How to invest during a global pandemic

Global markets received a wakeup call over the weekend as a string of countries closed borders with Italy and Iran due to outbreaks of Covid-19 (coronavirus). South Korea has delayed the start of its school year amid a spike in cases, and on Monday, markets sold off heavily around the world. In addition to the public health crisis, Covid-19 also poses another threat; an economic one.

In the first part of this series, half of the contributors responding said that Covid-19 was the biggest risk to economies and markets that was yet to be priced in. Here, three experts take a more direct look at the virus, explaining the impact they expect on the global economy, and whether they think investment allocations should be changed as a result. Responses come from Shane Oliver, AMP Capital; Seema Shah, Principal Global Investors; and Damien Klassen, Nucleus Wealth.

First quarter GDP could be negative, both in Australia and globally

Shane Oliver, AMP Capital

The coronavirus outbreak could wreak havoc with March quarter GDP growth – possibly leading to a stalling or even decline in the global economy – but it should prove short lived. With many Chinese staying at home as confirmed by various indicators around transport congestion, coal consumption and property sales, the hit to Chinese growth and the flow on to the global growth will be big this quarter. In fact, it’s conceivable that global growth will be zero in the March quarter or may even contract. Rough estimates suggest that 30% of China’s population and 50% of its GDP is under lockdown and each week this remains the case will knock 1% off Chinese annual GDP and nearly 0.2% directly off global GDP. However, if the outbreak is contained in the next month or so as we expect then growth will bounce back in the June quarter and shares will largely look through it, albeit with the high risk of further short term volatility.

For Australia, we see the combination of the drag from the bushfires and coronavirus detracting around 0.6% from March quarter GDP which will see the economy go backwards by around -0.1%. But growth should rebound in the June quarter as the rebuilding from the bushfires kicks in and if as we expect the Covid-19 outbreak is soon contained. There is a lot of uncertainty around all of this though and its come at a time that the economy was already weak with high levels of spare capacity leaving the RBA a long way from meeting its growth and inflation objectives, so we continue to see further monetary easing from the RBA in the months ahead and a stepped up fiscal stimulus in the May budget.

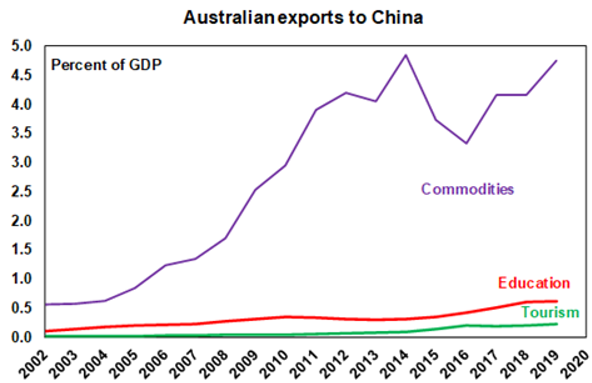

The broader vulnerability of the Australian economy should the outbreak drag on though is highlighted by the following chart which shows that Chinese tourists account for 0.2% of Australia’s GDP, Chinese students account for 0.6% and commodity exports to China account for nearly 4.8%, all of which are well up from where they were at the time of the SARS outbreak back in 2003.

Source: ABS, AMP Capital

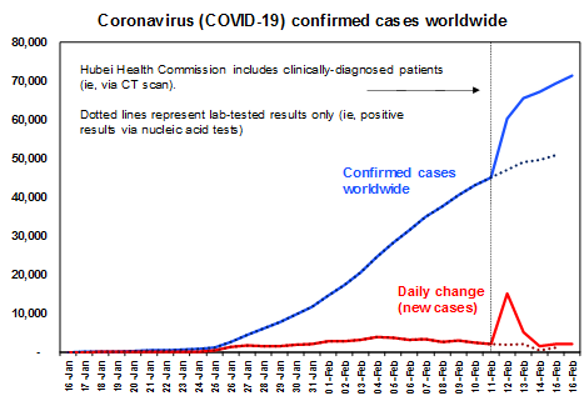

Source: ABS, AMP CapitalThe key to watch is the number of new cases, because as we saw with SARS once Asian markets became confident that this had peaked, they started to head higher. Recent data has been a bit confusing with a broadening in the tests used to define new cases resulting in a spike in China, but there is some evidence that the daily number of new cases may be stabilising and falling in China whether the narrower or broader definition of a Covid-19 case is used or not. An increasing concern though is the growth in new cases outside China – notably in Japan, South Korea and Italy.

Source: PRC National Health Commission, WHO, Bloomberg, AMP Capital

Source: PRC National Health Commission, WHO, Bloomberg, AMP CapitalAgainst this backdrop a cautious investment strategy is warranted in the near term until greater confidence is reached that the number of new cases has peaked and that economic activity will rebound. The key though is to look for opportunities to position for the eventual rebound with hard hit emerging market and Chinese shares, commodities, resources and travel stocks likely to be the key beneficiaries relative to say US, European and Australian share indices that have so far proven to be very resilient.

China to take severe hit, but investors should take a longer view

Seema Shah, Principal Global Investors

In the near-term, China’s economy is likely to take a severe hit as fears and travel restrictions weigh heavily on consumer activity. However, a short-lived shock with limited long-term damage to growth should see activity and Asian markets bouncing back sharply once virus cases peak.

If, however, the virus fails to plateau within the next two months, prompting Chinese authorities to extend the lockdown to the point that factories exhaust inventories, impacting complex global supply chains, the growth outlook – for both China and globally - deteriorates meaningfully. While China was not expected to drive nor lift a global recovery as it did in 2015/16, a stabilisation in China’s economic activity is certainly at the heart of forecasts for European stabilisation and an Emerging Asia upturn. China’s Q1 economic growth is already likely to take hit before rebounding in the second half of the year. However, if the magnitude and duration of the coronavirus is shock is greater and more persistent, then the basis for positive 2020 economic forecasts will be undone.

This perhaps explains the only limited rise in U.S. Treasury 10-year bond yields in recent days even as risk assets bounced.

2020 to date has been no stranger to sharp sell offs, followed quickly by big rebounds. In an environment where the pace at which tail-risks can affect asset prices is elevated and where there is still plenty of angst, surrounding not just the coronavirus but other concerns such as the U.S. election, this could be the pattern for the foreseeable future.

Against this backdrop, short term reactive investment decisions may leave investors continuously chasing market moves, so focusing on the longer-term view is preferred. Investors should continue to consider exposure to Emerging Asia as strategic positioning in a region that, even taking account of the coronavirus, demonstrates superior long-term growth potential.

Time to reconsider investment allocations

Damien Klassen, Nucleus Wealth

Investors should be considering their investment allocations in light of the Covid-19 outbreak. Global stock markets are trading on 20-year valuation highs with very few signs of growth. The worst outcome from selling stocks now is that you miss out on stocks returning to unsustainable "tech-wreck" level multiples. The best outcome is you miss a massive drawdown from any one of the above economic risks.

I explained the risks presented by the virus in more detail in the first part of this series.

Where to avoid

Sectors and countries that I’m looking to avoid have a number of key elements:

- Exposure to Chinese demand

- Reliant on Chinese and global tourism

- Companies with too much debt

- Countries with consumers carrying with too much debt

- Countries with too much debt not denominated in their local currency

- Cyclical companies, like resources or capital equipment which tend to rise more quickly in booms but fall more rapidly in busts

- Exposure to Chinese students

- Banks exposed to the above

Australia ticks almost every box above. Europe ticks a lot. Canada has a decent spread.

More perspectives on the coronavirus

For more views about investment and asset allocation implications of Covid-19, be sure to read:

-

'A call for action to stop you being coronered' by Jerome Lander;

-

'Will we crash? (and what to sell)' by Marcus Padley;

-

'The world just changed narrative is bulls#1t' by Damien Klaseen, and

-

'Gold - the investment vaccine to coronavirus?' by Kris Walesby.

Never miss an update

Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

2 topics

3 contributors mentioned