How these investors find quality (and 12 stock examples)

Quality is the word most professional investors use to describe their investment strategy in these times. Long gone are the days of "investing for growth" and piling onto companies that benefit from near-zero interest rates. Now, the focus is squarely on companies that reflect "quality" earnings metrics.

But quality means different things to different investors. What one investment team calls a "quality" investment is not necessarily all that to another investor. Sure, profitability growth is standard and balance sheet strength is a given. But how is that strength represented?

In this, part one of our deep dive into quality investing (and its various forms), we're taking a look at how two globally-focussed fund managers tackle this fundamental question.

Note: Part Two of this collection will focus on the ASX. It will be released the week of May 1st.

What does quality investing mean to you?

For Bob Desmond, head and co-portfolio manager of Claremont Global, quality investing is fundamental to what the firm does. It's even on the company's homepage: A quality, high-conviction global fund with a long-term focus.

"Once you find a good investment, you can just sit on your hands. Find something really good, buy at the right price, and just strap onto that earnings stream as it grows over time," Desmond says.

For Desmond, quality is best explained from the perspective of a business owner. If you run your own business, you would want to get a decent and sustained return on the capital you invested. Desmond uses this same approach for the fund.

"Quality means a sustained high return on invested capital and most importantly at the bottom of the cycle, a return on your invested capital which is above the cost of capital," Desmond told me in a recent interview.

And how does one find this sustainably high return on capital? Desmond says it's all about finding companies that can demonstrate a lasting competitive advantage and earnings predictability.

For Elisa Di Marco, portfolio manager for the Magellan Core International and Core ESG Funds, it's all about focusing on businesses with unique attributes.

"We define a quality company as having unique attributes, for example, favourable industry structure, barriers to entry, scale advantages, which enables the company to earn attractive sustainable returns over the longer-term," di Marco told me.

Like Desmond, Di Marco is passionate about finding companies that will perform well throughout an economic cycle rather than just the good times. But it's also about finding companies that can reinvest throughout a cycle. Companies that can find the balance between investing to stay ahead and creating a valuable product (rather than a voluminous one) have been rewarded over time.

"Quality companies can often reinvest through the cycle, whilst lower quality companies often struggle when the cycle turns as cash flows are needed to keep the business operating and investment suffers," she added.

What doesn't count as a quality investment?

In our interview, Desmond noted that sometimes it's easier to pick investments that are not quality rather than those that are. This makes sense, given the Claremont fund holds only 10 to 15 stocks at any one time.

He noted three sectors of the equity market that generally don't count as "quality" investments in his universe.

- Banks - Highly leveraged, regulated by central banks, and "no bank executive will ever go on an earnings call and tell you their balance sheet is in trouble otherwise there would be a bank run!" said Desmond.

- Commodities-centric businesses - "In the good times, they are great. But in the bad times, they are barely profitable and you don't know what the price of the commodity is going to be."

- Most retailers - Low margins and low switching costs

How can investors identify a quality investment?

After evaluating a potential company's return on invested capital, Desmond looks at several other balance sheet metrics.

- Return on tangible capital (fixed assets plus net working capital excluding cash)

- Organic revenue growth (he likes at least 5% per year)

- Gross margins (the average percentage in the Claremont portfolio is 65%, well above the S&P 500 average)

- Strong balance sheet (the Claremont Fund's Net Debt-to-EBITDA ratio is 0.5x)

- Low capital intensity (for example, looking at the CAPEX-to-sales or working capital-to-sales ratio)

For Di Marco, it's all about due diligence on industries, companies, and their peers. Every potential investment at Magellan goes through an Investment Committee where it needs to be debated, approved, and consistently monitored. But just some of its key criteria include:

- Barriers to entry: How hard is it for a new entrant to more effectively compete and take market share? For example, Microsoft (NASDAQ: MSFT) and it's leading software suite and cloud offering, there are few true competitors to their offering.

- Brand: Does the brand represent trust and quality? For example, Nestle (SWX: NESN), and its suite of leading food and beverage brands.

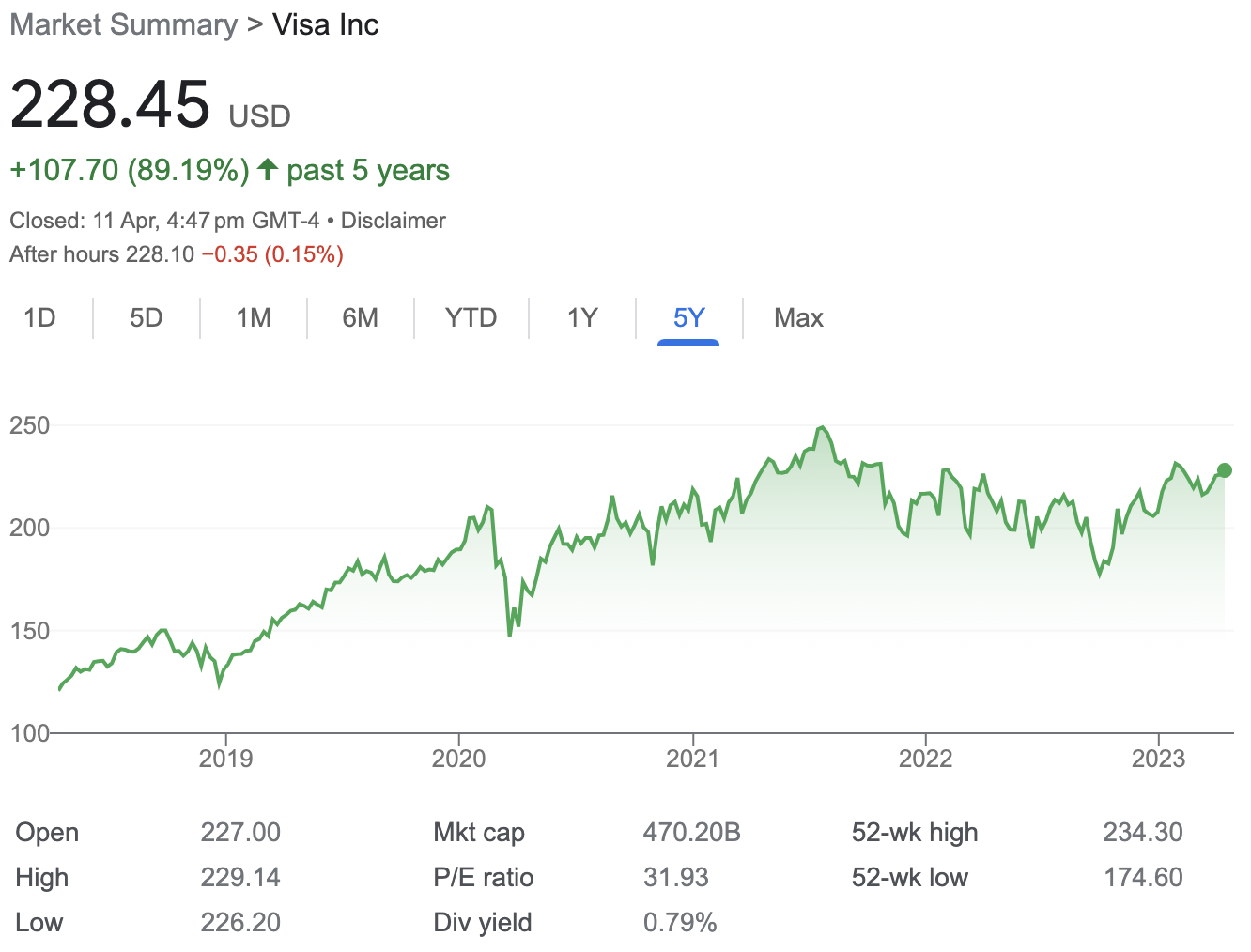

- Network effects: Is it hard to switch providers? e.g., Visa (NYSE: V) and Mastercard (NYSE: MA) are the largest global payment networks. Each additional user of the network boosts the benefits of the network for all users. It is extraordinarily difficult to launch and grow to scale a global network.

- Scale: Does the bottom-line benefit as the company grows?, e.g. McDonald’s (NYSE: MCD) is the largest restaurant chain in the world and benefits from scale advantages in sourcing ingredients.

Examples of quality businesses

Now that our fund managers have expressed their thoughts on what quality investing means to them and how they practice it, we asked them to provide some examples of what constitutes a quality investment.

Desmond started us off by discussing two "financial plumbing" businesses. He regards this as a better way to play the financials sector versus straight-out banks. To prove it, he called on two long-time fund holdings.

"Visa (NYSE: V) is the number one recognised card company, has huge network effects, and it's accepted at 100 million merchants around the world. They have 3.5 billion cardholders, sold through 16,000 banks, and their payment volume is US$12 trillion a year," Desmond noted. "We love businesses that have layers of competitive advantage."

"Along with Visa is another 60%+ margin business, and it's integral to the whole functioning of the financial system. If you want to hedge your interest rate futures book or commodity exposure, the best way is to do it through CME Group (NYSE: CME) and they all have the clearing as well. CME is integral to the functioning of the financial system, but you're not actually taking that balance sheet risk that we hate doing," he said.

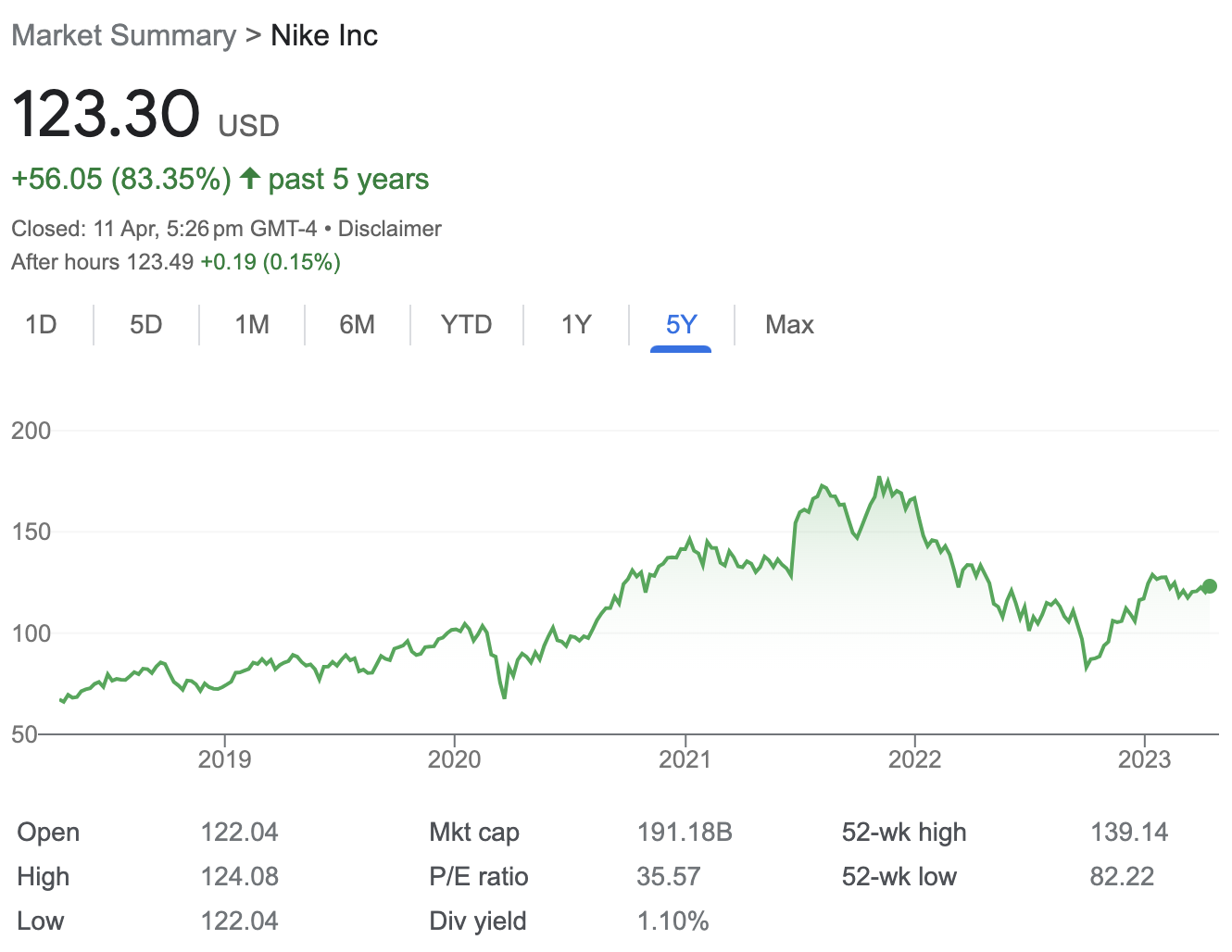

And although Desmond doesn't look at most players in the retail space, there is one name that stands out from all the rest.

"Nike (NYSE: NKE) would be amongst our top picks at the moment. At the headline level, it looks quite expensive, but it's under-earning because of elevated freight costs and discounting excess inventory," Desmond said.

"We think their natural organic revenue growth will be high single digits. And then when you talk about their competitive advantage, they are increasingly selling through their own stores or online. And it's really important because you can better control pricing, and the selling environment, get the wholesaler’s margin as well as much better customer data. It's still growing and it's got terrific pricing power" he added.

In the past, the fund has also owned the likes of Ross Stores (NASDAQ: ROST) and Lowe's (NYSE: LOW).

Di Marco also called out Visa for its network effect and its favourable industry structure. "We view with a reasonable degree of certainty that these characteristics are protected into the future," she said.

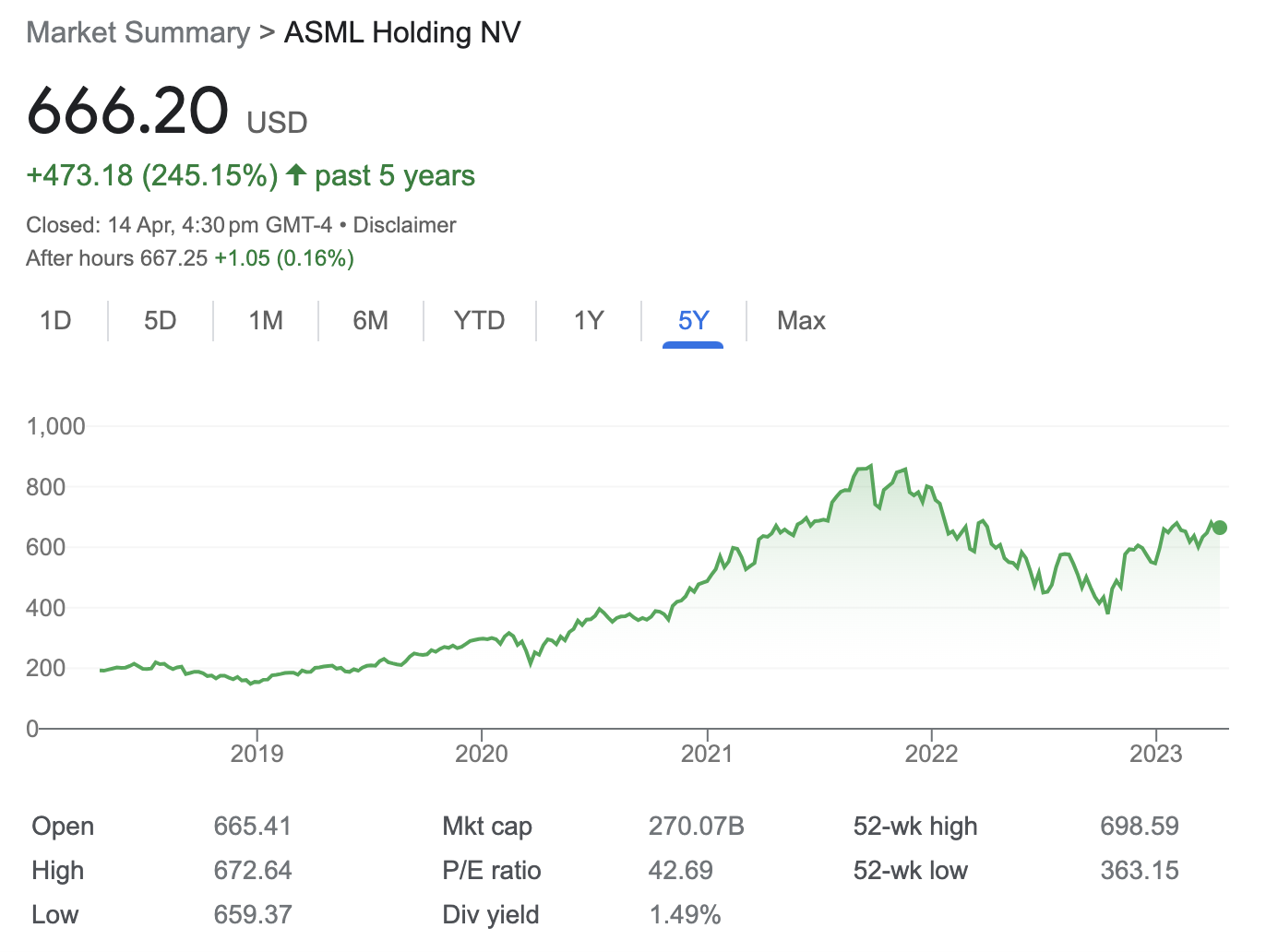

For her quality picks, she started with semiconductor giant ASML (NASDAQ: ASML). Given ASML has 90% of the market share in the lithography market, it immediately ticks Di Marco's boxes. Lithography is considered one of the "holy trinity" of semiconductor products.

"ASML commands a monopoly position, and supplies virtually every chip manufacturer in the world," she said.

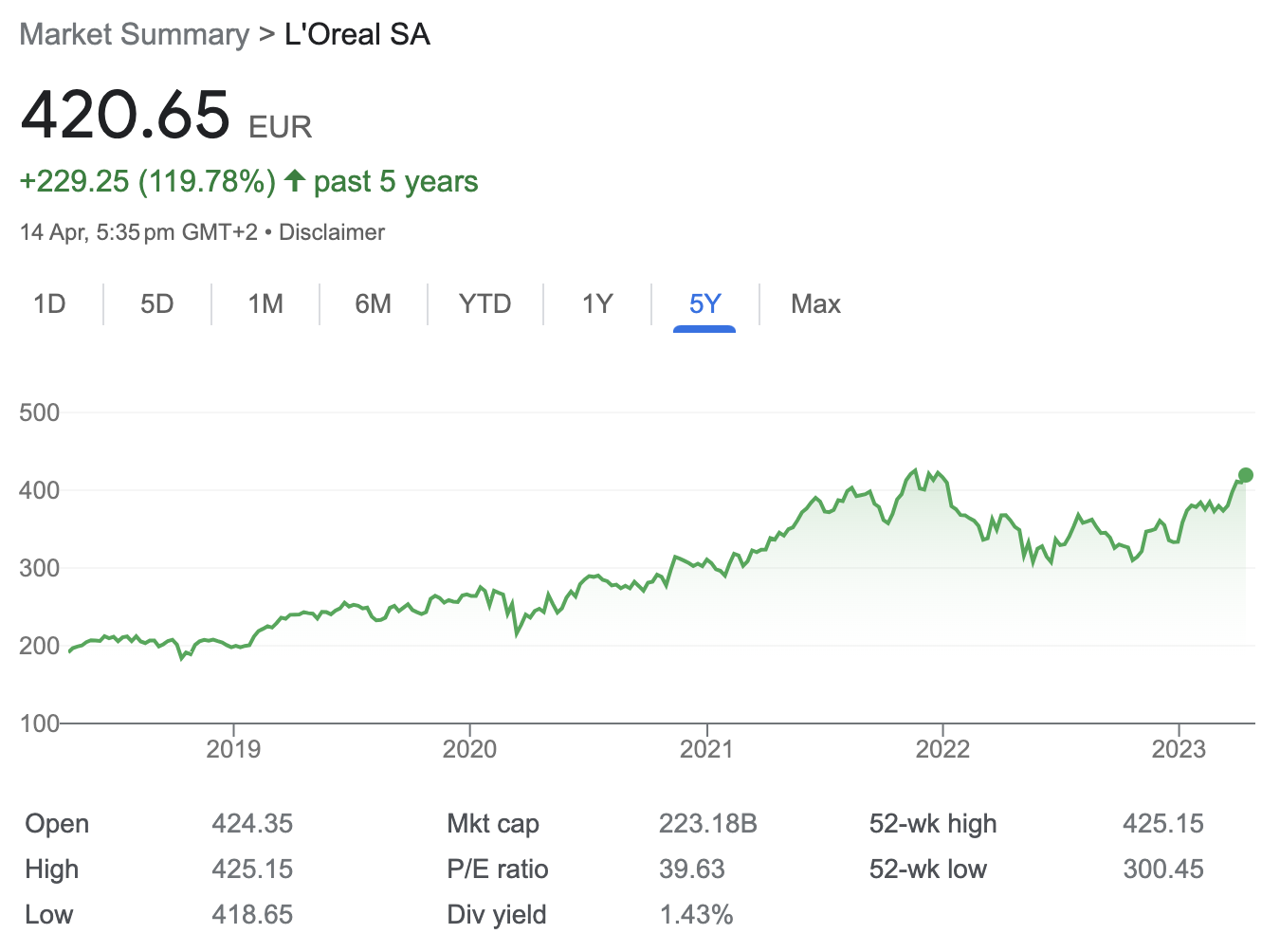

Di Marco also nominated French beauty giant L’Oréal (EPA: OR). The company just bought Australian-founded skincare brand Aesop for US$2.5 billion in one of the largest deals of all time for companies in that industry. The move is widely seen as L’Oréal's gateway into the Chinese and luxury markets. And while the company has massive scale advantages and a bigger R&D spend, there is one crucial trait it has over its competition.

"L’Oréal has pricing power, which is the best defence against inflation, and L’Oréal has diversified growth engines," Di Marco said.

The last company Di Marco is nominating is one that every investor knows - Google parent Alphabet (NASDAQ: GOOGL). From its dominant search engine to its Android operating system used by billions of devices to its various services, the company is considered one of the stalwarts of US big tech for investors around the world.

2 topics

10 stocks mentioned

2 funds mentioned

2 contributors mentioned