Investors should be excited, not fearful

Over the past few months, I’ve been writing about how the bear market that started in 2022 wasn’t done yet. In early August, I pointed out how the tech stock momentum trade in the US was breaking down.

In mid-September, just before the market cracked, I argued that this bear market rally peaked in July, and said the market was transitioning from a bullish to bearish phase.

In the space of a few weeks, that bearishness has come out in force. The CNN Fear and Greed index has gone from extreme greed in late July to extreme fear in late September.

Charts are breaking down, both the major indices and key stocks, especially in the US. Looking through hundreds of Aussie stock charts, the vast majority look downright ugly.

In September, only 40 ASX200 stocks finished in the green. That means 80%, or 160 stocks, finished lower for the month.

The question is where to from here?

With the caveat that I am as good or bad as the next person in predicting short-term market moves, it’s a good discussion to have and get you thinking about portfolio construction.

As everyone knows, the catalyst for the market’s recent sharp falls is that the Fed Reserve has now finally convinced traders of the ‘higher for longer’ scenario. Expected rate cuts for 2024 have been squeezed out of the futures market.

Now, if that’s because the labour market remains strong, inflation sticky, and nominal economic growth high, it needn’t be too bearish for stocks. Yes, there is a necessary adjustment based on higher yields increasing the risk free rate, but this shouldn't cause too much damage if growth prospects remain good.

That’s the optimistic view. But I think it’s a low probability outcome.

The problem is that the Fed doesn’t want the labour market to remain strong or inflation to remain sticky. And because both employment and inflation are lagging economic indicators, the Fed will stay tight for too long and cause a recession.

Cooling employment and inflation will only show up in the data after the damage has been done. When the Fed realises what is happening, it will cut hard and fast.

That could be in a few months, or well into 2024. My guess is that by the end of the year, it will be apparent that the US economy is in a recession.

This isn't the consensus view. Which is why it needs to be considered. The only way you can beat the market is to bet against the consensus view.

The Fed has successfully jaw-boned the market into thinking that the US economy is strong (the soft or ‘no’ landing scenario). As a result, the adjustment in global bond yields has been swift.

In turn, real yields (nominal yields minus inflation expectations) have surged to decade plus highs. This is putting pressure on asset prices across the board. As I mentioned, stock and stock indexes are breaking down into bearish trends. Commodities are weak across the board, except for oil, but even that strong run is now correcting.

Gold — always a good barometer of liquidity and financial conditions, fell sharply recently.

As did Macquarie Group’s [ASX:MQG] stock price. As you can see below, it recently broke down from a consolidation range…

Macquarie is another ‘liquidity barometer’. And it looks like it could be heading back to re-test last year’s lows.

In short, higher interest rates are starting to bite into asset prices.

Although that’s not exactly news, is it?

In answer to the question, where to from here, stock markets should put in a short-term bounce. The selling in the second half of September was vicious. Technically, markets are oversold. If they’re going to bounce, this is where it should occur from.

The catalyst is likely to be a rally in bond prices, or a fall in yields. Bonds are hugely oversold. There is almost universal bearishness and the ‘higher for longer’ narrative is all pervasive. It’s looking like a great contrarian set up for long-term bond buyers.

If you think the US is going into recession, and the Aussie economy will continue to slow, yields at these levels are attractive. Likewise, interest rate sensitive sectors like utilities, property trusts and gold stocks should do well in a falling yield environment.

But bear in mind stocks in general won’t bounce if lower yields are the result of an economic slowdown. Because that will put earnings under pressure. So you’ll need to focus on areas where genuine value exists, or where companies have already been through an earnings downgrade cycle.

This leads me to think you’ll see a bounce, not a bottom in the weeks ahead. The following few charts are evidence of this view.

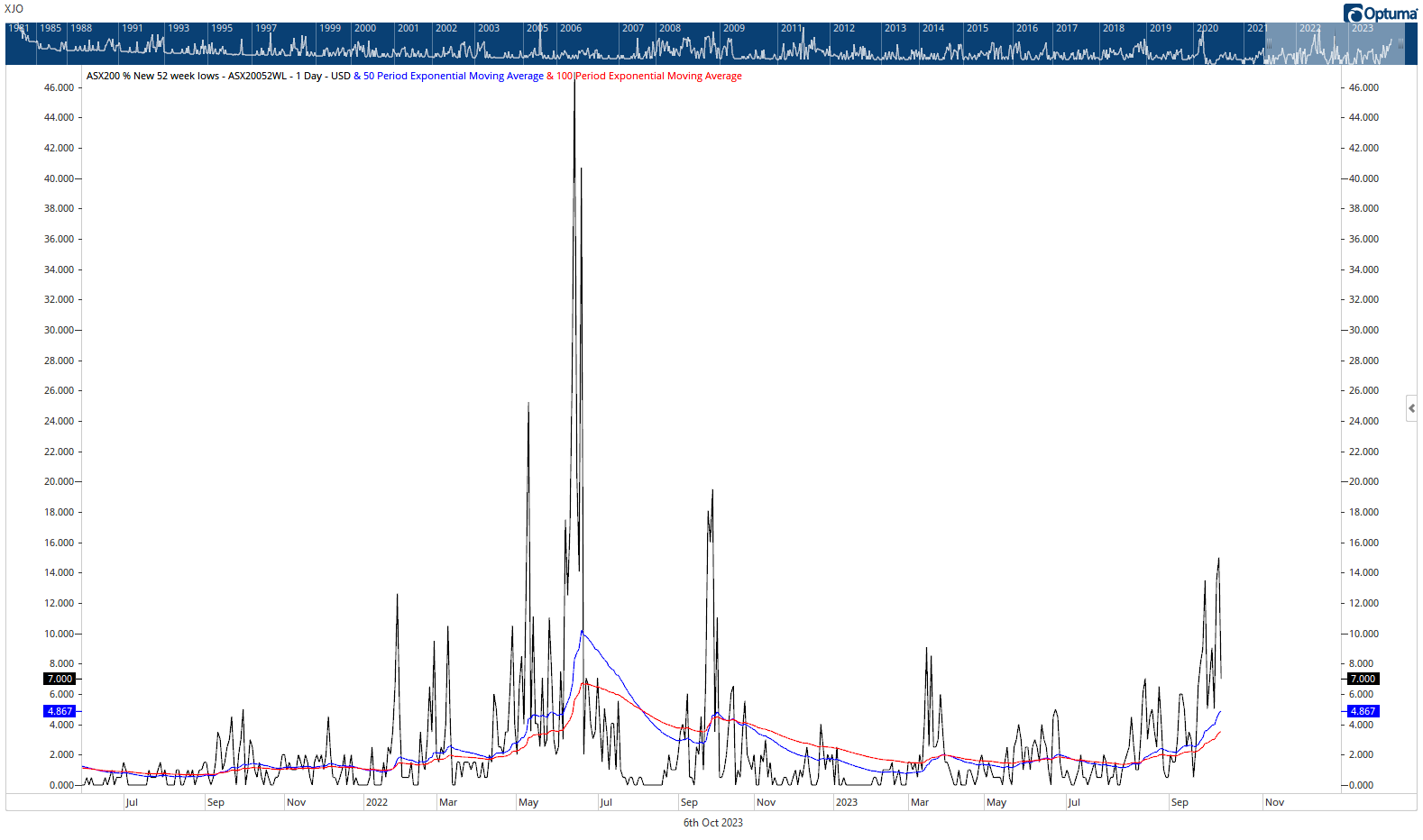

For example, the chart below shows new 52 weeks lows for ASX 200 stocks…

Spikes often denote short-term bottoms.And we got a decent spike in September.

If you’re in the ‘this is still a bull market’ camp, this is a buying opportunity. But, like i said, I think that is a low probability outcome.

As mentioned, central bankers are determined to fight inflation. The ‘Fed put’ is no longer there when inflation remains at these high levels. So expect rates to remain high until something breaks. That won’t be good for equities.

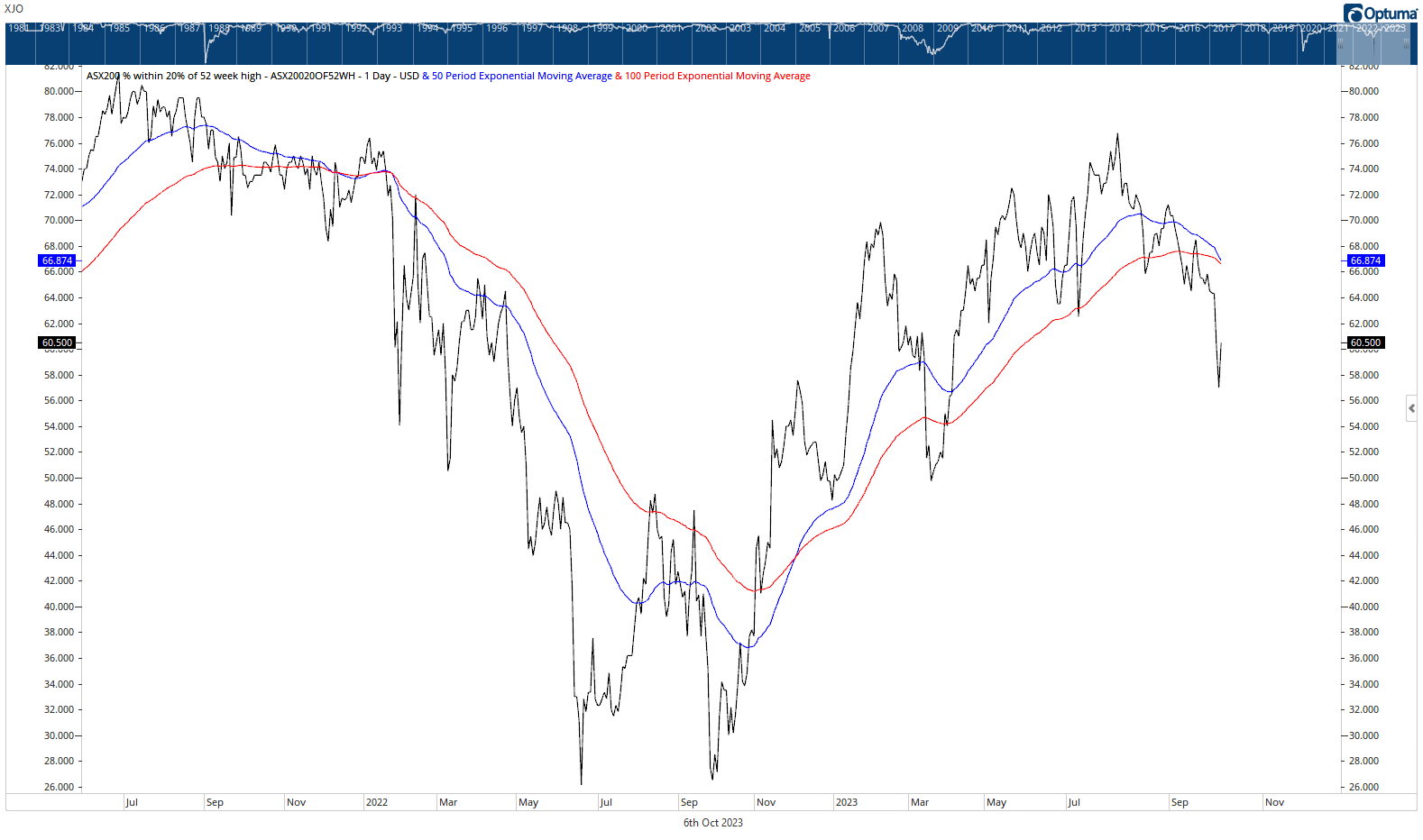

The next chart provides some evidence that we might not be close to a ‘capitulation low’ just yet. It shows ASX200 stocks within 20% of their 52-week highs. It’s a rough proxy for the number of stocks in a bull market.

While it’s dropped sharply recently, the reading is still high, at 60%. By comparison, it got as low as 26% during June and September 2022.

If the Fed wants to kill inflation, and the economy along with it, more stocks will succumb to the bearish trend.

So notwithstanding the potential for a short-term bounce, I remain cautious. Having said that, any decent sell-off from here should be looked at as an excellent long-term buying opportunity. Especially at the smaller end of the market, there are many well priced companies. When that market turns, it will turn hard.

Long-term investors should be looking at the next few months with excitement, not fear.

4 topics

1 stock mentioned