How to make your investments pay for themselves

Prices have risen in almost all aspects of life, so the average investor could be forgiven for tightening the purse strings on further trades. But for those investors still wanting to build up positions, there might be another way. Dividend reinvestment plans. While not every listed company or fund offers one, it can be a useful ‘set and forget’ means of building up your portfolio – particularly where you are invested in high yielding companies. That is, you can use your investment to ‘pay for itself’.

In short, this is what you need to know.

What is a dividend reinvestment plan (DRP)?

A dividend reinvestment plan is an elective scheme which a company or fund can offer which allows you to reinvest the dividends or returns you receive back into additional shares or units. You can often choose the extent you participate in a DRP – full participation would mean 100% of the dividend payment you are entitled to is reinvested, while if you choose a 50% participation for example, half the dividend would be paid to you as cash and the other half reinvested.

To explain how it might look in practise, say you have 1,000 shares in company XYZ, and it declares a dividend of 25 cents. Shares are valued at $10 per share for reinvestment purposes. Company XYZ offers a DRP or cash payments.

Your options follow:

- Dividend cash payment of $250 (1000 x $0.25).

- DRP where you acquire 25 shares ($250 ÷ $10/share).

Whichever option you choose, you still need to declare the $250 as assessable dividend income in your income tax return - your tax outcomes will generally not change based on your choice.

In some cases, you can elect to participate in a DRP via your trading platform. In other cases, you may need to log into the share registry (such as Computershare or Link Market Group) to nominate.

The advantages and disadvantages of DRP for investors

The advantages of a DRP include:

- The ability to accumulate shares without transaction costs.

- Potential discount for acquisition (some companies offer a discount to current market price).

- Can act as a dollar-cost averaging/regular investment plan which can enable regular investment and smooth out the challenges of volatility in prices.

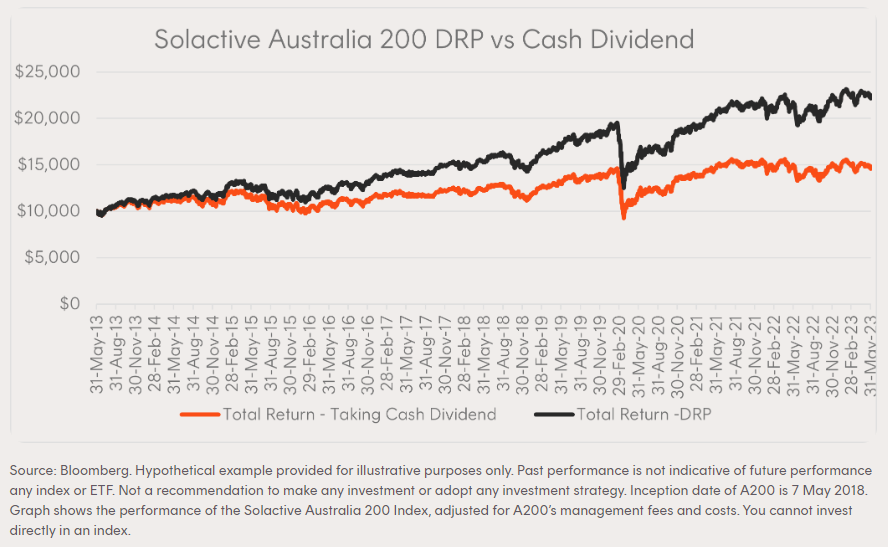

- The ability to compound returns because reinvestment grows the investments (see example below).

Example of long-term approach to using a DRP compared to taking the cash dividend

The disadvantages of a DRP include:

- Lack of diversification as reinvestment is in one company so you may need to consider selling to spread your portfolio.

- Not suitable for short-term investors because you can only buy the shares at the point that a company distributes its dividends which could be semi-annually or annually.

- No control over the price of purchase. While you could be buying at the bottom, you could equally be buying at the top.

- You still need to pay tax on the dividends earned even though they were reinvested. You’ll need to keep clear records of this, but also need to have cash aside to pay any applicable tax on the dividends.

Looking for companies that offer DRP

Market Index offers a screen for DRP which includes prices, yield, gross discount, sector, market capitalisation and 1 year performance. You can view it here.

Most of Australia’s largest companies offer a dividend reinvestment plan – for example, the 5 largest companies BHP (ASX: BHP), Commonwealth Bank (ASX: CBA), CSL (ASX: CSL), NAB (ASX: NAB), ANZ (ASX: ANZ) all offer a reinvestment plan.

You can also find reinvestment plans for many listed investment companies (LICs), listed investment trusts (LITs) and exchange traded funds (ETFs).

If you’d like to use a DRP to obtain a pricing discount, you might be surprised to find some of Australia’s larger companies do offer this.

The 5 largest ASX-listed companies that offer a discount as part of their DRP includes:

- Santos (ASX: STO) with a discount of 2.5%

- QBE Insurance Group (ASX: QBE) with a discount of 2.5%

- Fisher and Paykel (ASX: FPH) with a discount of 3%

- Auckland International Airport (ASX: AIA) with a discount of 2.5%

- Bluescope steel (ASX: BSL) with a discount of 2.5%

Some of Australia’s oldest and largest listed investment companies (LICS) also offer a discount, such as Australian Foundation Investment Company (ASX: AFI) which offers a 2.5% discount and Argo Investments (ASX: ARG) which offers a discount of 2.5%.

Both digital lottery company Jumbo Interactive (ASX: JIN) and listed investment company Mirrabooka Investments (ASX: MIR) offer the biggest discounts available at 10%. Jumbo Interactive currently ranks as a BUY in Market Index’s broker consensus tool while Mirrabooka Investments isn’t covered.

Do you use a dividend reinvestment plan in your portfolio? Let us know which investments you've found it most useful on as a strategy in the comments.

1 topic

14 stocks mentioned