Investors are bullish on these 3 assets - and bearish everything else

The return of Donald Trump to the White House may not exactly be breaking news but the changes (or lack thereof) that professional investors are making to their portfolios certainly is.

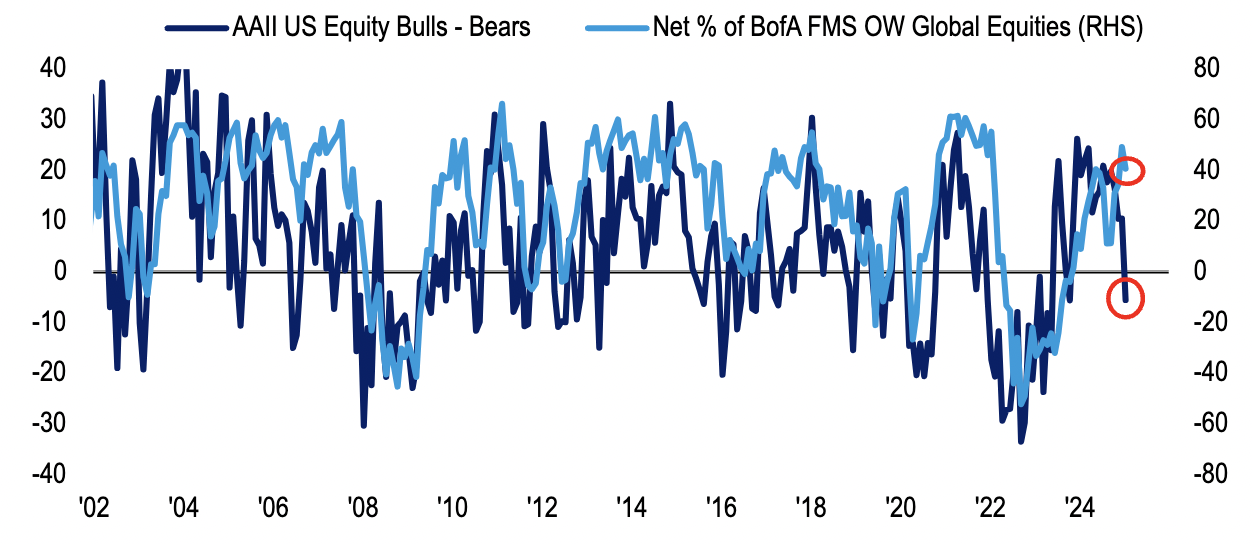

The latest Bank of America Global Fund Manager Survey, taken last week, suggests money managers are still very bullish. You can see this in their cash levels (hovering near mid-2021 lows of 3.9%), in the most recent reads of institutional investor sentiment, and the percentage of fund managers who are overweight equities (+41%).

But how do you reconcile being bullish when expectations for economic growth remain muted, more fund managers think a "no landing" scenario is now possible, and expectations for bond yields are at their highest since September 2022?

In this wire, we'll explore the fascinating divergence that is occurring among professional investors with the help of some really interesting charts.

Note: 214 professional investors, who manage US$576 billion in AUM participated in the January survey. 182 of these investors, managing US$513 billion responded to the global fund manager survey questions while 111 of the 214 responded to the regional fund manager survey questions either in addition to the global FMS or exclusively.

The 3 big themes from the January BofA Global Fund Manager Survey

- Global growth expectations (net score of -8%) remain muted

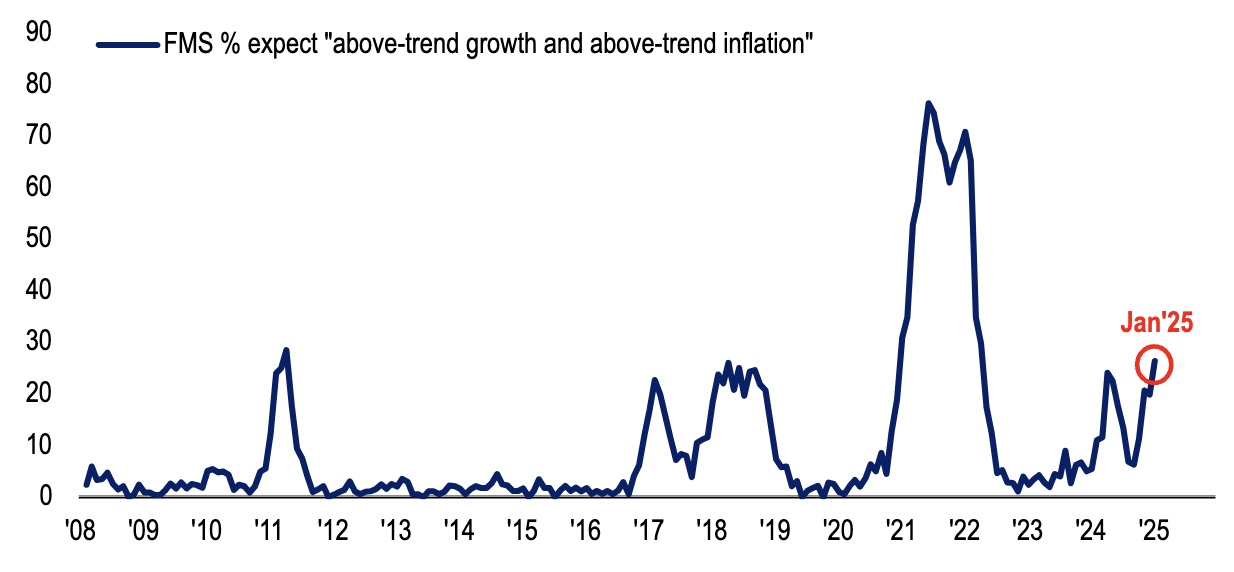

- But the percentage of macro hedge fund investors who responded that a "boom" (above-trend growth and above-trend inflation) is possible is at its highest since April 2022.

What would you rather: above-trend growth or above-trend inflation? In a boom scenario, you may not get a choice

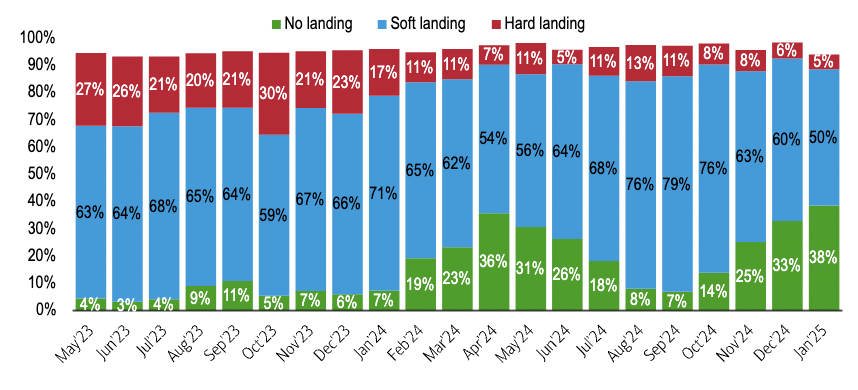

- Inflation expectations are at their highest since March 2022 and fundies who argued "no landing" was their base case is at 38% (+5% month-over-month; +31% year-over-year)

What is the most likely outcome for the global economy in the next 12 months?

Source: BofA Global Fund Manager Survey, January 2025

- 79% of FMS investors expect the Fed to cut rates in 2025 but an inflation spike derailing the Fed's plans are now the most-cited tail risk among professional investors.

What are professional investors bullish on?

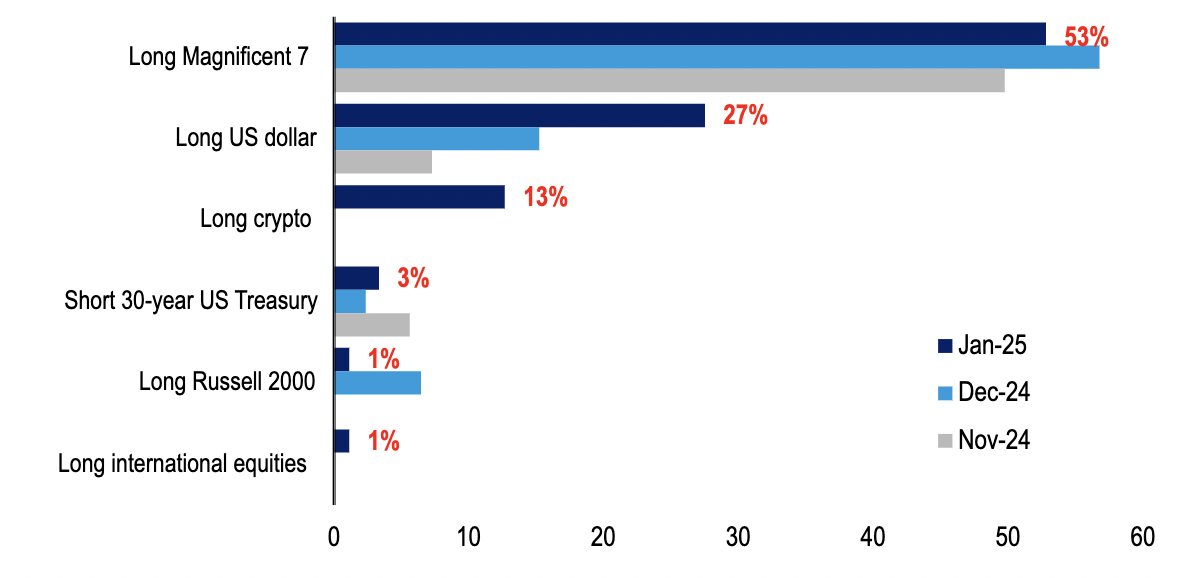

In short, the US Dollar, cryptocurrency, and stocks. Or put another way, the Trump trade. While the most crowded trade is the same - long Magnificent Seven (receiving 53% of the votes), long US Dollar and long cryptocurrency trades also now polled highly enough to make the top three.

What do fund managers think is currently the most crowded trade?

And while it's far from a crowded trade, the month-over-month move into European equities was the second-largest in 25 years. The move was enough to reverse a long underweight and make European stocks a +1 in BofA's asset allocation scores. While this doesn't change the big picture asset allocation, it is revealing that fund managers are looking elsewhere (or digging in the proverbial rubbish) for outperformance and that they're choosing to do so now.

Institutional investors' allocation to equities remains high

Within stocks, more fund managers expect large caps to outperform small caps. But the number of fund managers who said value would outperform growth is at its lowest levels since July 2024. Further, the percentage advantage (+14%) of those who said high dividend stocks would outperform low dividend stocks (a.k.a. believers in the dividend aristocrats strategy) is at its lowest level since October 2020.

So what could upset the bulls?

In short, a lot.

- The aggregate cash allocation of 3.9% is at mid-2021 lows. This marks a second consecutive month of a reliable "sell" signal from this survey. According to BofA, since 2011, there have been 12 prior "sell" signals which saw global equity returns of -2.4% in the 1 month after and -0.7% in the 3 months after the "sell" signal was triggered.

- Expectations for higher bond yields rose to the highest level since September 2022 despite the fact that most fund managers still expect one (and likely, two) rate cuts from the Fed this year. And, as this chart shows, that surge (or sentiment pivot if you prefer) happened fast:

The percentage of fund managers expecting higher long-term rates

In addition, a disorderly move in the bond market is now the event that most fund managers say would be most bearish to the narrative in 2025. That means we've got another year of watching inflation and unemployment prints in the US and Australia like hawks.

Finally, here are the contrarian trades, as nominated by the money managers:

- Long commodities, especially resources and energy (the latter is sitting at its second largest underweight relative to history)

- Buying EU/UK/EM stocks as a risk-on play if tariff and bond concerns end up unfounded,

- (Even longer) US stocks, in particular banks and tech given they are most vulnerable to Q1 risk-off events.

3 topics