Iron ore price slump silver lining: Looming supply cuts to rebalance market

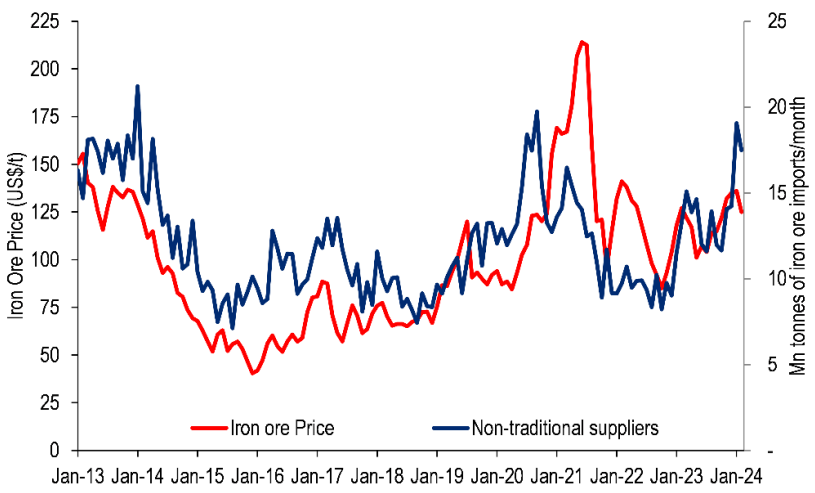

Citi suggests one of the major reasons for the recent weakness in the iron ore price is a surge in supply hitting the market from non-traditional sources. Non-traditional sources in the global iron ore market typically include countries other than major producers Australia, Brazil, and South Africa, namely Russia, Ukraine, Canada, and emerging producer, India.

Citi argues that this supply is significantly price sensitive as it tends to be higher cost and, therefore, marginal. According to the broker’s research, this means there’s a very high correlation between non-traditional production and the iron ore price, with the two sporting an r-squared of 72% over the last ten years.

Just a quick maths refresher: an r-squared of 72% implies that 72% of the variance in non-traditional supply over the last 10 years can be explained by the variance in the iron ore price. The chart below demonstrates this more clearly. Basically, when the price goes up, so too does non-traditional supply, and vice versa.

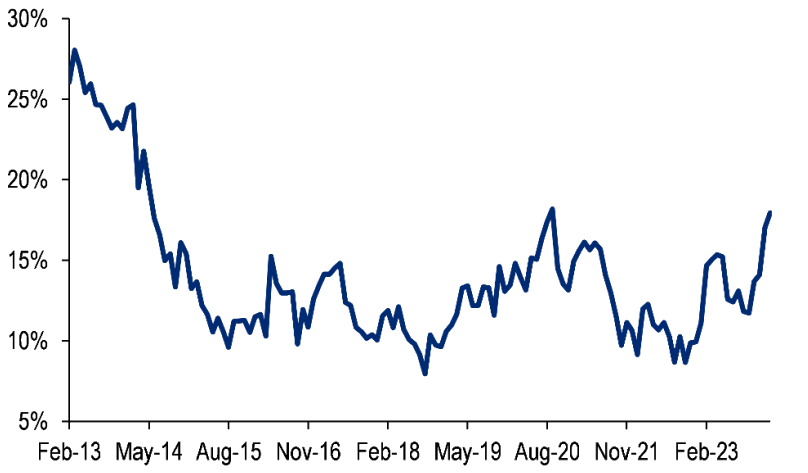

As iron ore surged to US$144/t in January, so did the supply into China from non-traditional sources, says Citi. They note that “17.5% of iron ore imported into China in Jan-Feb’24 came from non-traditional sources”, well above the 10-year average of 14%, and “one of the highest in recent years”.

Further evidence that non-traditional supply is the swing factor in the iron ore market and, therefore, for iron ore prices comes from data indicating that the vast majority of growth in Chinese imports over the last 12 months was sourced from non-traditional suppliers.

Chinese iron ore imports grew an impressive 8% year on year in the January-February period, but accounting for non-traditional supply, this was closer to 2%.

What does down, must go down

Correlation swings both ways, suggests Citi. They expect that the recent sharp pullback in the iron ore price to as low as US$100/t will significantly impact non-traditional supply. “With prices falling sharply from mid-February, imports from non-traditional sources should moderate going forward,” they said.

“At $100/t iron ore price levels, one should see 120-140mn tonnes annualised from non-traditional suppliers”, notes Citi. Moving forward, each US$10 per tonne change in the iron ore price will likely result in 13-15mn tonnes per year change in non-traditional supply.

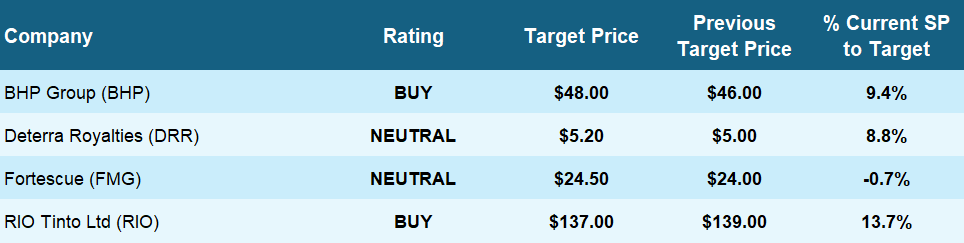

Citi’s iron ore & ASX miners price target changes

In a separate research report released on Monday, Citi downgraded its iron ore price forecast for calendar year 2024 by 4% to US$116/t but increased it by 1% for calendar year 2025 to US$101/t. This implies a modest price recovery from the current price of US$106/t but little movement over the medium term.

Citi’s “long term” iron ore price target of US$85 remained unchanged.

The shaving of Citi’s 2024 iron ore price target resulted in several tweaks to their price targets for their universe of ASX iron ore stocks: BHP Group (ASX: BHP), Deterra Royalties (ASX: DRR), Fortescue (ASX: FMG), and RIO Tinto Ltd (ASX: RIO). The changes are summarised in the table below.

Citi’s ASX iron ore stocks ratings and target prices. Source: Citi Research

This article first appeared on Market Index on Friday 22 March 2024.

5 topics

6 stocks mentioned