IPO Watch: is Airtasker the next gem?

Welcome, all! It is with excitement that I present the first instalment in what (I hope) will become an insightful new series: IPO Watch.

In this series, we will aim to highlight some of the most exciting opportunities on the horizon entering the public domain.

Whether you subscribe to the float or simply add it to your watch list, we hope this will provide new investment ideas and opportunities to keep a watchful eye on. Throughout this series, we will dig through the financials of soon to be listed or just listed companies, give you a wrap up of the company including its key advantages and competitors and we even have a bonus insight for you.

In this edition, our focus will be on Airtasker which has listed at last after a glitch in the ASX delayed it a day.

It is set to be one of the most popular IPOs of the year in Australia and is certainly a stock to keep a close eye on (as well as a practical solution to fix that shoddy guttering you’ve been putting off). With demand being 10x oversubscribed from staff, there is strong demand and following on this gig economy centrepiece.

Airtasker management has reported that existing staff already hold significant equity through the company's employee share ownership plan. According to Airtasker, current and former staff have subscribed for over $1.6 million in additional shares, with 45% of Airtasker staff participating in the IPO at an average investment of $22,400.

On that note, let’s begin.

Key details:

- Principal activity: Online labour marketplace

- Issue Price: $0.65

- Ticker: ART

- Capital to be Raised: $83,700,000

- Expected offer close date: 9 March 2021

- Listing date: 23 March

- Underwriter: Morgans Corporate Limited (Lead Manager), fully underwritten

The prospectus can be found here.

Welcome to the gig economy

Launched in 2012, Airtasker is an online labour marketplace connecting customers with ‘taskers’. Any number of services, both local and remote can be offered on the service, examples being handy-man repairs, tax consultancy and legal advice. The current addressable market in Australia is worth around $52 billion, per their prospectus

From launch until 2019, the primary focus of the company was increasing the number of taskers, customers and completed tasks. This was achieved through the development of a scalable technology platform that was relatively hands-off for staff in terms of connecting parties. From 2019 onwards, the firm has looked to increase marketplace growth and ultimately lift results through increasing operational and cost efficiency, improved marketing and an augmented revenue model.

Airtasker generates revenue via fees on both sides of the matching, taken as a percentage of the agreed-upon price. It currently has over 950,000 customers and 150,000 taskers.

The average dollar value in the early days almost 10 years ago was $97 per task. That had gone up to $159 for the 2020 financial year, while $189 is forecast by the end of the current year.

The company is currently exploring opportunities with a focus on increasing customer and tasker acquisition, improving usage frequency and expanding the addressable market. They are hoping to achieve this through:

- Growth marketing – investing in marketing initiatives to drive new customer and Tasker acquisition;

- Airtasker Superstore – creating new marketplaces (such as Airtasker Listings, Instant Booking and Subscriptions) to increase usage frequency;

- International expansion – Expanding into new markets, utilising Airtasker’s scalable technology platform, centralised operations and marketing strategies.

A dig through the financials

The first point of note is the sustained revenue, albeit over only two years of reporting. There was 44% revenue growth between FY19 and FY20, with a forecasted 27% growth into FY21, highlighting that they are continuing to expand market share.

However, this comes at a cost: Profit/loss after tax was negative $27.2 million in FY19. This did improve to negative $5.2 million in 2020, on the back of reduced sales and marketing expenses in tandem with growing revenues. Worryingly, this figure is forecasted to decline slightly in FY21 as marketing expenses return.

It will be pleasing if revenues continue to grow in line with continued market expansion, however, plans to expand both domestically and on an international scale will inevitably push sales and marketing, and administration expenses significantly higher. Accordingly, do not rely on expenses plateauing in the short term as a gateway to profitability.

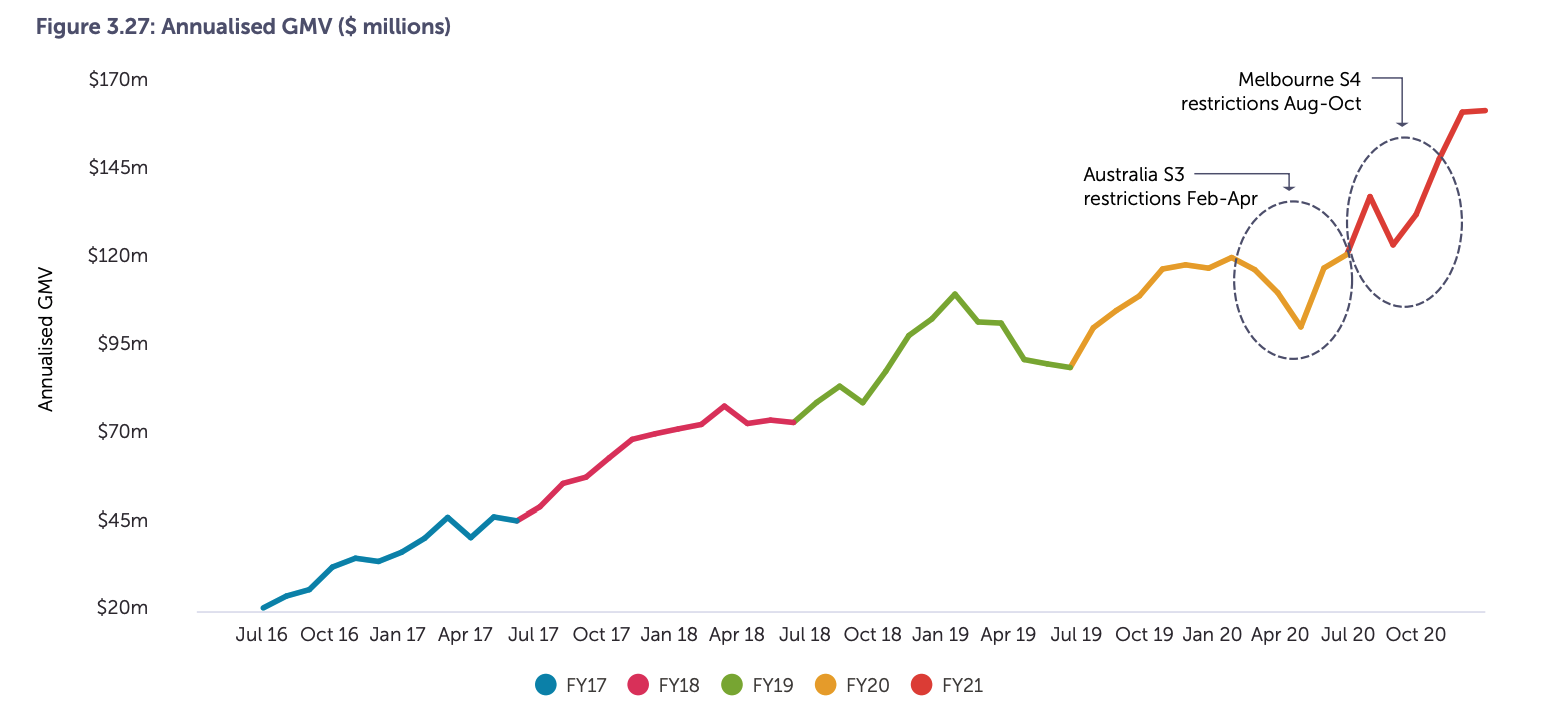

Airtasker annualised GMV showing the impact of government restrictions. Source: Morgans.

As you can see in the graph above, Airtasker initially experienced a drop in marketplace activity during the early phase of the COVID-19 pandemic, between February and April 2020, due to the effect on consumer sentiment and the impact in Australia of Federal and State government restrictions. Severe restrictions applied by the Victoria State Government (S4) saw a negative impact on marketplace activity in August 2020. Airtasker saw a rebound in the market with its GMV growth trajectory recovering following the lifting of government restrictions.

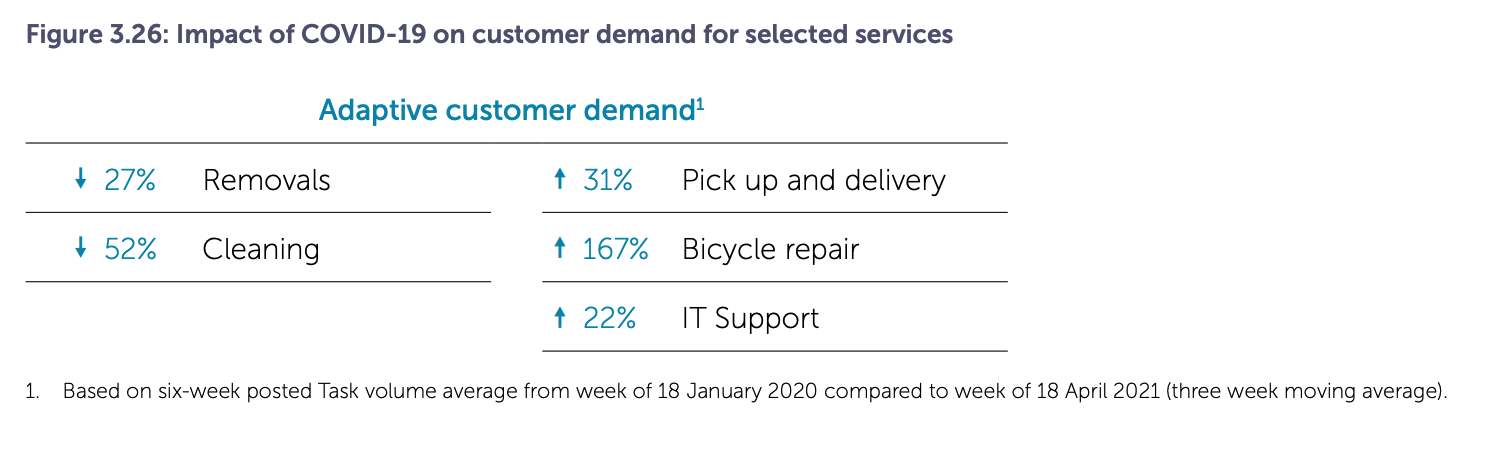

Of note, was the rising revenue despite COVID-19. What appears from the prospectus was the value of flexibility offered by the platform, with customer demand pivoting to changing needs.

In response to COVID-19, there was downward pressure on cleaning, while IT services received a boost. Source: Morgans.

What are the funds going to be used for?

As per the prospectus, the IPO is being conducted to:

- Provide Airtasker with capital to fund the further development of Airtasker’s marketplace platform, international expansion and working capital requirements

- Provide Airtasker with the benefits of an increased profile that arises from being a publicly listed company

- Provide Selling Shareholders with an opportunity to realise all or part of their investment in Airtasker

- Provide a liquid market for Shares and an opportunity for others (including members of the Airtasker community) to invest in Airtasker

They also note that “Airtasker has enough working capital at the time of its admission to carry out these stated objectives".

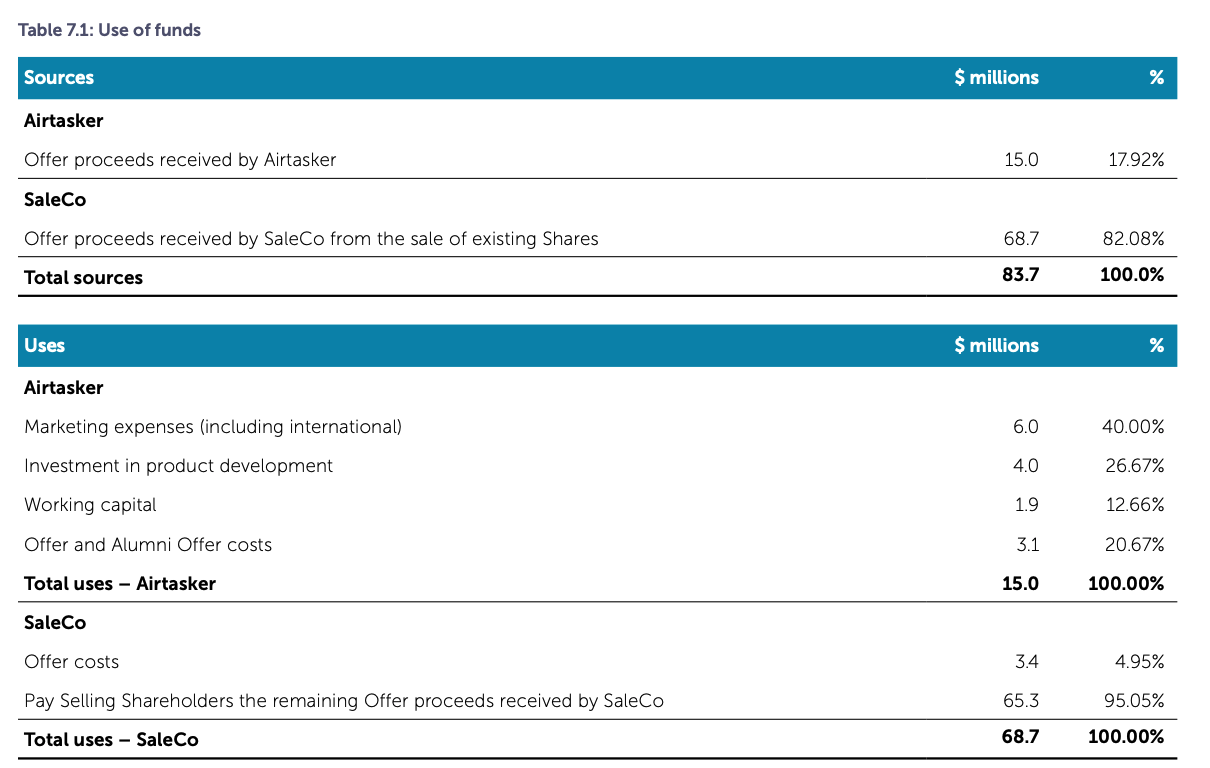

A breakdown budget is below:

Source: Morgans.

Please note, all proceeds under the “SaleCo” section are being used to pay off investor sell-downs – Airtasker will only receive $15 million out of the total $83.7 million to invest in operations.

What to watch out for

As with every company, there are a number of core risks. Here are the most pertinent ones that emerged from the prospectus:

- Data breaches: All tech businesses can be prone to cyber-attacks, and Airtasker is no different. Data breaches and other data security incidents could disrupt Airtasker’s marketplace, exposing the company to penalties for breaching laws or require Airtasker to incur substantial costs to remedy any loss of data.

- Changes to laws and regulation: Laws around the ‘gig-economy is constantly changing and evolving as regulators try and catch up. Airtasker needs to be wary about amendments relating to employee classifications of Taskers, privacy, data and taxation as they could all spell compliance issues, particularly as the firm looks to expand internationally.

- Technology: Given the nature of the tech innovation, it is easy for new, sleeker and improved platforms to rise and capture the imagination of consumers. There is always a possibility of competitors developing new technologies which give them a competitive advantage over Airtasker, or may be able to replicate Airtasker’s systems at a cheaper cost to users

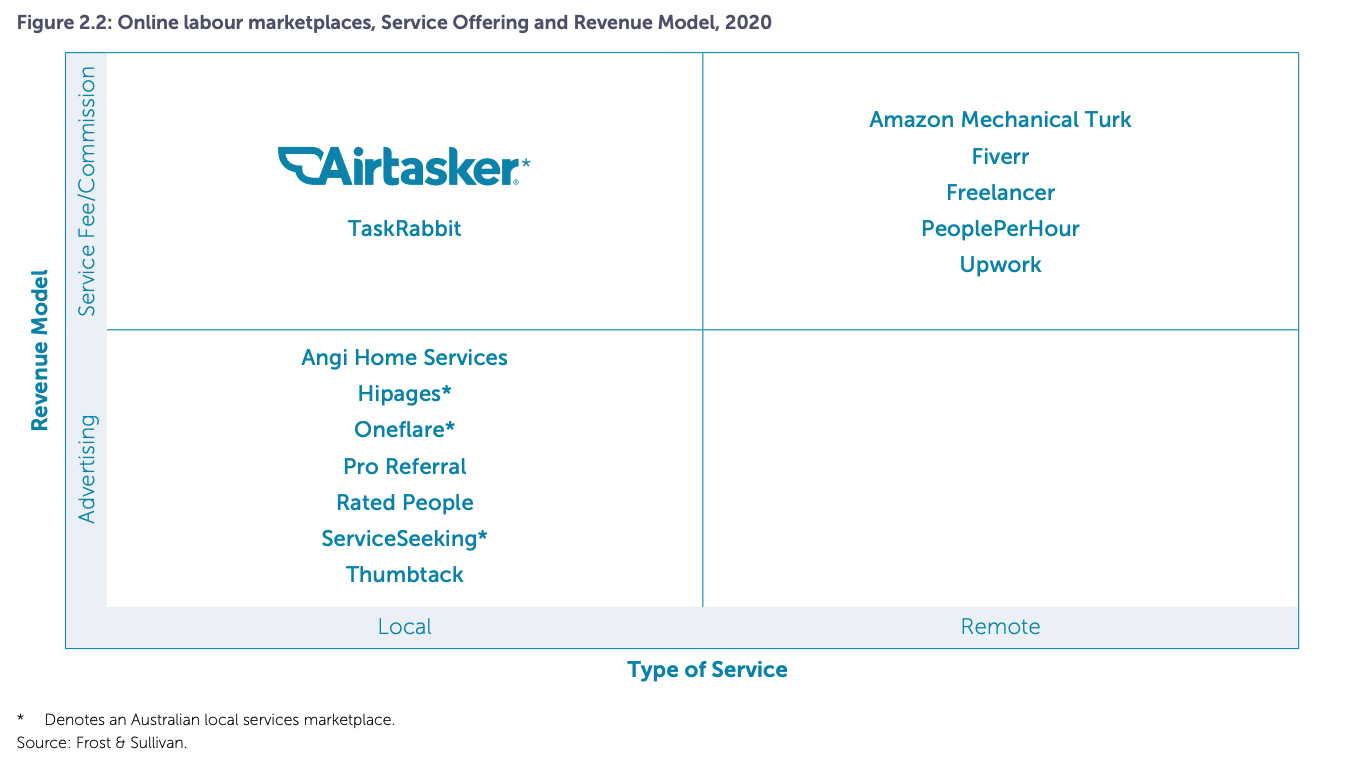

- Competiton: Airtasker’s main competitors revolve around a number of online labour marketplaces focused on either remote or local services. Most current marketplaces that tend to focus on local services have a single offering or limited categories, such as ride-sharing including Uber and Didi; pet services including Rover and MadPaws; building trades including Thumbtack and Hipages.

The key online labour marketplaces that cover wide categories include local platforms such as TaskRabbit, Rated People, Pro Referral, Thumbtack and Oneflare and remote marketplaces such as Fiverr, Upwork, Freelancer, PeoplePerHour and Amazon Mechanical Turk (see section 4.2.2 of the prospectus for a detailed breakdown of each of these).

According to a competitive landscape report from Frost & Sullivan:

Online labour marketplaces can be differentiated based on the nature of services offered through the platform and the revenue model of the marketplace operator. There are few other marketplaces which adopt a similar model to Airtasker of offering local services with a service fee revenue model, and Airtasker is by far the most widely used digital labour marketplace in the Australian market

Source: Morgans.

BONUS: Fundie view

Eleanor Swanson, who runs the Small Companies Fund at Firetrail Investments recently spoke to Livewire about Airtasker as one of the fund’s top two holdings:

“Amazingly, Airtasker is actually the #1 online marketplace employer in Australia – well ahead of peers such as Uber Australia and Deliveroo. The platform is scaling rapidly in Australia and the company has a material opportunity to expand into global markets such as the US.”

To read her complete thoughts and find out more about the fund, see the entire wire here.

Conclusion

Airtasker has already established itself as a brand within many households and is set to continue building its presence through an aggressive expansion strategy. The revenue growth is promising, however, as with many tech companies, we must ask ourselves whether we see a path to profitability. With much of the capital raised in this float (82.08%) being used to pay out previous investors, a slight question lingers about whether there is sound justification for raising funds from an operational standpoint.

Only time will tell. What do you think about Airtasker? Are they set to be the next tech unicorn, or will they fizzle into stagnation as fellow labour market provider HiPages has?

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

If you have any suggestions for companies we should cover next time, please drop them in the comments!

3 topics

1 stock mentioned

2 contributors mentioned