I’m sorry, you don’t need (or even want) property – Part 2/2

Last week, I wrote a rebuttal to a piece from Vishal Teckchandani (his piece is below):

.jpg)

My rebuttal highlights 5 points in Vish's piece that I wanted to challenge and that, I believe, highlight the flawed mindset that sends many Australian investors into sub-par buy-and-hold-and-manage real estate with their marginal investment dollars.

The first 3 points Vish made were that, the majority of Australians who got rich did it, at least partly, through real estate (they didn't), that real estate expenses are investments (they're not), and that his dad's first property yields 20%-plus (it doesn't).

Here are points 4 and 5.

Point 4 - you’re a bad investor so buy property

If you're on this site, my guess is you're deliberately investing, and trying to achieve goals that you’re holding yourself accountable to - you don’t need to protect you from yourself. You don't need to be told "you're not good at this". You don’t need forced discipline, and in fact, you don’t want it. Liquidity is valuable, it has a price, and you should be willing to pay it.

Vish's piece has many definitional issues, and the conversation around missing the best days in the stock market is another one. If you’re trying to catch the best days and miss the worst ones, I have bad news for you – you’re not an investor.

You’re a trader.

Just like property where you’re in for years on end, compare being in US stocks for years on end and looky here – the real return, especially the real risk-adjusted return, is significantly higher than real estate, and with full liquidity.

Point 5 - are yields low in residential real estate?

Yes, they're very low.

And this idea that you’re somehow magically protected against inflation is bunkum. I bought my first property a long time ago (I’m old), and over a 12-month span in 2020, I received $16,545 into my bank account. In 2024, over the same 12-month span, I received $18,012.

So I’m up 8.9% over a period where inflation was probably 50% Where’s my protection??

My average net yield across all my properties is 2.63%. The Fed funds rate is 4.25%, the RBA cash rate is 4.10%, the dividend yield on the ASX is 3.70%, a term deposit rate is around 3.50%, my US money market rate is 4.57%.

Don’t fall for the story – rental yields are low. They’re structurally supposed to be because capital growth is allegedly going to get you over the line. Except once you take out all of the running costs, that total return is pretty poor, and very often negative.

And it starts with the low yield.

Conclusion

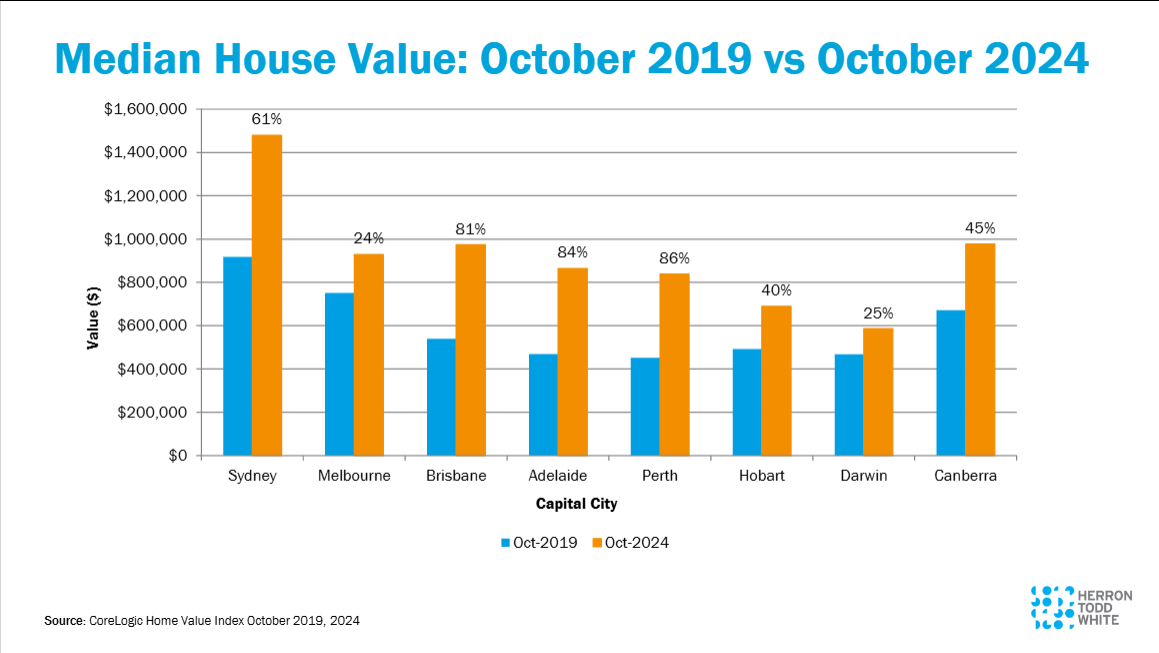

Investment markets tend to converge over time. Large returns in one market will attract capital and subdue those large returns. A somewhat new and growing problem in the real estate market is that Governments are your new business partners, damaging your returns with punitive land tax, stiff regulations, and other targeted imposts. So maybe real estate was a better market in the past but today, many old school real estate people, like Vish and his dad, still think it's the 1980s and the 1990s.

It's not.

To make real money in real estate today, you're forced to develop property, get into commercial property, rezone property – all high risk activities. The idea that you can buy-and-hold-and-manage your way to significant real estate wealth is flawed. I don’t mean you won’t make money – you probably will – but for the risk you took, the lack of liquidity, the time you deployed, and the opportunity cost you paid, your risk-adjusted return in the equity market, especially the US equity market, is much higher.

This is not a strategic asset class for a very large number of participants. Not only do sub-optimal tax considerations drive many decisions (almost two-thirds of RRE investment properties in Australia are negatively geared, so losing money), property is largely a local market. Someone who happens to grow up in Adelaide will buy property in Adelaide. Someone who grows up in Wangaratta will likely buy property in-and-around Wangaratta. And if you grew up in the eastern suburbs of Sydney or on the north shore of Sydney, purely by happenstance, you bought property around you and by fluke you’ve had a better experience than most RRE investors.

I could go on for a long time but I won't, so here's a short summary:

Income = Australian fully franked dividend paying stocks.

Growth = US stocks.

Sub-par pain in the bum = buy-and-hold-and-manage real estate.

Good luck out there.

5 topics