Investment themes 2021 revisited - Part 2.

Over the last few weeks, investors have been fixated on rising yields in fixed income markets. The benchmark US 10-year Treasury Note yield rose from 1.08% to 1.40% during February as financial markets begin to price in the current economic recovery, in combination with the unprecedented level of monetary and fiscal stimulus from the COVID-19 induced recession in 2020.

We detailed the extent of this stimulus in our previous article "Investment Themes 2021 revisited - Part 1". We noted the goal of governments and central banks alike was to reflate their economies to a healthy level. To do this they implemented supportive monetary policy, in conjunction with fiscal stimulus packages.

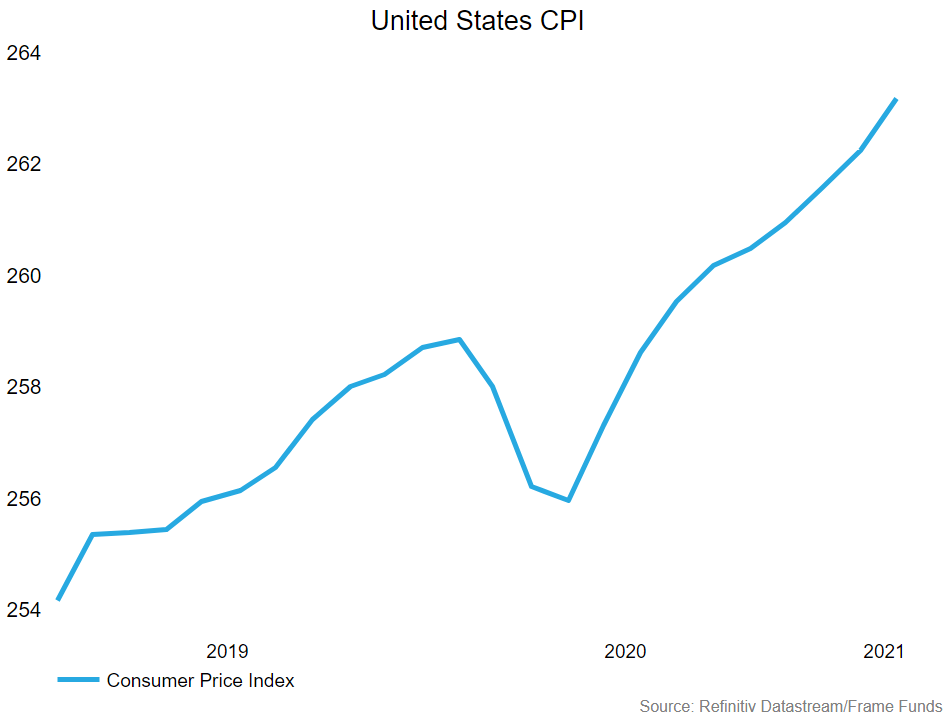

Since the release of our “Investment Themes 2021 revisited - Part 1. “, the US House of Representatives has passed the final version of a $1.9 trillion relief plan which will see another round of stimulus cheques sent out to Americans earning less than $80,000 per year. With US Federal Reserve Chair Jerome Powell continuing to signal support for low interest rates for the foreseeable future, expectations that we may see a rise in inflation can be seen in the bond market. Real yields also seem to be signalling approaching inflation. Real yields are calculated by subtracting the rate of inflation from the nominal (regular) yield. Increasing real yields imply the economy is recovering to a healthy state, however a rapid increase in real yields is a warning the cost of capital may be rising too fast – in other words inflation. The US 10-year US Treasury Real Yield is up to -0.66% from -1.08% at the beginning of the year.

Given these developments in the market, the remainder of this piece will be spent discussing assets that have historically performed well in an inflationary environment.

Commodities

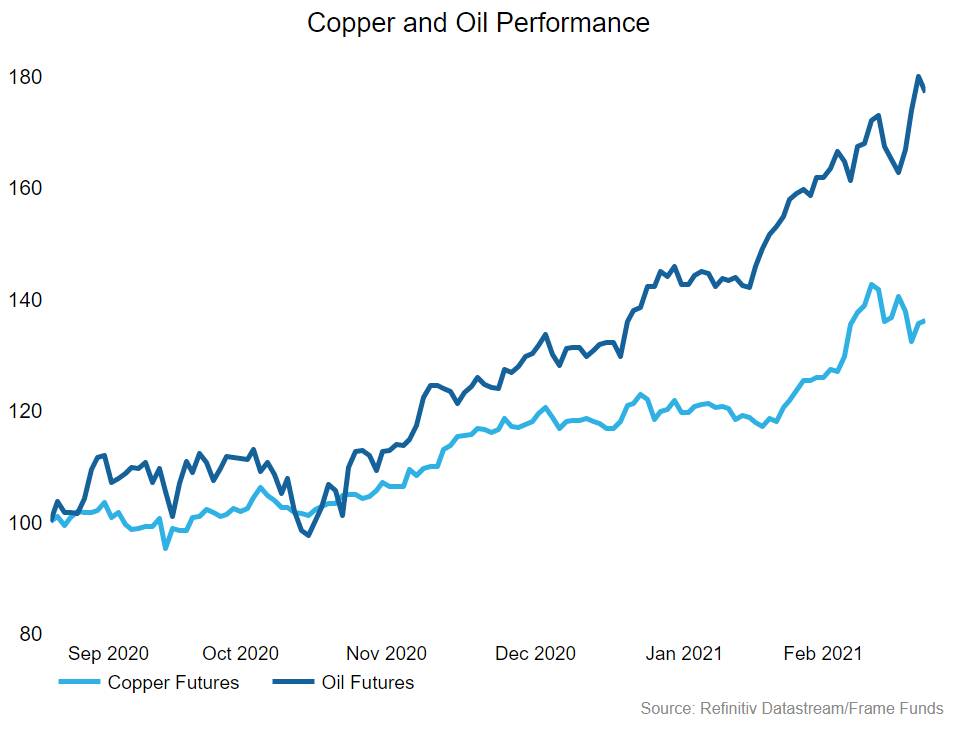

Commodities tend to perform well as inflation increases. This is because as the demand for goods and services increases above available supply, the price of the goods and services rise as the market seeks to maintain equilibrium between supply and demand. This effect flows down the supply chain causing the price of the commodities used in the production process to also rise.

Crude Oil

Oil is a major input in the economy and is used in many critical activities such as electricity production, steel production, fuel for cars, construction of roads and heating, among others. With the current global roll-out of the vaccines produced by Pfizer and AstraZeneca, in combination with the aggressive stimulus efforts noted above, the global economy should continue to recover from COVID-19. As global economies recover, more people will begin to travel overseas , businesses will continue to reopen and there will be an increase in economic productivity. Oil will therefore be a key input in almost all economic activity associated with the global economy reopening. If prices begin to increase further up the supply chain, we expect to see the price of oil appreciate in response.

Copper

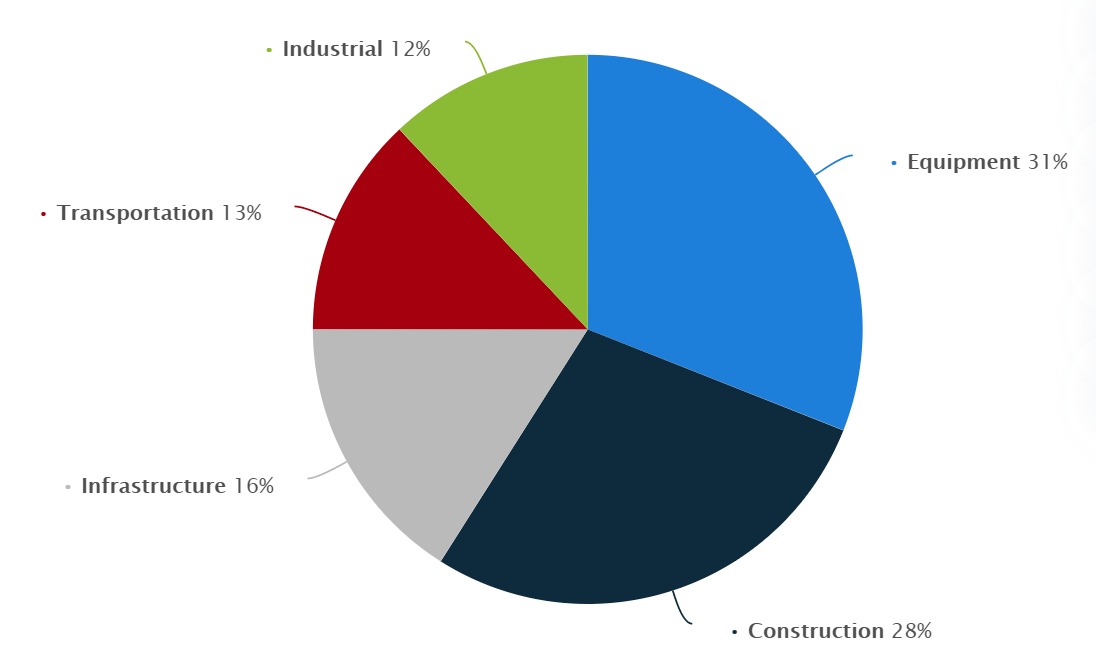

Similarly, to oil, copper is a commonly used commodity in economic reopening activities, especially for infrastructure projects where it is used for wiring, roofing, plumbing and other industrial machinery. In fact, 29% of all copper usage is used in construction, 16% in infrastructure, 13% in transport and 11% in industrial activity (including renewables). These are sectors that could be set to see the most significant increase in prices as the most recent waves of government support hit the economy. Copper is therefore naturally positioned to positively adjust to inflation induced price increases.

.jpeg)

Source: Statista 2021

Real Estate

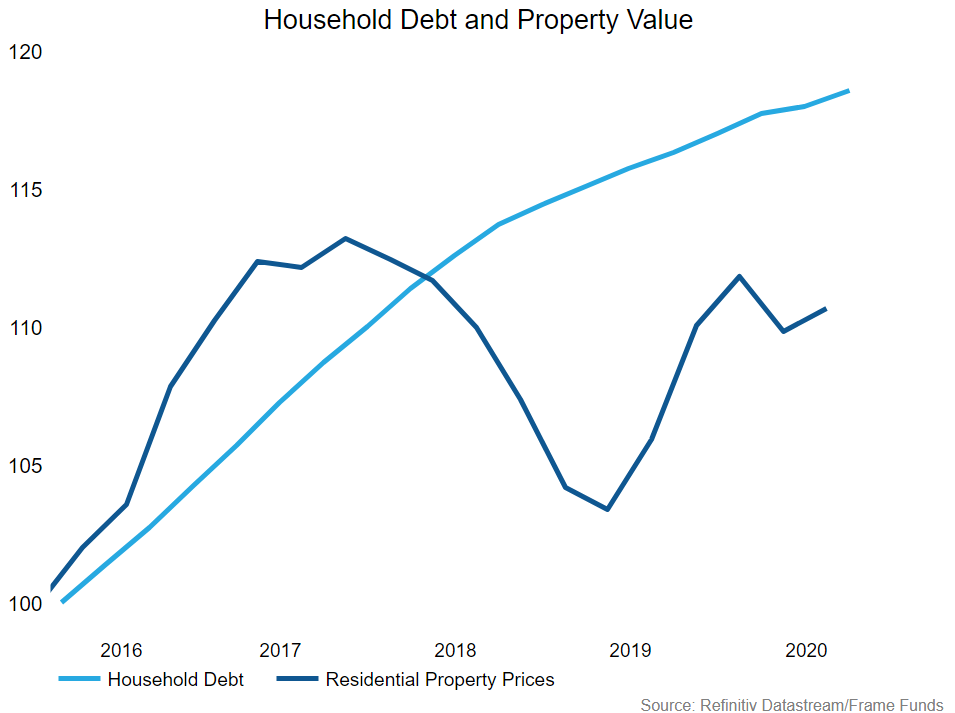

The current low interest rates also have a significant impact on house prices, as the cost of borrowing decreases making mortgages more affordable. Lower rates discourage saving as return on investment in a bank account is low – people either seek higher returns elsewhere (for example in the share market) or spend more of their income. Both of these increase demand in the market and therefore prices.

.png)

Additionally, supportive rhetoric around sustaining the current monetary policy stance will further encourage leverage. This is due to interest payments on mortgage loans being more affordable. Recent RBA analysis suggested residential property prices could increase as much as 30% in the coming years if borrowers believed the cut to interest rates is permanent.

While the future of commercial property is uncertain as it goes through a transformative period due to new work from home practices, an economic restart should support retail centres and commercial property in central business districts as more people return to work. We would expect this upward trend in prices to continue as inflation becomes a more present threat.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

*time of writing 08/03/21

4 topics