How to profit from ASX small-cap volatility

An “all-cap” fund manager, QVG Capital invests in Australian companies across the market cap spectrum but is biased toward small or mid-caps.

In a recent investment webinar, portfolio managers from the asset manager’s two funds shared their views on markets and how they’re currently positioned.

Kicking off the presentation, portfolio manager Tony Waters discussed what he regards as the most surprising things happening in the market currently. There’s more than one, including the speed with which markets have priced-in rate cuts in the backend of 2023, he says.

On the first of these, the QVG portfolio manager notes there have been “endless forecasts [about companies] adjusting to the environment, and we’re now in a relief rally.”

Another surprise was the great success many Australian listed companies have had in reducing their costs over the last 18 months to two years. Given the success of many companies in this regard, the return to something more like normality for markets brought the first period of margin expansion since COVID. This comes back to the cost management of Aussie corporates: “But that’s a one-trick pony, you can’t keep cutting costs forever,” Waters says.

What’s driving volatility?

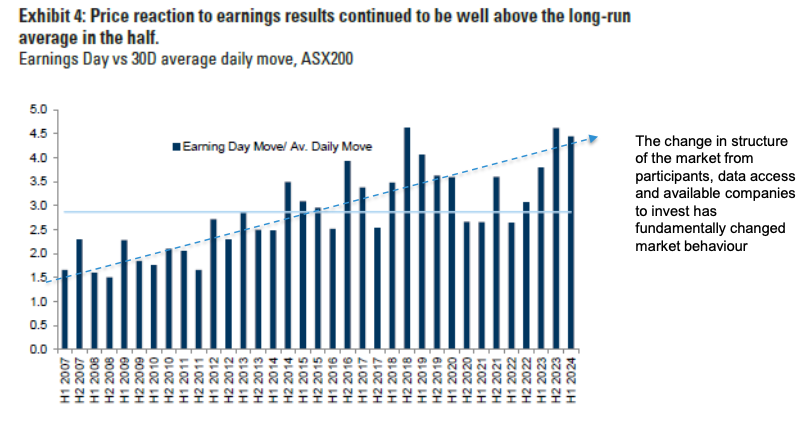

On the current market environment and persistent volatility, Waters notes there have been several reasons for this including the move from active to passive investments and declines in the number of listed companies.

“That’s all partly true, but another thing I’d add to the mix is that earnings consensus has become commoditised,” Waters says.

“Data, in terms of earning consensus in the market, has become a commodity. Everyone is playing the game of whether the next bit of incremental news flow is good or bad”.

While QVG pays attention to this, it's far from the whole story: “We invest in companies with good balance sheets and other financial metrics that should deliver better than expected results over the long term," says Waters.

QVG’s watchlist: Where the team sees value now

Waters believes some companies are currently overvalued, pointing to Pro Medicus (ASX: PME), Temple & Webster (ASX: TPW), and Audinate (ASX: AD8) as examples.

He notes they are good companies, but their high valuations mean they’re not currently in the portfolio.

“I always maintain that if you pick a good company, even if you stuff up the entry point, the longer you own it, the more likely you are to make money. And the inverse is true for a bad company,” Waters says.

“We have to wait until the end of this decade until they grow into a valuation that we think is reasonable.”

He calls out six of the fund’s top 10 companies he expects will deliver good earnings growth over the next three to five years – primarily driven by their potential to acquire other companies.

“But what’s really important is that these companies have solid track records of delivering on that basis, performance above where market consensus expects,” Waters says.

The companies are:

- Johns Lyng Group (ASX: JLG)

- Maas Group Holdings (ASX: MGH)

- PSC Insurance Group (ASX: PSI)

- Corporate Travel Management (ASX: CTD)

- ABB Limited (ASX: ABB), and

- Hansen Technologies (ASX: HSN)

The long and the short of QVG’s investment process

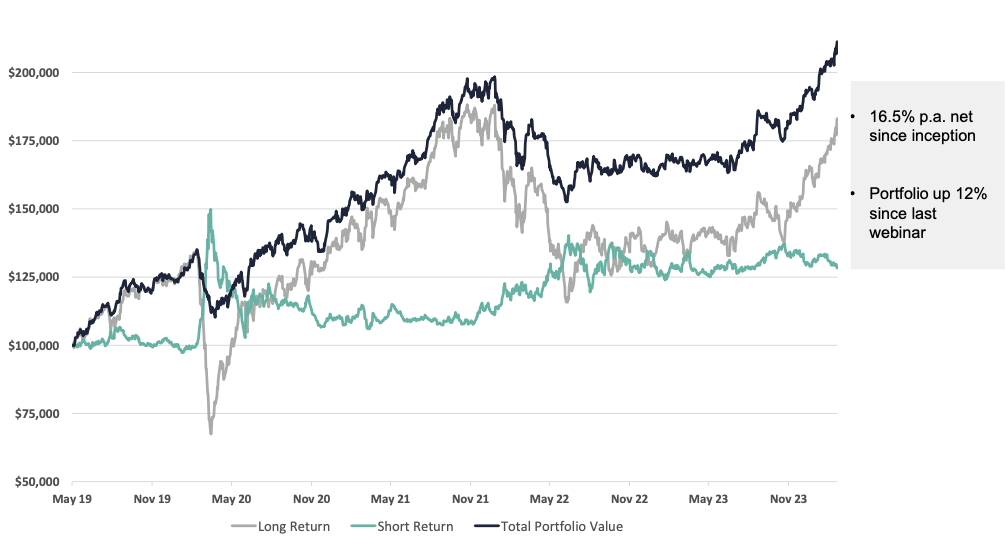

Josh Clark, portfolio manager of the QVG Long-Short fund, spoke about the role the fund’s short book plays as a “shock absorber” in delivering long-term returns.

QVG Long Short Fund - contribution of Long versus Short

On the long side, some of the key holdings he calls out as top drivers of recent returns include:

The 10 largest positions, which also include MAAS Group (ASX: MGH), HUB24 (ASX: HUB and Zip Co (ASX: ZIP) are a mixed bag in terms of their respective industry and sector exposures and their differing business models.

“There’s a lot in there…but there’s a consistent theme. The vast majority of these have proven themselves capable of consistently growing their earnings over the long-term.”

On the short side, the fund typically holds short positions in between 10 and 30 names, which complement the 20 to 40 long positions. Clark says the team has been covering (buying back) a few of these positions recently, where it believes the worst of their earnings weaknesses are behind them. Examples include:

“When you’ve got a well-diversified portfolio, rather than just look at industry classifications in terms of sector, I look at the real classification in terms of its exposure”.

Small cap stocks

“One of the joys of small caps is that you are going to step on a few landmines, that’s an inevitable part of the space in which we play,” says Chris Prunty, portfolio manager of the QVG Opportunities Fund.

“But more important is how you deal with it and how you build the volatility into your investment process.”

He called out Lovisa (ASX: LOV), Maas Group and Aussie Broadband (ASX: ASX: ABB) as holdings that performed strongly in the latest earnings season in February. Their share prices have gained 40%, 19% and 18.5% respectively in the month since their half-yearly results.

On the other side of the ledger are Corporate Travel Management (ASX: CTD) and MA Financial (ASX: MAF), which were down more than 22.6% and 18% on the day of their results.

Prunty believes the key to dealing with results like this lies in how the portfolio management team responds to earnings news.

“We try to be as objective as possible in incorporating 'new news' into our fundamental assessment of the businesses. Company share prices typically don’t move plus or minus 20% without some fundamental reason,” Prunty says.

A couple of other examples where the team took profits ahead of strong half-yearly results from animal feed manufacturer Ridley (ASX: RIC) and technology firm Data#3 (ASX: DTL)

While these are examples of reactions to short-term trends, Prunty emphasises that QVG’s investment selection is focused on the long term.

Watch the full webinar

A full replay of the QVG Capital March 2024 Investor Webinar is available on the QVG Capital website.

4 topics

21 stocks mentioned

1 contributor mentioned