How to minimise portfolio risk as the macro backdrop worsens

Calls of a US recession are getting louder, particularly in the US, amid a 40-year high for inflation and a worsening outlook for employment. The situation in Australia is only marginally better. As the Reserve Bank of Australia grapples to rein in local inflation, some are tipping a cash rate of 4% by the end of the year, from 0.85% currently.

What does this mean for your portfolio? It’s not a good time for risk assets. But the troubled macroeconomic and geopolitical backdrop – the war in Ukraine could drag on for years – has also knocked bond yields.

At a time when traditional and passive strategies across stocks and bonds are struggling, Janus Henderson’s David Elms believes an active approach with broad diversification is key.

“We believe economic and market conditions are likely to get worse before they get better. It is too early to start adding risk, in our view,” says Elms, co-portfolio manager (alongside Steve Cain) of the Janus Henderson Global Multi-Strategy Fund.

"The strong inflationary backdrop to economies and markets is an opportunity for trend following strategies."

These are part of the fund’s Portfolio Protection strategy, one of the six underlying strategies and a particular area of focus in the current environment. Drawing on his almost two decades of experience, in the following interview Elms discusses:

- Why a multi-strategy approach is ideally suited to current market conditions

- What he’s learned from previous market cycles, and

- The parts of the market he expects to perform best over the next two years.

What makes this asset class valuable now, in a rising inflation environment?

In a word, diversification. Rising interest rates are weighing on longer-duration equities and fixed income assets. The negative correlation between equities and bonds, which has been a natural diversifier for multi-asset portfolios for many years, is being eroded by higher inflation and rising interest rates. The Janus Henderson Global Multi-Strategy Fund has historically delivered attractive risk-adjusted returns with very low sensitivity to equities and bonds.

What’s the process your team uses to identify opportunities?

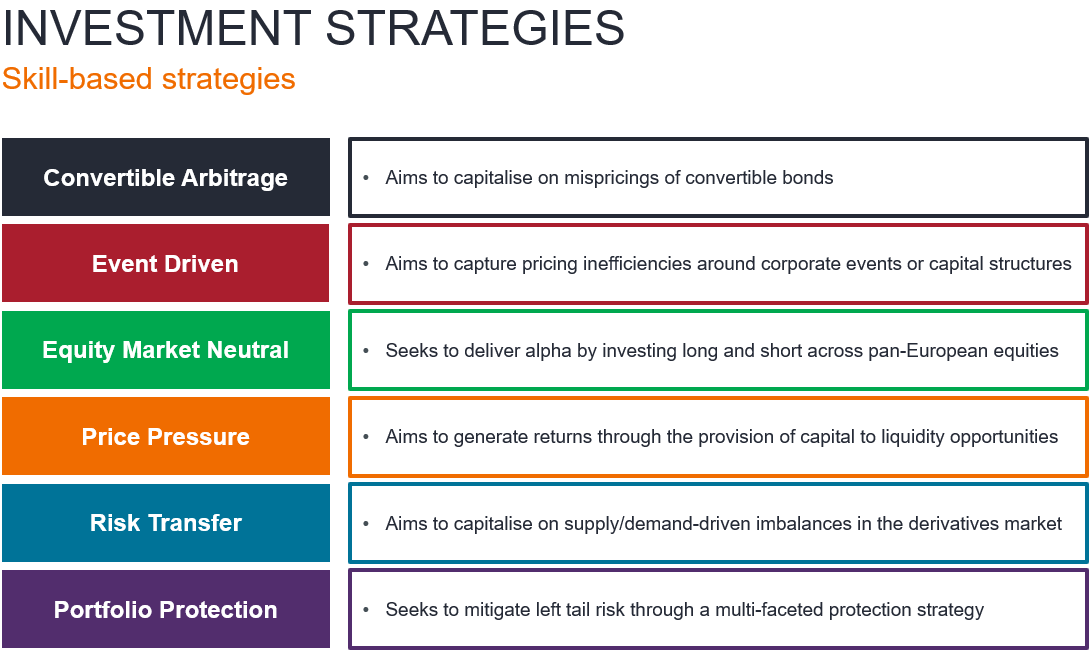

We manage six investment strategies and more than 20 sub-strategies, so the processes we use to identify investment opportunities are varied and involve both quantitative and qualitative input, as well as macro, micro and security level modelling and analysis.

Please discuss some of your past successes and failures and the lessons for investors.

One of our successes, or the things we believe we have got right, has been patience. We tend to wait for opportunities to come to fruition. Admittedly, this is easier when managing a multi-strategy fund, but our capital allocation tends to be bottom-up versus top-down driven. For example, at the end of 2019, we were running one of our lowest levels of risk, as spreads were narrow in the premia from which we look to benefit.

At the same time, market volatility was, we believed, artificially suppressed by low interest rates and volatility sellers. So, we regarded this as an unattractive environment in which to put our client’s capital at risk and resisted the pressure to increase gross exposure. This, along with our Portfolio Protection, put us in a strong place to manage through the difficult markets of the first quarter of 2020.

But last year we were arguably too early in moving the portfolio to a defensive position, which was a drag on performance. We had a cautious view on markets and economic growth – and still do – and know our clients invest in the strategy to provide not only attractive returns but also diversification.

We realise that in times of market and economic stress our diversified risk-on strategies can suffer coincident drawdowns with traditional risk assets. That’s why we implement a Portfolio Protection strategy. While this defensive positioning carried negatively last year, we have seen the contribution from this Protection strategy add strongly in 2022 so far.

What opportunities do you see in the current market environment?

With a strong inflationary backdrop to economies and markets, we see this as a strong opportunity for trend-following strategies. Inflation is effectively autocorrelation in prices, and autocorrelation in security prices is what trend following strategies are designed to capture. That’s why we have increased the allocation to our trend-following strategy within Portfolio Protection.

As already mentioned, we remain cautious on markets. The strategy has benefited from monetising hedges that we put in place over the past 12-18 months. But we believe economic and market conditions are likely to get worse before they get better. It is too early to start adding risk, in our view.

Key to Janus Henderson Global Multi-Strategy underlying strategies

In response, we’re devoting resources to benefit from attractive investment opportunities when they arise. For example, we are researching hedging strategies within convertible notes, where we currently have minimal exposure, so that we can add exposure in a safe way when we are ready.

Where does this strategy fit within a portfolio and what is the ideal investor type?

Typically, Alternative allocations are regarded as satellites within a portfolio that is predominantly exposed to traditional equity and fixed income volatility. At this satellite level, the strong diversification that the Janus Henderson Global Multi-Strategy Fund exhibits can only marginally mitigate this risk. A more significant, core allocation would be required to have a more material diversification benefit. Within the context of an Alternatives allocation, however, we see our Multi Strategy as a core defensive investment given its strong diversification benefits.

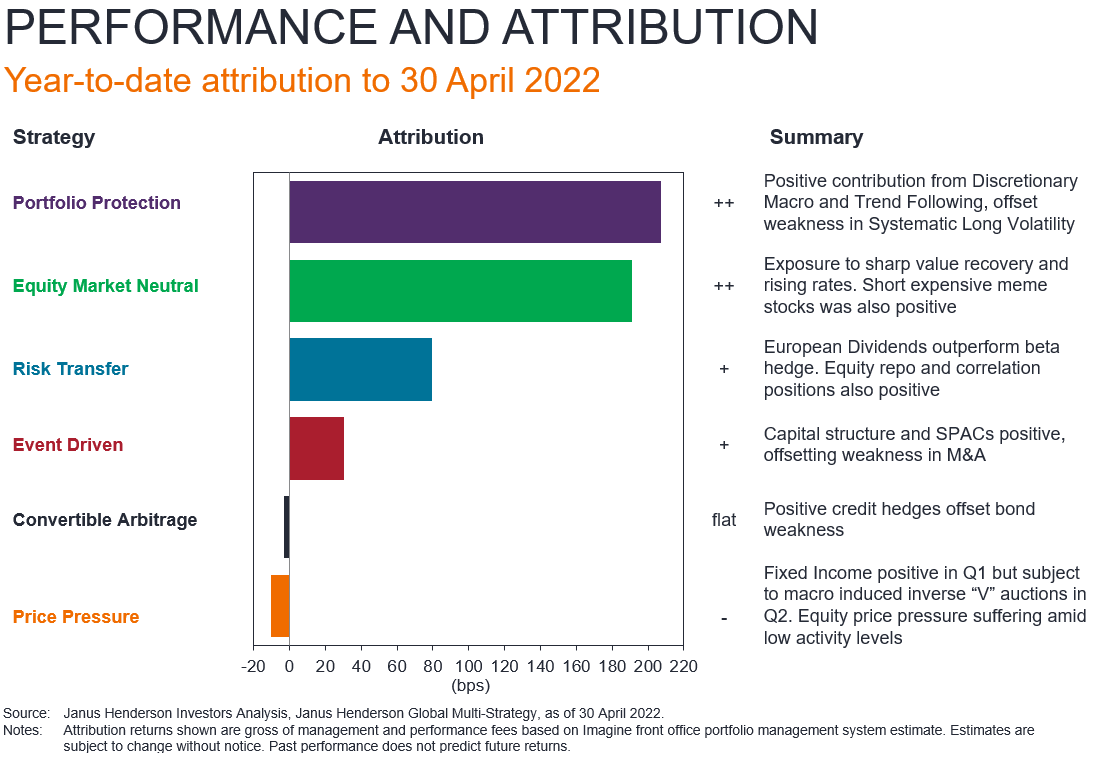

How is the portfolio currently positioned across the main strategies you use in the fund? In terms of performance, which has moved the most in 2022 so far?

Our strategy allocations are broadly mid-range relative to levels over the past decade, with the exception of:

i) Convertible Arbitrage – where we are at the lower end of the range and

ii) Portfolio Protection – where we are at a slightly higher level than the average, given our caution about markets.

Which of the stock-focused parts of the fund do you expect to contribute the most to performance in the next 12 to 24 months?

Within our Equity Market Neutral strategy, we use a Value-Range approach, which benefits from mean reversion trends. As such, the momentum driving market extremes over the past two years, and especially in 2021, has been a headwind for the strategy that we’ve been negotiating.

But the reversal in these trends during 2022 has seen the strategy deliver strong performance. Amid an uncertain outlook, with the market oscillating between inflation and growth/recession, we believe this environment could continue to be positive for the strategy.

How has the strategy performed during the many market cycles you’ve seen, and what are some of the key takeaways for investors?

Multi-Strategy has performed well over the past decade since David Elms and Steve Cain have been co-portfolio managers, hitting its return target with lower than expected volatility. As well as an experienced and stable investment team, we believe patience has been one of the key factors behind this; waiting for the opportunities to arise. This is difficult to do if you run a single strategy fund; however, a multi-strategy approach provides a wider opportunity set.

In addition, innovation has always been key. We have made several sub-strategy additions over the past decade – the Systematic Long Volatility, Trend Following and North American Event-Driven sub-strategies, for example. To deliver a successful multi-strategy fund, you consistently need to run faster to stand still, devote resources to new strategies, further research and invest in the team and investment platform.

See alternatives in a different light

To perform differently from the market, you have to invest differently. You can find further information on the Janus Henderson Global Multi-Strategy Fund here, or via the Fund Profile below.

3 topics

1 fund mentioned

2 contributors mentioned