Investing in graphite: A comprehensive guide for ASX investors

Graphite – It makes up almost half of a battery’s mass (some 7-10 times the amount of lithium), but it’s arguably one of the most unloved metals out there.

In this wire, we will provide a concise guide for graphite for investors, including:

- A brief overview of the commodity.

- Supply and demand dynamics.

- Outlook for graphite prices.

- Key ASX-listed graphite companies.

- Why it’s not receiving any love.

Graphite: An Overview

Use case: Approximately 60% of graphite production goes towards pencils and heat-resistant refractory materials such as crucibles and moulds. 20-25% is used as an anode material in lithium-ion batteries, according to the US Geological Survey. The rest goes towards a variety of other applications such as lubricants, brake linings, and other industrial products.

Graphite prices: Graphite prices peaked a decade ago. The market has spent most of the past decade in a surplus due to oversupply and weak demand from key industries such as steel and refractories. The market started to inch towards a deficit in 2017-18 as the demand for graphite in lithium-ion batteries started to grow.

Understanding grades: Graphite is typically classified based on the size of its flakes, measured by the number of microns in diameter. The most common ones include:

- Jumbo flake (more than 300 microns in diameter) which is considered relatively rare and high cost

- Large flake (150-300 microns)

- Fine flake (less than 75 microns)

The prices can vary substantially, with price spreads of up to US$1,500 a tonne between flakes.

Downstream products: There are also some other mid-stream and downstream products you might frequently come across, including:

- Spherical graphite: A high-purity product produced via a process called micronisation. It is used primarily as a key component in lithium-ion batteries and other high-tech applications.

- Graphene: A single layer of graphite atoms arranged in a hexagonal lattice. It's extremely thin, strong and conductive.

- Expandable graphite: A form of graphite that can be expanded when heated, resulting in a highly fire-resistant material.

Natural vs. synthetic: Graphite is produced from two sources. Natural graphite is a naturally occuring mineral and available in different grades (above). Synthetic graphite is produced from a complex process that involves heating carbon-based materials such as petroleum coke, coal-tar pitch, or oil in a high-temperature furnace. The process causes the carbon atoms to arrange themselves into the same structure as natural graphite.

Grades vs. ESG: Synthetic graphite is currently the largest supply source (~60%) of graphite by mass. Synthetic graphite can also be manufactured to have higher purity than natural graphite, which makes it ideal for high-performance applications such as lithium-ion batteries and nuclear reactors. However, producing synthetic graphite is more expensive than natural graphite and a carbon intensive process.

Graphite: Demand and Supply

All about Chinese supply: China currently produces ~70% of natural graphite and ~60% of synthetic graphite globally, according to Macquarie. Downstream, they also produce more than 80% of global battery anodes.

But also Chinese demand: From a demand perspective, China consumed over 70% of the world’s graphite in 2022, according to the US Geological Survey. This was driven by broad-based demand for both EV batteries and industrial applications.

And why that’s a problem: “During 2022, China moved to a net importer of flake graphite reinforcing its strategy to dominate the anode supply chain end-to-end. This has resulted in increased demand for ex-China supply sources and with sustainability a key requirement of any new supply sources,” says Evolution Energy (ASX: EV1) Managing Director Phil Hoskins.

Graphite: So Far in 2022

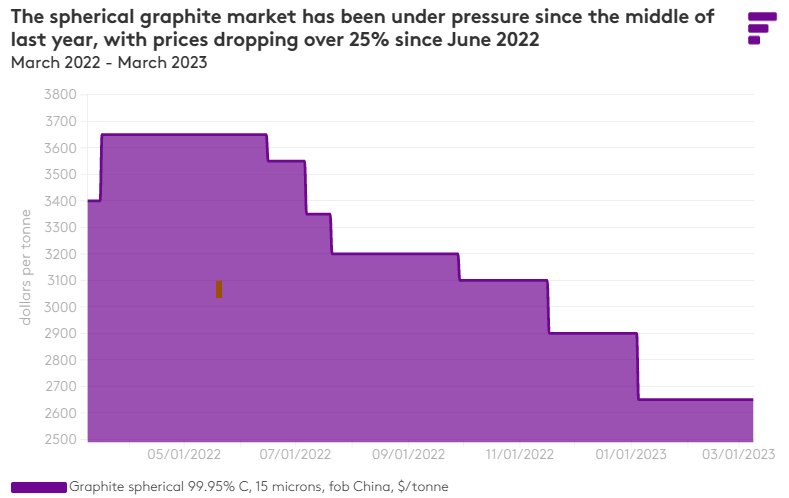

Graphite’s had a pretty rough start to the year after spot prices experienced a strong rally between April 2021 and March 2022. Fastmarkets reviewed its recent performance in a Graphite Anode Market report on 13 March. Some key events so far this year include:

- Pressure from both sides: “China’s natural graphite anode market has been under pressure since capacity for synthetic graphite production rose in the second half of 2022, with cuts in the subsidy for electric vehicle (EV) purchases then hitting demand.”

- No more Chinese EV subsidies: The Chinese government pulled its EV subsidies in January 2023, which “slashed demand for natural anode material in the immediate term, according to market sources, with consumers slowing their purchasing.”

- What manufacturers are saying: “We haven’t seen any positive signs for demand in the first quarter,” a battery manufacturer in China said. “It might be the second quarter before there’s any recovery. The problem is that prevailing destocking among battery manufacturers and original equipment manufacturers [OEMs] has resulted in lower demand for upstream raw materials.”

- Aggressive supply expansion: “The rapid expansion of graphitization in China will result in further cost falls in anode production, and thus lower anode prices. Total nameplate capacity of graphitization was said to be around 2.5 million tonnes [per year] last year and was expected to reach 3 million tpy in 2023.”

Spherical graphite price chart (Source: Fastmarkets)

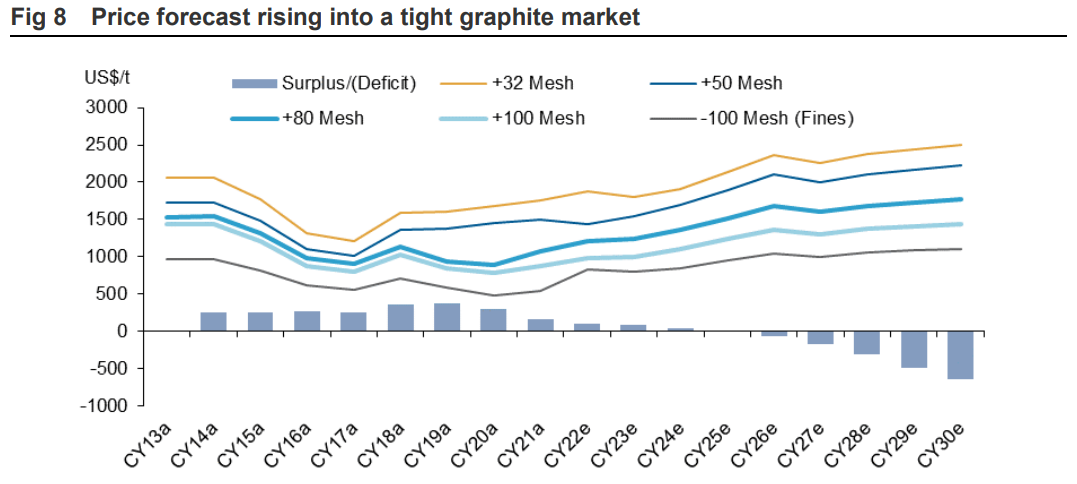

Graphite Price Outlook

Macquarie released a Graphite Market Outlook note on 27 March, 2023 and here are its key takeaways:

- Graphite demand is expected to achieve a 27% compound average growth rate through to 2030, driving prices 25-50% higher from current levels.

- This growth will predominantly come from the EV market, where demand will grow from 8.8m in 2020 to 60.5m cars in 2030.

- Graphite prices are forecasted to remain “relatively flat” in 2023 before “rising over subsequent years.”

- “We believe higher natural graphite pricing is required to incentivise supply beyond the current prospective projects.”

- “Our pricing is largely based on Sub100 Mesh product, where we forecast prices to increase from US$831 a tonne in CY22e to US$850 a tonne in CY24; rising to above US$1,000 a tonne from CY26e with a long-term pricing of US$900 a tonne.”

Graphite price forecasts (Source: Macquarie Research 2023)

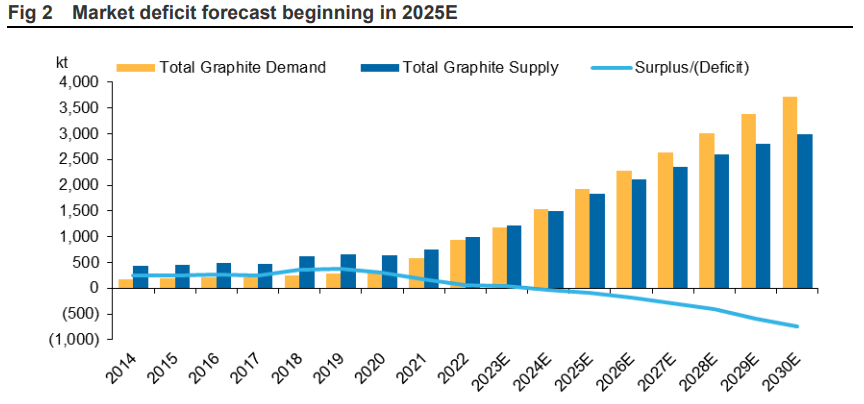

A Growing Deficit

Macquarie expects the market to swing into a supply deficit by 2025. Some of the key drivers and outcomes include:

- The graphite market is currently in a surplus but “we expect the market to absorb current excess supply in the next two years before rapidly moving into a deficit by CY25e.”

- “We note that despite including a large portion of prospective supply within our forecasts, the market remains in deficit beyond CY25e, which is positive for pricing.”

- The market is expected to shift slightly away from synthetic graphite due to its ESG challenges. Synthetic and natural graphite currently supply approximately 60% and 40% of the market respectively. The market is expected to move more towards a 50/50 split by the end of the 2020s, says Macquarie.

Graphite market supply chart (Source: Macquarie Research 2023)

ASX-listed Graphite Stocks

Large caps:

Ticker |

Company |

Mkt Cap |

1 Year |

|---|---|---|---|

Syrah Resources |

$1.22bn |

+12.0% |

Emerging players:

Ticker |

Company |

Mkt Cap |

1 Year |

|---|---|---|---|

Renascor Resources |

$598m |

-21.7% |

|

Talga Group |

$571m |

-8.1% |

|

Black Rock Mining |

$128m |

-49.0% |

|

Volt Resources |

$40m |

-47.4% |

|

Evolution Energy |

$37.6m |

-39.0% |

Notable explorers:

Ticker |

Company |

Mkt Cap |

1 Year |

|---|---|---|---|

Sovereign Metals |

$212m |

-25.0% |

|

Quantum Graphite |

$180m |

+62.0% |

|

First Graphene |

$50m |

-49.4% |

|

Buxton Resources |

$30m |

+80.9% |

|

Greenwing Resources |

$30m |

-50.0% |

|

Sarytogan Graphite |

$24m |

+95% |

No Love?

Graphite has failed to keep up with the performance of battery metal peers such as lithium. A heavyweight name like Syrah Resources experienced a classic post-Covid rally but has struggled for meaningful upside since the start of 2022.

The question for many graphite investors and speculators is: why does a metal that takes up such a large portion of a battery underperform?

The first thing that comes to mind is the lack of spot price upside. As the below chart suggests – prices have more or less gone nowhere for more than a decade.

Graphite is also a much more opaque metal market – it’s difficult to gauge how the market’s performing and spot prices are difficult to come by – so investors often forget the lack of spot price movement.

The market has also been in a surplus for more than a decade but forecast to finally enter a deficit at the beginning of 2025. Lithium on the other hand has been in a volatile deficit since at least 2021.

If you pit graphite (no spot price upside, market surplus) against lithium (higher spot prices, market deficit) — where would you have wanted to invest? Perhaps this dynamic has further exacerbated the outperformance and capital inflows into lithium.

Will the tide begin to turn or will graphite forever live in the shadow of lithium? Let's see if the market can enter a deficit first.

We'd love to hear from readers which commodity they'd like to see in our Investing in X series. Click here to vote (and don't worry, we'll get to all of them ... eventually).

This article was first published for Market Index on Friday, 31 March 2023.

3 topics

11 stocks mentioned