Investing in a millennial world

LGT Crestone

In recent years, millennials have increased their footprint in the investment world. There are a number of reasons for this, including the unfolding significant inter-generational transfer of wealth, a growing pool of young entrepreneurs who are millennials, their better understanding and access to investment information, and their focus on technology. Millennials have had the benefit of coming of age at a time when globalisation, technological change and economic disruption have accelerated.

As millennials have risen in prominence, there has been increasing pressure on the investment world to provide more choice, reduce fees and invest responsibly. In this article, we explain the process for developing an investment strategy for a millennial investor. We outline the key factors we consider at each stage of the portfolio construction process—including understanding the millennial investor’s objectives, developing an appropriate asset allocation, selecting instruments, and managing risk.

Millennials are shifting the investment landscape

Millennials can be broadly defined as those born between 1980 and 1994 or currently between the ages of 27 and 41. They have overtaken baby boomers as the largest living generation. According to KKR, 68 million millennials in the US are now at an age where they are buying houses, spending on their families and shifting consumer preferences. In Asia, there are more than 800 million millennials. Importantly, millennials will account for 75% of the workforce by 2025.

Millennials as a percentage of each region’s total population

Source: United Nations 2019.

Investment strategies have been fairly rigid in the past and this has meant limited flexibility for millennials who wish to adopt a differentiated investment approach. This has happened for a number of reasons and led to millennials increasing their footprint and driving freedom of expression in their investments. A critical point is that millennials tend to have a longer-term investment horizon, an element that allows for flexibility with their investments.

In our flyer, From founder to investor, we provide a guide to how investors should think about investing, so they can align their financial assets with their objectives and values. We explain that, regardless of where the money has originated, grouping one’s overall wealth into different buckets (personal assets, core investments, and personal interest investments) is a good starting point, as it allows investors to plan for the long term.

The typical millennial investor

For the typical millennial investor, investing tends to be more than just about achieving a financial outcome.

The typical millennial is also driven to invest in causes aligned to their values, beliefs and priorities, as well as themes they have an interest in.

To this end, sustainable investing and thematic investing are areas many millennials are passionate about. According to Factset, 70% of millennial high-net-worth investors expect their wealth managers to screen for ESG factors, and 67% believe investments “are a way to express social, political or environmental values” (US Trust research Insights on wealth and worth, 2014).

At Crestone, we define sustainable investing as investing in companies with sustainable business practices, with the aim of maximising risk-adjusted investment returns over the medium to long term. Sustainable investing is a broad term, which can stand alone or can include complementary or sub-strategies like environmental, social and governance (ESG) investing, values-based investing, and impact investing. Importantly, sustainable investing doesn’t mean settling for lower returns, and research shows sustainable investment returns have kept up with, if not outperformed, the broader market over the long term. For more details, see our Observations piece Can an eye to ESG enhance long-term portfolio performance?

In terms of thematic investing, there are a number of themes millennials have developed a strong interest in, ranging from technology to health. Some of the popular themes are illustrated below. The Indxx Millennials Thematic Index, a widely used benchmark for millennial investing, identifies key demographic and consumer behaviour trends that are characteristic of the millennial population. The index targets key spending categories, ranging from clothing, entertainment, travel, education and health and fitness. While this index is a good guide to establishing a measurement tool, it does not quite encompass all the themes millennials have an interest in.

While some millennials are driven to invest in themes because of a genuine passion, others are driven by the ‘fear of missing out’ and herd behaviour. This has led to large flows into certain themes, particularly in the social media age, which has led to ‘bubbles’ in certain investments.

One such example is cryptocurrency, where supporters initially focused on concerns regarding fiat (or paper) money’s ability to hold its value, given zero interest rates and aggressive money printing by global central banks. Demand drivers then swiftly shifted to distrust of governments and banks—and eventually, a simple fear of missing out. More positively, there is less debate over the potential for crypto technology to facilitate decentralised, secure and anonymous transactions via blockchains in a way that has material societal applications—and some millennials recognise the value in that.

The visual below provides an overview of some of the themes that we have identified to be of interest to millennials.

Typical themes millennials

are interested in

Source: Crestone Wealth Management.

Constructing portfolios that satisfy the millennial brief

Our portfolio construction process begins with asset allocation then drills down to instrument selection. Our in-house millennial illustrative portfolio has a combination of funds, direct instruments, active/passive management, exchange-traded funds (ETFs) and exposure to various themes. The portfolio also utilises our in-house direct equities millennial list. This equity list provides investible ideas exposed to the themes discussed earlier.

Asset allocation reflects a longer-term investment horizon

One of the most important aspects of being a millennial investor is ‘time’.

Millennials have plenty of time on their side to harvest growth. With a longer-term investment horizon, they can potentially tolerate more volatility and more illiquidity than other investors, which means they can invest in portfolios with a higher proportion of growth assets and higher levels of illiquidity than other investors.

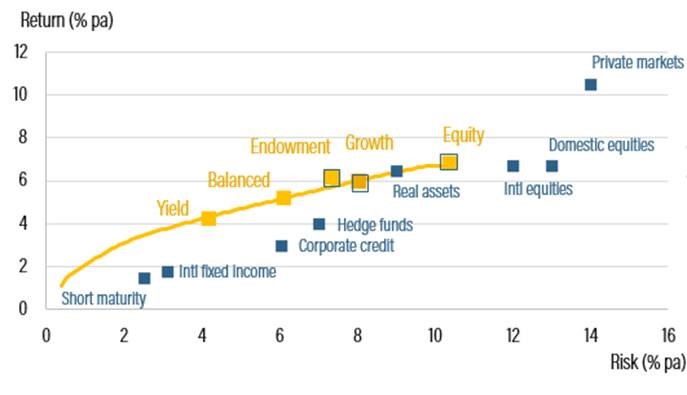

At Crestone, our asset allocation process begins with the formulation of

five-year forward-looking expectations of return and risk for each asset class,

as well as the expected correlations between those asset classes. Quantitative

analysis then helps drive the efficient frontier, which is the subset of all

possible portfolios and which maximise returns for a given level of risk. This

aspect of our portfolio construction process does not change. Below is an

illustration of where millennials would generally be expected to sit on the

efficient frontier, with equity (aggressive), growth and endowment-style

profiles best suited to their requirements. However, for those investors who do

not fit within these categories, we can build a bespoke asset allocation to

align their investments with their objectives, risk profile and values.

Millennials typically have endowment, growth or equity risk profiles

Source: Crestone Wealth Management.

Millennials have greater investment choice at their disposal

With more information at their fingertips, millennials have shown an overwhelming desire to be in the driving seat when it comes to dictating how their money should be invested.

Millennials have shown a keen interest to differentiate themselves, even within the constraints of risk-adjusted returns and asset allocation.

Pressure from millennials and other groups of investors over the years has driven the investment world to provide more choices in terms of instrument selection. Now, millennials have a range of investment choices at their disposal, including funds, direct instruments, active/passive investments, as well as the ability to invest in particular themes, such as sustainability and disruption.

Millennials have also shown a bias towards lower fees and anti-establishment, particularly in more predictable parts of the market, such as equities and bonds. This is understandable considering the difference fees can make to an investment balance over time from a compounding perspective. This lower fee bias has driven the popularity of index investments, with significant inflows into ETFs over the past decade. Smart strategies tend to have a good mix of ETFs, direct investments and actively-managed funds strategies. Typically, managed funds have clearly defined policies around how they treat sustainability and manage risks. For more specific investment requirements, investors have an option to directly invest in instruments that suit their investment goals and beliefs.

Risk needs to be mitigated by building a diversified investment portfolio

A number of the themes millennials focus on tend to be correlated in an investment sense and some can be prone to investment ‘bubbles’. We look to mitigate risk by building a diversified portfolio that limits reliance on a particular outcome to deliver results. The first layer of defence is asset allocation; a diverse multi-asset portfolio with a mix of growth and defensive assets. The efficient frontier chart in the previous section highlights our recommended asset allocation, which maximises risk-adjusted returns. From an underlying investments perspective, investments are sized proportionately to expected risk. In practical terms, investments that exhibit high volatility patterns and a high degree of variance from desired benchmarks are sized smaller than those with lower volatility. Generally, unlisted investments, particularly in the alternatives space, will help dampen the volatility or risk profile of the overall portfolio. An emphasis on ‘quality’ (sound management, low debt, recurring earnings etc) is prudent in this part of the market to reduce risk. The reality is there will be investments with high risk of impairment should the theme they are leveraging not prove fruitful. There are other sophisticated ways to manage portfolio risks through the use of derivatives, but investors need to weigh the cost versus the benefit. For investors with a long-term investment horizon, the benefit of such strategies tends to be minimal compared to the cost.

Conclusion

Millennials have continued to increase their footprint on the investment world and this trend is only likely to grow. There has been increasing pressure on the investment world to provide more choices, reduce fees and invest responsibly. Millennials can have the best of both worlds, investing responsibly and thematically, while still achieving their desired investment outcomes. At Crestone, we construct portfolios for millennials that can satisfy the brief, while also ensuring that risks are managed appropriately.

Learn what Crestone can do for your portfolio

With access to an unrivalled network of strategic partners and specialist investment managers, Crestone Wealth Management has one of the most comprehensive global product and service offerings in Australian wealth management. Click 'follow' below for more insights.

2 topics

With 12 years in financial markets and managed investments research, Stan works closely with Crestone’s investment advisers to understand individual client goals and to deliver suitable portfolios.

Expertise

With 12 years in financial markets and managed investments research, Stan works closely with Crestone’s investment advisers to understand individual client goals and to deliver suitable portfolios.