Investing in megatrends (the other ones)

Investors who felt safe hiding in lithium stocks supported by broad-based belief in the global electrification theme have had a rude awakening over the past four months as the price of lithium has tanked by -50%-plus and share prices in the likes of Pilbara Minerals, Allkem and Liontown Resources are down by -25% or more.

This does not imply the global transition towards greener transport and electric power has been over-hyped. It does highlight that when it comes to industrial chemicals, metals and minerals, the short-term horizon is almost always determined by the balance between supply and demand - and history shows supply has a habit of catching up, eventually, as well as intermittently.

To put it bluntly: commodities seldom, if ever, move in a straight line. A similar observation today very much applies to producers of coal, the ultimate beez neez in 2022, while oil & gas producers are one of few sectors not posting a gain year-to-date. Uranium is widely believed to be part of the Megatrends story for the decade(s) ahead, but it's not apparent from share prices in Paladin Resources or Boss Energy.

Megatrends (Supercycles) or not, commodities move through cycles, with often violent price corrections, in both directions, along the way. The promise of a super-sized gain on the way up will always remain too attractive to resist, while the threat of a Wile E. Coyote dive-off-the-cliff is never far off.

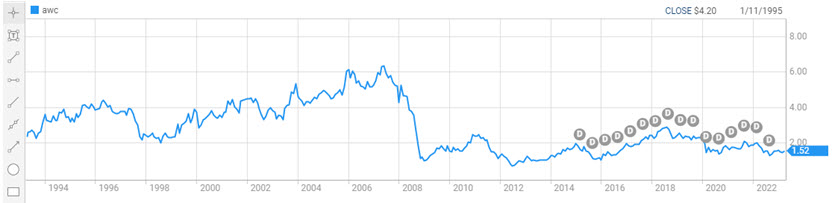

To illustrate the dilemma, I have included the thirty year price chart of shares in Alumina Ltd, one of the longest-listed commodity producers on the ASX.

It doesn't take much time to figure out there have been numerous occasions when the share price doubled, plus some, on the way up, only to give it all back, and some, on the way down.

Another, equally important, observation to make is that time does not by definition work in the patient shareholder's favour. While Alumina Ltd pays an annual dividend, its share price has effectively posted no sustainable gains since 2008, when shares tumbled from an all-time high above $6 to below $1. Today's circa $1.50 had never been recorded throughout the 1990s.

Sector mega-caps BHP Group (ASX: BHP) and Rio Tinto (ASX: RIO) did record new all-time highs in 2022, but their prior records dated from 2007, and we might well be past the summit in the current cycle for iron ore. As a side note: don't be confused by historical data on free websites including ASX.com.au - all those data have been 'corrected' for dividend payouts, and thus show lower share prices for the past.

BHP shares peaked at $50 in late 2007, despite what is shown today on backward-looking historical price charts. (As per always, details matter, as does a great memory).

Alternative: The Forgotten Megatrends

Investing in Megatrends can be a completely different experience through larger sized industrial companies, on the condition that investors can get past the misguided belief that only shares trading on low PE ratios offer sustainable long-term gains, plus the underlying Megatrend needs to remain in place, of course.

Below is the historical chart for shares in property marketing portal REA Group (ASX: REA) which, on anybody's observation, shows a fundamentally different trajectory over time.

Admittedly, the global bond market reset has pulled down the share price valuation from its 2021 peak, but the shares have embarked on a solid uptrend in line with the market generally since October for a return of approximately 50% from last year's June low (25%-plus year-to-date).

The property market in Australia has been oft maligned by many over the past decades, but its underlying resilience remains on display even when faced with an unprecedented pace of RBA rate hikes since early 2022. I am not defending anyone's policy or intentions, but merely making the observation.

Most importantly, REA Group's fortunes are intertwined with overall market activity through marketing and the selling and purchasing of properties, independently of falling and rising prices or of the pricing of building materials. As building companies are defaulting in large numbers, and with Australian banks preparing for much tougher conditions ahead, the specific drivers for local market leader REA Group stand out above the rest.

It goes without saying, REA Group is not immune from the many challenges in property markets this year. On current consensus forecasts, its profits will go backwards in the current financial year while most analysts covering the sector believe its share price above $140 looks bloated.

The offset is that current consensus sees both earnings per share and the dividend recovering by 20%-plus in FY24. The latter probably explains why REA shares have performed so strongly already (earnings estimates have been upgraded recently by analysts).

REA is the perfect example of what an industrial market leader, well-managed and carried by at least one long-lasting Megatrend, can deliver for the patient, long-term focused investment portfolio. The return from share price appreciation alone (ex dividends thus) exceeds 1000% since early 2012 (a little over eleven years).

Of all the companies I follow closely, not many can boast an even higher return, but shares in TechnologyOne (ASX: TNE) and ResMed (ASX: RMD) have appreciated by 1354% and 1211% over the period respectively.

In comparison, the ASX200 ex-dividends returned 77%. Even if we double that percentage, to (generously) account for dividends and franking tax benefits,... I probably do not need to finish that sentence...

Trading on a forward PE ratio of 41x (FY24) and offering a prospective yield of 1.3% only, shares in REA Group perfectly symbolise the always-present dilemma for investors: when exactly is the ideal time to get on board this Megatrend train? It's a question that has been permanently present throughout the past decade.

Maybe the next pullback on a general retreat in risk appetite as the US recession -finally- shows up in concrete numbers, while Australia suffers the unfolding from the proverbial Mortgage Cliff might assist local investors with solving the REA riddle?

****

Not all Megatrends have been around as long as Australian property. This suggests we might still be witnessing the early stages of trend development.

One such Megatrend relates to global data and its application and storage through data centres. This belief saw me adding more shares in NextDC (ASX: NXT) when their price sank closer to $8 in October-November last year. In recent times the independent data centres operator has reminded investors, through its largest customer contract ever, there's no end in sight for this Megatrend just yet.

On the contrary, some analysts believe large corporate users of data might be getting a little anxious about future storage capacity in Australia, which should result in more of such large contracts forthcoming for NextDC. The offset here is this also highlights the need for more data centres, which are not cheap to build, and which will require the company raising more capital.

As long as the market understands this dynamic, and remains comfortable with it, this need not be bad news for patient, loyal shareholders. See also, for example, the recent capital raising by Carsales (ASX: CAR) and where that share price is post execution.

For reasons that only the ASX can explain, NextDC shares are included in the local All Technology Index, alongside genuine technology stalwarts such as Altium, Pro Medicus, TechnologyOne, WiseTech Global and Xero. I believe this causes many an investor to treat NextDC as a non-profitable tech wannabe, while also not understanding its support from a strong Megatrend.

A more accurate approach would be to treat NextDC as a young, emerging next Transurban. Long after the data Megatrend has run its course, and supply and demand across the sector are in reasonable balance, NextDC shares will be revered for its dividend yield and franking, but that picture is still far, far away into the future.

A slowing in global economic growth can certainly instill more pricing pressure on the industry, with consequences for valuations generally, but NextDC's recent contract, on top of broader sector insights, suggest the pendulum is still swinging in favour of independent data centre owners.

Don't try to somehow put a PE ratio on the shares either. That simply does not apply to Transurban & Co. Maybe leave the forward projections and implications for valuation to the experts. FNArena's consensus price target currently sits at $13.56, implying 15%-plus upside from the current level.

****

The most obvious company to mention in this regard remains CSL (ASX: CSL) - often nominated in the same breath with REA Group as "probably the highest quality company on the ASX".

It is no coincidence both companies have rewarded loyal shareholders handsomely (or should that be "excessively"?) as time passed by - both quality stalwarts enjoy being carried by solid, long-term Megatrends.

What is, or has been, the precise importance of respective management teams at those companies will always remain a point of public debate. But what cannot be denied is that it's far easier to generate healthy returns from a position of market leadership on top of Megatrend support.

In CSL's case, the global demand for blood plasma continues to grow each year, with the global market leader specialising in developing treatments and medicines derived from its core product. CSL is often labeled Australia's largest and most successful biotech, but truly understanding its business requires an appetite for complexity, including putting a 'value' on future products under development.

Australia's third largest index weight spends more than $1bn per annum on R&D, operates with authority on sector-leading efficiency, and has a knack for highly profitable acquisitions. The latest, Vifor, no doubt will add to future growth on the back of what already looks like a robust recovery post covid interruption, similar to what was achieved post acquisition of Novartis' loss-making flu vaccine business in 2015.

What makes CSL's investment case so compelling today is the company's operations are essentially recovering from restrictions, costs and other headwinds endured during the covid pandemic. With sales to grow and margins to recover, market consensus is projecting USD EPS growth higher than 20% in FY23 and FY24.

Similar to the companies mentioned earlier, simply slapping a PE ratio on CSL virtually never whets an investor's appetite, but 27x times FY24 EPS does not look demanding considering the embedded safe haven security with more challenging times on the horizon for most listed companies.

The consensus target sits at $337, still double-digit above the present level, dividend not included.

****

There are plenty more Megatrends available through the local bourse, including a plethora in small and micro cap companies offering exposure to online shopping, electric vehicles, cyber security, data centres, et cetera, but the above can serve as a reminder that large-cap exposures to ongoing, long-lasting Megatrends can offer above-average returns with a much more benign risk profile (even with above-average valuations).

Other companies worth mentioning in this regard include Carsales, Cochlear (ASX: COH), Goodman Group (ASX: GMG), ResMed and Seek (ASX: SEK). Though having a long runway for growth ahead need not necessarily be linked to an identifiable Megatrend, as proved by companies including Breville Group (ASX: BRG), Hub24 (ASX: HUB), IDP Education (ASX: IEL), Pro Medicus (ASX: PME) and WiseTech Global (ASX: WTC).

If we truly adopt a broad spectrum on this, we might even shine a light on Macquarie Group (ASX: MQG) and Wesfarmers (ASX: WES).

Investors like the idea of snapping up a bargain or playing tomorrow's Megatrends through commodities, but history shows true outperformance can be achieved through less risky, larger cap industrials trading on above average valuations.

And that is a lesson yet to be learned by many an investor, big and small, both institutional and retail.

FNArena offers truly independent, ahead-of-the-curve analysis and research, on top of proprietary tools and data for self-managing & self-researching investors. The service can be trialed for free at (VIEW LINK)

5 topics

18 stocks mentioned