How to navigate profit-taking

This is a short wire on current opportunities created by the global correction.

I will illustrate how to spot some of the natural differences in market behavior which show up in market corrections, and how these differ from a general bear market.

The Magnificent Seven fall out of bed

This past week has seen some big moves in global markets with a savage correction in the broad Japanese market, steep corrections in Aussie banks and a savaging of some leading names in the US AI stocks boom.

Let's set aside the market commentary, and dive into some of the market internals that are driving this wild trading behavior. The phrase market internals refers to the health of the market itself, as opposed to company fundamentals, or the economy.

This can be difficult to grasp, at first, so I will simplify the problem.

- The economy of composed of many activities many which are not for profit.

- Some profit-oriented parts of the economy are organized as companies.

- Some companies are listed on the stock exchange.

- Investors buy and sell stocks to make profits.

Notice the nexus between the last two points.

The profits an investor makes from buying and selling stocks differ from those the company makes, which need not match other companies, or the economy.

Sometimes it is all too easy to forget these differences.

If the stock market suddenly takes a lurch to the downside this fact must be explained, and the ready explanation is news related to the company, the economy, or both.

Here I want to introduce you to the idea that markets can make their own news.

The essence of this idea is very simple:

When stock prices fall, investors start losing money, so their business, that of investing, is not doing so well. This can happen even when the company is doing fine.

At the risk of sounding like Yogi Berra:

Stock prices can fall, because they fell, which makes them fall further.

The essence of our approach to sentiment is to make the process of parsing market news easier by showing where in the markets these effects are dominant.

Of course, the fundamentals of the company matter, as do those of the economy, politics, the world, and everything in it. However, investors are simple creatures.

Investors are happy when making money and sad when losing money.

A few weeks ago, investors in the Magnificent Seven were very happy.

Now they are pretty grumpy.

Profit-taking corrections dissected

These points are made clear by dissecting the market for investor profits.

Perhaps the bull market is dead and buried?

Perhaps this is a healthy correction accompanied by sector and market rotation?

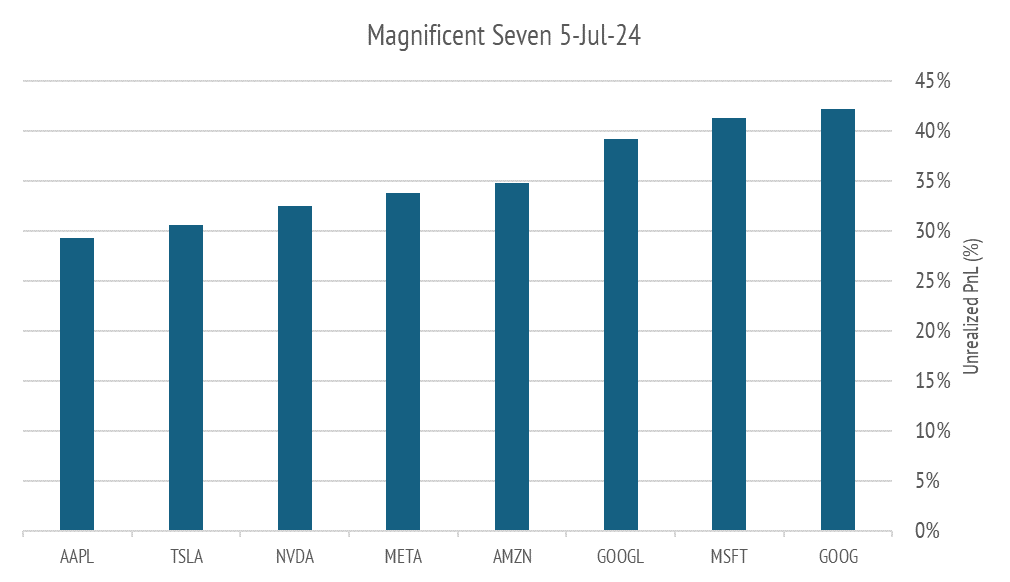

We can all have a theory, but some factual information on investor profits is helpful. Here is the chart of unrealized investor profits in Magnificent Seven stocks from my newsletter of a month ago. You can see that they were all very healthy.

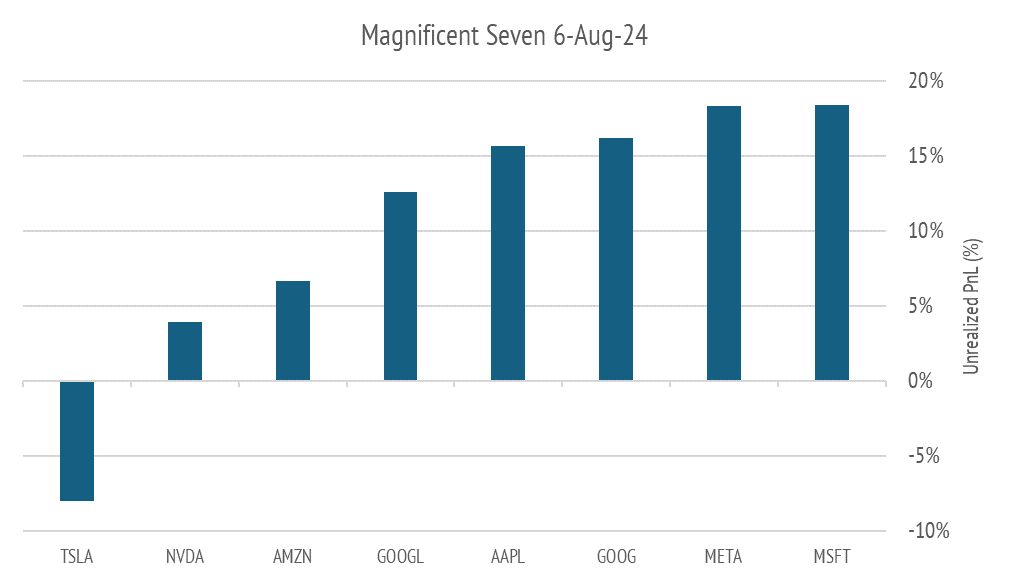

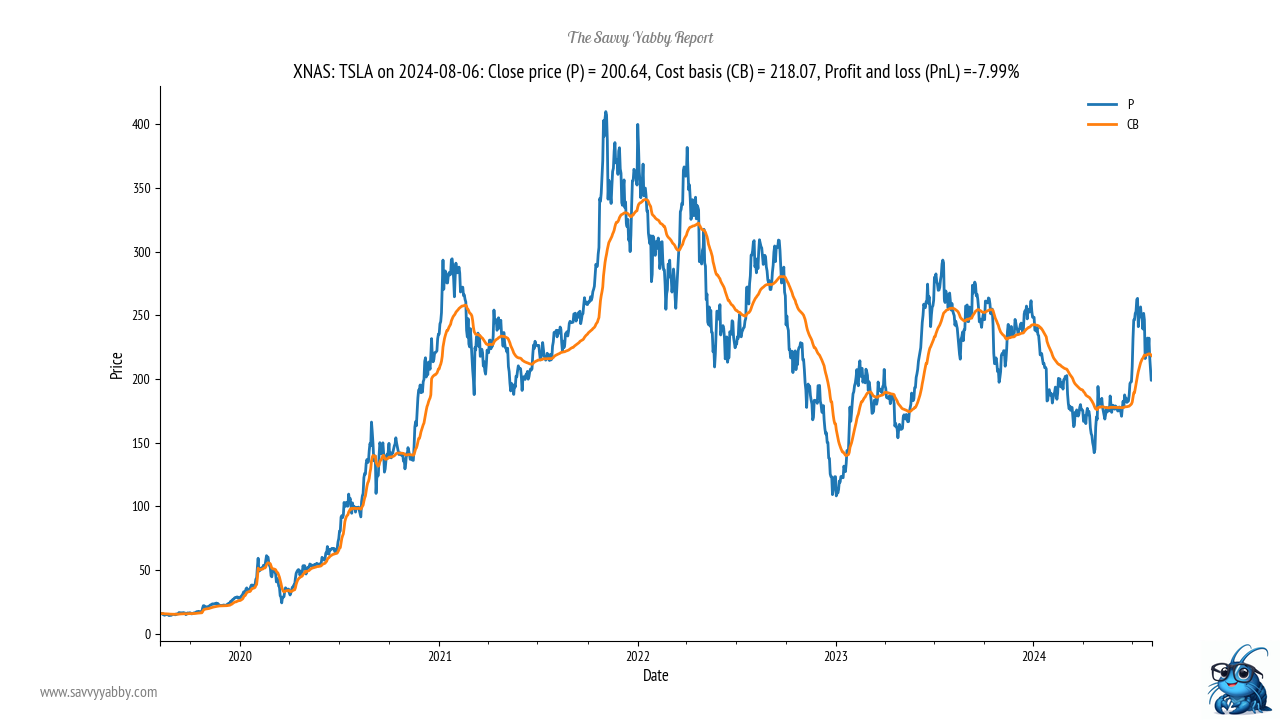

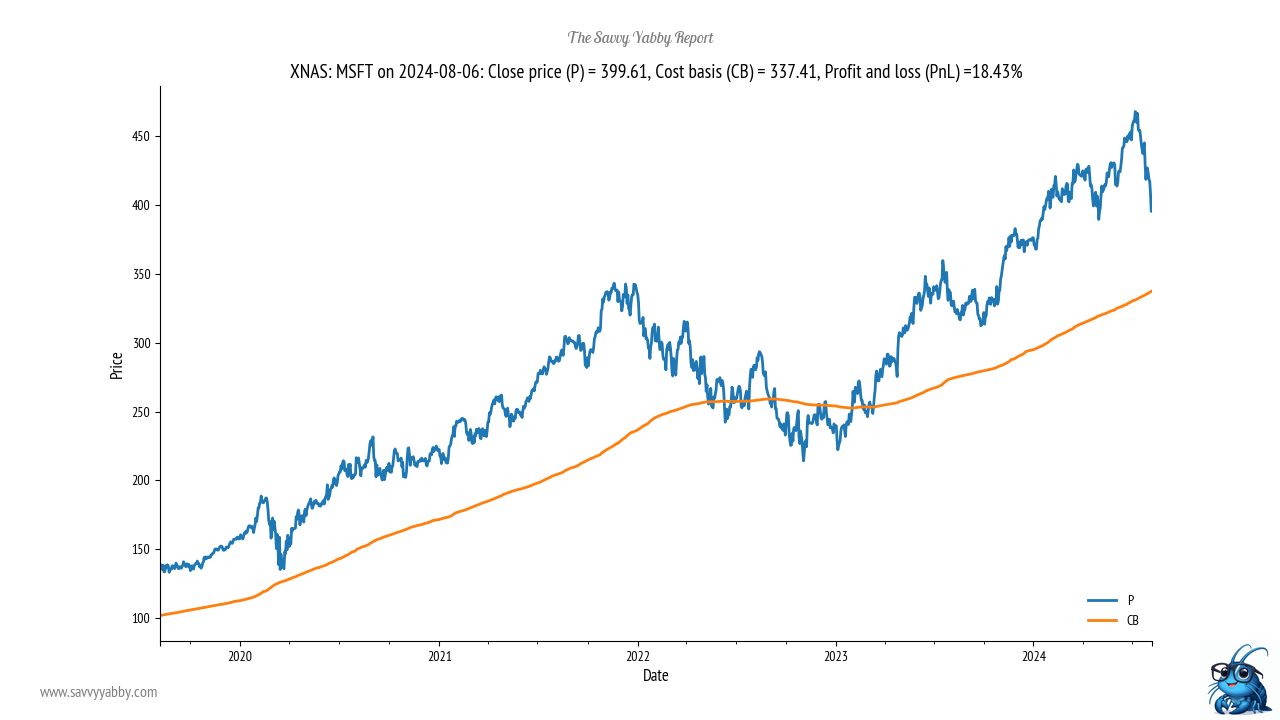

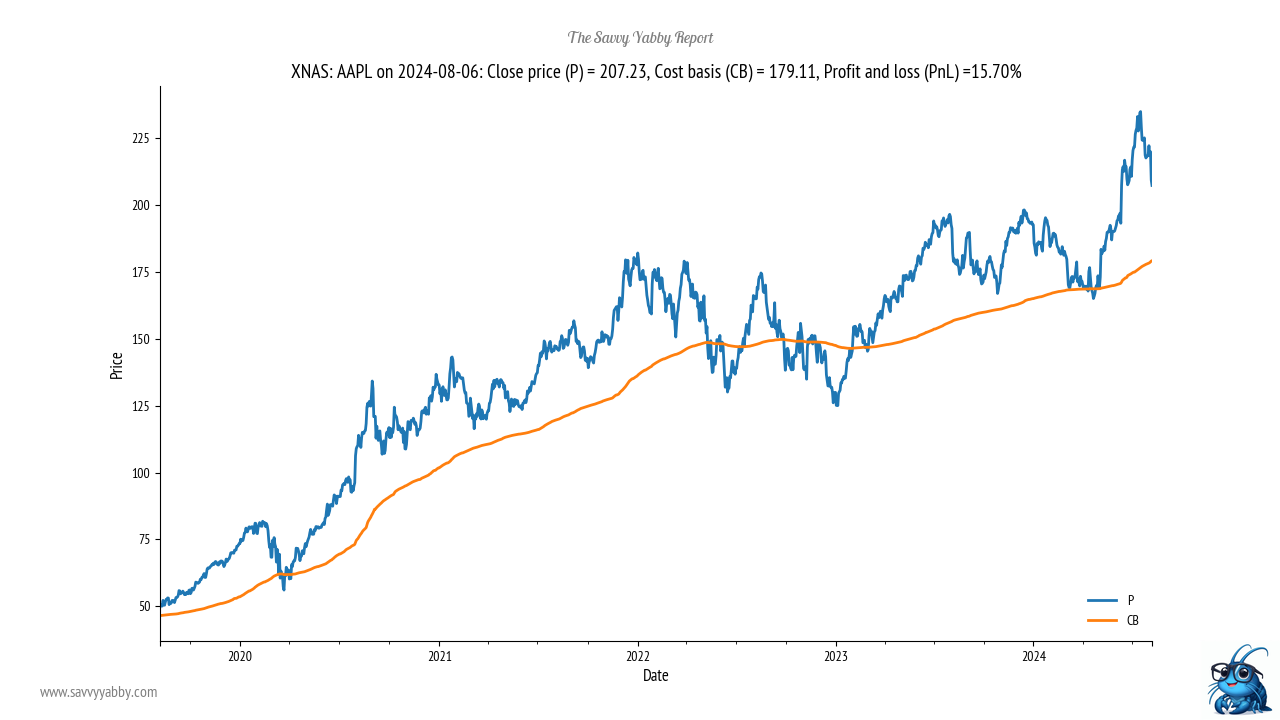

Now look at the same chart for the market close 6-Aug-24 that I published in my newsletter overnight. The newspapers will talk about recession risk, the AI boom, or bust, Japan, war in the Middle East, and all manner of causes.

However, this is what actually happened.

Notice the profound difference. Some stocks took a haircut, but still have a healthy unrealized profit. Others fared less well, with Tesla NASDAQ: TSLA now in a loss.

In a general bear market, all of these stocks would be in loss making territory.

That is not the case right now, so we need to be alert to the difference and why.

The Nvidia bounce is healthy

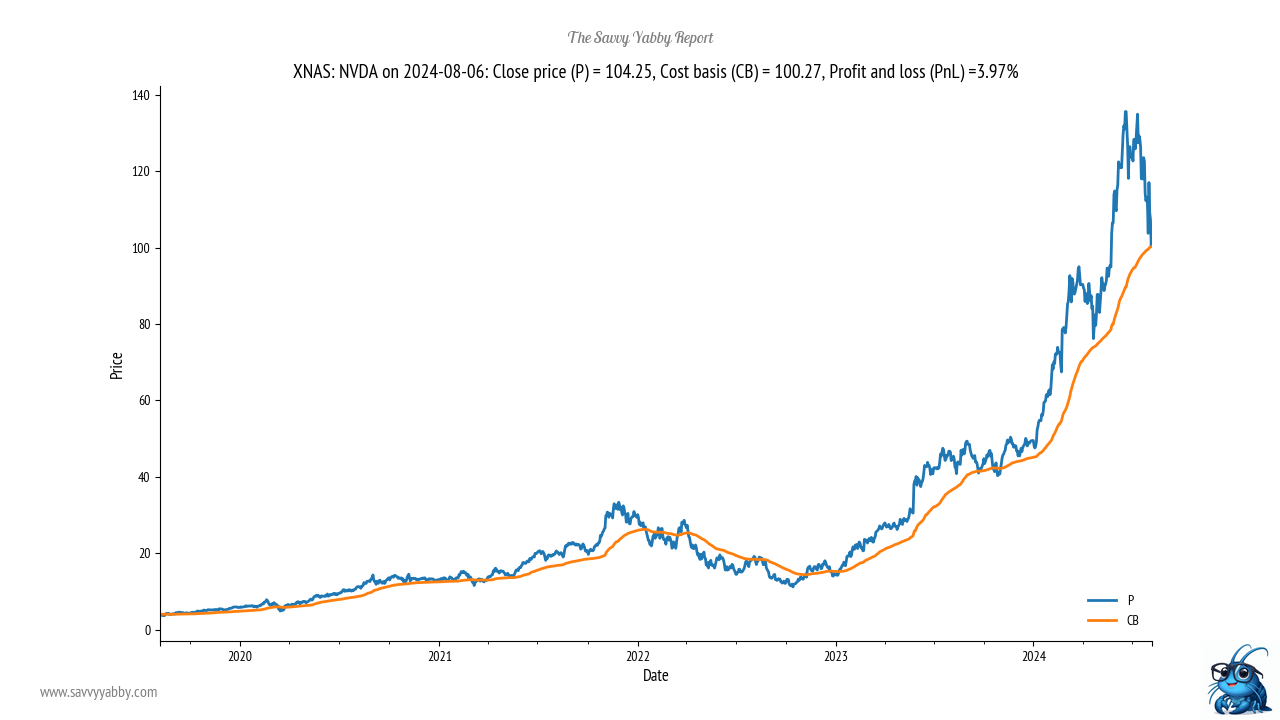

Let me start with AI darling Nvidia NASDAQ: NVDA.

This has been a savage correction where all conventional technical indicators are broken. The cost basis indicator is at break-even, and we had a bounce from that level.

This is what I look for in a profit-taking move.

Such moves stop when there is no profit left to take and we are there now, on average.

Of course, this stock has been held by highly levered investors, as was Japan, but we need to note when a move has likely run its course and be alerted to buying opportunity.

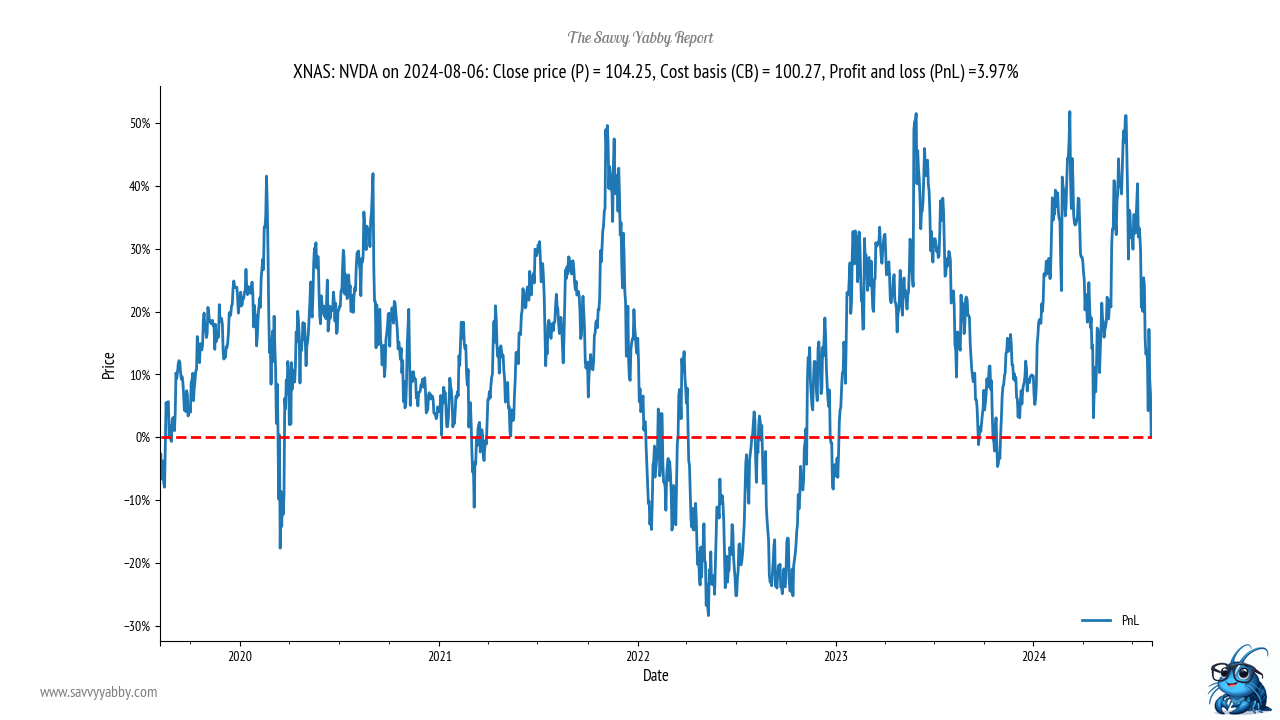

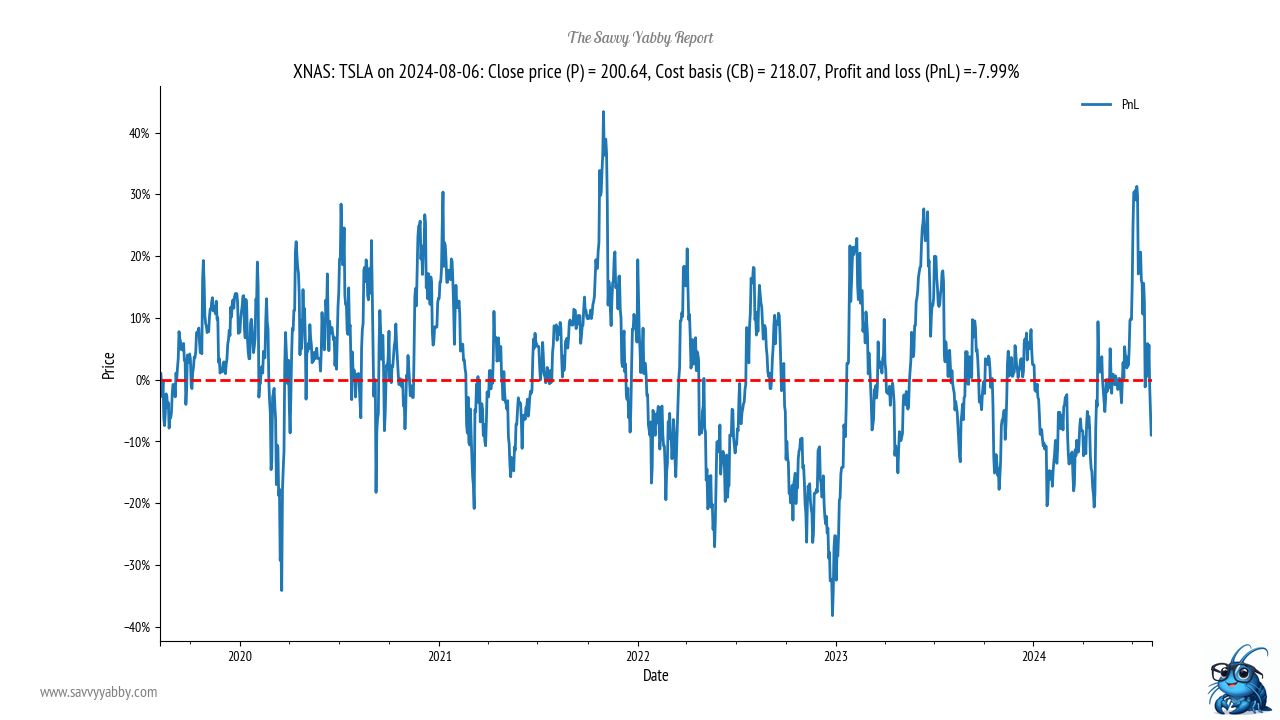

The better way to see this is to look at the investor profit-and-loss chart above. You can take out the drama of the price chart, and clearly see the profit-taking.

The Tesla correction is expected.

Let me now contrast Nvidia with Tesla NASDAQ: TSLA.

See how much wilder the progress of investor profits is with Tesla.

These are the stocks I habitually avoid. Too much buzz for me. In the business of investing in stocks, your fellow travelers are all neurotic manic-depressives.

Like I said elsewhere, I bought the car, but not the stock.

What about Steady Eddie and Stable Mable?

The Beast from Redmond NASDAQ: MSFT is an unexciting way to make money.

I like this stock because my fellow investors are boring folks focused on making money. The California Engine of Woke is similarly blessed NASDAQ: AAPL.

Apple is a great company which rarely disappoints but is a little over-extended. Once it pulls back to the top of that former range it is looking like a top-up opportunity.

These are boring stocks for boring people who like to make money.

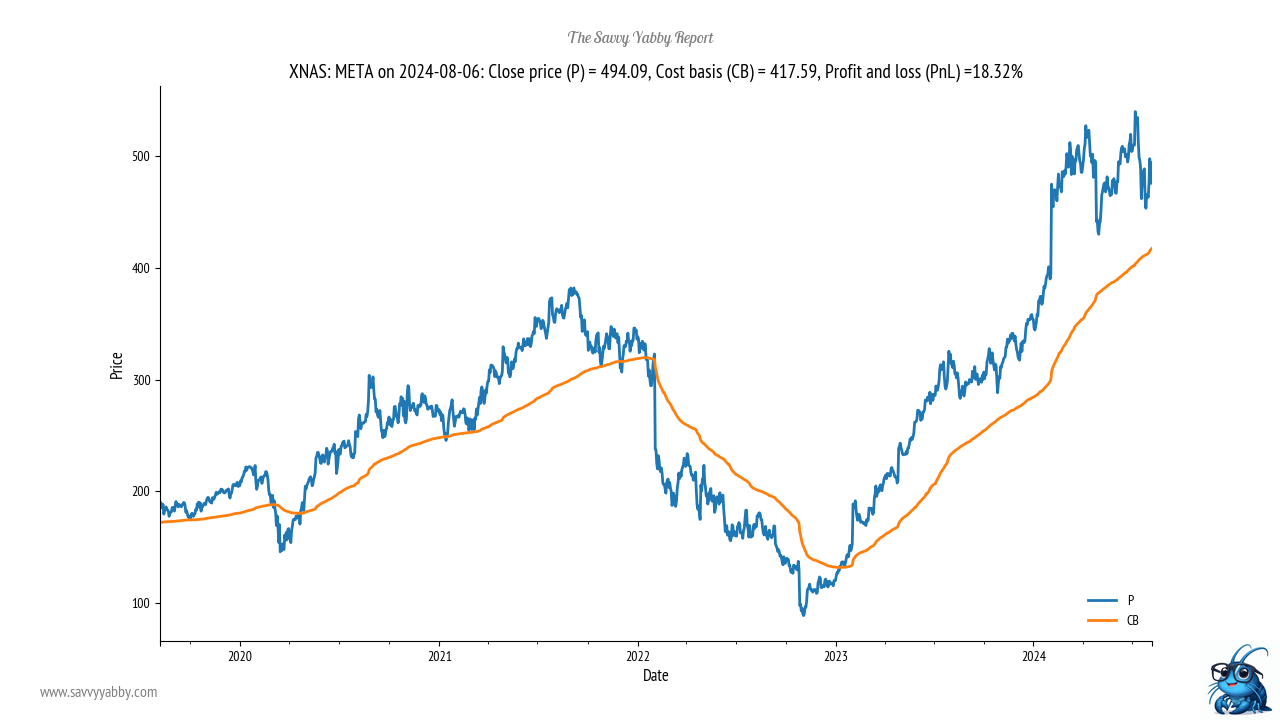

The return of Zuckerberg

Some stocks are genuinely driven by entrepreneurial zeal. Meta NASDAQ: META is a company where it matters greatly what bug has burrowed into the brain of Zuckerberg. When it was the Metaverse, the prognosis for investor profits was Condition Custard.

Then Zuckerberg did the sensible thing and changed his mind.

Now we are in a cautious period, so watch Zuckerberg's earnings calls, his pitch, and how the market perceives it. His strategic moves matter, and the market responds to what it sees.

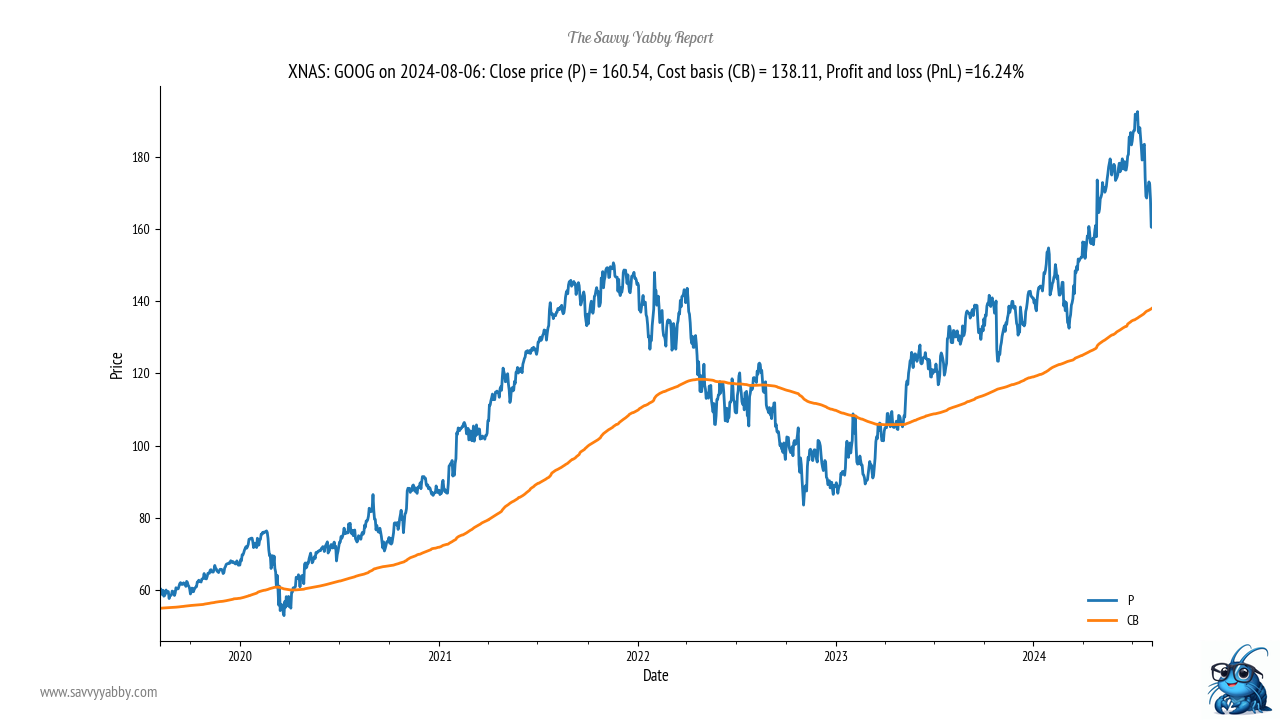

Alphabet soup

Alphabet NASDAQ: GOOG is a great company hiding behind a stupid rebranding.

Nobody that I know refers to them by their actual name.

It is always Google.

When your brand becomes a verb you should not change that.

However, I am not bearish on this company. It is a mild correction, and a business that is not trading on a huge multiple. This looks like a good contrarian buy, but we would wait to see where the stock price settles. Google is not leading this AI market. It is a follower.

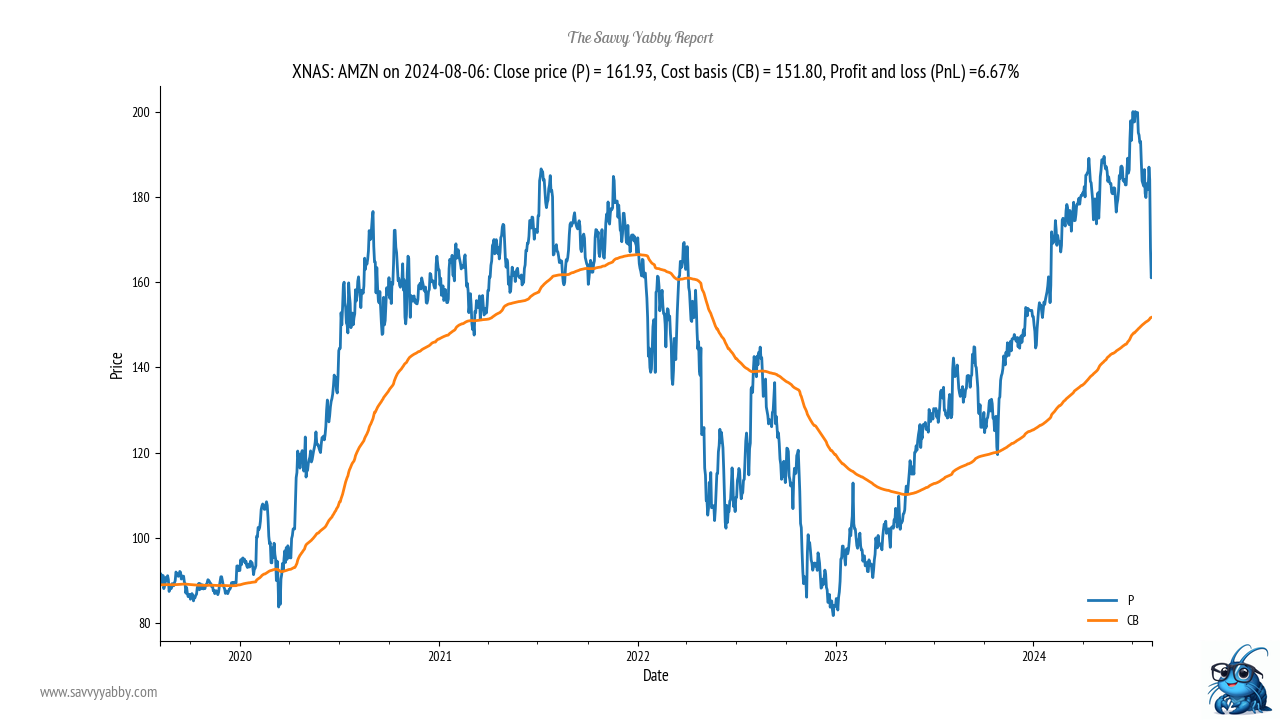

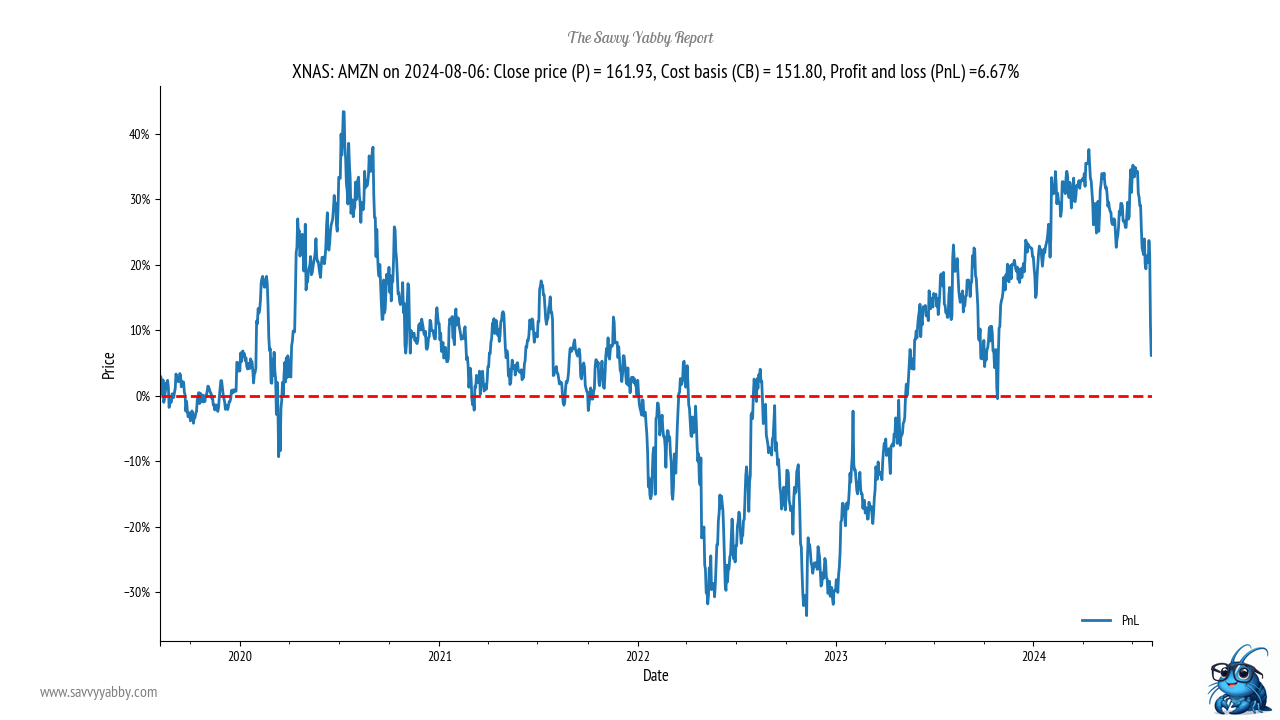

Amazoned into the end zone

Amazon NASDAQ: AMZN has been tarred with the recession brush.

Look at the pace of that correction!

Look at how neatly Amazon turned last time!

I have my target entry nailed.

$152 and change.

Conclusion

Don't despair over lost paper profits.

Do focus on potential real ones.

This market is correcting and is starting to rotate to find new leadership. That is not likely in technology, but the real place is not yet clear. Perhaps healthcare?

We will continue dissecting this market for opportunity

2 topics

7 stocks mentioned