How to invest in AI: finding winning AI stocks

But the fanfare died down. And the public’s attention drifted.

Fast-forward to 2023’s launch of ChatGPT and the public can’t get enough of AI.

What changed?

Why now?

Why is this AI’s moment?

And why are the AI technologies behind ChatGPT a step-change to the technologies behind AlphaGo?

Above all else, how should investors approach artificial intelligence as an investment theme? What methodologies should they adopt to pick AI stocks?

In this week’s What’s Not Priced In, I quizzed two special guests best placed to answer these questions.

They are Ryan Dinse and Charlie Ormond. The tech specialists heading the new investment service Alpha Tech Trader.

As Charlie quipped during the episode, there is the age before ChatGPT and the age after.

Forget 2024. This is Year 1, AC (After ChatGPT).

This episode swarmed with insights. Here are the key topics we discussed:

- Is AI ‘the most profound technology humanity is working on’?

- Biggest misconceptions about AI

- Economics of AI — costs, supply chains, and margins

- The most viable AI use cases now and in the future

- Impact of AI on labour market and productivity

- Best ways to play the AI theme as investors

- Methodology to picking AI stocks

- Does the ASX have viable AI stocks?

- Can AI ever be commoditised with high competition?

How transformational is AI technology?

AI is the hottest thing in town. That comes with a lot of hot air.

This is how a Goldman Sachs report from June last year described the technology:

‘The rapid rise and mass adoption of generative AI in a relatively short amount of time…have led to a velocity of fundamentals shifts and strategic decisions we haven’t witnessed since the advent of the Internet and mobile technology.’

Google CEO Sundar Pichai waxed philosophical about AI’s impact:

‘I’ve always thought of AI as the most profound technology humanity is working on. More profound than fire or electricity or anything that we’ve done in the past.’

And Nvidia’s Jensen Huang said this on the chip maker’s recent earnings call:

‘Generative AI is the largest TAM expansion of software and hardware that we’ve seen in several decades.’

AI as transformational as the Internet. AI as impactful as electricity. AI the largest total addressable market in decades.

These attitudes inevitably percolate into stupendous projections. Like this one from McKinsey in June 2023:

‘Our latest research estimates that generative AI could add the equivalent of US$2.6 trillion to US$4.4 trillion annually across the 63 use cases we analyzed — by comparison, the United Kingdom’s entire GDP in 2021 was US$3.1 trillion.’

US$2.6 to US$4.4 trillion annually?!

Funnily enough, Ryan Dinse mentioned McKinsey’s estimate. He agrees AI will be transformational … but in a mundane way.

Mundane in what it will improve. Namely, labour productivity.

AI will be a big efficiency booster. Drudgery, grunt work, administrative red tape … all eliminated or reduced by AI.

Here’s that McKinsey report again:

‘Our updated adoption scenarios, including technology development, economic feasibility, and diffusion timelines, lead to estimates that half of today’s work activities could be automated between 2030 and 2060, with a midpoint in 2045.’

But that raises questions … and fears.

Is AI coming for our jobs?

Labour efficiencies are often euphemisms for job losses.

So I asked Ryan and Charlie if AI will lead to job losses on net.

Both agreed some jobs will go. The real question is what jobs will be created.

Each technological innovation displaced jobs dependent on obsoleted technology. But each innovation created new jobs entirely.

But is AI technology of a different kind?

Will most of us soon sympathise with the Luddites?

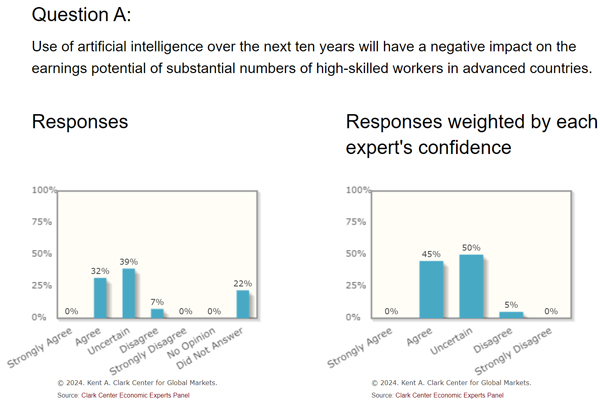

Top economists polled by Chicago University’s Kent Clark Centre for Global Markets are ambivalent about AI’s impact on labour.

Most either agreed or were uncertain that AI will hinder the earnings potential of ‘substantial numbers of high-skilled workers in advanced economies’.

Only 5% thought AI use wouldn’t affect the earnings potential of white-collar workers in the next 10 years.

Not a great sign.

Eggheads at the heart of the AI revolution are ambivalent, too.

Earlier this month, Bill Gates interviewed OpenAI’s Sam Altman. During the conversation, Gates raised concerns about the speed of AI improvements:

‘I guess you and I have some concerns that AI will force us to adapt faster than we’ve had to ever before.’

To which Altman replied:

‘That’s the scary part. It’s not that we have to adapt. It’s not that humanity is not super-adaptable. We’ve been through these massive technological shifts, and a massive percentage of the jobs that people do can change over a couple of generations. And over a couple of generations, we seem to absorb that just fine. [But] each technological revolution has gotten faster and this will be the fastest by far.’

Here’s the discomfiting part:

‘That’s the part that I find potentially a little scary — the speed with which society is going to have to adapt and that the labour market will change.’

Gates then chimed in saying the fear of white-collar job displacement has obscured the threat to blue collar jobs via robotics:

‘[Robotics] could change the job market for a lot of the blue-collar type work, pretty rapidly.’

How to play the AI theme as investors?

OK. So AI is transformational.

But how should investors play it?

What is the AI stocks universe?

Currently, only the giant firms like Nvidia, Microsoft and Google are seen as obvious AI stocks. Nvidia the prominent one.

But what are others?

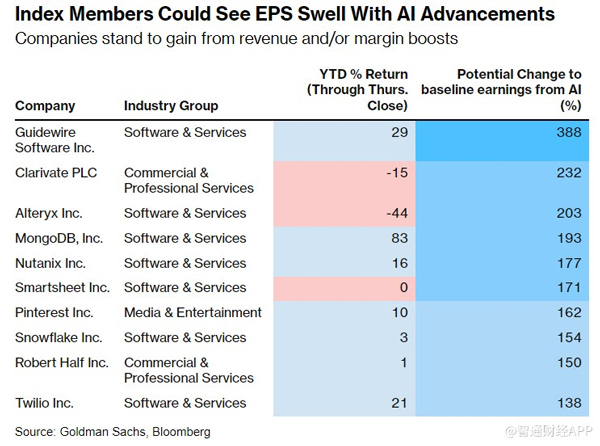

Goldman Sachs recently created a basket of potential AI winners. Its list was dominated by software firms.

But how do you go about finding others?

Ryan and Charlie both explained their methodology on the pod. I recommend having a listen!

I’ll outline part of it here.

One way is to break the AI industry down. Let’s have a quick go of it here.

- Hardware of AI

- Data of AI

- AI models (LLMs)

Then you can follow the supply chain for each until you find firms with monopolistic tendencies.

Take the hardware of AI. Like GPUs. None of the fancy AI tasks performed by the likes of ChatGPT can happen without GPUs.

And no one currently produces GPUs more suited for AI than Nvidia.

Nvidia currently boasts a large competitive advantage. Its mighty margins reflect that.

But you can follow the supply chain further upstream.

What’s the hardware behind GPUs? And who has that segment cornered?

Chips require photolithography tools. And there’s only one photolithography company capable of manufacturing components for advanced chips.

That’s ASML.

But I don’t want to spoil or misquote Ryan and Charlie here. The episode was lengthy and substantive. Nothing beats hearing what the guys have to say for themselves.

By the way, if you want to know what AI firms Ryan and Charlie find attractive, you can watch on here.

Enjoy the episode!

5 topics

4 stocks mentioned

.png)

.png)