Hybrids vs equities in a time of crisis

In this time of crisis, it is useful to reflect on some hard data on where we are today, where we have been in the past, and what that can tell us about the future. In contrast to previous man-made crises, this is a truly external one. That in turn means that we are likely to get very aggressive stimulus from central banks and treasuries, as we are increasingly seeing. And the crisis will pass as anti-viral drugs come online in 3-6 months (Gilead Sciences is increasingly cited as have an effective solution that stops the virus replicating), the summer months heat the northern hemisphere up, and when we have publicly available vaccines over the next 9-18 months. Today I want to focus particularly on the performance of the ASX hybrids market during this extreme stress-test. There are a few key questions I want to address:

- What has the liquidity of ASX hybrids been like?

- How have ASX hybrids performed relative to equities?

- What are current hybrid credit spreads like compared to past crises?

The ASX hybrid market is dominated by Australian banks, and the major banks’ hybrids are rated investment-grade, or BBB-. This means they are not rated sub-investment-grade, or high-yield or junk. I have warned repeatedly about the risks of investing in listed investment trusts (LITs) that invest in foreign (not Australian) high yield bonds/loans, and particularly that these high yield LITs can trade at big discounts to their net tangible assets. We have seen that risk materialise in recent times with KKR’s LIT (ASX: KKC) trading at more than a 23% discount to NTA in the last few days. That does not mean the product is bad at all, it is just the nature of the beast when dealing with LITs that invest in foreign high yield bonds and loans.

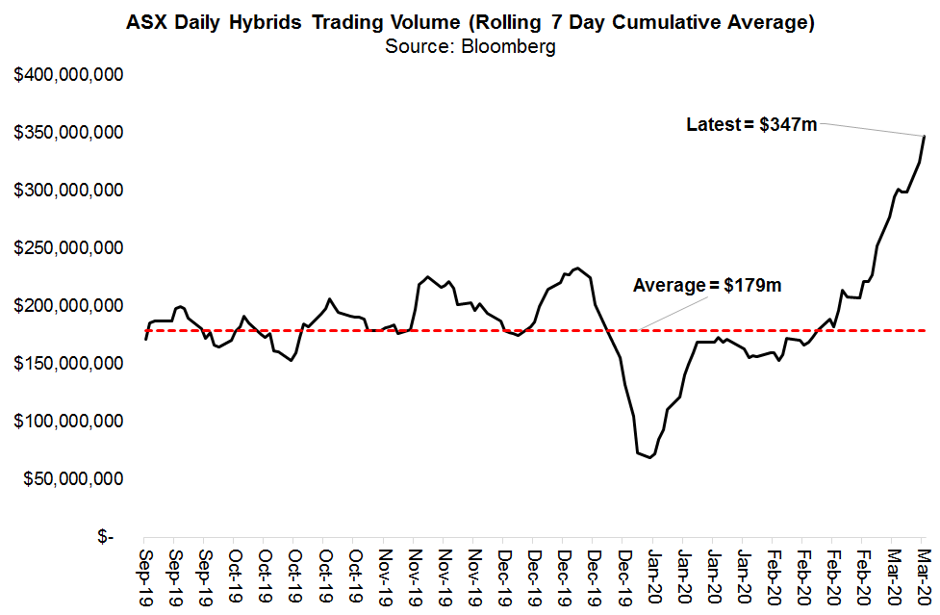

Turning to liquidity, my first chart below shows that the rolling 7 day turnover of ASX hybrids has improved dramatically, as is normally the case during crises as investors flee equities and look for more defensive or protective assets. Specifically, average 7 day turnover has jumped from about $180 million to almost $380 million.

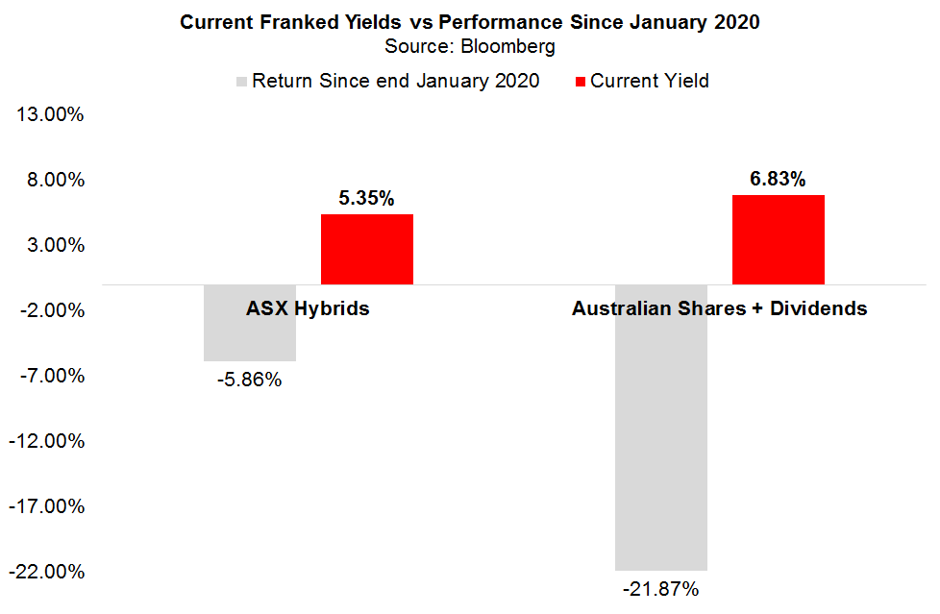

ASX hybrid performance relative to Aussie shares has also been as expected (ie, very similar to the GFC). Whereas Aussie shares including dividends have lost 21.87% of their value since 31 January 2020, ASX hybrids have only lost 5.86%. That is, they have suffered about one-quarter of the downside of equities. And here it is worth stressing that the major banks in particular have never been healthier. CBA has, for example, reduced its risk-weighted balance-sheet leverage from 21.3 times in 2007 to 8.2 times today. And whereas CBA did not have government guaranteed deposits in 2007 or access to a special emergency liquidity line with the RBA, called the Committed Liquidity Facility, all banks do today...

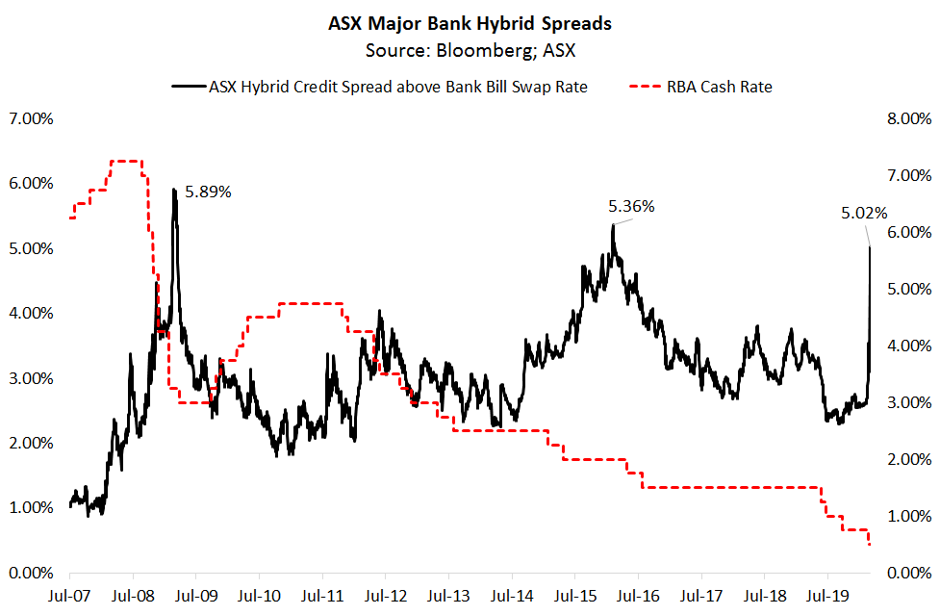

Another way of thinking about current hybrid valuations is to examine the compensation we get paid above cash for their inherent risk. This is measured through credit spreads above the bank bill swap rate. My third chart below shows that across all major bank hybrids you are today earning a credit spread of more than 5.02% above the bank bill swap rate, or a total yield of about 5.62%. (This is above 5.35% yield in the second chart because it captures all hybrids whereas the final chart only looks at major bank hybrids.)

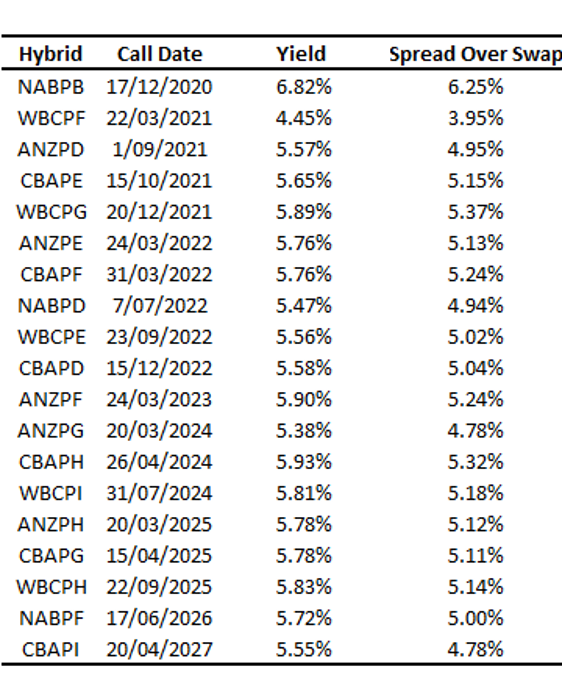

Finally, to give you a sense of the individual yields and spreads on the major banks' hybrids right now, I have outlined them below.

1 topic