How to generate equity income in a volatile market

When the market’s going well many people forget about income. If your capital is growing at 10% a year, it’s easy enough to sell stock if you need extra cash. But when things are volatile, the last thing you want is to be forced to sell. If you’re forced to sell when the market is down, then you need to sell more stock than you would in the good times, you lock in your losses and deplete your capital. This is why income becomes so important in volatile times, particularly if you’re retired or your investments are your main source of income.

If you have sufficient, stable income generated by your portfolio then it doesn’t really matter if your capital fluctuates. Your income provides for your immediate needs and you can sell stock when it suits you, or when the price is right. Of course, you don’t want to focus solely on income. You want your capital to grow too, and keep pace with inflation, but if your income remains steady then you can forget about short-term fluctuations in share prices.

In Australia people rely too heavily on dividends, and too much on the big banks and resources companies. For steady, reliable, income you need a diversity of income sources, and you need to look beyond the big names.

So, what’s the best way to get steady income and capital growth?

In short, diversity of income sources and careful stock selection. With interest rates and bond rates still very low the sharemarket is the most likely place, right now, to generate the majority of your income – while still growing your capital over the long term. Inflation is high and rising, and it’s much higher than interest rates, so to keep your overall wealth growing well ahead of inflation you really need your capital to be growing and still delivering healthy income at the same time.

There are three main types of income generation in sharemarket investing:

- Dividends

- Capital gains

- Options

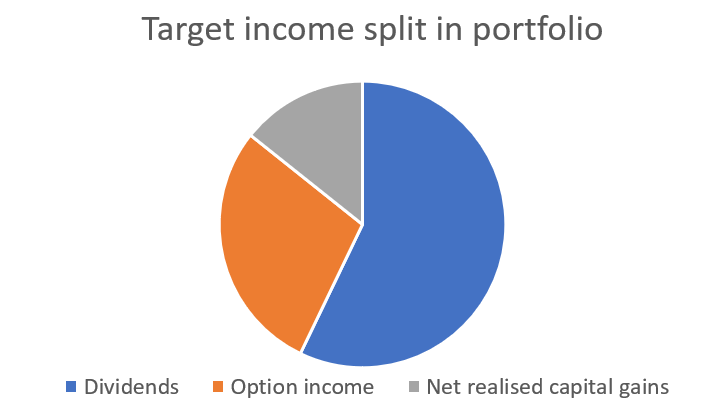

This chart shows the percentage of each income stream that we aim for in our Equity Income Fund (EIF), the main fund we have with a specific income focus.

As you can see, we think dividends should do the heavy lifting (between 50-60%) and then look to options and capital gains to increase the overall level of income and fill the gaps between dividend seasons.

For this reason, picking the right dividend stocks becomes critical for investors, particularly for direct investors who may find it challenging to incorporate option income into their portfolios.

Which are the best dividend stocks to invest in?

This is the critical question, and a lot of investors spend huge amounts of time trying to work out which stocks are likely to pay the biggest dividends. I think a lot of people focus on the wrong things here.

If you’re focused on building a long-term investment portfolio then you shouldn’t be chasing the highest dividend payers each year. Instead, you should build a diverse portfolio that pays consistently strong dividends through the economic cycle. In Australia when many people think of dividends they think of resources companies, which have been coined “the new banks” due to their recent history of paying outsize dividends. Unfortunately, the fortunes of resources companies fluctuate significantly, as does the size of their dividends. Resources stocks might have standout years for paying dividends, or even standout multi-year-runs (like 2020 and 2021) but this kind of dividend yield for resources is unsustainable.

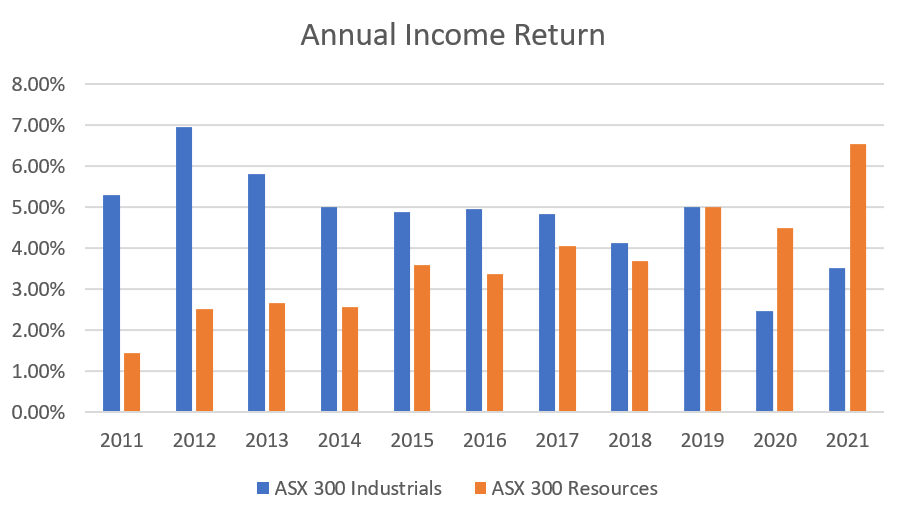

Take a look at this chart of income return for the last 10 years:

You can see that over the past 10 years the only years in which the ASX 300 Resources paid a better dividend yield than the ASX 300 Industrials (all ASX 300 companies except Resources) was in 2020 and 2021. It was close in 2019 and close-ish in 2018 but for the rest of the last decade the Industrials index was way ahead.

That’s why we don’t rely much on Resources to deliver income in our portfolios, instead we rely on a more diverse range of stocks in the broader industrials index. Stocks like Aurizon, Brambles and Metcash which might not be household names but generate high dividends, year after year, in good times and bad. In another positive light for income investors many industrial companies have been overly conservative since 2019 and now have excess capital to return to shareholders through special dividends and buybacks.

Income investors shouldn’t bank on Resources

In the heady excitement of the long bull run, many investors stopped thinking about income. Now that volatility is increasing and the froth has faded away it’s time for investors to think more seriously about which parts of their portfolio are likely to generate income and whether they have the diversification mix right. Investors in the ASX 300 over the past 20 years (to 30 April 2022) would have received an average annual return of 8.6%. 4.5% of this was dividends, just over half. Right now, due to the high volatility, income is making up an even higher percentage of the returns for many of our portfolios – and we think it’s likely to continue to do so while volatility remains high.

When you’re investing in the Aussie market a high exposure to industrials, combined with an active approach to income investing, can get you good income at a lower risk than just buying the index. Be especially wary of chasing the highest dividend payers in any given year – like Resources stocks. If you’re a long-term investor (not a speculator) then you should select the most consistent dividend payers over a longer period of time. That will get you better income, with less risk, and lower the chances that big market downturns will force you to sell stock you’d prefer to keep.

Want access to a steady stream of income?

To find out more about the income options that Investors Mutual provide, please visit our website.

1 topic

1 fund mentioned