How to identify winning growth stocks (and 2 that Michael Wayne has recently been buying)

Just like the recipe for Big Mac sauce, or the closely guarded formula to develop Coca-Cola, investors have been trying to discover the "secret sauce" to successful investing for decades - if not centuries.

However, according to Medallion Financial's Michael Wayne, there is no "secret" when it comes to investing - nor do investors need supercomputers or algorithms to generate market-beating returns.

Instead, Wayne recommends investors keep their strategies logical. His team, for instance, identifies themes and changes within the economic landscape before identifying the sectors that could benefit from said shifts. Then, it's all about the bottom-up, company-specific analysis - where Wayne and his team identify high-quality businesses within these sectors with consistent revenue and/or earnings growth, expanding margins, high return on equity and low debt.

"When you remain disciplined, it can be quite powerful how the strategy can play out over time," he says.

"The analogy we like to use is, if you think about it being like a cricketer, if you're used to playing a certain way conservatively, you're playing straight down the ground, staying in the V, it makes sense to stick with your approach rather than coming out in the next innings and trying to hit every ball for six, taking a "Bazball" approach.

"We remain within our circle of competence, we stick to what we know and we build high degrees of confidence in the businesses we're investing in."

In this Fund in Focus, Wayne dives deeper into the Australian Equities Growth Fund's strategy, outlines why he believes there to be outsized opportunity on offer today within mid-cap stocks, and highlights some of the stocks that have led to the firm's outperformance over the last 12 months.

Plus, just because I know you love a stock pick, he also names two companies he has been buying running up to their results this month.

Note: This interview was recorded on Wednesday, 21 February 2024. You can watch the video or read an edited transcript below.

Edited Transcript

Performance since Fund launch

Michael Wayne: We're coming up to the 12-month anniversary. And so far, fortunately, we've had a particularly good start, which is always a nice thing. The portfolio, looking at the live data as of today, is about 14% higher versus the market's slightly above 9%. And that's in a year where we've carried a fair amount of cash as well. So the cash drag has been significant, which in retrospect is a little bit unfortunate. However, we are by no means under any illusion that one year makes a long-term track record. We've still got a lot of hard work to do, but it is nice to get off to a good start.

Key learnings from the past 12 months

Ally Selby: What are some of the key learnings you've taken away from the past 12 months?Michael Wayne: It's more reinforcing some of the old learnings. The whole media noise, and the media news cycle, are things that I think a lot of investors can become too focused on. And if we cast our mind back to the beginning of 2023, there was all this talk of rampant inflation, interest rates going up, the US consumer being crunched, large stimulus coming out of China, and a big mortgage cliff occurring in Australia. And as it turned out, none of those things played out. So there were a lot of reasons to be nervous about 2023. There were a lot of reasons to not take the risk in equities or share markets. However, as it turned out, it was quite a constructive year across the board. So often it's important to block out much of the noise and just focus on your strategy and your way of doing things and making sure that you remain disciplined at all times.

There's no secret sauce when it comes to investing

Michael Wayne: The secret sauce... Look, I'm not sure there's a secret sauce per se. A lot of people engender ideas of supercomputers, and algorithms placing hundreds and thousands of trades per day or month. But our investment strategy is very logical. We're very process-driven. So, we identify certain themes and different changes in the economic landscape. And then once we've done that, we look to identify the sectors of the economy that are booming and benefiting from those shifts. So you can think about, for instance, the ageing population and the benefits to healthcare, the use of technology and the thirst for data and information and how that's going to benefit the technology space.

So the idea is once we've done the top-down analysis, we then look to do the bottom-up company-specific analysis, and that's really the third pillar. It's where we look to identify high-quality businesses that meet certain criteria, with interesting characteristics such as consistent revenue growth, consistent earnings growth, high but expanding margins over time, high return on equity, and low debt - these sorts of company-specific characteristics that we like to see in businesses. And then the final pillar is the portfolio active management around certain positions. So in many ways, that is our approach.

When you remain disciplined, it can be quite powerful how the strategy can play out over time. But the analogy we like to use is, if you think about it being a cricketer, if you're used to playing a certain way conservatively, you're playing straight down the ground, staying in the V, it makes sense to stick with your approach rather than coming out in the next innings and trying to hit every ball for six, taking a "Bazball" approach. So we remain within our circle of competence, we stick to what we know and we build high degrees of confidence in the businesses that we're investing in.

The opportunity in mid-cap stocks

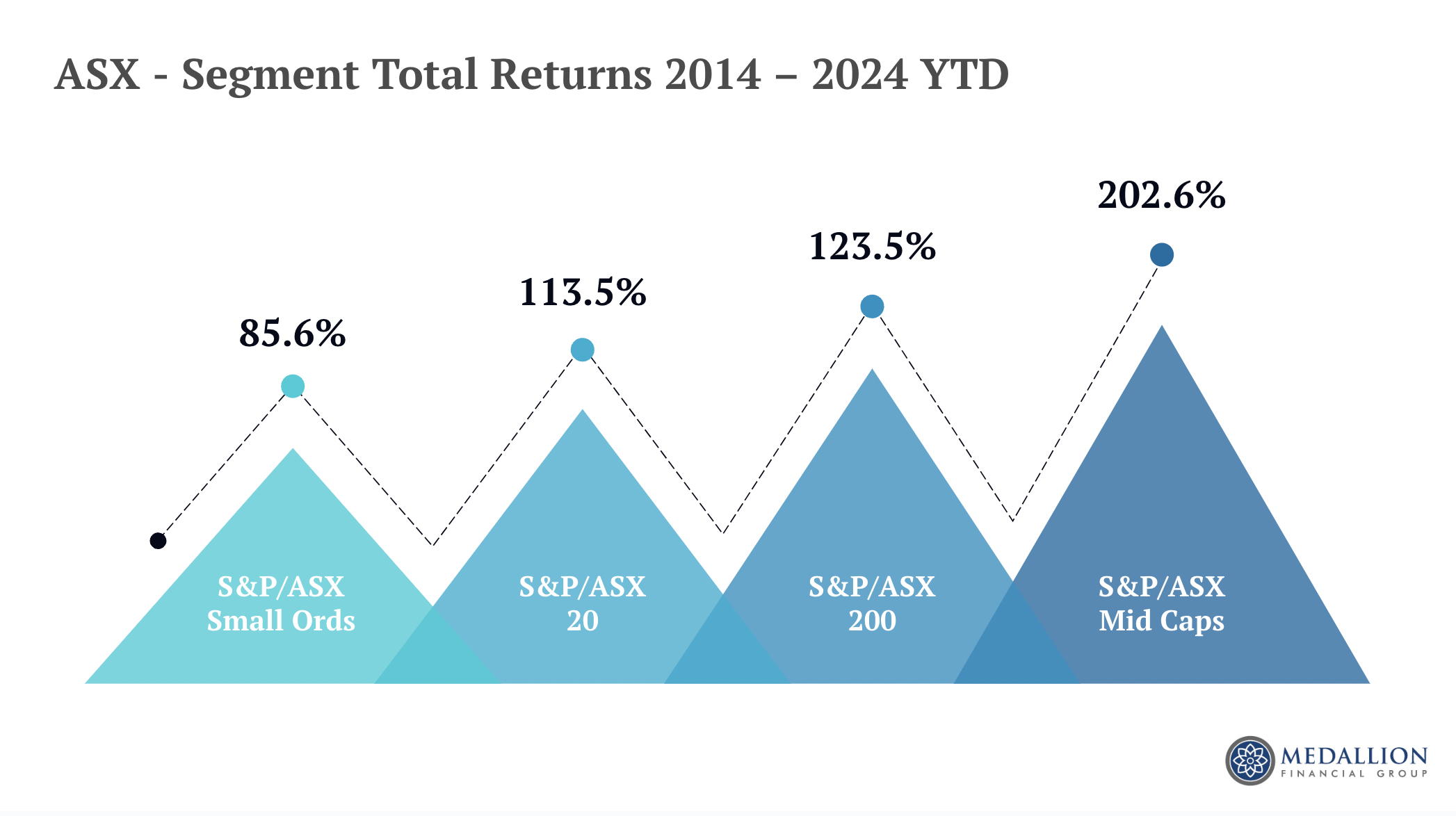

Michael Wayne: So if we look at the first slide here, what I've done is I've broken down the different segments of the ASX, looking at the performance from 2014 to 2024 year to date. These returns are the total returns, so the capital growth plus the dividend income paid over that last 10-year period. And what we can see is over that last 10-year period, the small caps indices have returned 85.6%. The ASX top 20, so the largest household names that people are familiar with, increased 113.5%. The ASX 200 more broadly increased 123.5% over that 10-year timeframe. And then finally, we have the S&P ASX mid-caps, which over the same timeframe has dwarfed all other segments of the market to increase by 202.6%. There's been a clear outperformance by the mid-cap part of the market.

And people often don't understand - they ask, what do you mean by mid-caps, what do you mean by small caps? So the mid-caps by definition is really anything ASX top 50 to ASX top 100. And small caps, for instance, is anything in the ASX's top 100 up to ASX 300.

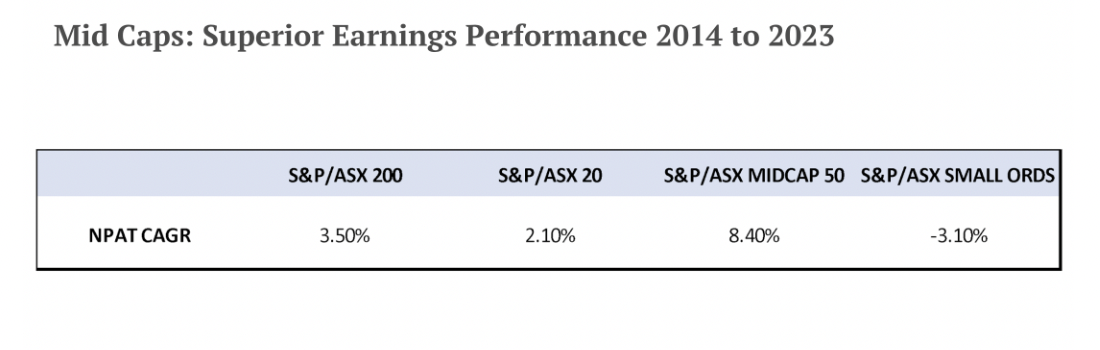

So we believe that long-term, the mid-caps stand a very good chance of delivering continued outperformance. That particular chart that I put up then was looking at the last 10 years. But if you extrapolate that and take that back even further to the year 2000, the outperformance of mid-caps relative to the rest of the market is even more pronounced. So if I put up this particular chart, you can see again this is the performance since 2014 of the mid-caps versus the other segments of the market. And again, it becomes very clear about the significant outperformance over that time.

Ally Selby: Michael, there's obviously quite a lot of competition within the small and mid-cap market. And in addition, many of these funds fail to beat the benchmark. What are you doing to set yourself apart from the competition?

Does an unconstrained, high-conviction approach suit all conditions?

Ally Selby: It sounds like quite a broad exposure. Are there any market conditions where you feel like this fund would not perform that well?

Michael Wayne: Yes, because we're unconstrained and because we're high conviction, from time to time, we might have a lot of exposure to one particular sector. Nothing is stopping us from having 30-40% of the fund in technology stocks, for instance. Likewise, nothing is stopping us from having zero exposure to things like utilities. From time to time, there'll be months when we outperform by a large proportion given the benefits that might play out in one particular sector. But likewise, there might be periods where a certain sector is out of favour or a certain style of investing is out of favour. And if that were to play out, yes, that would be adverse for the portfolio in the short term. But again, we're taking a very long-term view. We're very disciplined in that. And we have the capacity as well to hold large cash positions. So if we do see the markets being a little bit choppy or valuations becoming too extreme, then we have the capacity to build cash, sit on the sidelines and wait for opportunities to present themselves again.The best and worst-performing positions in the Fund from the last 12 months

Ally Selby: Let's get a little bit more granular now. What have been some of the best-performing positions in the portfolio over the last 12 months?

Michael Wayne: So there have been two particularly good positions, but we've been very fortunate that the breadth of the performance across the portfolio holdings has been very good. There's only really been one stock, which has been down more than 10%. But the best performer in the fund and the biggest contribution has come from Audinate (ASX: AD8). You would probably know from Livewire, I've been going on about this business for a couple of years now, but over the last 12 months, it's really started to play out for that company. And we expect that the business will be able to continue to deliver in the months and years going ahead. So we're very excited about that particular company.Another business that we've held in the top five positions in the fund that's done very well is Altium (ASX: ALU). It has been recently acquired, which is an unfortunate end to the stanza for that particular business because it has been a very strong performer over a long period, so it's going to be sad to see that go.

Michael Wayne: So the one stock that we've had, which has been down more than 10%, is Allkem, or now Arcadian (ASX: LTM), in the lithium space. So that's been the worst performer. We've been a little bit premature in jumping back into that lithium space after the big selloffs have been playing out across not only the underlying commodity but the share prices of lithium producers as well. Fortunately, it's a position of around 1% in the portfolio. So we look to ease our way into that position. And the idea is that over time, we can look to add to that. But that's been by far in the way, the worst absolute return performer in the portfolio.

2 stocks Michael Wayne has been buying during reporting season

Ally Selby: We're in the midst of reporting season right now. Have you been making any additions to the portfolio during this month? Is there anything that you're feeling particularly bullish on right now?

Michael Wayne: So, one of the stocks we've been adding to in the lead-up to its report was GQG Partners (ASX: GQG), the fund manager. This is a company that's got very high-quality fund managers rather than one specific fund management star. The business has seen very strong fund inflows in recent times, with dividend per share growth being very impressive. And in an industry that has generally struggled, being an equity fund manager, they've been a shining light. And in many cases, they traded a big discount to many of their listed peers globally. So that's one particular business that we like and have been adding to recently.The other company that we have been adding to is Readytech (ASX: RDY). This is a high-quality technology business. Effectively, they're looking to compound earnings growth around 16-17% over the next three years. It's a business with a very high customer retention ratio. It's got high levels of recurring revenue. And it's a company that's been penalised in recent years with that shift away from high growth unprofitable tech. However, we see a pathway for this company to not only continue to grow revenue at a very, very high number but turn profitable in the years to come.

Invest in tomorrow's leaders today

To learn more about the Fund, click the link here.

Or, for more insights like this, follow my profile on Livewire.

5 topics

5 stocks mentioned

1 contributor mentioned