IPO Watch: Third-time plucky for Latitude

Alec Baldwin and his army of ‘better-ers’ were once plastered all over our screens. But while Latitude Financial Group may (and I mean may) have been memorable amongst consumers, they were a name soon forgotten by markets. Tuesday, 20th April 2021 marks Latitude's third try to list: an initial attempt in 2018 was abandoned given the uncertainty of the financial services royal commission; then they failed to find demand for $1.04 billion worth of shares in 2019 even after slashing the offer price by 11%.

However, having dramatically lowered the amount to be raised to $200 million, and secured underwriters in Credit Suisse, Jefferies and Merrill Lynch Equities, it appears that 2021 will finally mark the debut of ASX: LFS.

In this wire, I conduct a deep dive into the business' operations and consider what it needs to do to stand out amongst both the incumbent financial big dogs and dynamic buy now, pay later rockets.

Key details:

- Principal Activities: Consumer finance – instalments and lending

- Issue Price: $2.60

- Ticker: LFS

- Capital to be Raised: $200,000,000

- Listing date: 20 April 2021

- Underwriter(s): Credit Suisse (Australia), Jefferies (Australia) and Merrill Lynch Equities (Australia), Fully underwritten

The prospectus can be found here

The bridge between Big 4 and BNPL

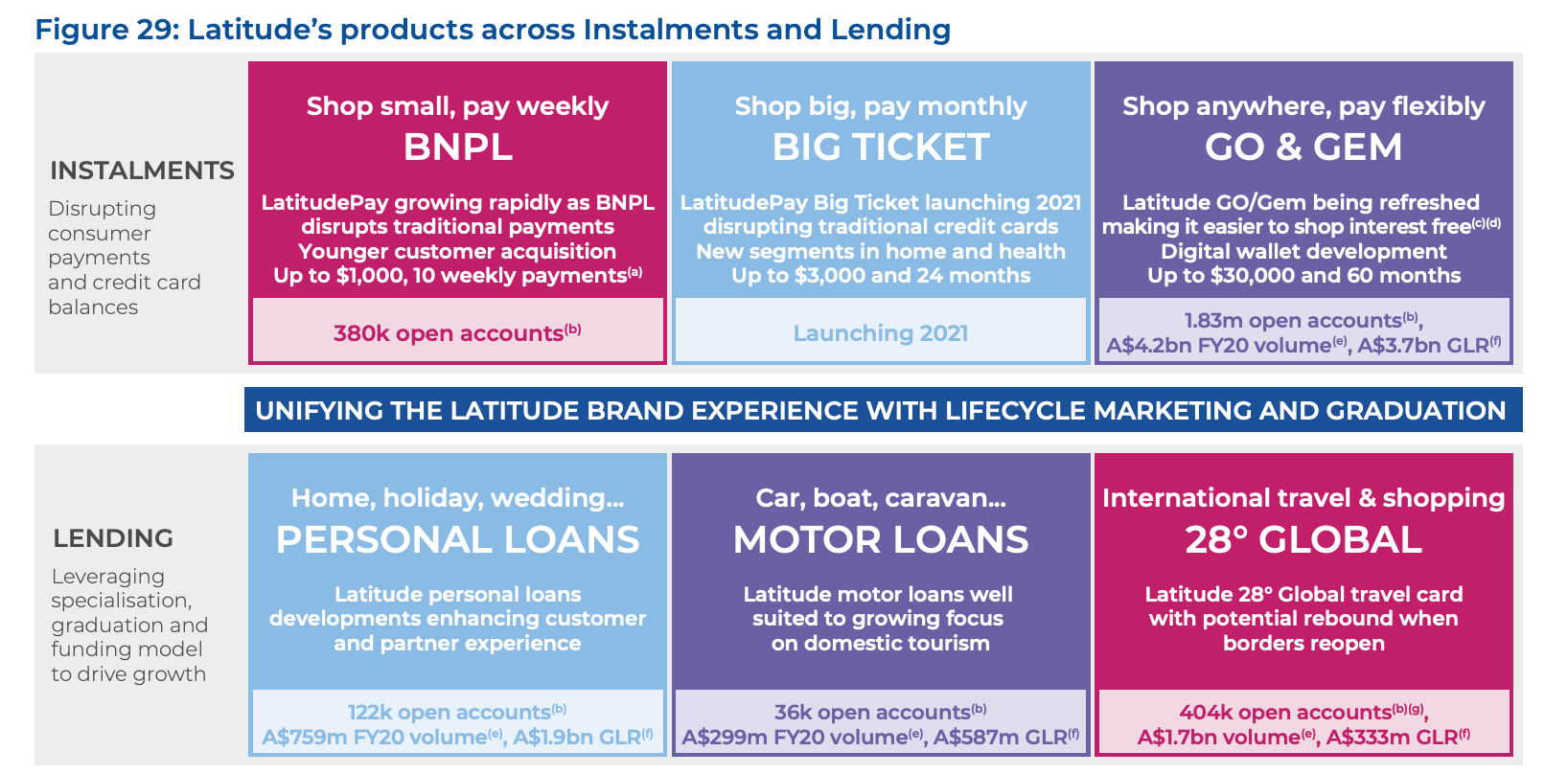

Latitude Financial Group emerged in 2015 after Värde Partners, Deutsche Bank and KKR acquired and subsequently rebranded Australia’s biggest consumer retail finance company at the time GE Capital Finance. The company offers digital Instalments and Lending services through its ‘Business to Business to Consumer’ model, which aims to engage customers both directly and through merchants.

The company brought in Ahmed Fahour - former CEO of Australian Post - to run operations in 2018 and since then have sought to ride the wave of momentum associated with the rapid ascent of BNPL.

The company generates the bulk of its revenue through net interest income, that is, the interest charged to customers less the interest Latitude pays to borrow these funds. Accompanying this are a range of merchant charges on loans, late fees and general administrative fees to account holders. Its value proposition to customers is the wide suite of instalment offerings, automated decision making and instant provision of funds.

Today, Latitude has 2.77 million customer accounts (as at 31 December 2020) and a transactional Net Promoter Score (‘NPS’) of +40. …They also have an established network of over 3,400 merchant partners and 5,800 accredited brokers.

Latitude is currently looking to drive further customer acquisition alongside its partners while continuously building its product offerings. It has identified four main goals to underpin their future growth in their prospectus:

- Building momentum with partners

- Growing instalments

- Growing lending

- Developing a low-cost digital platform organisation

While the descriptions of what these entail rest on the vague side (Section 2.1.3), what is apparent is the importance they place on their strong merchant relationships, low-cost technology and using the headwinds from the BNPL sector to grow.

Unlike other BNPL names, it will also look to not charge merchants to use its instalment services in an attempt to attract consumers and eventually drive them to its other, more profitable, service offerings.

More insightful were recent interviews with the CEO regarding the prospect of Asian expansion, capitalising on an ever-expanding and tech-hungry middle class:

“We’re focused on this interest-free instalment space, and we’ve identified a couple of geographic expansion opportunities, and we’ve nominated a couple of internal executives who have built this kind of platform in Asia,”

A dig through the financials

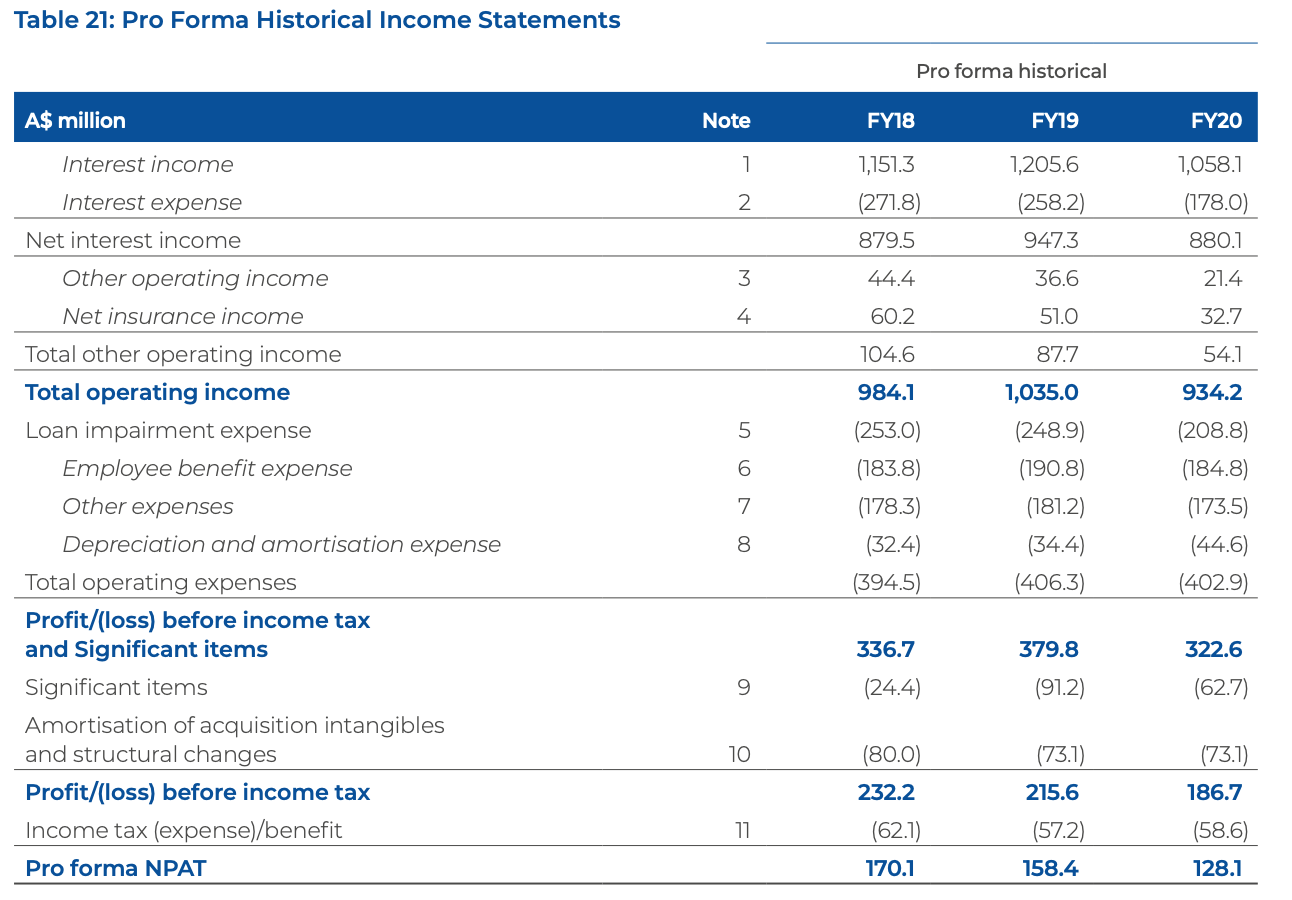

The overall revenue (or total operating income) is

the first line note, and this does set off an initial alarm

bell. After growing 5.2% between FY18 and FY19, it undid all of that growth over

FY20, falling 9.7%. It was a similar story with profit, 12.8% initial growth

offset by a decline of 15.1% in the following period.

Despite this, profitability is a positive sign and an expectation given their intention to compete with the Big 4 Banks. Equally, none of the major BNPL players has come close to securing a profit, which reflects positively on Latitude given their exposure to the space; has it potentially positioned itself to enjoy the best of both worlds?

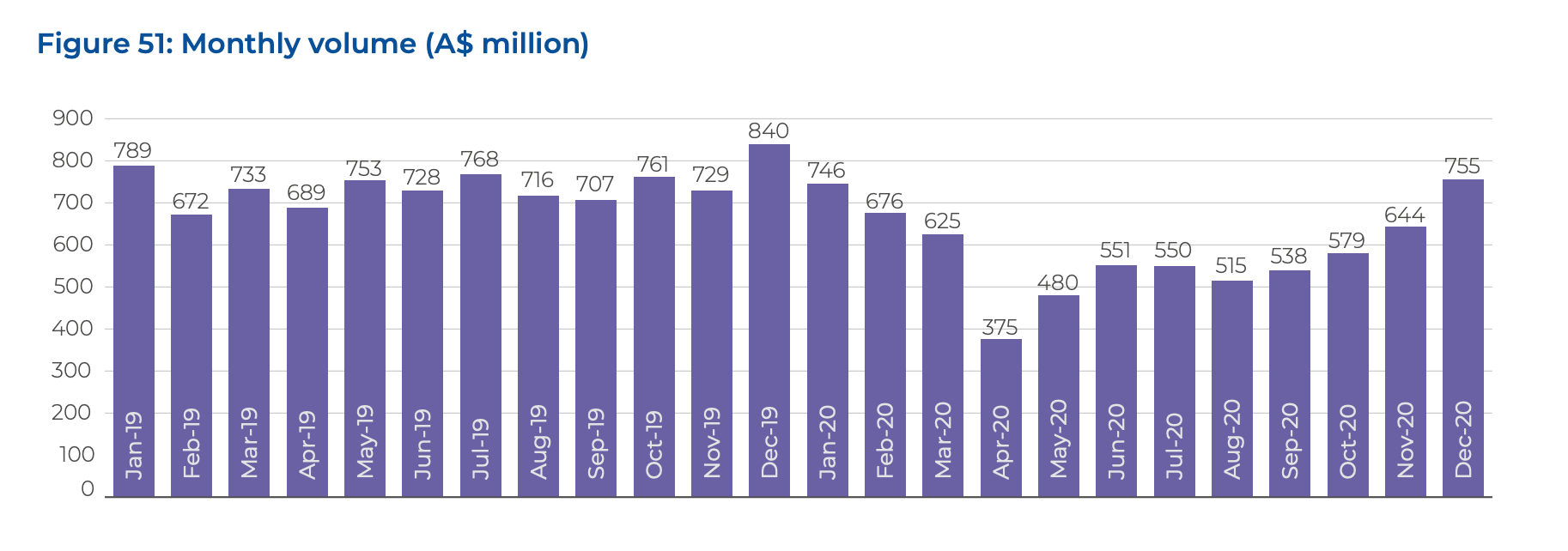

Further, it is pertinent to note the COVID-19 context of the FY20 figures, which, as shown below, resulted in a significant reduction in volumes across all products. The major impacts were seen in International and Travel Scheme and Travel Personal Loan volume which fell by A$1 billion in FY20.

"In 2020, Latitude’s travel credit card product 28º suffered an 80% decline in revenue as COVID-19 closed the borders and stopped overseas travel. The company is expecting that sales of this product will pick up as Australians start travelling." - Australian Financial Review

On another note, the economic impacts in tandem with government stimulus resulted in an elevated level of customer repayment rates in the back end of 2020, particularly among higher-risk customer bases, reflected in a slightly improving loan impairment expense figure.

Latitude remarks that its “proactive tightening of credit risk strategies in anticipation of significant increases in unemployment that were forecast at the time.”

Another factor underpinning this trend may have been the willingness of “customers to deleverage given economic uncertainty, lower base interest rates increasing post‑mortgage‑related disposable income, access to federal and state government stimulus as well as early access to superannuation savings in Australia,” all helping to cushion repayments.

A recovery in volume looks to be on the horizon with easing government restrictions in Australia and New Zealand driving an uplift in consumer activity. The business has also been cash-flow positive through this time and holds few debts outside of those utilised in their main loan service offering.

What are the funds going to be used for?

As per the prospectus, the IPO is being conducted to:

- Allow the Existing Investors to realise a portion of their investment in Latitude;

- Provide a market for the Shares and increase the liquidity of the Shares;

- Provide an opportunity for others to invest in Latitude; and

- Provide Latitude with access to the public equity capital markets, which will improve its financial flexibility to pursue further growth opportunities.

Reading this sent certainly left me with raised eyebrows: Where were the details relating to the company’s future prospects. My eyebrows stayed aloft when, a few pages down, the proposed uses of funds were elaborated:

“No proceeds of the Offer will be received by the Company” - Section 7.1.3

The $200 million raised is to be wholly distributed to pay out the existing shareholders. Whilst this is a natural part of every raising, to use the entire funding pool for this purpose may be a red flag for some prospective investors.

What to watch out for:

- Evolving regulatory requirements: With continual reviews of responsible lending obligations, yet to be realised outcomes of the Banking Royal Commission and constant scrutiny on the BNPL sector, there is constant uncertainty around the payments and instalments space.

- Impacts of COVID-19: Disruption was clearly seen in the FY20 financial figures, and while we have experienced an initial recovery on the back of unprecedented government stimulus, the potential for future inflation and recession may negatively affect demand. This could also hamper Asian expansion plans.

-

Access to and cost of funding: Latitude currently receives the funds for its loan book from Warehouse Facilities, Term Securitisations, corporate debt facilities and cash deposits. A restriction on one of these could impact their ability to both write new business and finance expiring debts. Further, they are also exposed to interest rate rises and in the scenario it is unable to pass increases onto customers will be detrimental.

- Reliance on commercial partnerships: While its wide array of merchant partners is indeed a strength, the multitude of new BNPL players means that merchants have more choice than ever when it comes to offering instalment terms to customers. With merchants being the key to on-selling more lucrative services to customers, Latitude must pay close attention to these relationships.

- Competitive threats: Finally, being involved with both loans and instalments means that Latitude is competing with both banks and BNPL firms. Continuing financial success will rely on whether it can develop and commercialise new products or enhance existing products in order to compete with the conveyor belt of technology backed financing solutions constantly emerging.

BONUS - Fundie view:

Hugh Dive from Atlas Funds Management offered coverage for Livewire on Latitude’s second IPO attempt in 2019. He concluded:

History doesn’t repeat itself, but it sometimes rhymes. Going through the Latitude prospectus, there is a range of similarities to the RAMS prospectus 12 years ago: namely, a financial company built on arbitraging the difference between wholesale and retail interest rates that ultimately depends on the goodwill of banks to continue to lend to them. While the price multiple appears to be prima facie attractive, there are too many warning bells for Latitude to be included in the Atlas portfolios at the IPO.

In order to assess whether there has been much change between then and now, I highly recommend reading through Hugh's above analysis.

Conclusion

The consumer finance industry has been thrown wide open by innovation, and with established names like CBA jumping on the BNPL bandwagon as well as the continual cry for regulation, its narrative is still to be written.

With its founding roots in the 129-year-old GE, in tandem with a tech-first approach to its products, Latitude has certainly positioned itself to continue imposing itself across the sector.

In the aftermath of their 2019 debacle, the AFR wrote:

The silence was deafening out of the Latitude camp on Tuesday night which, as one fund manager put it, meant "it is not getting done at 11-times (forecast cash profit)".

This time around, it is sitting at 11.7-times, albeit at a significantly smaller scale. Can they reach the absurd revenue multiples of Afterpay? You certainly do not want to take a raincheck on watching this space.

4 topics

4 stocks mentioned

1 contributor mentioned