If the China rally has more to run, Macquarie says these 5 ASX stocks have the most upside

For a country not known for handing out huge wads of cash at once to its citizens, the stimulus measures proposed by the Chinese government last week have sent ripple effects throughout global markets. Not just because the stimulus measures were significant but because this time, the proposal comes with the promise of more to come.

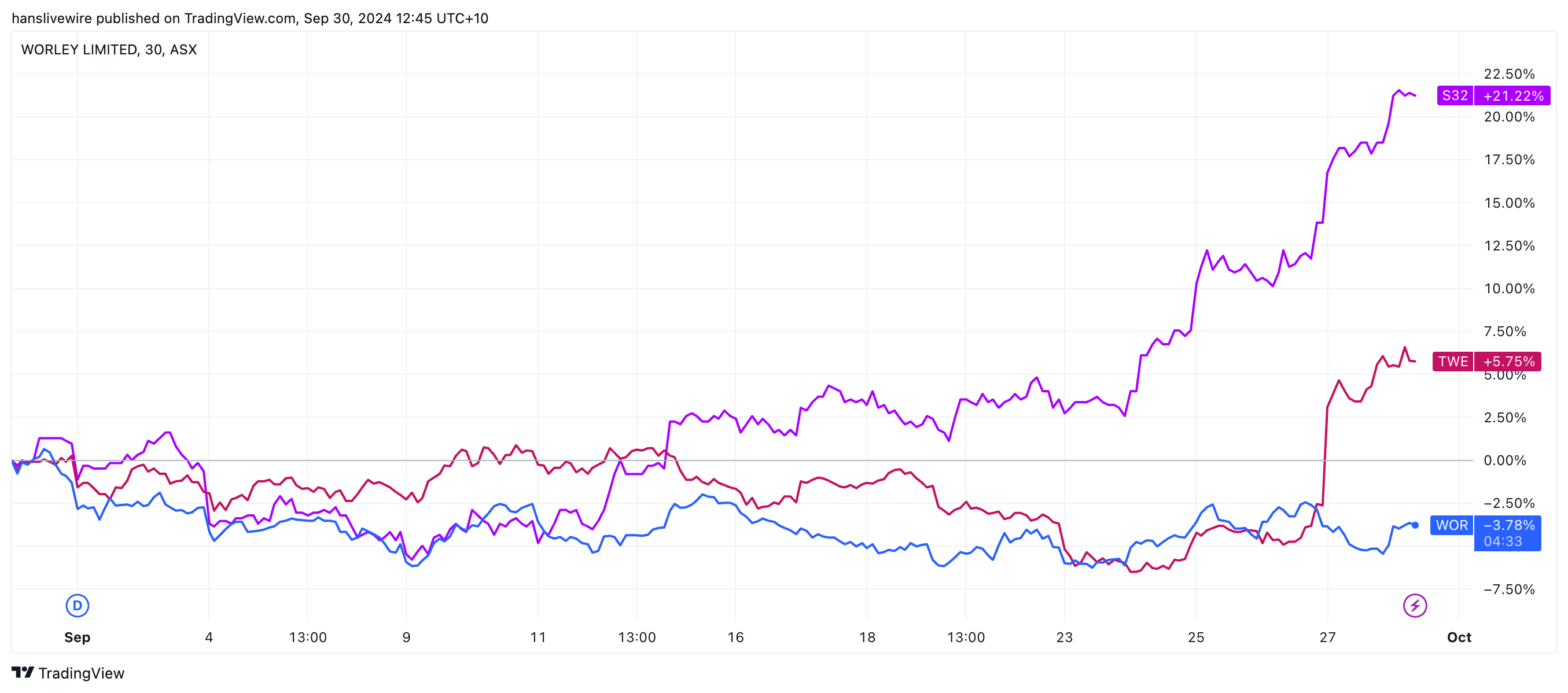

Nowhere is this renewed optimism more apparent than in stocks. The Shanghai stock market soared 5% yesterday alone. Here at home over the last five days, the S&P/ASX 200 Materials Index has risen more than 11% while the equivalent Banks Index has fallen more than 4%. Commonwealth Bank (ASX: CBA), the poster child of the Australian banking sector and the world's most expensive bank by valuation, lost 7% off its share price last week alone.

But with the Fed also starting to cut interest rates, which story will be the more powerful for markets? And with the Miners up by double digits in just five trading sessions, are there any more gains to be had?

Macquarie has penned a note that answers these and other questions, and this wire will summarise that note.

A quick recap of what was announced

For those who are not caught up already, the Chinese government (through the People's Bank of China) announced a raft of stimulus measures which are the largest since the COVID pandemic hit. You can read a comprehensive list of the stimulus measures in this article by Antipodes' John Stavliotis. But the basic stuff that has moved markets is as follows:

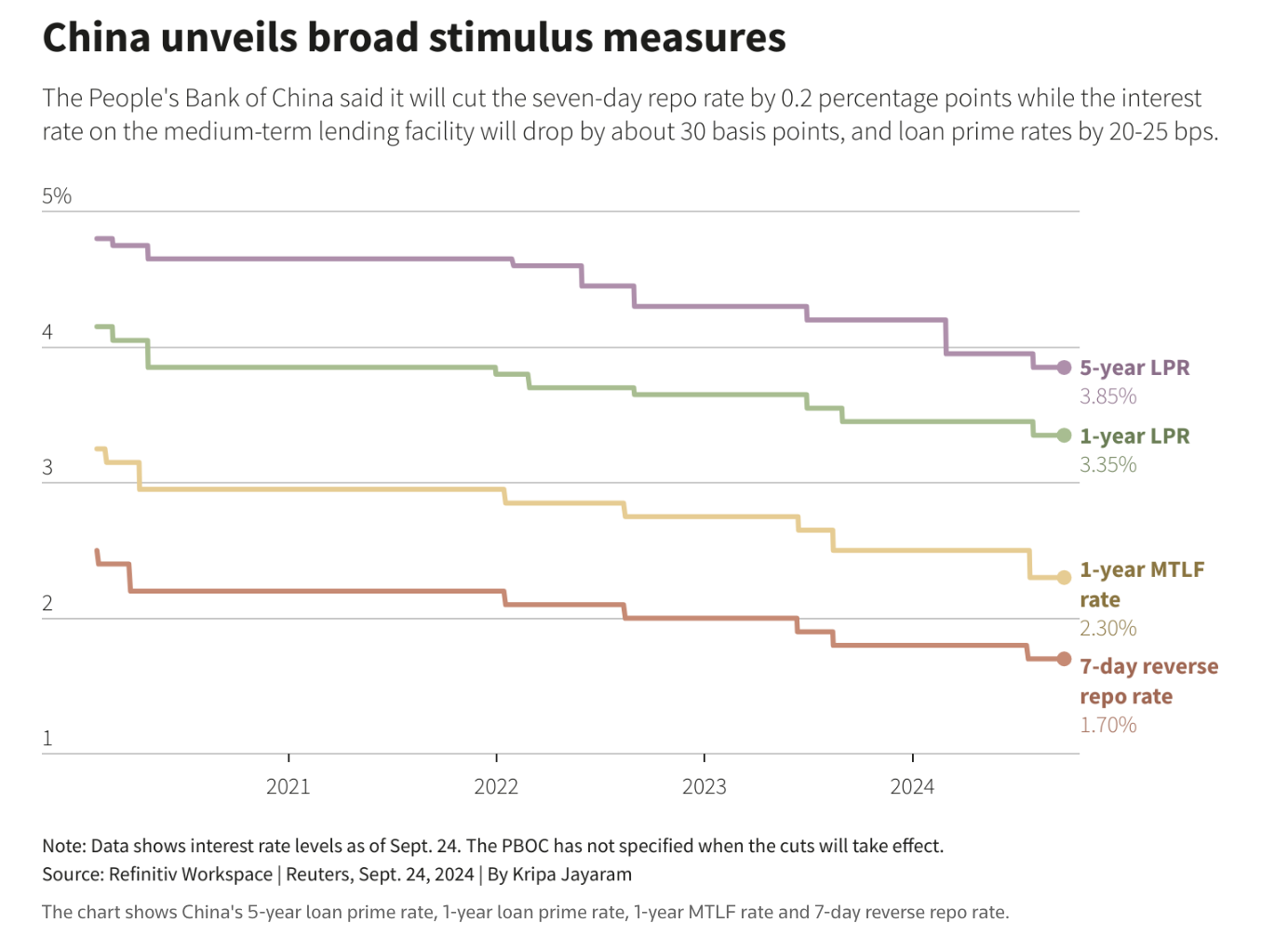

- A 30-basis point cut in the 1-year medium-term lending facility rate (from 2.60% to 2.30%)

- A 20-basis point cut in the 7-day reverse repo rate (from 1.90% to 1.70%).

- Reserve requirement ratio (RRR) cut by 50bps which frees up about US $142 billion of liquidity which could be used to generate new lending measures.

The cuts are larger than what analysts were expecting, but economists and analysts remain divided.

Helen Qiao, Bank of America's Greater China Chief Economist, says there is not just more stimulus coming - she argues it's actually already in the works.

"In our view, policy formulation of more fiscal stimulus may already be underway. We expect the announcement of a fiscal package in the coming weeks, include demand-boosting stimulus on consumption and investment, as well as further enhancement of social security, healthcare, and pro-birth measures," Qiao wrote to clients.

Meanwhile, Citi's commodities team, led by Wenyu Yao, are not as convinced:

ANZ tend to agree:

"The package is sufficient for our 4.9% GDP forecast this year. However, it remains too small and too late for the ongoing property woes," ANZ's Zhaopeng Xing wrote.

As for the Macquarie team, they offer the following:

"To chase China-exposed stocks after their strong run this week, we think investors need to have some confidence the gains could continue."

But if you've got confidence...

They argue that the most upside will be gleaned not necessarily in the ASX-listed miners but in other China-exposed ASX stocks.

Stocks that have gained on the China news but still have more than 10% upside, according to Macquarie's own forecasts include:

In addition, Woodside (ASX: WDS) and Santos (ASX: STO) both offer 20%+ upside. But, as Macquarie's analysts add: "We would be wary chasing industrial mining and energy stocks after this week's rally."

One big reason the Macquarie team are not chasing the miners is how the rise in commodity prices stacks up against existing year-end forecasts. For instance, iron ore prices are up significantly on the stimulus news, "but this rise only lifted prices to be roughly in line with consensus for 2025 and 2026. In other words, iron ore prices would need to rally further to drive earnings upside for related miners."

In addition, with oil prices falling on prospects key OPEC+ member Saudi Arabia may raise output, Macquarie analysts say earnings downgrades cannot be out of the question.

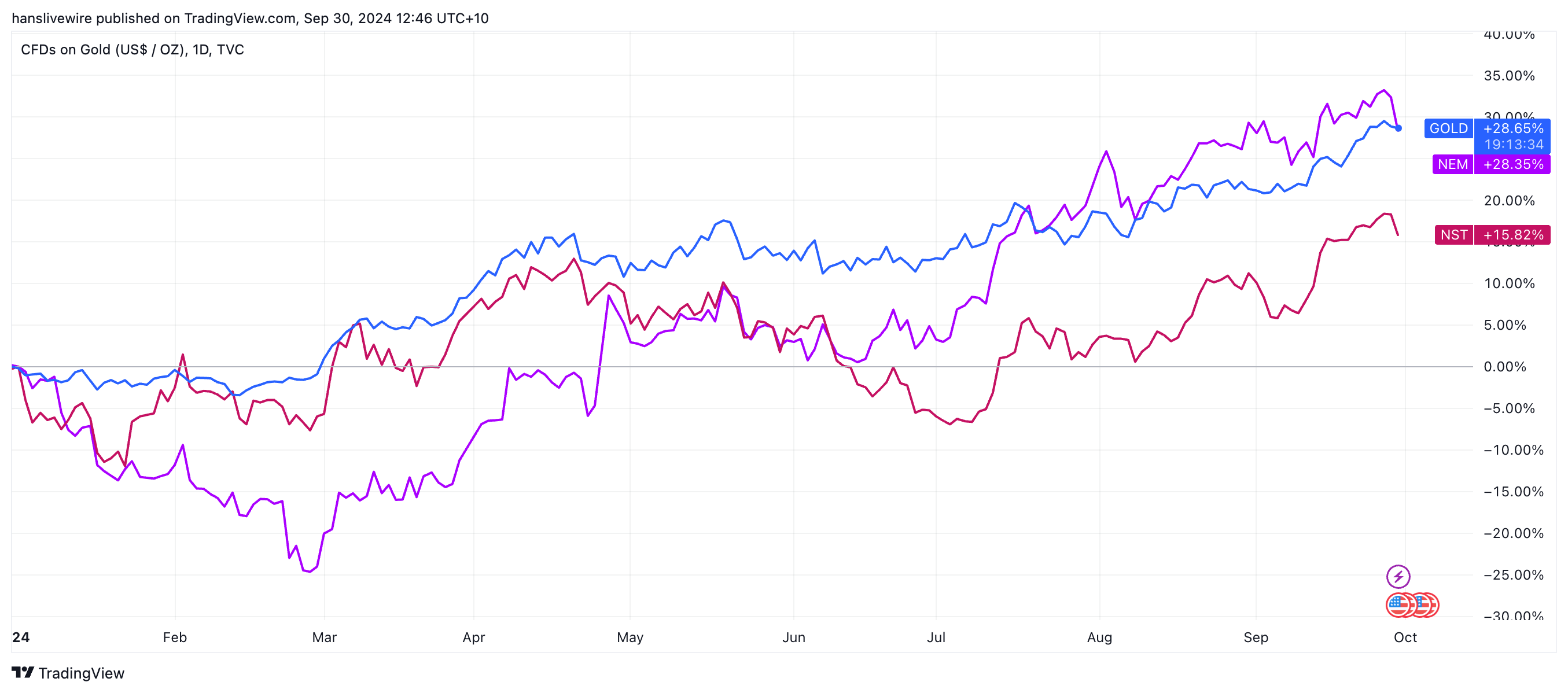

In fact, the only commodity that is positioned for further upgrades is actually the one that's rallying the hardest - gold. Gold stocks tend to outperform following the first Fed cut, and hence, this is why Macquarie's strategy portfolio is overweight Newmont Mining (ASX: NEM) and Northern Star (ASX: NST).

4 topics

5 stocks mentioned