Insider Trades: Biotech director offloads $15m of stock (and 3 other sells, 4 buys)

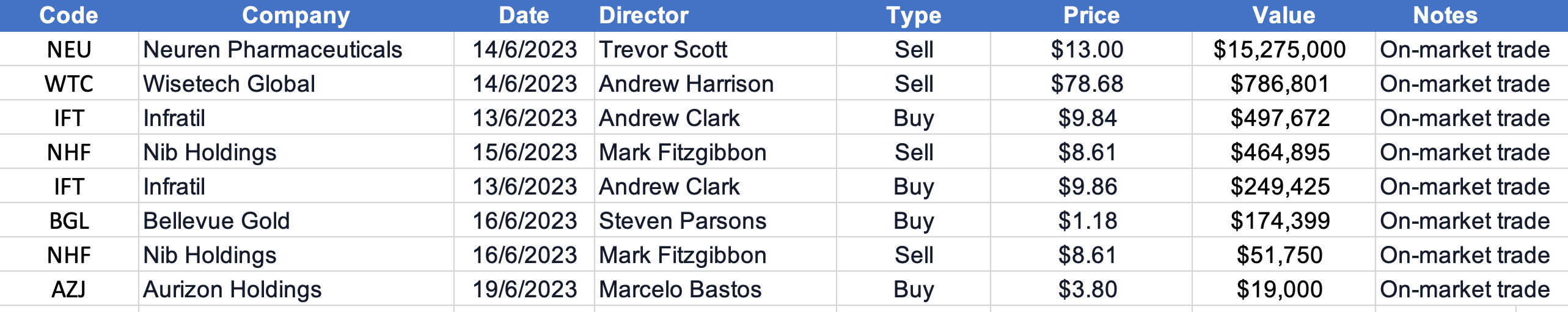

Welcome back to the Insider Trades series, a summary of director transactions – those on-market trades valued above $10,000 – that have taken place between 12 June and 19 June 2023.

Among ASX 200 companies, transactions meeting the above criteria this time around were evenly split between “buys” and “sells” – with three of each. And in the mid-caps (companies sitting in the lower third of the ASX 300 in terms of market cap) we saw one buy and one sell.

Multiple transactions from inside the same firm occurred twice last week, at infrastructure investment company Infratil (ASX: IFT) and health insurer Nib Holdings (ASX: NHF), where $747,000 and $516,000 worth of stock was bought and sold, respectively.

Neuren Pharmaceuticals (ASX: NEU)

By far the largest insider transaction on the ASX last week was among the mid-caps. Trevor D. Scott, non-executive director of Neuren Pharmaceuticals, sold more than $15 million dollars worth of the biotech’s stock. This came just a couple of months after the drug maker received US Food and Drug Administration approval for DAYBUE, a treatment for the rare neurological disorder Rett syndrome.

The company was called out as “overhyped” by Yarra Capital’s Katie Hudson in a recent episode of Livewire’s Buy Hold Sell.

Wisetech Global (ASX: WTC)

The next-biggest transaction – around 20 times smaller in dollar value terms – was at logistics software firm Wisetech. The $786,000 stock sale by non-executive chairman Andrew Harrison is his first on-market transaction of the company’s stock in 2023 so far.

Wisetech CEO Richard White has sold $22.7 million worth of his company’s stock, in four tranches, since early February.

Regardless, the logistics software company is the pick of the local tech sector for Morningstar’s sector analyst, Dr Roy van Keulen - who awards the company a narrow moat of competitive advantage and a price target (what Morningstar terms “fair value”) of $90.

Infratil

The latest stock acquisitions by Andrew Clark last week mean the infrastructure investment firm’s director has scooped up more than $1.2 million worth of the company’s shares in the year so far.

Earlier this month, Infratil announced the NZ$1.8 billion acquisition of a 49.95% stake in One NZ, New Zealand’s largest telecommunications company – a transaction partially funded by a NZ$100 million capital raise.

Nib Holdings

The health insurer’s CEO Mark Fitzgibbon sold more than half a million dollars worth of his stock in the firm over two days last week. Fitzgibbon has led Nib – the fourth-largest in its category – since 2002, heading up a firm that Auscap Asset Management’s Will Mumford believes is a “high-quality defensive business.”

This article was originally published on Market Index on Wednesday 21 June 2023.

3 topics

4 stocks mentioned

2 contributors mentioned