In the spirit of the quant king

Today I’m going to introduce you to my friend Chewbacca.

We call him Chewie for short.

You might be thinking he’s a very tall, hairy, sidekick type of character.

Well…he’s not that hairy…or that tall.

But he’s certainly my sidekick — for trading the market.

You see…

Chewie builds algorithms to digest the gigantic data the stock market generates every day.

There was another man that did that too — Jim Simons. He died last week at 86.

Jim is Chewie’s hero.

Why?

Jim Simons is the greatest market player you’ve never heard of.

His Medallion fund, part of his firm Renaissance Technologies, returned over 30% a year for 30 years.

They called him the Quant King. And no wonder — Jim turned himself into a multibillionaire.

Even more amazing, he didn’t really hit his trading straps until he was in his 50s.

He didn’t follow in the classic footsteps of Warren Buffett or Phillip Fisher.

Simons was a mathematician and a codebreaker before he took on Wall Street.

Bloomberg had this to say…

‘Simons avoided employing Wall Street veterans. Instead he sought out mathematicians and scientists, including astrophysicists and code breakers, who could ferret out usable investment information in the terabytes of data his firm sucked in each day on everything from sunspots to overseas weather.’

Simons loved to smoke and fagged his way through life for 70 years.

Suffice it to say…he trod his own path!

Well done, that man.

That brings me back to Chewie…

We’d never claim he’s the next Jim Simons. No one can be!

But Chewie’s algorithms are still very potent tools.

Let’s take right now as an example…

Should you be aggressive or defensive in your market positioning?

You might be feeling a little wary given the news cycle. The next set of US consumer price data could be ‘make or break’, as the Australian Financial Review penned yesterday.

That data is due this week.

Indeed, there’s a whole list of worries that might be on your mind…

· Geopolitical tension

· The Australian federal budget

· High interest rates

· Depressed consumer spending

· High inflation

· Big debts

And on and on I could go…

It’s enough to freeze you into inaction.

Sometimes it’s enough to put the stock market in the ‘too hard’ basket.

That would be a mistake…at least as far as one of Chewie’s algorithms is concerned.

One of its signals is a measure of stress in the market. It does this using volatility indicators.

Contrary to the list above, and the way you might be feeling, Chewie’s algo is currently signalling very low stress.

This is not to say it can’t change on a dime or go up tomorrow.

But, right now, the market is not pricing in any calamity.

A maths whiz like Jim Simons would say, I imagine, that probability suggests now is a good time to go ‘long’ the share market.

Of course, no trader would use one indicator to make a move with their cash. It’s one brush stroke on a canvas.

Is there another one we can see?

Well, yes.

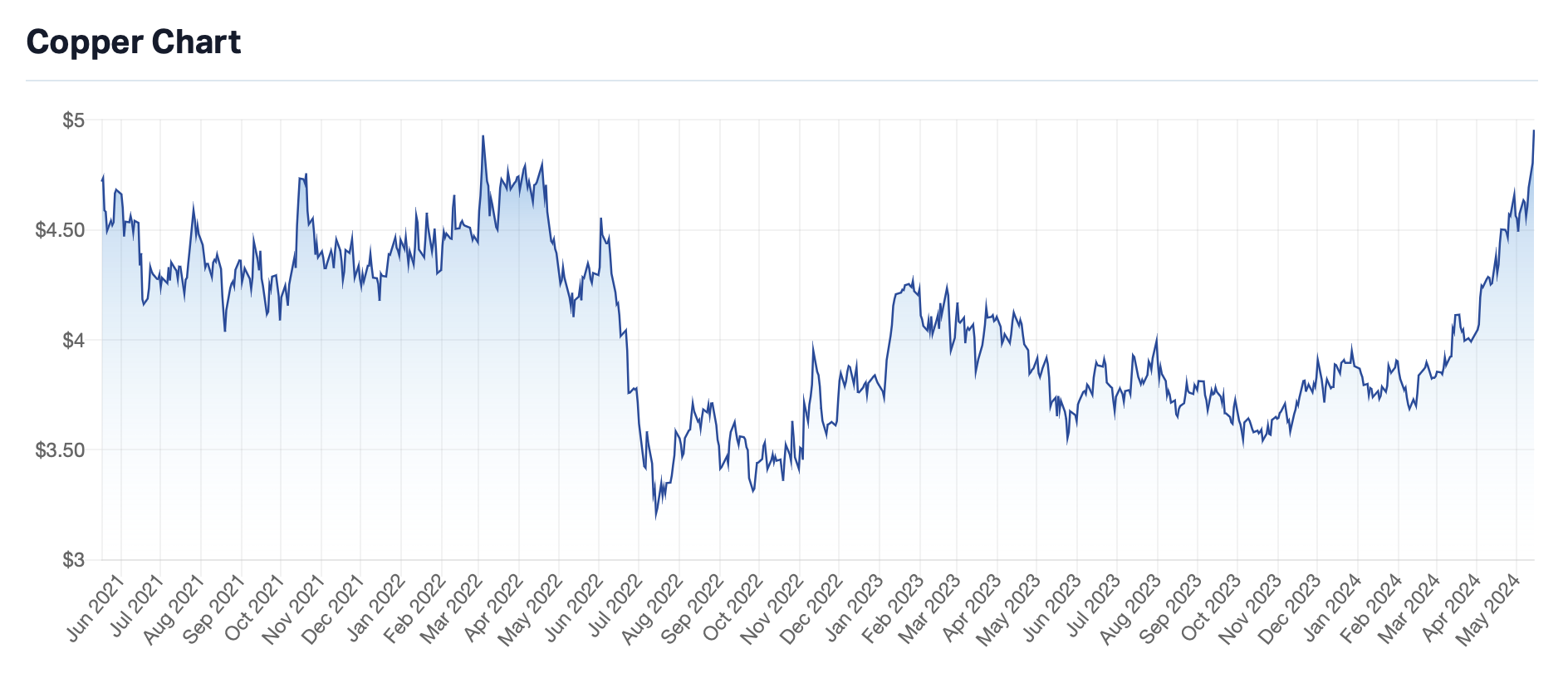

The price of copper is breaking out.

See for yourself…

Some people say that ‘Dr Copper’ has a PhD in economics. It’s such a versatile metal used across the industrial economy that its price is a good barometer for conditions on the ground.

It’s hard to get too bearish with copper moving like that.

Again, it’s not to say copper can’t fall back, or the currently rally won’t fizzle out.

Only, it’s another signal that the share market is likely to be less volatile and risky to the downside than it’s been over the last few years.

This is all part of the case I’ve been making to investors since last year.

We’re moving away from the high volatility and uncertainty that plagued investors over 2022 and 2023.

If you’ve been in the market, or following it, over this time, you’ll know what I mean.

Last year I suggested the market was moving into a period called ‘reviving confidence’. Another way of saying this is ‘Stage 1’ of a new bull market.

That’s what we saw with the big rally between November and March.

Now we’re moving into what I call ‘Stage 2’.

This is when the market is starts chasing stocks that can grow profits, market share and revenues.

I mention copper breaking out above. Look at copper producer Sandfire [ASX:SFR]lately…

The stock has shot up right alongside the copper price.

Again, there’s no guarantee it will keep going up. But it’s been a bankable move — at least up until now.

My subscribers had the opportunity to get on that trade…and it was thanks to another of Chewie’s algorithms.

This one uses machine learning and artificial intelligence to find stocks exhibiting high momentum.

It’s certainly not faultless. Nothing in the market is.

However, it’s an example of how AI is impacting the markets today. And in similar way to Jim Simons pioneered over the last three decades.

There are other ways to exploit AI on the index.

That’s finding companies that can use its benefits in their operations.

I put down five stock ideas in a recent report.

There are no guarantees there, either.

I’m pretty sure Jim Simons would be curious to see if there was an edge he could exploit.

It’s working so far. One of the stocks hit 52-week highs last week. Four out of five are up from their original recommendation. And while there are no guarantees this will continue…

I’d like to think Jim Simons would be chuffed at that.

RIP to one of the best.

Best wishes,

Callum Newman

Fat Tail Investment Research

PS For more investment ideas and analysis, be sure to subscribe to Fat Tail Daily.

2 topics

1 stock mentioned