Income investing done differently: Global reach, lower risk and less volatility

There are other ways for Australians to generate investment income, beyond the well-worn approach of harvesting fully franked dividends from ASX stalwart stocks.

We take a broader view, using a high-conviction, value-oriented process to identify high-quality large-cap companies from around the globe. And with a 16-year track record and around $810 million in funds under management, the Talaria fund generated an average yield of more than 9% p.a. in the last decade.

How did we do this? Our use of derivatives is a key distinction of the Talaria Global Equity Fund. Specifically, we sell a put option for each share we wish to buy, which provides additional income and reduces volatility.

But crucially, there is:

- No use of leverage – if we want $1 million of exposure, we have the same amount in the bank.

-

No counterparty risk – as exchange-traded vehicles, there are always other buyers and sellers.

On the macro front, it’s clear that global markets are now transitioning from a period of elevated capital growth driven by historically high asset prices. In this environment, we believe the importance of income – as a proportion of overall investment returns – will be magnified.

Read or watch below to learn more about Talaria's distinctive approach to global equities income investing, and its potential role within a diversified investment portfolio.

Edited transcript

Hi, I'm Chad Padowitz, co-CIO of Talaria Asset Management. For the past 16 years, we have generated consistent income, lower market risk, and greater certainty of returns through a differentiated approach to global equity investing. Our objective is to compound real wealth over time, and we do this via a strategy of investing in 25 to 40 global companies from developed markets, using our strong Value orientation.

Established in 2005, we now manage over 750 million dollars, and over the last 10 years have averaged over 9% a year in income, highlighting our differentiated approach to investing,

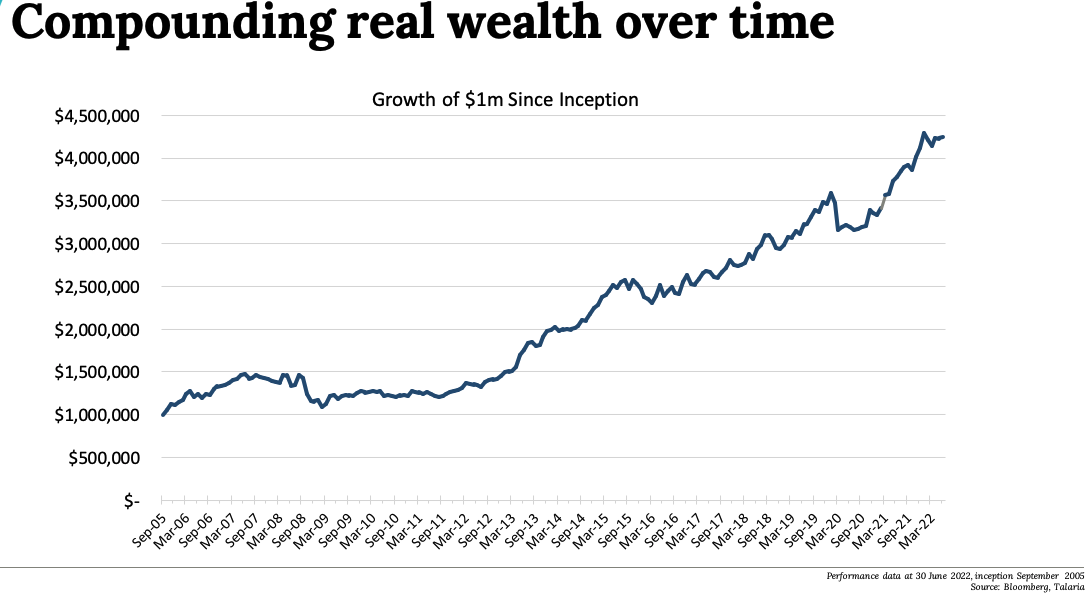

We are on all major platforms, while also offering an active ETF, meaning investors can access us via platforms, through our responsible entity, or via a stockbroking account. As discussed, our objective is to compound real wealth over time, and as you can see, we have continued to deliver against that and this covers multiple market environments.

It's important to remember that our investment process is a bottom up fundamental one, and the investment team has over 120 years of collective investment experience. And once a share goes through our rigorous investment process and is added to our portfolio, we apply a differentiated approach in implementing that.

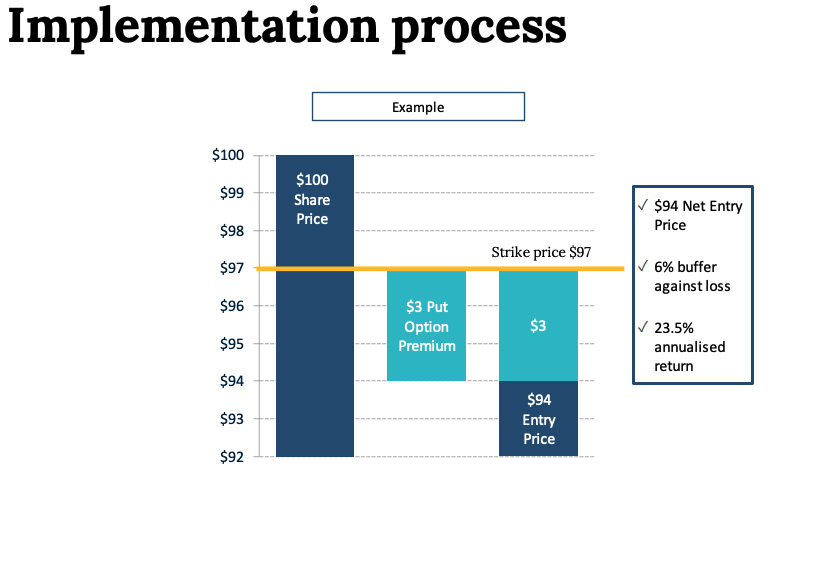

Every share we own, or seek to own, begins life as a put option. That process is shown in the image below.

Let's assume a company we want to own is trading at a hundred dollars a share, and we believe it's worth $120. Rather than buying that share directly, we sell a put option, which is an obligation on us to buy that share for $97 in two months’ time. For that obligation, we get paid $3, an option premium. This means that, in two months’ time, if the share is above $97, we won't get it. But importantly, we keep the $3 premium.

But if the share price falls below $97, we do get it, while also keeping the $3 premium, so our net cost is $94. So, as you can see, there is a 6% buffer against the loss. This is to get a share that if we do end up owning, we believe it's worth 120, so we're happy to own it. And we get this $3 income regardless, which annualises at close to 20% a year.

Importantly, there are things to remember about our implementation process and approach to risk.

There is no leverage. So if we want a million-dollar exposure, we've got a million dollars in the bank.

And secondly, these are exchange-traded options, so there is no counterparty risk.

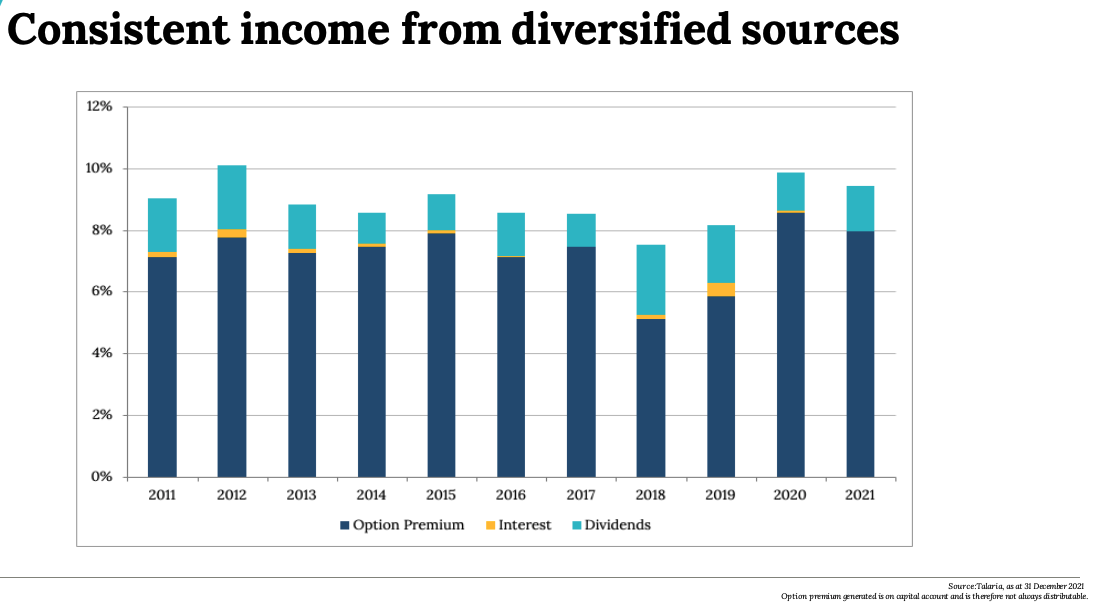

Our process achieves three important outcomes. Firstly, a consistent level of income from diversified sources. As shown in the below chart, the option premium we generate in dark blue is a very high and sustainable number. When combined with dividends and some interest, this produces a very high consistent income component, which compares favourably to other equity funds.

Secondly, we provide a structurally superior risk-return profile, capturing most of the up, but much less of the down, meaning you have far more money working for you when the market ultimately recovers.

And lastly, we deliver lower volatility. The journey matters. We have significantly lower volatility than most other equity funds and the index.

Talaria's performance in the current context

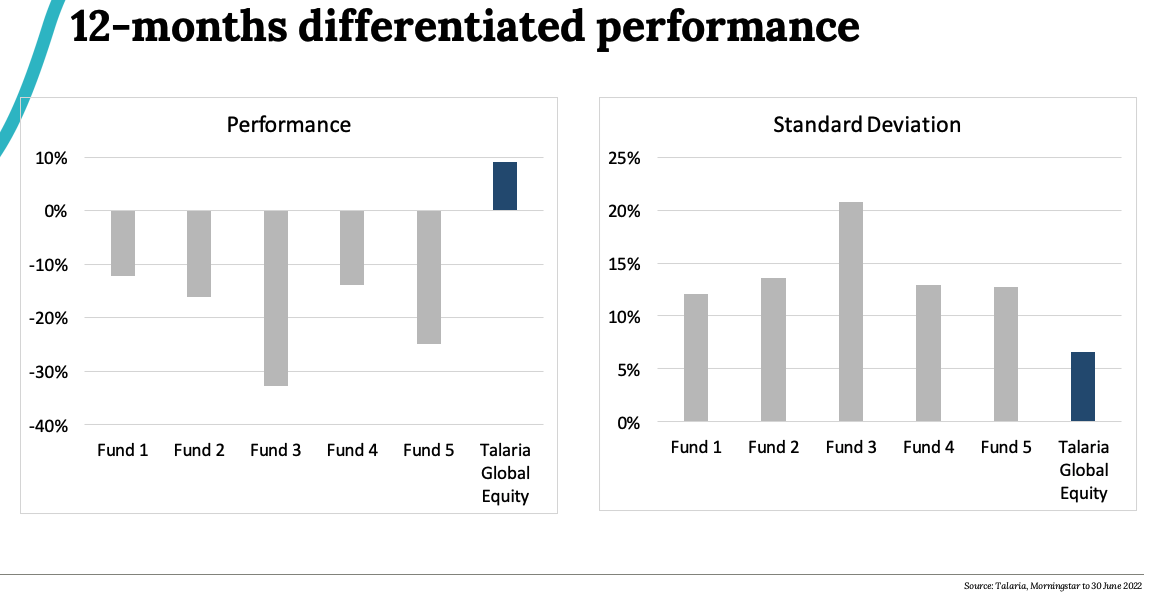

It's important to contextualise the Talaria Global Equity Fund in the 2022 financial year, which is a highly challenging one for global equity markets. And what we have done is we've compared our performance and our volatility against those of the top five Australian-based global equity funds by inflows for the 2021 year.

The Talaria difference

It’s not just our performance that is superior, but the way this is delivered with far lower volatility. We know that many of our investors look to blend us with growth managers. In this context, it's worth highlighting our very low correlation to NASDAQ, which means investors can achieve our high level of diversification by including Talaria into their portfolios.

Income versus valuation - The bigger picture

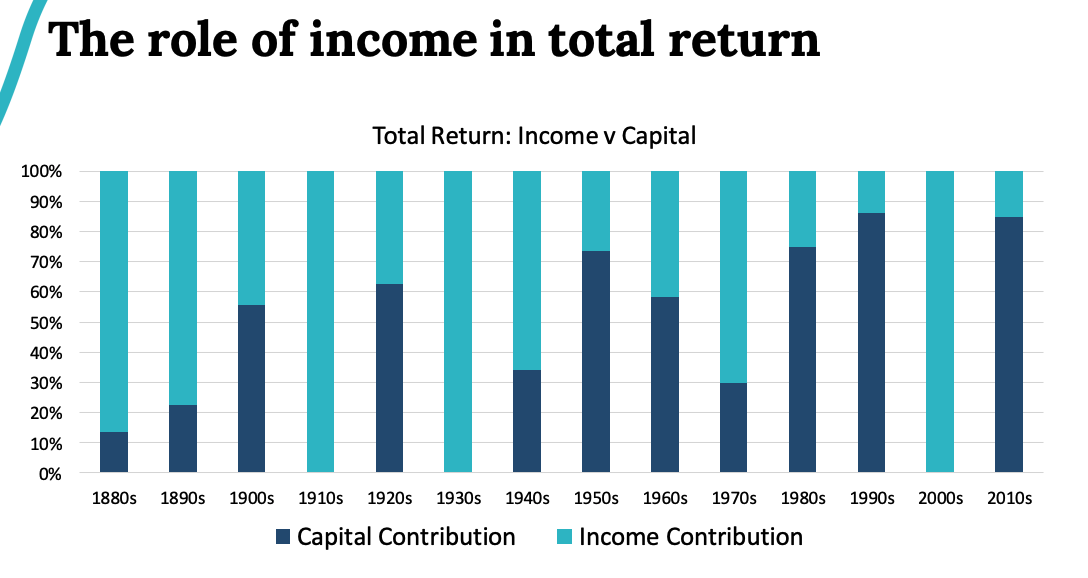

We've been talking about Talaria specifically, but now I'd like to zoom out and talk a little bit about income and valuation. What you can see here is the total return by decade over the last 140 years. And what you can see in the light blue is income and dark blue is capital contribution. What's very obvious is that every single decade income matters and does contribute, but capital doesn't actually contribute every decade. In fact, there's been three, the 1910s, 1930s and more recently the 2000s where you had no return from capital appreciation.

The importance of income usually increases after a period where capital gains have been very strong, as you can see in the above graphic.

And the most recent period is certainly one of those environments, which leads us to believe the decade we're currently in is very likely to be one where capital gains will be a far lower contribution of return, highlighting the importance of income.

Looking at valuation across regions, across sectors, one can see there is quite a big difference between these. And in an environment where much of the market is very expensive, it is important to take these into consideration as we do about where investors allocate their capital.

In summary, I'd like to leave you with the following slide, which highlights the key benefits of the fund and how we've been able to help clients and communities enjoy a more certain financial future for more than 16 years.

For more information, please head to our website or get in touch with a member of the sales team – and thanks for watching.

A little certainty can be empowering, especially in volatile times

For more than 16 years Talaria has been delivering a greater certainty of returns through its unique and alternative approach to global equity investing, with over 9% p.a. average income distribution for the last 10 years, low volatility and lower market risk.

2 topics

1 fund mentioned