Inflation and the US Dollar Devaluation

After a recent trip to Argentina over the Christmas break, we couldn't help but notice the relentless rise in prices the country has experienced in recent years. This inflation was evident at one of the restaurants we ate at.

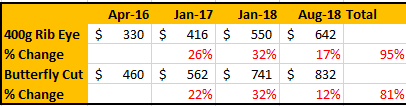

Below are prices (in Argentina Peso) from a restaurant we visited. These historic prices we got while looking at photos posted to Trip Advisor of the menu. We have singled out a couple consistent menu items to show the inflation that has been experienced.

In total since April of 2016 to August 2018, the price of these steaks had increased by 95% & 81% respectively. As you can see from the below chart, the price of the Argentinean Peso relative to the US Dollar has collapsed.

Argentina, like a lot of other emerging economies, has had many issues. After the economy fell into recession, the currency decreased substantially as investors fled the country. This has made the inflation a problem as wage inflation hasn't kept up with cost inflation, causing rising unemployment and increasing social issues.

During times of inflationary turmoil, many countries turn to the mighty US Dollar - The 'reserve currency' of the World. The stability of the US Dollar has given the US economy a somewhat privileged position. One we believe may start to be tested in the years ahead (China is already starting to try muscle in on this position and even provided a loan to Argentina).

Looking at the US, we have concerns about their own economic conditions and the rising risk of a forthcoming recession. With record levels of debt and a widening budget deficit, it's highly likely investors may begin to question their ability to be paid back.

Typically during economic good times, governments should be responsible and pay down debt and reduce budget deficits. The US has done the complete opposite and now as the risk of recession rises, the ability to repay this debt looks incresingly more difficult.

As investors realise the US can't repay their debts without printing dollars (or inflating their way out of the debt) they may start to shy away from the mighty US Dollar. This could cause rising interest rates, further exacerbating the problem of the interest burden.

We ask the question: How willing will investors be to finance this deficit when concerns about inflation rise?

So while most investors we encounter are bullish the US Dollar and don't share our inflationary concerns... Maybe they should take a trip to Argentina?

4 topics