How to invest $10,000 for growth with 3 ETFs

Markets may be rallying but it's also true that investors still have a lot of cash on the sidelines. The most recent data from the US suggests there is still US$6 trillion sitting in money market funds - which is their equivalent of a term deposit. In Australia, data on retail deposits from the end of 2023 suggests that the local figure is more than $1.4 trillion.

That's a lot of cash looking to find a home in these markets! But where do you start given how many options are now available to the everyday investor?

That's where our $10,000 Idea series comes into play. Last year, we asked seven of Australia's leading investors to share where they would put some new-found cash to work. More than 100,000 of you read those pieces across the series.

So we're back with more investment professionals who are ready to take on investing's most thought-provoking challenge. We start with Russel Chesler, head of investments and capital markets, VanEck Australia.

As with last time, the rules are simple. Each participant answers a couple of quick-fire questions about their process and views on valuations. They then use $10,000 in (hypothetical) cash in up to three individual assets. Any spare money goes into a term deposit that fetches (for the sake of simplicity) a 4% yield.

A word of note, however, is that Chesler represents a product issuer - and thus, his product choices are all from the VanEck exchange-traded product stable. To keep things simple, Chesler was given a specific focus (growth investing) and was asked to focus his picks on three asset classes rather than promoting three specific products. We also asked him to specifically reveal some assets that these products invest in.

What’s your opinion on valuations in the markets that you cover?

The euphoria around the strength of the United States' Magnificent 7 stocks and increasing hopes of avoiding a recession in 2024 has taken the market by storm with the S&P 500 returning 24.69% over 12 months. The standout has been chipmaker NVIDIA, whose share price surged following a substantial uplift in earnings guidance and excitement over the company’s broader involvement in the artificial intelligence (AI) revolution.

While strong performance is supported by a bounce back in earnings growth, share price growth has risen faster. This has resulted in S&P 500 valuations reaching the upper bound of NVIDIA's historical average.

Chart 1: S&P 500 valuation z-score (12-month forward P/E ratio, 12-month forward P/B ratio, 12-month forward P/S ratio, CAPE)

Although US equity valuations, driven by IT stocks, are higher than they have been on average over the long term, we do not believe that they have reached a level that will lead to a general downturn in markets. If the past 12 months have taught investors anything, it’s that being selective and diversified is key to riding the economic cycle.

Had investors avoided risk assets on the back of many economists calling the “most anticipated recession” that never happened, they would have missed the double-digit return recorded by both global and local equities. In this market being selective and diversified will be the key to success.

What is your biggest hope and concern for markets moving forward?

Our biggest concern is that inflation re-emerges as it did in the late 1970s during the Great Inflation period. It's looking more likely that the "transitory" has transited, both up and down, and the remaining inflation rate is too high.

After dropping surprisingly sharply in Q3, US inflation rebounded just as hard in recent months. Over the past quarter, headline CPI has run at an annualised rate of 3.7%, core at 4.2%; and (US Fed) Chairman Powell’s alleged favourite ‘super-core’ measure – services less rent of shelter – at over 6%.

Last quarter, inflation optimists were wilfully ignoring the Fed: their six to seven cuts were in wild contrast to the Fed’s forecast of three. Now, markets have seemingly fallen into line with the Fed. On the growth front, the US economy looks fine. Business investment is solid. At the same time, real household income has improved as inflation has retreated, stoking consumer sentiment. The housing cycle is turning up and in an election year, there’s no sign of any fiscal retreat.

Investors are now left to wonder where we are now. We are hoping and do believe that we will see “no landing” or a soft landing both in the US and globally.

Explain your process for deciding which assets you’d pick for this experiment

We have focused on sectors within asset classes that we believe have the largest upside relative to risk over the next year. We have two sectors that we consider to be particularly undervalued and an income sleeve to build in some diversification.

| Asset Class | ETP | Stock Code | Allocation (%) |

| Global Small Caps | VanEck MSCI International Small Companies Quality ETF |

(ASX: QSML) | 40 |

| Gold Miners | VanEck Gold Miners ETF | (ASX: GDX) | 30 |

| Private Credit | VanEck Global Listed Private Credit (AUD Hedged) ETF |

(ASX: LEND) | 30 |

The case for global small caps

The size premium, defined as investing in smaller market cap companies relative to their larger counterparts, has been shown to harvest excess returns relative to market beta. However, over the last 12 months, small caps have been overshadowed by the strength of the Magnificent Seven.

Looking ahead, 2024 could be the year for global small caps for two reasons. Valuations are

attractive. Global small-cap valuations relative to large caps are near 25-year lows. Global small cap valuation z-score is also below its historical average. If we do see a prolonged market recovery, small caps typically outperform large caps.

Chart 2: Global small less large cap valuation z-score (12-month forward P/E ratio, 12-month forward PB, 12-month forward P/S ratio, CAPE)

Within global small caps, it pays to be selective. Quality small companies have shone over the last year, including the ones in our VanEck MSCI International Small Companies Quality ETF.

These are small companies that satisfy the “quality” requirements of exhibition high return on equity, earnings stability, and low financial leverage. Companies in the fund include leading audio tech company Dolby Labs (NYSE: DLB), famous for creating surround sound in cinemas worldwide, British board game company, Games Workshop (LON: GAW), which is famed for the Warhammer series, and First Financial Bank (NASDAQ: FFBC), a leading financial institution based in Texas.

The case for gold miners

With gold rebounding this year, we see a gold rush in 2024, with gold mining stocks presenting a buying opportunity not seen since 2011.

The gold price has shot up in 2024 following markets ramping up policy rate cut bets in 2024. Since its October 2023 low of US$1,819.45/oz, it is up by about 25%. It’s been a big gain, but there could be more to go. Looking back since 2000, the price momentum following a spike of this magnitude (initially greater than 15% in 90 days) has resulted in strong gains.

Persistent inflation, a potentially bumpy economic path and heightened geo-political tensions could serve as a tailwind for gold prices. With rate cuts on the horizon, even though they have been delayed, real yields have cooled, increasing the relative attractiveness of non-interest-bearing gold.

Gold miners are trading at a 50% discount to gold, presenting a strong value opportunity. Gold miners typically outperform gold bullion when the price rises, and underperform if the gold price falls. However, there is currently a disconnect in that relationship meaning we have an opportunity not seen in the last decade.

The only other time there was a disconnect in that relationship was in 2011, but it wasn’t long before the two started to move as they had before that date, with gold miners racing ahead. In 2023 that relationship disconnected again. As the gold price rose, the price of gold miners fell. We could be on the precipice of a gold miners rally.

Gold versus gold miners' performance

The companies inside the VanEck Gold Miners ETF (ASX: GDX) are the world’s largest and most traded gold mining companies. They include the world’s largest gold mining corporation, Newmont (ASX: NEM), Australia’s Northern Star (ASX: NST) which has projects locally and in North America, and Kinross (NYSE: KGC) which currently operates out of five different regions.

The case for listed private credit

With US inflation tracking higher than expected, there are risks that the US 10-year government bond rate could go higher than its current 4.3% yield. Any further rise in inflation could spook the Fed into more hikes, given its determination to avoid the monetary policy missteps of the 70s and 80s. With rising yields impacting bond prices, it has left many considering income alternatives.

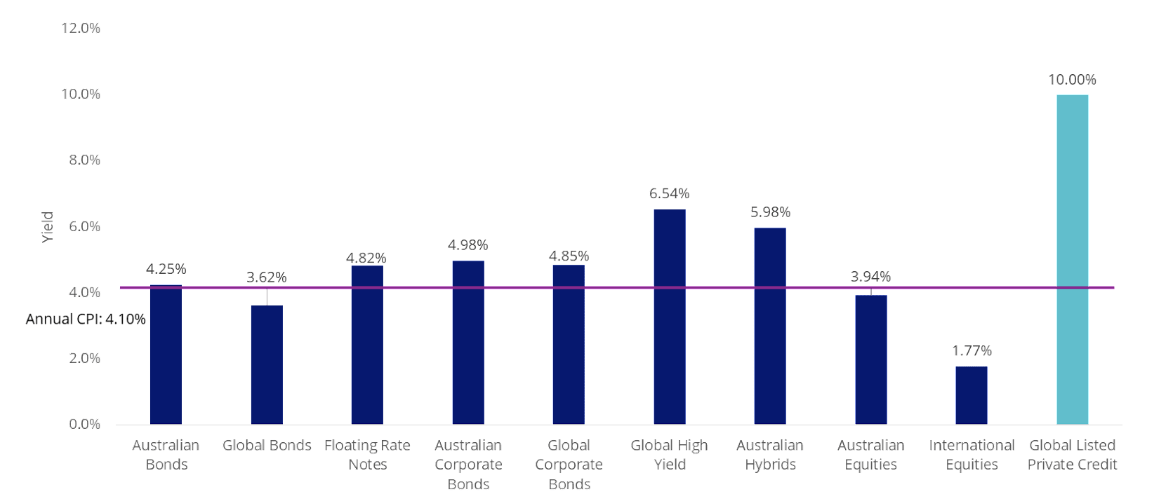

Source Bloomberg, FactSet as of 29 February 2024, You cannot invest in an index. Past performance is not a reliable indicator of future performance.*

Private Credit is one asset class that has been generating interest among large institutions and high-net-worth clients during the most recent rate hiking cycle. Over the past decade, non-bank lenders have emerged to fund a range of borrowers seeking finance or strategic capital. For Australian investors, private credit investment has generally been limited to high net worth and the big end of town, who don’t require immediate access to cash and can take concentrated positions.

The VanEck Global Listed Private Credit (AUD Hedged) ETF (ASX: LEND) - is a diversified portfolio of globally listed private credit companies. In Australia, these types of companies may be LITs.

In the US, they are known as Business Development Companies (BDCs). Some of these BDCs, which investors gain exposure to through this fund, include Blackrock (NASDAQ: TCPC), Goldman Sachs (NYSE: GSBD) and Bain Capital (NYSE: BCSF).

About 90% of BDC assets are floating-rate loans, which means that companies would earn extra income from their loans given the current rising rate environment, and the value of the loans will not be impacted, as is the case with fixed-rate bonds. A key benefit of investing in globally listed private credit is the high income potential relative to other asset classes and well above inflation.

You can find more insights from Russel Chesler here.

5 topics

13 stocks mentioned

2 funds mentioned

1 contributor mentioned