Iron ore rally risks “fizzling” here –Morgan Stanley

The iron ore market has experienced a tumultuous October, with prices now sagging back toward the psychological US$100/t level in choppy trade after peaking at US$110/t earlier in the month. The euphoria over news in late September that Beijing intends to implement a range of monetary and fiscal measures to jump-start China's ailing stock and property markets appears to be wearing off.

%20SGX%20chart%2031%20Oct%202024.png)

Major broker Morgan Stanley has released a new research note titled “DataDig: IO fizzling?” in which it ponders the future path of the iron ore price for the next six months, as well as highlighting the broker’s top ASX iron ore picks. Here’s a snapshot of the report.

Don’t bet on any more big stimulus measures in 2024

Morgan Stanley’s China economics team sees the initial round of stimulus measures as “largely over”. The broker expects the next key potential news event, the November 4-8 National People's Congress (NPC) meeting, is unlikely to deliver any new measures that may raise the budget deficit for 2024.

Whilst this might rule out a repeat of September’s iron ore price heroics this month or next, Morgan Stanley suggests that what’s already in the system is still likely to maintain iron ore prices around current levels.

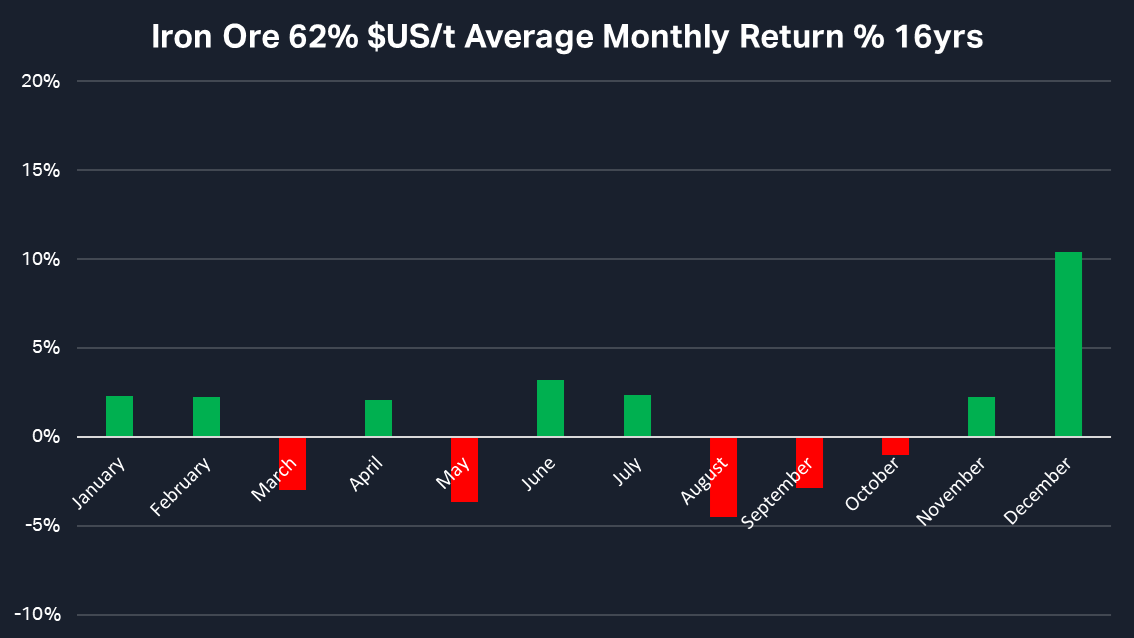

The Chinese government's frontloading of the RMB200 billion 2025 infrastructure budget on October 8 has provided some support, notes the broker, and it has occurred around the time iron ore typically experiences seasonal strength. November through to February is a typically strong period for iron ore prices as Chinese steel producers restock ahead of a ramp-up in production ahead of Lunar New Year holidays in late January – early February.

You might also be interested in: What’s in store for iron ore this November and December

Demand versus supply factors

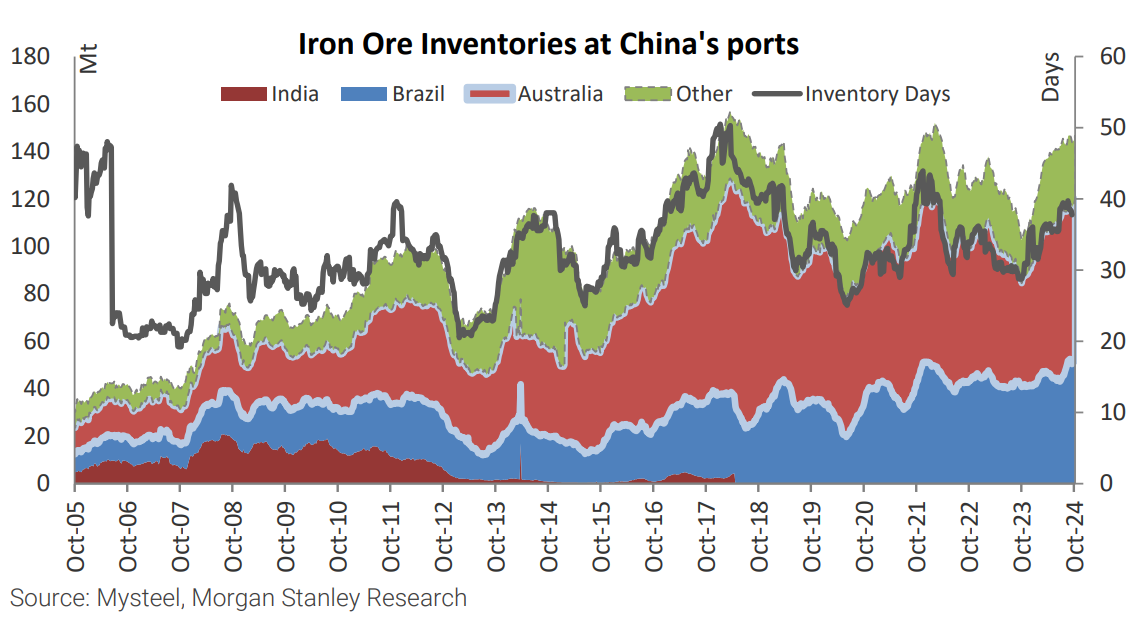

Morgan Stanley notes that the iron ore price might also be supported in the short term by an expected easing of supply from major producers. Working against this factor, and the aforementioned stimulus and seasonal factors, is the fact that Chinese port inventories of iron ore remain elevated.

In light of these competing factors, Morgan Stanley expects the iron ore price may continue to ease in the very short term, before firming modestly into 2025. The broker is tipping an average price of US$100/t for the rest of 2024, rising to US$105/t during the first three months of 2025. The spot iron ore price on 31 October was US$103.78.

Morgan Stanley’s top ASX iron ore stocks

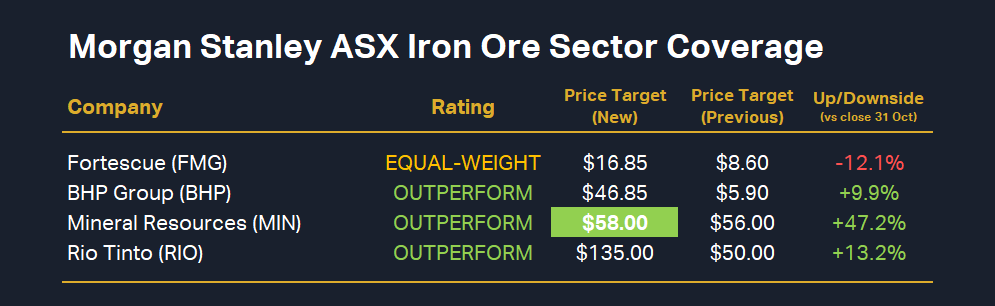

As far as Australian iron ore stocks go, Morgan Stanley’s preference is Mineral Resources (ASX: MIN). The broker likes the company's attractive valuation, suggesting MIN has the lowest implied iron ore pricing of its peers; it's also in the process of ramping up lower-cost volumes from its Onslow operation.

Morgan Stanley also sees Rio Tinto (ASX: RIO) and BHP Group (ASX: BHP) as potential strong performers, with the broker forecasting as much as 60% and 55%, respectively, of underlying earnings to come from iron ore in 2025. Morgan Stanley has an OVERWEIGHT rating for each of these three stocks.

The odd one out is Fortescue (ASX: FMG), which Morgan Stanley only rates at EQUAL-WEIGHT. It is less favoured due to the view that the company’s green energy ambitions increase the risks to costs and, therefore, free cash flow. Morgan Stanley’s full ASX iron ore coverage is summarised in the table below.

This article first appeared on Market Index on Friday 1 November 2024.

5 topics

4 stocks mentioned