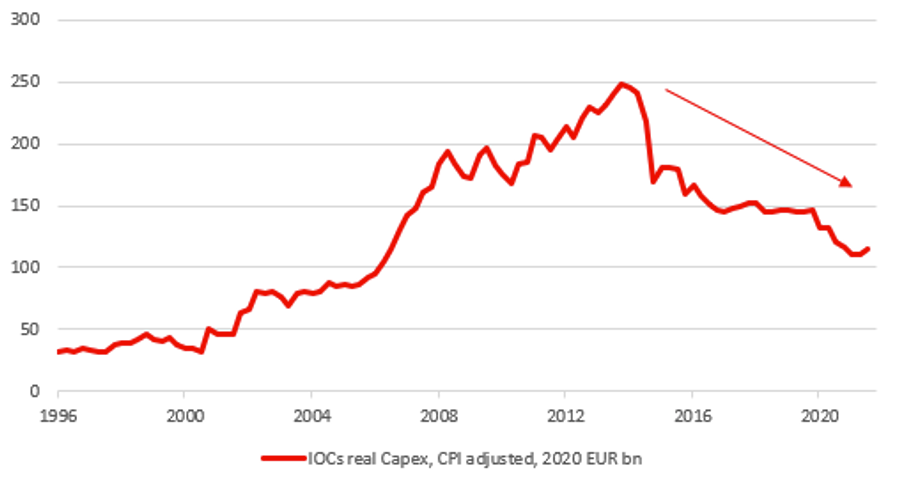

The global economy will remain heavily reliant on fossil fuels for several decades to come despite the transition to a green economy. Even if all the currently announced climate pledges were fully implemented, oil demand in 2050 would still be 75m barrels per day, down only 25% from current levels (source: IEA, 13/10/2021). However, capex in the sector is down 50% from its peak in 2014. Thus, it is quite possible that the supply of fossil fuels will decline more than demand as the development of low carbon alternatives may not be adequate to keep the market balanced. Underinvestment in the hydrocarbons sector amid green transition efforts and changing government regulations could lead to growing energy scarcity.

This structural underinvestment in high carbon sectors is likely to drive hydrocarbon prices higher over the medium-to-longer term, raising affordability concerns, but also increasing the innovation of decarbonization technologies.

Conclusion

In conclusion, as the momentum behind the ‘E’ of ESG grows stronger, we will continue to see an increasing demand for greener materials and we believe Emerging Markets are set to benefit. However, unless more investment comes through, mined raw materials may become a bottleneck to tackling climate change.

This content has been prepared by the Redwheel Global Emerging & Frontier Markets team and is for professional investors and advisers only.

*Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations of advice.

Livewire's Decarbonisation Megatrend Series brings you feature articles that go deep on carbon-neutral investing, alongside special episodes of Buy Hold Sell, a megatrend investing podcast and interactive panel sessions with leading fund managers. You can find all the articles, videos and the podcast on our dedicated Series page.

1 topic

John joined RWC Partners in March 2015 from Everest Capital to co-manage the Emerging and Frontier Markets team with James Johnstone. He has 23 years of experience in global investment management, commodity, debt and equity research analysis.

Expertise

John joined RWC Partners in March 2015 from Everest Capital to co-manage the Emerging and Frontier Markets team with James Johnstone. He has 23 years of experience in global investment management, commodity, debt and equity research analysis.