Investing in NFTs: Why can pixelated images be worth millions of dollars?

Holon Global Investments

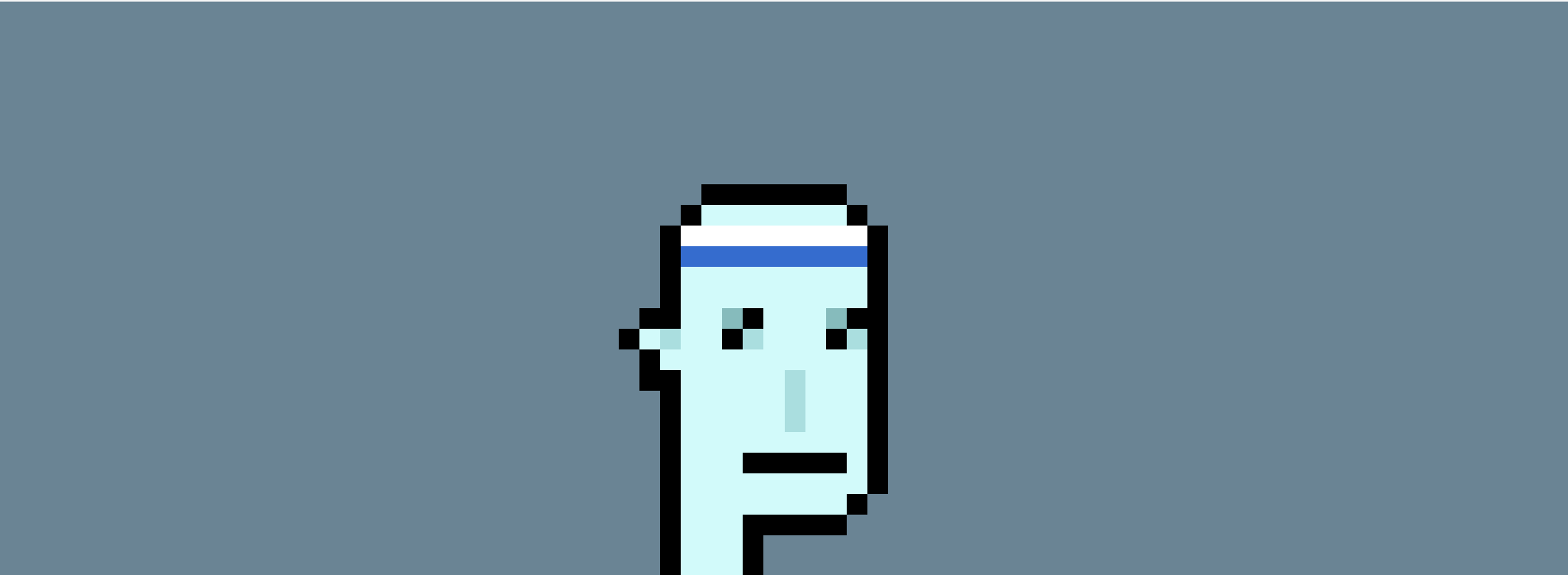

In March this year, this seemingly simple pixelated image below, Cryptopunk #3100 an NFT, sold for a staggering $US7.58 million.

... Welcome to the strange world of NFT’s!

NFT stands for Non-Fungible Token. (Fungible essentially means replaceable or exchangeable.) So as the ‘non’ in the name suggests, the NFT is distinguishable from others, meaning that the token itself is unique.

An NFT is a digital representation of a physical or digital asset. A baseball card, for example, is a unique physical asset. An NFT could be the digital representation of that baseball card. NFTs can extend to luxury items, property, artwork - really, an NFT can represent anything.

That is what makes investing in NFT’s both exciting and confusing.

Over the last few years, we have seen an explosion of experimentation in the NFT world from anonymous developers on Ethereum all the way to the mega cap companies of today, like Alibaba, Tencent and, more recently, Visa who also purchased a Cryptopunk for a considerable USD$150k. This purchase sent the internet into a frenzy on the possibilities for what an NFT looks like, what a NFT can do, and what an NFT is worth.

As investors, when we see mania like we do in the NFT space right now, we need to ask ourselves is it all hype or is there something of substance?

Traditional investors are quick to dismiss a JPEG with USD$7.5 million as another ‘Tulip bubble’ (mind you we have heard this with Bitcoin for a decade now). And like with much of the digital asset space, it is only when you dig a bit deeper do these things seem to make much more sense.

It is important as equity investors that we understand the potential opportunity here for companies because if one JPEG can sell for USD$7.5m there just might be something here.

Below we look at a number of areas where NFTs are revolutionising the internet to help.

Establishing authenticity

So, let us start with where NFT’s make logical sense - luxury goods.

NFTs can prove luxury items are authentic and allow people to track who owns them. A company can ‘mint’ an NFT and associate that NFT with a luxury item. This allows a potential buyer to verify the good and gain comfort that it is unique and scarce.

We often outsource this process to auction houses or ‘experts’ who verify the authenticity for us but replacing that with a blockchain helps eliminate the costs of establishing that trust.

It does not necessarily change anything about the physical good, but it does make the commerce side much simpler and safer. A digital representation of the good materially minimises fraud, making investing in NFT’s or luxury items much safer.

The tricky part, however, is linking the digital representation to the physical asset. Fortunately, many companies are solving that part too. Wisekey, which is listed on the NASDAQ, for example, is doing just that.

Ownership Rights and royalties

NFTs are also making it easier for creatives to make money to take ownership of their creative work.

NFT’s represent ownership and with ownership comes ownership rights. As a digital asset, NFTs open up a whole world of automation and programmability around these rights.

We are starting to see artists that program into their Artwork (NFT) that they earn a 10% royalty every time the art is sold. This is simple and automated on a platform like Ethereum and the design of the royalty programs are limited only by the imagination of the developer.

We are also seeing musicians selling limited editions of their songs/album covers, even song royalties themselves. For many users this is no different to memorabilia that you would purchase at a concert, just in a digital version.

Moda is a web 3.0 company that “is redefining the future of music ownership, distribution and publishing via NFT standards, decentralised governance and automated finance.” It is possible that in the future all music royalties will be captured under NFT’s.

This means investing in NFT’s is not necessarily a new concept but rather a technology used to provide certainty around the cash flows from existing investable assets i.e., royalties.

Engagement, Engagement, Engagement

NFTs are allowing brands to create new revenue streams

Brands are increasingly blurring the lines between the physical and the digital. They are allowing owners of unique physical goods to experience them in a digital world.

Why can’t your digital Avatar wear a ‘digital twin’ of your physical sneakers? (Not sure what an Avatar is? The movie ‘Ready Player One’ just might be your best introduction to digital avatars and the metaverse.

In the future, brands will leverage the power of NFT’s to create brand experiences and social status for their loyal customers. Done correctly, it can elevate a brand’s equity value by creating new revenue streams that stem from the digital world.

Digital first

Finally, NFTs are allowing new online businesses.

Taking it a step further, we are seeing an explosion in the Ethereum space of digital first products. That is, NFT’s that have no physical connection.

Zed.run is an Australian-based company using NFTs to allow people to own, breed and race their own unique digital horses. It is attracting huge interest globally as brands start to partner with Zed.run to release limited-edition horses and their community starts to build around the Zed ecosystem, i.e., websites that track horse statistics and eventually entire racetracks.

Another example is Decentraland, a virtual online world where people can buy plots of lands backed by tokens, and the owners of that land determine what is virtually built on those plots of land. Interestingly, art galleries have been some of the most popular spaces in Decentraland.

This is creating a monetizable online space where pieces of art are being rented to art galleries. Sometimes the art galleries are sponsored.

Is anything digital really valuable?

As these digital universes expand, there is no limit to what can be built in these worlds. A few lines of code mean you have an art gallery, a casino, a playground, a theme park - you can have whatever you want because, in a digital world, resources are infinite.

But this is exactly why NFT’s are so valuable. In a world where anything is possible, and infinite resources exist, scarcity is everything. It is our uniqueness that sets us apart and that creates social status. The only way to represent that in the digital world, particularly an open-source ecosystem, is to create a digital asset that represents that uniqueness - a Non-Fungible Token.

When people laugh at a 24x24 pixelated JPEG that sells for USD$7.5m ,what they miss is that this is a unique asset. It cannot be replicated and, in terms of the history of the NFT world, ‘crytopunks’ are at the very start of it.

A digital asset etched in history - Would I pay USD$7.5m? No. But I wouldn’t pay USD$85m for Kasimir Malevichs Suprematist Composition either. Perspective helps here.

Not all NFT’s will be valuable. Similarly, not all art is valuable. But the digital world will hold increasingly larger amounts of value and NFT’s represent the way to distinguish who owns what parts, whilst ensuring rights and authenticity and enabling a closer connection between consumers and these online worlds.

An investor should understand that NFT’s open up a completely new investable universe. It creates opportunities for businesses to create new revenue streams and it will be those companies that adapt the fastest and understand the enabling capabilities of this technology first that will benefit the most. It is something that we (Holon) are watching closely.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

Mark has spent 10+ years in Financial Services, with expertise in wealth management platforms, Mark has worked across multiple start-ups and founded a digital asset research company before joining Holon as an investment analyst. Mark is focused on...

Expertise

No areas of expertise

Mark has spent 10+ years in Financial Services, with expertise in wealth management platforms, Mark has worked across multiple start-ups and founded a digital asset research company before joining Holon as an investment analyst. Mark is focused on...

Expertise

No areas of expertise