How to build a portfolio of ETFs

Exchange-traded funds (ETFs) are a simple solution for investors just getting started or for those looking to expose their portfolio to a different part of the market. But how can you construct a portfolio of ETFs that showcase Core and Thematic strategies?

Core ETFs typically refer to a group of exchange-traded funds that help form the foundation of a portfolio. These ETFs are designed to provide exposures to a market, asset class, or sector in which the investor holds a high conviction. In general, core ETFs are characterised by their low costs, diversified holdings, and long-term investment horizons.

Thematic ETFs capitalise on the worlds constantly evolving landscape, and as it evolves, megatrends emerge. Megatrends are shifts in society that usually come in the form of significant advances in technology, or global dynamics which have the potential to reshape entire industries. As investors, these global macro-movements create long-lasting opportunities called ‘thematics’.

We explore each of these in more detail below:

What is the Core and Satellite model?

The core and satellite model involves combining a stable, diversified “core” portfolio with a more specialised, and potentially higher-return, “satellite” portfolio. The core usually consists of conservative, long-term holdings like index funds or ETFs, providing a foundation for the strategy. Whereas the satellite often includes more targeted investments like individual stocks, thematic ETFs, or alternative assets, which offer higher growth potential. By incorporating both components, this approach allows your portfolio to strike a balance between stability and growth.

Why use ETFs in the Core?

Core ETFs are a great option for those looking to build the foundation of their portfolios. They offer efficient and diversified access across a broad range of assets from market indexes to bonds and precious metals. Additionally, the transparency and liquidity of ETFs provide ease of access and flexibility in buying or selling positions. Ultimately, incorporating core ETFs into a portfolio offers a blend of diversification, cost efficiency, and accessibility, making them a valuable tool for both novice and seasoned investors alike.

However, it’s important to note that while core ETFs are designed for long-term investing, they are not without risk. Market conditions and economic factors can affect the performance of these funds. Therefore, it’s crucial to conduct thorough research and consider consulting a financial advisor before making any investment decisions.

What can go into the Core?

Core holdings are the fundamental investments of a portfolio, usually suited for long-term strategies due to their low volatility and diversification. Some common examples of core holdings include:

- Index funds and ETFs, which track the performance of market indices, providing broad exposure across various sectors.

- Bonds, whether government or corporate, offer regular interest payments and are generally considered lower risk compared to stocks. These can sometimes serve as cash equivalents due to their liquidity and consistent yield.

- Alternative assets, such as precious metals, can help to smooth out volatility thanks to their low correlation to equities and market indexes.

- Diversifiers, such as sector-specific or sector-excluding funds, can provide investors with the tools to maintain broad diversification while also adjusting their specific exposures.

What are some examples of Core ETFs?

Core ETFs come in numerous shapes and sizes, and can encompass many different strategies.

Index ETFs

Example fund: The Global X US 100 ETF (ASX: N100) provides investors with efficient exposure to 100 of the top technology and innovation driven companies on the US market. N100 is an example of a growth-oriented holding that may fit in the core of your portfolio. As an index fund, N100 provides a well-diversified exposure to industries such as information technology, consumer goods, healthcare, food services and more.

Bonds/Cash equivalents

Example fund: The Global X US Treasury Bonds ETF (Currency Hedged) (ASX: USTB) offers efficient exposure to US treasury bonds, the largest and most liquid bonds in the world. These bonds are often considered the safest assets, outside of cash, to have in your investment portfolio. USTB invests in a diversified portfolio of US treasury bonds and seeks to generate consistent income while mitigating risk.

Alternative assets

Example fund: Global X Physical Gold (ASX: GOLD) provides investors with direct, efficient, and secure access to physical gold without the need to store it themselves. Gold is one of the most common alternative assets in portfolio allocation as it has historically outperformed when other assets struggled. It is also a hedge against crises thanks to its low correlation with global markets.

Diversifiers

Example fund: The Global X Australia ex Financial & Resources ETF (ASX: OZXX) is an example of a diversifier which investors can use as a portfolio completion tool. OZXX invests in Australia’s top 100 companies excluding financials (including REITs), material and resource sectors, enabling investors to control their degree of exposure to ASX heavyweights.

What are Thematic ETFs?

Thematic ETFs are tools that allow you to capitalise on these long-term trends by encapsulating a basket of all the stocks that may benefit from the developments. They are formed by looking at a larger universe of stocks and then applying strict rules to ensure significant exposure to the desired thematic. Examples of thematics and their ETFs include the rise of electrification (ASX: ACDC), the digitisation of finance (ASX: FTEC), and the advancement of medicine and biotechnology (ASX: CURE).

How do you Identify a Thematic?

Thematics are often backed by strong governmental or institutional initiatives that promote investment, thus opening numerous opportunities for investors. However, structural backing is just one part of the puzzle as thematics require time to fully materialise. A historical example would be the advent of personal computing (PC), a thematic which took the better part of the past half-century to come to fruition despite growing government backing (annual government funding toward computer science grew from $180 million in 1976 to $960 million in 1995) and record corporate spending.1 Looking at the PC industry now, it is easy to see how steadfast investors could have reaped utterly incredible returns as the thematic grew to maturity.

What’s the Difference Between a Thematic and a Bubble?

The identifier of a true thematic lies in the ability to cause a paradigm shift within an industry or the broader society. When seeking to differentiate bubbles from thematics formed by megatrends, investors can once again benefit from looking at historical instances.

Beanie Babies, once the pride and joy of the US toy collector and now an icon of the speculative bubble, were part of a frenzy that gripped household investors in the late 90s. Collectors clamoured to possess exclusive plush companions in hopes that their rarity would be key to unlimited price potential. And for a fleeting year, the speculators were right; by the tail end of the mania, prices had soared from $15 per toy to astronomical valuations of $5000 or more. But as with most non-constructive speculation, hysterical pricing precipitates a devastating fall. By February 2000, only a year or so after its rise, beanie babies were selling in packs of three for $10, and the manic episode was over.

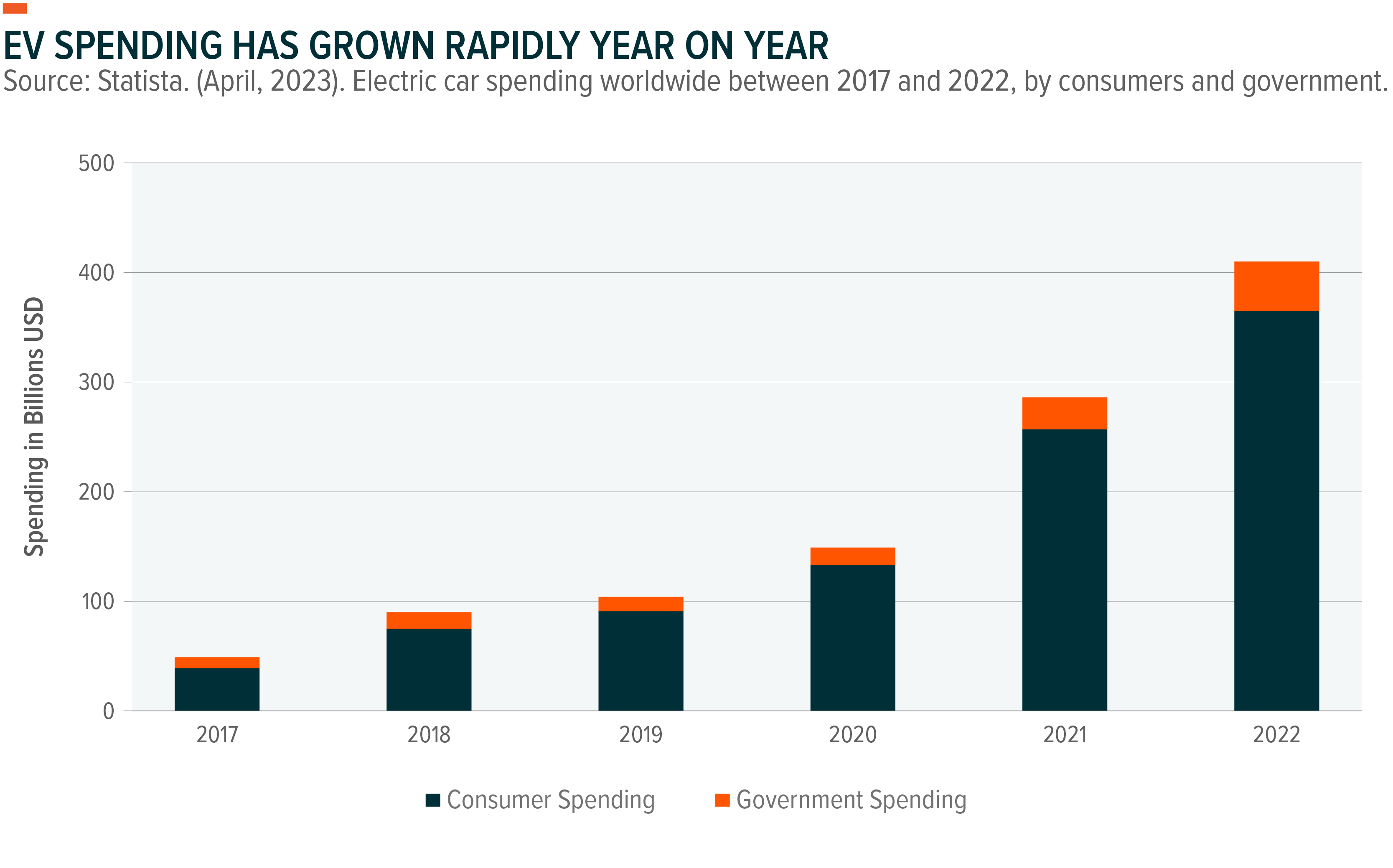

In contrast, the rise of electric vehicles (EVs) is representative of a truly long-term thematic trend. Beyond the buzz and excitement, the increasing popularity of EVs encompasses a profound shift in transportation and sustainability, necessitated by a warming climate and net-zero targets. Governments and consumers worldwide all recognise the urgent need for cleaner and greener alternatives to traditional ICE (internal combustion engine) vehicles, with spending in the sector growing rapidly year-on-year.4

Driven by technological advancement, the growth of EVs has all the markers of a truly systematic change, unlike that of a toy-based mania.

What is Your Thematic Investing Timeline?

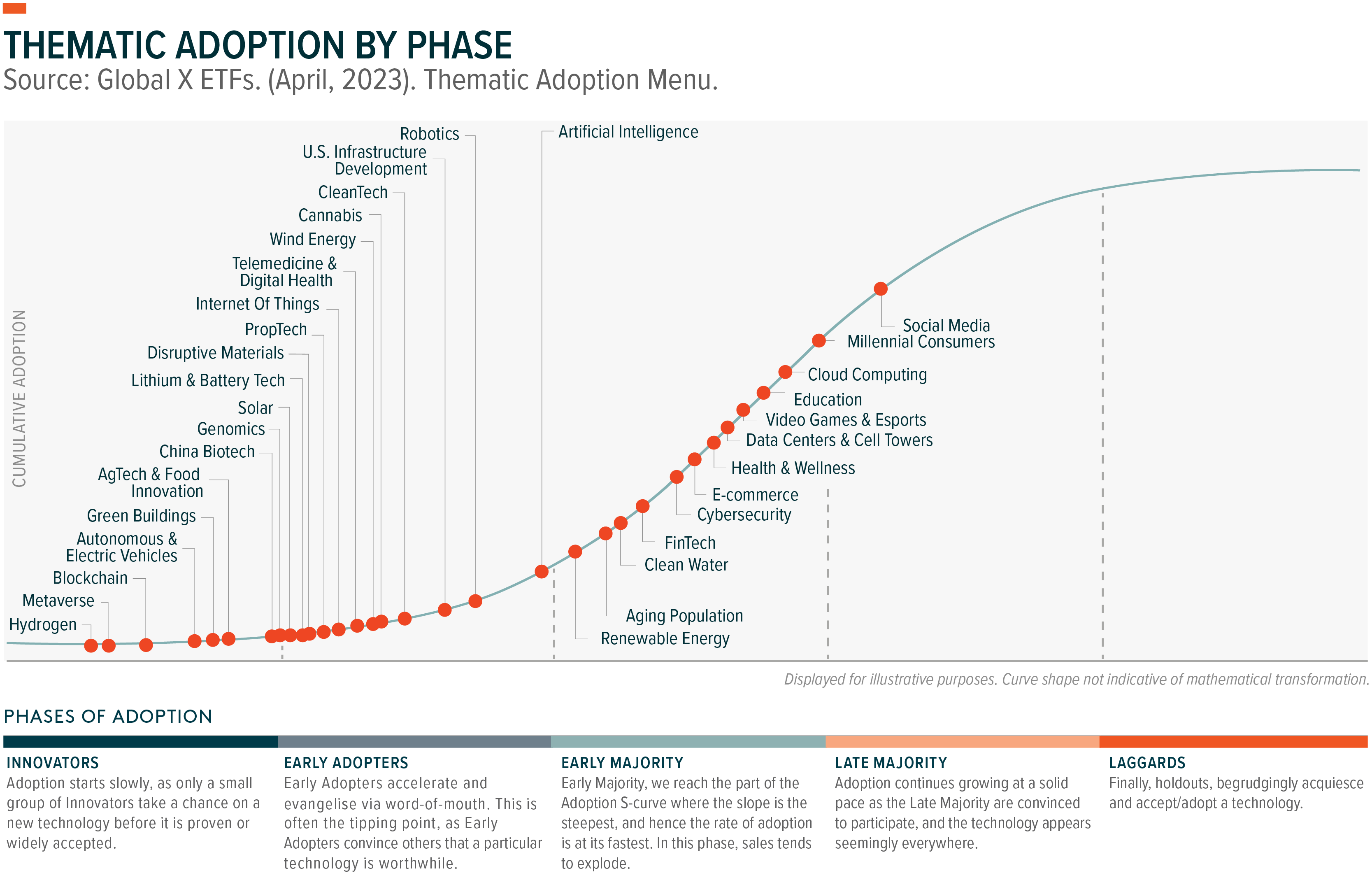

The ‘Diffusion of Innovations Theory’ (DOIT), a concept first proposed by Everett Rogers in 1962, is a model of categorisation and adoption that is particularly useful in describing the assimilation of new technologies or concepts into society.5 There are five categories of adopters in the model: Innovators, Early Adopters, Early Majority, Late Majority, and Laggards.

As shown in the above graph, the five categories each represent a stage of market share and development in the advancement of a thematic trend. The ‘S-Curve’ shown in the background represents the speed at which the thematic may grow.

Taking a look at the specific categories – In the early stages of any thematic, ‘Innovators’ take on the role of pushing the limits and exploring all the possible applications of their inventions. At this stage of development, markets may be sceptical or even dismissive of their potential (thus growth can be slow). Current examples of emerging thematics in this category include hydrogen fuel, the Metaverse, and blockchain technologies.

Skipping forward to the ‘Early Majority’, these thematics have already taken hold of their respective industries, but still have the potential to continue expanding at a rapid rate. Here, one can see the speed of adoption along the S-curve is at its steepest. Investors may find that many of the highest-growth companies of our time sit in this category. Examples include e-commerce, video gaming and cloud computing.

When thinking about thematic trends, it is crucial to understand the stage of development of a particular industry and appreciate the appropriate timeframes for each themed allocation. An investment in a hydrogen fuel producer may yield high, long-term potential but demonstrate low short-term growth until further adoption is observed, whereas an investment in a proven technology may be more lucrative in the short term but experience a slowdown as markets reach saturation.

Why Invest in Thematic ETFs?

Thematic investing is not as simple as picking any one company exposed to your megatrend of interest. Companies are not valued on growth potential alone, but also on fundamentals such as financial health and experience of management. Furthermore, some firms may not be as exposed to a chosen thematic as they seem (e.g., Revenue purity). So, there may be an inherent risk to picking only one or two specific companies as your exposure to a chosen thematic. This is where a thematic ETF can provide significant advantages.

By utilising thematic ETFs, investors can gain pure-play exposure to a diversified portfolio of stocks that represent the entirety of a theme. This diversification helps to reduce individual stock risk and can also improve overall performance through survivorship whereby poor-performing companies, or companies no longer representative of the thematic, are removed from the index. ETF diversification is also cost-effective and professionally managed, ensuring liquidity and often providing high-quality research to help cement your investment thesis.

Global X is a leading provider of thematic ETFs. Explore our extensive library of industry-leading research and thematic products.

Beyond Ordinary ETFs

A lineup that spans disruptive tech, equity income, commodities, digital assets and more. Or simply put, we strive to offer investors something beyond ordinary. Learn more

6 stocks mentioned

6 funds mentioned