Inflation was the focus - then global banking broke

If you thought this week was all a blur, you aren’t alone. This time last week, everyone was just learning what Silicon Valley Bank even was. Fast forward seven days and the main question has shifted from the high pace of inflation to the low health of the global banking system.

All this week, the Morning and Evening Wraps have been covering the global banking crisis as one domino fell after another. But we acknowledge that it’s been a massive task just to keep on top of the headlines. So in aid of that problem, we’ve compiled a list of the pivotal moments over the last week. We’ll also look ahead to two huge central bank decisions next week - and conveniently, they are the decisions of the US Federal Reserve and the Swiss National Bank.

It (was) a wonderful life

The whole saga started with a classic bank run at Silicon Valley Bank. The bank, which had big money VCs and startups as its main client base, experienced a collapse in confidence following an SEC filing that caused rumblings across the US financial system.

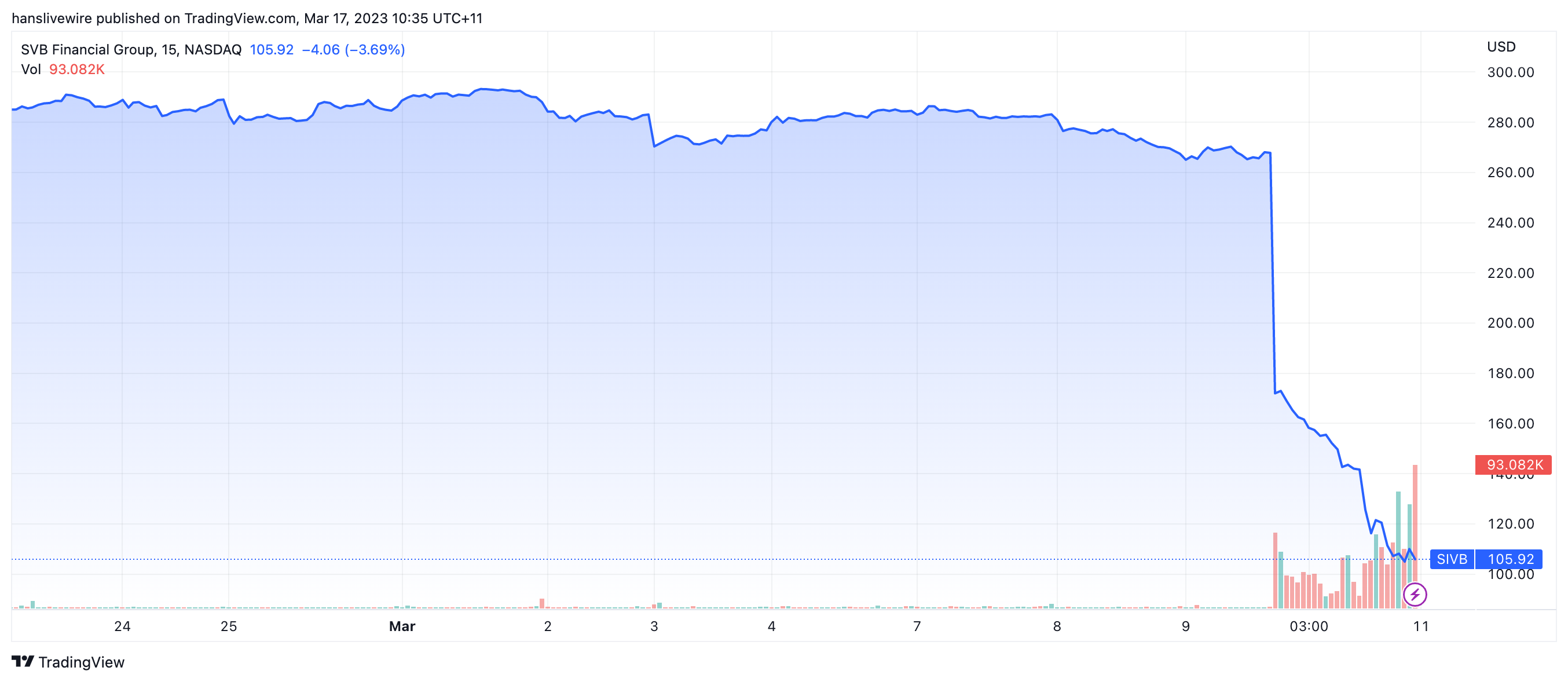

The filing showed that SVB needed to execute a $1.75 billion capital raise after it needed to sell off a lot of long-term Treasuries and mortgage backed securities to beef up its balance sheet. Selling these before maturity would normally not be a problem in a zero-interest rate world. But when the Federal Reserve has hiked rates by 450 basis points in under a year, that’s not good for the valuation of those assets.

In 48 hours, the bank went from being a public company with a $267 share price to being taken over by state banking regulators.

Who’s exposed to what?

The problem has spread far beyond Silicon Valley. Most of the bank’s customers have balances beyond the $250,000 limit that is insured/guaranteed by the state regulator. Among the list of companies with exposure to SVB - Roblox, Roku, and crypto-focussed Circle just to name a few.

Locally, several ASX tech small-caps as well as unicorn Canva all have holding accounts with SVB. Some of these small-caps have since informed the market that they have been able to retrieve their cash.

What did the insiders know?

Soon after (and by soon, we mean the following Sunday US time), federal regulators said they would guarantee all deposits of all sizes. In effect, a bailout. The collapse will go down as the second-largest in US banking history…. For now.

The US bank is, as of writing, up for sale. No one (unsurprisingly) wants it. But its UK bank was bought by HSBC for the token sum of £1. A relief for SVB, and a deal not looked upon too favourably by HSBC shareholders.

Now, in a normal world, that’s plenty for management to deal with. But it turns out that may not be all they will have to answer for. CNBC has done some digging and found out that executives at SVB have dumped tens of millions in stock over the last two years. Alarm bells, anyone?

If that wasn’t enough…

All of these headlines so far are about SVB. But you may have forgotten that there was another bank collapse hours after it - Signature Bank. New York regulators closed it before a bank run could take place. Signature is slightly different from SVB in that its customers are more corporate clients than startups and, most importantly, a lot of Signature’s assets are in the cryptocurrency market.

Customers in that bank have since moved their money to the larger alternatives of JP Morgan and Citigroup. Regulators have treated Signature Bank the same way as SVB - that is, all deposits are guaranteed and the bank is up for sale. As of writing, no one has bought them either.

Regulators have given any parties until tomorrow, Sydney time (Friday US time) to express interest in buying out either SVB or Signature Bank.

Will there be a third collapse?

Oh, and by the way, there’s a third bank at risk if regulator actions are anything to go by. It’s important to mention that this next bank has not collapsed but the fact that regulators have stepped in isn’t exactly confidence-boosting.

A consortium of Wall Street’s largest banks including Bank of America is stepping in to ensure the deposits of First Republic Bank. First Republic is different again to the other two cases we’ve discussed so far - namely because its clients aren’t corporations or VCs - they’re actually wealthy individuals (Meta’s Mark Zuckerberg among them).

The total amount of those deposits is US$30 billion. But will that be enough?

And then, there’s Credit Suisse

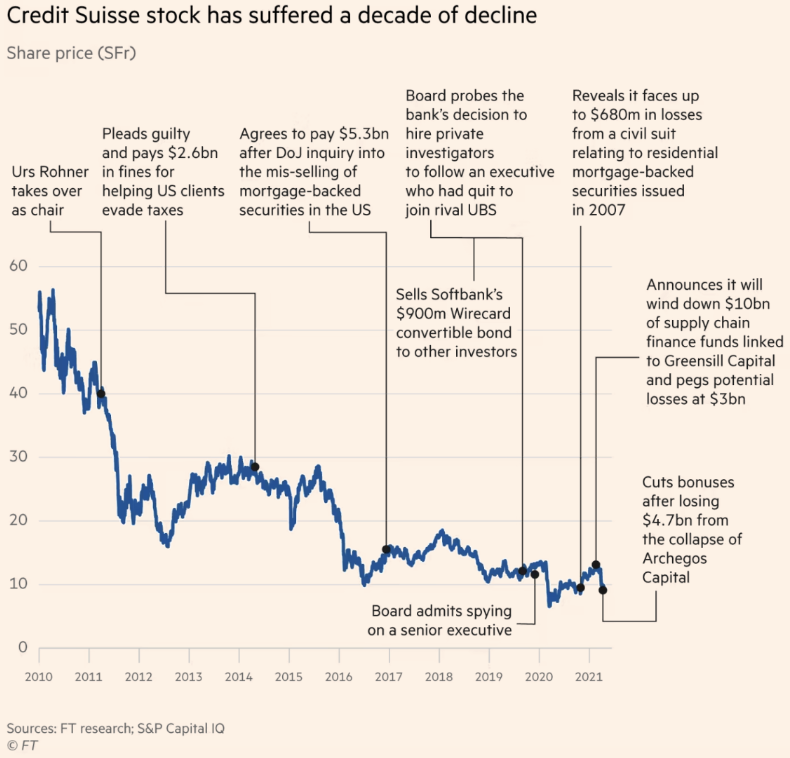

The beleaguered Swiss bank has had a litany of troubles in the past 10 years. I’d be here all day if I explained it to you, so here’s a chart from the Financial Times that does the job much better than I can:

Fears over the banking crisis in the US had spread to other banks around the world, but the spotlight was focused on Credit Suisse given its decade of troubles. The lack of trust and credibility is best seen in the outflows over the last couple of years. It doesn’t help that their largest non-central bank shareholder (the Saudi National Bank) has explicitly already said it won’t provide more funding.

To stop them from going under, the Swiss National Bank stepped in with a CHF50 billion covered loan facility along with a second short-term liquidity facility.

All this is complex talk for saying that the Swiss National Bank cannot afford for Credit Suisse to fail. One, because Switzerland only has two major banks (merging with UBS has already been ruled out) and the other being that the ECB can’t afford to have a European “Lehman moment” right when it’s in the fight against surging inflation.

So, what happens now?

The corporate headlines will keep coming through as they break but for the immediate big picture, there are two major risk events coming up that just became super-risk events. Both are central bank rate decisions and both put financial stability right on par with inflation for topic de jour.

The Federal Reserve decision is handed down next Thursday morning AEDT. All the talk about a 50 basis points hike has been shelved and replaced with talk of either a pause or a 25 basis points hike.

While some research houses (Principal Global Investors, Bank of America, Goldman Sachs etc) have no problem with the Fed pausing hikes this once, others (Citi, Morgan Stanley etc) do think they should push ahead anyway. It’s a classic case of will they “hike until something breaks”.

The Swiss National Bank will also meet next week. But if you thought the talk for a pause in Washington was crazy, spare a thought for the consensus of Swiss economists who think the SNB could either pause or - get this - jumbo-hike rates again. And it’s now officially a line-ball call.

Next week is going to be absolutely nail biting - and we’ve got you covered every day.

Get ahead of the game. Subscribe to Australia's best market wrap written by the team that really knows financial markets.

5 topics

1 contributor mentioned