Income hunters: where to find the best dividends right now

Livewire Markets

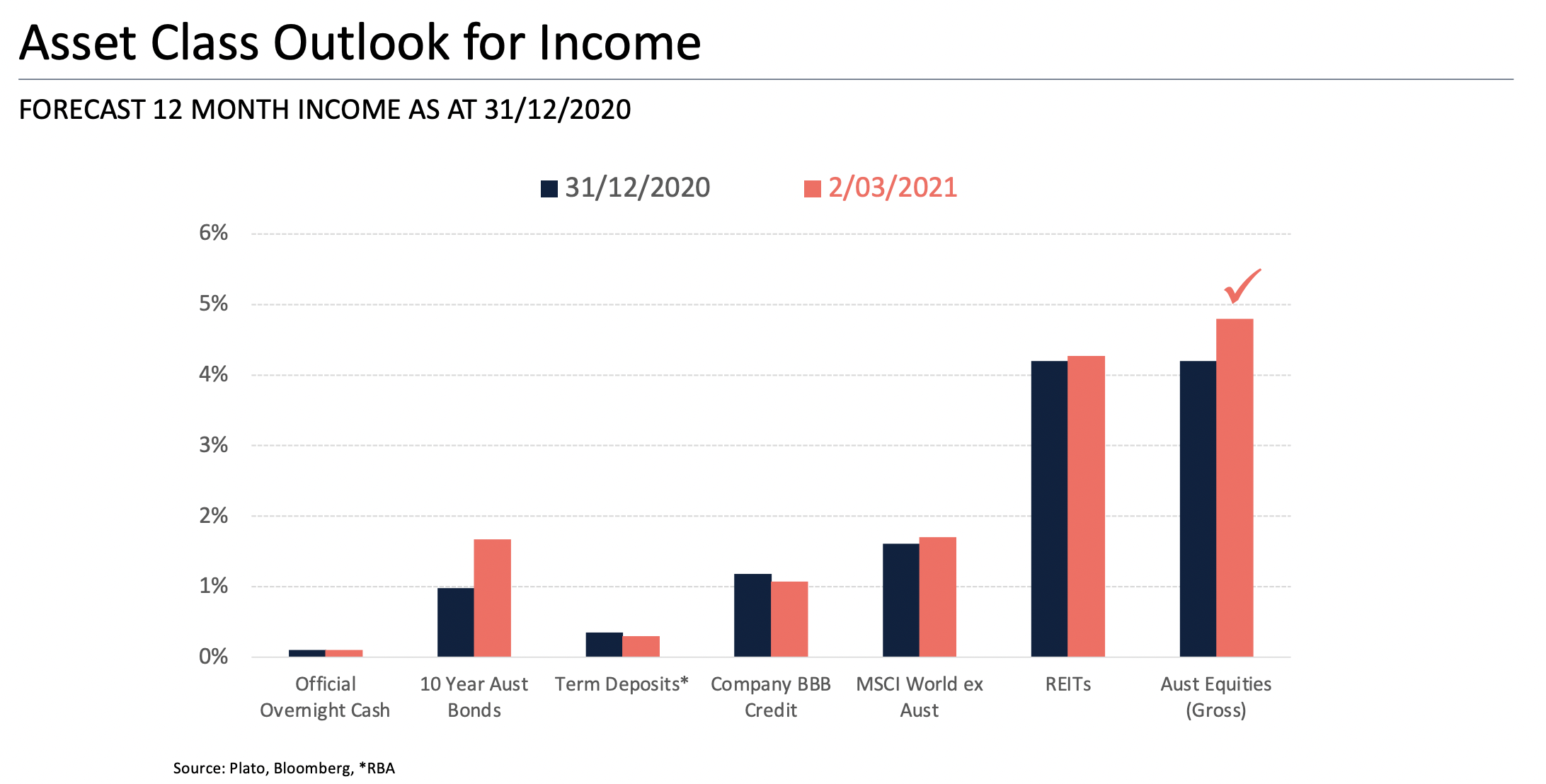

Cash rates are effectively at zero, term deposits aren't providing the income return that investors need but fortunately the Australian equity market is still at an attractive level. After a stellar reporting season for many Aussie equities, Dr Don Hamson from Plato Investment Management explains how he's selected the cream of the crop for dividend payouts.

"There's also been a big rise in the gross yield out of Australian shares because it's been such a good reporting season," said Hamson at a recent Pinnacle Insight Series webinar.

Source: Plato Investment Management.

"We're actually increasing our forecast for dividends in Australia which is good news for retirees, remembering that we're going to target something like 3% higher than what the index is going to give so if it's nearly five, then we're looking at something more like eight (per cent).

The Australian market is changing: Iron ore plays are the new banks

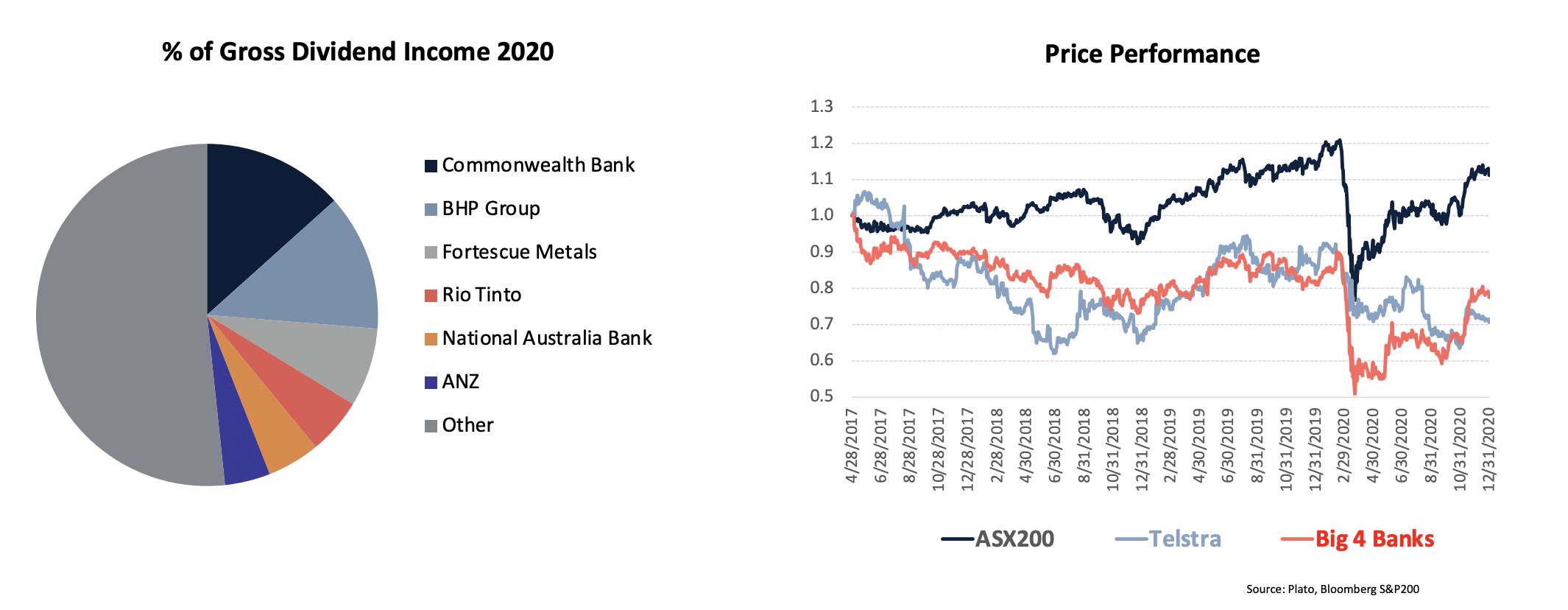

About four years ago the best options for dividends were your typical traditional income stocks, that is, the big four banks and Telstra (ASX:TLS).

"Now if you look at that pie chart, actually, There are only three banks on there, but amazingly, the three big iron ore plays in Australia are actually now in the top six dividend payers which I don't think anybody would have forecast, three or four years ago," said Hamson.

Source: Plato.

How to pick the winners

Banking, mining and retailers: the dividend trifecta

The banks last year were hedging against a much higher level of bad debt. During the pandemic, APRA instructed banks not to pay dividends, although some still did albeit at a lower rate. As the recovery came about APRA has lifted its advice, but the banks are benefitting twice over from paying lower dividends last year when the bad debt never eventuated.

"They've also got increasing dividends because of higher payout ratios on higher profits. So you're going to get a double whammy this year," said Hamson.

Mining, the newer entrant to Australia's top dividend payers have been boosted by iron ore's runaway rally. And this trend is likely to continue. Hamson believes iron ore will continue to maintain its high payout ratios because they're not spending money on capital.

"Iron ore prices have kept up very very strongly. There's great supply and demand...they are now equal with the banks in terms of distributing dividends," he said.

Lastly, retailers such as Harvey Norman, Super Retail Group and Bunnings, to name a few, have been like pigs in mud from the latest consumer spending patterns.

"They're benefiting from working from home and no international travellers so what are you doing to buy a new TV or a new lamp suite," he said.

As Australia extends the national border control, this trend is likely to persist. Australian government's latest forecast is that Aussies won't be travelling until 2022 (although Qantas is a bit more optimistic).

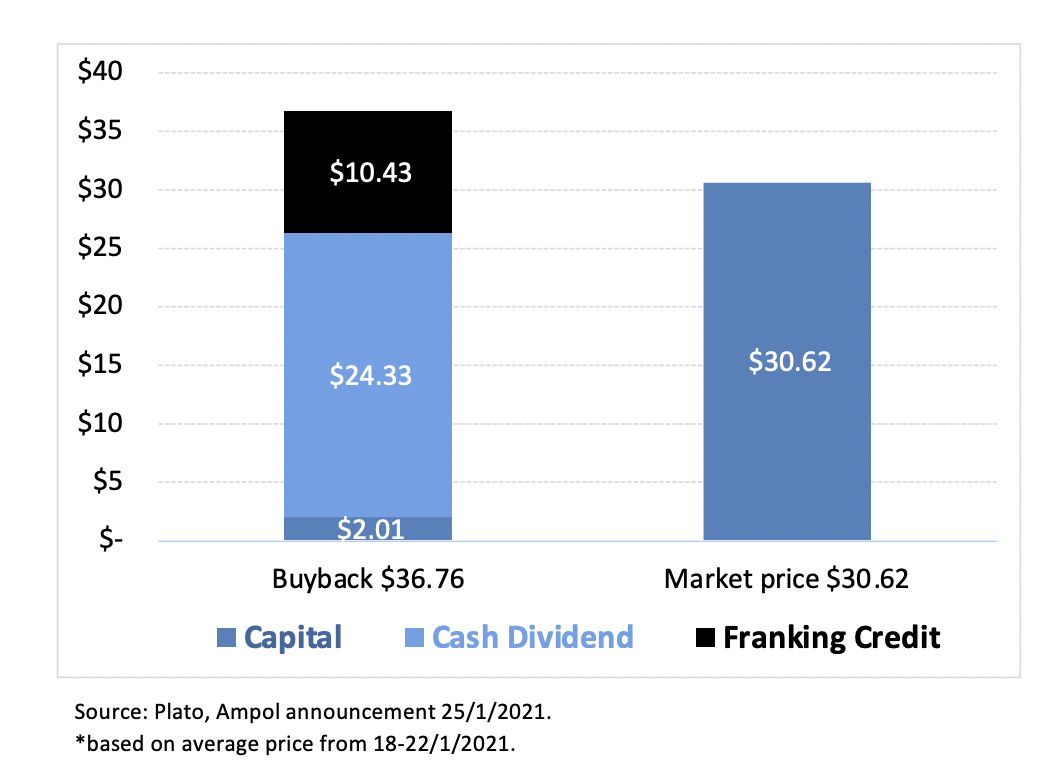

Look for off-market buybacks

Lastly, off-market buybacks can present an outstanding opportunity for investors. If you had bought Ampol (ASX:ALD) shares in January last year, said Hamson, you could have received $30 per share. However, at the time, Ampol was executing a buyback. So, if you'd sold those same shares into the buyback you would have received $2 cash for capital, a $24 dividend and a $10 franking credit refund, which equates to $36 per share.

"Do you want $36 or do you want $30? I think most people would want $36," he said.

How to avoid the losers

Look at the franking credits

Similar to dividends, investors should be looking at a company's capacity to pay out franking credits - it's indicative of the overall health of the company. AGL (ASX:AGL) and Origin Energy (ASX:ORG) both cut their franking credits to zero.

"I think more concerning for us, is AGL cut its franking to zero, so did Origin….its never a good sign that your profits are high quality because you're not paying any tax to the tax department in your tax returns mean you're not you're not making any money," said Hamson.Beware of historical yield

Historical performance may not be indicative of future yield, especially in the dividend universe. G8 (ASX:GEM) is an example of a stock that had a terrible reporting season and had to cut its dividend to zero, despite a historical annual yield of 6.7%. Similarly, AGL's historical performance was an 11% annual yield, but it's now in Plato's bad books.

"Obviously if you cut your dividends to nothing you know you're not going to go too far and you'll lose your capital. Protecting capital is important to shareholders."

Look out for red flags in the market

Is its accounting practices up to scratch? Are there possible environmental issues? Are there any underpaid workers?

"We've looked at a range of indicators around 100 just over 100 now. And what we find is that the more red flags that a stock has if they go six or more they actually have subsequent very poor performance in the next 12 months," said Hamson.

Conclusion

The great reopening of the economy has begun. After one of the strongest reporting seasons, investors can position themselves to reap the rewards from profitable companies that have a good outlook. While Australia doesn't have a very diversified set of options for dividend payout, the changing players at the top show that the market can change.

The entrance of iron ore into the top five players is a significant shift for income hunters and has created a new and sustainable opportunity for the market. Meanwhile, the recovery play has brought retailers to the fore and the post-earnings season glow is warming to those who want reliable income. You can also read more about the "duds and darlings" of reporting season here.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

5 topics

13 stocks mentioned

1 contributor mentioned

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...

Expertise

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...